Creating Purchase Order Schedules

This section discusses how to Create Purchase Order Schedules:

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PO_SCHEDULE |

Specify ship to, quantities, due dates, comments, SUT, miscellaneous charges, price adjustments, and multiple distributions per schedule within a purchase order line. |

|

|

Item Description Page |

PO_ITEM_DESCR, PO_ITEM_DESCR2 |

Enter and view descriptions for a specific item. The item description link includes the first 30 characters of the item's description in the Transaction Item Description text box on the Item Description page. |

|

Details for Schedule Page |

PO_SCHED_DTLS |

Review or add schedule details to the selected schedule line. |

|

PO_ONE_TIME_ADDR |

Set up a one-time ship to address for the selected purchase order schedule. You cannot define a one-time address for direct shipment purchase orders. To change the address for a direct shipment you must go to the sales order in PeopleSoft Order Management and make the address change there. |

|

|

Price Adjustments for Schedule Page |

PO_VAL_ADJ |

Adjust the price of a schedule. |

|

Miscellaneous Charges for Schedule Page |

PO_SCHED_MISC |

Change miscellaneous charges on this schedule. |

|

PO_SCHED_MISC_3RD |

Select a third-party supplier to whom to pay the miscellaneous charge. |

|

|

Sales/Use Tax Information for Schedule Page |

PO_SCHED_SUT |

Enter the SUT information for the schedule. |

|

PO_SCHED_VAT |

Review and update VAT details for this schedule. This page is accessible only if the General Ledger business unit on the Purchasing business unit links to a valid VAT entity. |

|

|

Direct Shipment Page |

PO_SCHED_OM |

View sales order information about a drop-shipment purchase order. The purchase order must have a direct shipment. Drop-ship orders are not eligible for receiving in PeopleSoft Purchasing, because they are normally sent directly to a customer site and received there. |

|

PO ShipTo Comments Page |

PO_COMMENTS_SEC |

Enter comments for a transaction. You can enter a unique comment, or you can select from predefined standard comments. |

|

IN_PEG_DETAIL_SP |

Apply, change, or remove pegs from items. |

|

|

IN_PEG_DETAIL_SP |

View pegging information for line items. |

|

|

Qualified Distributions page |

PO_DIST_PEG |

Select the purchase order distribution that you want to maintain or view the pegging information for. |

Use the Maintain Purchase Order - Schedules page (PO_SCHEDULE) to specify ship to, quantities, due dates, comments, SUT, miscellaneous charges, price adjustments, and multiple distributions per schedule within a purchase order line.

Navigation:

Click the Schedule button next to a purchase order line on the Maintain Purchase Order - Purchase Order page.

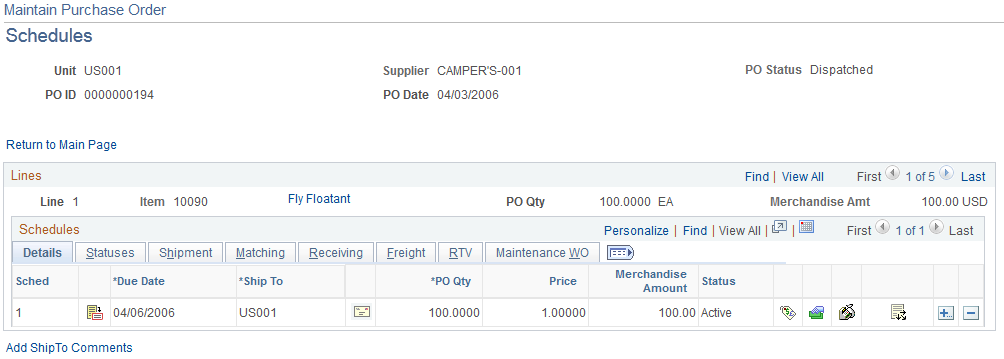

This example illustrates the fields and controls on the Maintain Purchase Orders - Schedules page. You can find definitions for the fields and controls later on this page.

The Schedules page displays header information for the purchase order, such as the purchase order ID, date, and status. The page also displays schedule details for purchase order lines. The Lines group box provides basic information about individual lines and the Schedules grid box provides detailed schedule information.

Field or Control |

Description |

|---|---|

|

Click the Finalize Document button to finalize all referenced requisitions for the current purchase order. The system verifies that all line distributions in the purchase order schedule have the associated predecessor requisition distributions. If the associated requisition has been finalized, the system de-associates the requisition from the purchase order before running budget checking to avoid over liquidating the pre-encumbrance. If multiple purchase order schedules are associated to the same requisition schedule, the entire requisition schedule may be finalized from any of the related purchase order schedules. The system does not display this button if commitment control is off or if the purchase order is not sourced from a requisition, and thus has no predecessor. |

|

Click the Undo Finalize Entire Document button to reverse finalizing the referenced requisitions for this purchase order. The system does not display this button if commitment control is off or if the purchase order is not sourced from a requisition, and thus has no predecessor. Note: If you identify a distribution line as final for less, you must run budget checking afterwards. |

Note: If a schedule is a PeopleSoft Order Management direct shipment, the system displays a warning when you change, delete, or cancel the schedule. Changes that you make to schedules here that are related to PeopleSoft Order Management do not update the related information in the PeopleSoft Order Management application. You can tell if you have a direct shipment, because the Schedule Direct Shipment button appears on the Maintain Purchase Order - Schedules page, instead of a ShipTo Address button.

Field or Control |

Description |

|---|---|

PO Status |

Current status of the entire purchase order. Valid status values are Initial, Open, Pending Approval, Approved, Dispatched, Canceled, and Complete. |

Description |

Click the Item Description link to view a description of the item. The link displays in the Lines group box next to the item ID. |

Add Ship To Address Comments |

Click to access the PO ShipTo Comments page. |

Details

Use the Schedules grid box to view and maintain a variety of schedule information for purchase order lines that appear in the grid box. The Details tab enables you to define basic schedule information for the purchase order line.

Field or Control |

Description |

|---|---|

Sched (schedule) |

Displays the schedule number used by the system to track multiple schedules for a purchase order line. The system automatically assigns the number. |

|

Click the Details button to access the Details page where you can view or maintain schedule details. |

Due Date |

Displays the default due date for the schedule. If there is no default due date, the system calculates one by adding the lead-time days to the purchase order date. You can override the due date for each schedule as long as it is not earlier than the purchase order date. If the item is an inventory item and an Inventory business unit is entered on the first distribution line of the schedule on the Distribution Details page, the due date is validated against the closure calendar definition for the PeopleSoft Inventory business unit. This ensures that the business unit is open to receive merchandise on that day. If the date is not a valid date for that business unit, the system issues a warning for you to accept the date anyway or use the next available date. If the item is not an inventory item, the shipping due date is validated against the closure calendar definition for the PeopleSoft Purchasing business unit. When you create a change order by adding a line to the purchase order on a purchase order that has a due date in the past, the system will populate the due date for the new line with the current date plus lead time days, if a lead time exists for the category. Otherwise, the current date will appear in the Due Date field. When the purchase order is created using the copy from purchase order method, the due date is calculated again. If the resulting calculated date is greater than the due date copied from the copied purchase order, then the calculated date is set as the due date for the new purchase order. If the calculated date is less than the copied due date, the copied due date is retained as the due date in the new purchase order. |

|

Click the Schedule Direct Shipment button to access the Direct Shipment page. Use the Direct Shipment page to view PeopleSoft Order Management sales order information related to the direct shipment. |

Ship To |

Ship to destination. A change to the ship to can result in a price change, a sales and use tax recalculation, or a VAT recalculation. |

Ship To GLM (ship to global location number) |

Displays the global location number for the corresponding ship to location, if available. |

|

Click the Ship To Address button to access the PO ShipTo Address page. Use this page to set up a one-time ship to address for the selected purchase order schedule. Note: You cannot define a one-time address for direct shipment purchase orders. To change the address for a direct shipment you must go to the sales order in PeopleSoft Order Management and make the address change there. |

PO Quantity |

The purchase order quantity for the first schedule automatically changes to the entire line quantity. You can override the quantity with a lower number and insert a second schedule for the difference. The purchase order quantity for the second schedule automatically changes to the difference between the line quantity and the quantity on the first schedule. If you update the line quantity and have only one schedule, the system updates the schedule automatically. If you have multiple schedules, you must update the schedules manually so that the total schedule quantity equals the line quantity. Changing the schedule quantity never updates the line quantity. This field is not available for entry for amount only lines. When you change the purchase order quantity or amount by changing the price, the system verifies the distribution method and liquidation methods. If the distribution method is Amount or if the method is Quantity and the liquidation method is Amount, the system does not allow the quantity or amount to be reduced to less than the quantity or amount vouchered. Also when you change the price, the system does not allow you to make changes when there are vouchers matched to the line or schedule. The system provides a message that you should unpost and unmatch the voucher before it allows the change. |

Price |

The system calculates the price for the items. Price calculations can range from simple to complex, depending on the factors you set up. If there is a contract associated with the line, the system uses the contract rules to determine the price. Contract rules include whether to use the contract base price or the supplier price for the unit of measure on the purchase order. Contract rules also determine which sets of price adjustments the system considers (contract price adjustments and supplier base price adjustments) and in what order. If you are ordering items by description only, you must enter the price manually. While price is not required, if you have entered schedules without prices, you'll get a warning when you save the purchase order. This field is not available if the purchase order is used with a recurring purchase order voucher. |

Amount |

The system calculates the extended amount as the schedule price multiplied by the schedule quantity. This is the merchandise amount of the schedule. It does not include other amounts associated with the schedule, such as freight and tax. You can override the schedule merchandise amount here, unless the item definition or contract definition for the item on the line does not allow the price to be changed on the purchase order. This field is not available if the purchase order is used with a recurring purchase order voucher. When you change the purchase order quantity or amount by changing the price, the system verifies the distribution method and liquidation methods. If the distribution method is Amount or if the method is Quantity and the liquidation method is Amount, the system does not allow the quantity or amount to be reduced to less than the quantity or amount vouchered. Also when you change the price, the system does not allow you to make changes when there are vouchers matched to the line or schedule. The system provides a message that you should unpost and unmatch the voucher before it allows the change. |

Status |

Displays the status of the purchase order line schedule. |

|

Click the Value Adjustment button to access the Price Adjustments page. |

|

Click the Miscellaneous Charges button to access the Miscellaneous Charges page where you can view and update price information. |

|

Click the Sched Sales/Use Tax button to access the Sales/Use Tax Information page. See Sales/Use Tax Information for Schedule Page, Sales/Use Tax Information for Schedule Page. |

|

Click the Distributions/ChartFields button to access the Distributions page. |

Statuses

Field or Control |

Description |

|---|---|

|

Click the Create Schedule Change button to change an attribute on the purchase order schedule. This button and functionality are available only if the purchase order is in Dispatched status. When you click this button, all fields defined on the Chng Ord Template (purchase order change template) page become available for entry and can be changed. When you save the purchase order, a change order is created. If approval is required before dispatching it to the supplier, the change order must go through the approval process. |

|

Click the Cancel Schedule button to cancel the purchase order schedule. This button is available if the purchase order status is Dispatched. If you cancel a dispatched schedule, a change order is created. This button is also available when the purchase order status is Approved, but only if the purchase order was previously dispatched and subsequently changed and approved. To cancel the schedule, you must have the authority to cancel purchase orders on the User Preferences - Procurement: Purchase Order Authorizations page. |

|

Click the Pegging Workbench button to access the Pegging Workbench page. Use this page to view and maintain the pegging information associated with this purchase order schedule. See Using Pegging with Requisitions in PeopleSoft Purchasing. |

|

Click the Pegging Inquiry button to access the Pegging Inquiry page. Use this page to view the demand for this purchase order. See Using Pegging with Requisitions in PeopleSoft Purchasing. |

Shipment

Use this tab to define purchase order line shipping details. This information is similar to fields used for the purchase order header. Refer to those fields for additional descriptions.

Field or Control |

Description |

|---|---|

Attention To |

Displays the person to whom, or place to where the services or goods are to be delivered. If the purchase order's scheduled shipment originated from the requisition, the Attention To field value is carried onto the purchase order. When the purchase order schedule is manually entered, this field will be blank. This field value is Multiple Recipients if there are more than one person or place that this shipment is to be distributed to. |

Revision |

Displays the manufacturer's product revision number of the item ordered. If the ship to is a PeopleSoft Inventory business unit and the item is under revision control in that business unit, the revision number defaults to that revision number effective on the due date. |

Time Due |

Displays the time that the shipment is due. |

Original Promise Date |

Displays the date on which the supplier originally committed to deliver the item. The default due date appears by default in this field and is updated when the item or item category (ad hoc items) changes. If you override the due date on the PO Defaults page, the purchase order date plus the number of lead time days defined for the item or item category (ad hoc items) will be used, not the overridden due date. You can override the original promise date on the PO Defaults page. |

Ship Date |

Displays the actual date on which the line item was shipped by the supplier. |

Custom Price |

Select this check box to indicate that you entered a custom price on the schedule. |

Zero Price |

Select to indicate that the price for this item is zero. |

Frozen (Planning) |

Select to prevent PeopleSoft Supply Planning from changing the schedule. The two schedule changes that PeopleSoft Supply Planning can recommend include rescheduling the due date to ensure supply is on hand for a particular demand and canceling the schedule if demand does not exist. |

Ship Via |

Displays the ship via code for a carrier or method of shipment. You define ship via codes for SetID using the Purchasing Options page. |

Matching

Use the Matching tab to view and maintain default price tolerances for the PeopleSoft Payables Matching process (AP_MATCH) that matches purchase orders, receipts, and vouchers to verify supplier charges. If you do not specify tolerance values for the business unit, the system uses tolerance values defined for the item's purchasing attributes.

Field or Control |

Description |

|---|---|

Match Status |

Displays the match status for this purchase order line. |

Matching |

Select a method for matching and verifying supplier charges at the line level. Methods include: ERS (evaluated receipt settlement ): Select to indicate that the system matches the line based on the purchase order header match control. Full Match: Select to indicate that the system does not match the line. No Match: Select to indicate that the system matches the line. |

Price Tolerance Over and Price Tolerance Under |

Enter the amount over or under the individual item price that you plan to allow on the voucher and still have the transaction qualify for a match. |

% Unit Price Tolerance Over (percent unit price tolerance over) and% Unit Price Tolerance Under (percent unit price tolerance under) |

Enter a percentage amount over or under the individual price that you plan to allow on the voucher and still have the transaction qualify for a match. |

Ext Price Tolerance (extended price tolerance)Ext Price Tolerance - Under (extended price tolerance - under)% Ext Price Tolerance% Ext Price Tolerance - Under |

Enter the amounts or percentages over or under the extended item price (price multiplied by quantity) that you plan to allow on the voucher and still have the transaction qualify for a match. |

Receiving

Use the Receiving tab to view and maintain receiving information.

Field or Control |

Description |

|---|---|

Reject Qty Over Tolerance (reject quantity over tolerance) |

Select to reject a shipment at receiving time if the quantity received is over the tolerance set in the Qty Rcvd Tolerance % (quantity received tolerance percentage) field. |

Qty Rcvd Tolerance % (quantity received tolerance percentage) |

Displays the quantity received tolerance percentage for the item on the purchase order. |

Close Under Quantity Percent |

Enter the percentage that represents the under quantity tolerance for receiving this purchase order line. The percentage entered here is then used by PO close in determining if the PO line is eligible for closing. |

Freight

Use the Freight tab to view and update information about freight terms for this schedule.

Field or Control |

Description |

|---|---|

Freight Terms |

Displays the freight term code that applies to the schedules for this purchase order. You define the code for SetIDs on the Purchasing Options page. |

Arbitration |

Displays the freight and transportation arbitration plan for this business unit. |

Charge Method |

Displays the method by which freight is charged for the purchase order. This value can be overridden for the schedule on the Details for Schedule page. Values are: Volume: Freight is charged by the volume of the shipped item. Quantity: Freight is charged by the number of packages. Value: Freight is charged by the value of the order. Weight: Freight is charged by the weight of the items. |

Freight Charge Override |

Select this check box to override the freight charge set on the Purchase Order Defaults page with the values entered on this page. |

RTV

Use the RTV (return to vendor) tab to define exchange returns to vendors associated with this purchase order line schedule. By assigning the RTV information, the PO schedule is identified as the order of the item being exchanged for the item on the return to vendor. A return to vendor for exchange will not be eligible for closing until the exchange item is identified on a PO schedule.

Note: When the due date is changed for a fully-received schedule, the system checks for any supplier returns for that schedule. If there is a return to vendor, the system prevents you from changing the date.

Field or Control |

Description |

|---|---|

BU RTV (business unit return to vendor) |

Select a business unit to which the supplier return is going to be assigned. |

RTV ID (return to vendor ID) |

Select a RTV ID. You must first specify a business unit before you can select a RTV ID. |

RTV Line (return to vendor line) |

Select a RTV line. The available selections are based on the RTV ID that you enter. |

Maintenance WO

Use the Maintenance WO (maintenance work order) tab to define information work order details.

Note: This will not appear on this page if PeopleSoft Maintenance Management is not installed.

If the purchase order was created through the PeopleSoft Purchasing sourcing processes the work order information fields on this page will already be populated with the values that came through the sourcing processes. If work order information does not already exist you can manually associate the work order information with the purchase order using the fields on this page. This page is used to associate non-inventory and ad hoc (description-only) items to purchase order schedules with a work order. If work order information is specified, then all distributions are associated with the work order specified. Use the Pegging Workbench to associate inventory items to a work order.

When you associate a work order with a purchase order the system will copy the distributions from the work order parts template, including distribute by method, distribution percentage, general ledger business unit, ChartFields, and projects information.

Field or Control |

Description |

|---|---|

Maintenance WO Unit (PeopleSoft Maintenance Management work order business unit) |

Select the PeopleSoft Maintenance Management business unit. |

Maintenance WO (maintenance work order) |

Select the work order you want to associate with this purchase order. |

Task Number |

Select the work order task number. |

Resource Type |

Select the type of resource you are defining a purchase order for. Values are:

|

Resource Line No. (Resource line number) |

Select the resource line number associated with the work order, work order task, resource type entered. If the ad hoc (description only) item on the purchase order line doesn't exist on the work order, you can leave the resource line blank. At save, the system will add the ad hoc (description only) item to the work order task. |

Custom Fields |

The user definable fields in this Custom Fields section are available when you check the Enable Custom Fields checkbox on the Purchasing Installation Options page. You can customize these fields for your use. The custom fields are informational only. . For more information on Custom Fields SeeUnderstanding User-Definable Fields |

Schedule Date |

Displays the schedule date for the Maintenance Work Order This field is only displayed in update and display mode, and not visible in Add mode. |

Amount |

Displays the total amount for the Maintenance Work Order This field is only displayed in update and display mode, and not visible in Add mode. |

Currency |

Displays the currency for the Maintenance Work Order This field is only displayed in update and display mode, and not visible in Add mode. |

The Schedule Date, Amount, and Currency fields are display fields from the WO schedule and not from the Purchase Order schedule details. If the Amount Only check box is selected for purchase order line and purchase order line is associated to Amount Only Work Order Schedule, only then the Schedule Date, Amount, Currency fields are displayed.

Changing Work Order Information

If the purchase order distributions are associated with a requisition, you must clear the requisition before you can change the work order information. Also, if the work order is associated with the purchase order schedule (non-inventory and ad hoc (description-only) lines), when you make a change to the purchase order and reopen the quantity back on the requisition, the system will reopen the requisition pegs to the work order. Changes that can cause this behavior are reducing quantity, canceling a distribution, and deleting a distribution. If the purchase order is for an inventory item, reopening the requisition quantity does not reopen the pegs. You must manually redo the pegging.

Use the PO ShipTo Address page (PO_ONE_TIME_ADDR) to set up a one-time ship to address for the selected purchase order schedule.

You cannot define a one-time address for direct shipment purchase orders. To change the address for a direct shipment you must go to the sales order in PeopleSoft Order Management and make the address change there.

Navigation:

Click the Ship To Address button on the Maintain Purchase Order - Schedules page.

Note: This page is not available for direct shipment purchase orders.

One Time Address

Field or Control |

Description |

|---|---|

Location Type |

Select an alternative location type other than the supplier location specified on the supplier Location page. The location type that you enter here automatically overrides the previous location defaults. Values include: Order of Acceptance: In Taxware, this is also known as the Point of Order Acceptance (POA). This indicates the location that the order was accepted. In some states, the order of acceptance identities tax applicability. For Taxware, this is the supplier location where the buyer order is approved and accepted. This is generally the order entry location. Point of Order: This option applies to Taxware software only. Point of order is the supplier location where the buyer order is generally received. Values are: Ship From: Location from which the order was shipped. Ship To: Location for which the order will ship. Service Performed: Location where the service will be performed. Note: This field is only available when the Taxware software is installed. If you leave this field blank, the TaxCalc process derives the address information from supplier Location page. |

GeoCode |

Click this link to select a new geocode. |

Use the Sales/Use Tax Information for Schedule page (PO_SCHED_SUT) to enter the SUT information for the schedule.

Navigation:

Click the Sched Sales/Use Tax button on the Maintain Purchase Order - Schedules page.

Field or Control |

Description |

|---|---|

Tax Destination |

Location code on which the SUT calculation for the schedule should be based. This is also known as the tax basis. Note: This option appears by default from the supplier Information - Tax Options, Purchasing Item Attributes, and Purchasing Item Category pages. |

Ultimate Use Code |

In most cases, sales tax is computed as a use tax based on the tax code applicable to the ship to or usage destination. However, how merchandise is ultimately used may also result in a different tax rate within the same ship to or usage destination. Enter an ultimate use code to override the default tax rate for a location. Note: This option appears by default from the supplier Information - Tax Options, Purchasing Item Attributes, and Purchasing Item Category pages. |

Exception Type and SUT Excptn Cert (sales and use tax exception certificate) |

Appears by default from the ship to location for the SUT destination. SUT exception type values include Direct Pay, Exempt/Exonerated, and None. |

Field or Control |

Description |

|---|---|

Calculate SUT (calculate sales and use tax) |

Click this button to run the TaxCalc API process, which calculates the sales and use tax. Use this option when Vertex or Taxware is installed. |

Calculation Parameters

Field or Control |

Description |

|---|---|

Include VAT |

This setting is especially relevant if each line has separate tax code values for SUT and VAT, in which case it is possible to have both on a given line resulting in a tax-on-tax situation. In these instances, the system calculates VAT, then SUT, either on the net-extended amount for the line or on the sum of the net-extended amount and VAT amount. If this option is selected, it indicates that the VAT amount needs to be taxed and the system adds the VAT amount to the net-extended amount before calculating SUT. |

Include Freight |

If selected, indicates that the freight amount needs to be taxed and the system adds the freight amount to the net-extended amount before calculating SUT. |

Include Misc Charges (include miscellaneous charges) |

If selected, indicates that the miscellaneous charges need to be taxed and the system adds the miscellaneous charges to the net-extended amount before calculating SUT. |

Note: The Include Vat, Include Freight, and Include Misc Charges calculation parameters appear by default from the Ship To Location Sales/Tax setup page.

Exception Handling

These exceptions apply to the Schedule Sales/Use Tax Information page:

If the SUT exception type is exempt or exonerated for the ship to location, the system does not call the TaxCalc API to calculate the exception.

If the SUT exception type is direct pay, the system updates the defaults on the SUT Excptn Cert (SUT exception certificate) with the direct pay permit from the ship to location and calls the TaxCAl API to update calculations.

If the SUT applicability is sales and the exception type is none, then send the ship to, ship from, POA, POA address, and geocodes, along with the extended amounts, to the TaxCalc API. Sales tax amounts are updated accordingly and distributed to purchase order lines.

If the SUT applicability is use and the exception type is none, then send the ship to, ship from, POA, POA address, and geocodes, along with the extended amounts, to the TaxCalc API. Set the transaction type to 1 - sales. Sales tax amounts are updated accordingly and distributed to purchase order lines.

Use the VAT Information for a Schedule page (PO_SCHED_VAT) to review and update VAT details for this schedule.

This page is accessible only if the General Ledger business unit on the Purchasing business unit links to a valid VAT entity.

Navigation:

Click the Schedule VAT button on the Maintain Purchase Order - Schedules page.

Expanding and Collapsing Sections

To manage the VAT data more efficiently, you can expand and collapse sections on this VAT page making it easier to manage the information on this page.

Field or Control |

Description |

|---|---|

Expand All Sections |

Click this button to scroll to and access every section on the page. You can also expand one or more sections by clicking the arrow next to the section's name. |

Collapse All Sections |

Click this button to collapse all sections displaying only the header information. If you expand one or more sections, you can click the arrow next to the section's name to collapse the section. |

Physical Nature

Field or Control |

Description |

|---|---|

Physical Nature |

Indicates whether an object is a good or a service. Many countries are required to report the sale and purchase of goods separately from services. The default comes from the customer location, customer or receivables business unit. |

Change Physical Nature |

Click to override the default physical nature for this item. The system resets all the VAT defaults. |

VAT Locations

Field or Control |

Description |

|---|---|

Location Country |

For services only, displays the PeopleSoft Purchasing business unit bill to location country. |

Location State |

For services only, displays the PeopleSoft Purchasing business unit bill to location state. |

Supplier Location Country |

For services only, displays the supplier's order from location country. |

Supplier Location State |

For services only, displays the supplier's order from location state. |

Service Performed Country |

The system sets the value for this field depending on the services performed flag setting in the product defaulting hierarchy (for example on the supplier or business unit):

|

Service Performed State |

The system sets the value for this field depending on the services performed flag setting in the PeopleSoft Purchasing defaulting hierarchy (for example on the supplier or business unit):

|

Ship From Country |

Displays the supplier's ship from location country. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship From State |

If the ship to country is defined as tracking VAT by state or province, it displays the supplier's ship from location state. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship To Country |

Displays the ship to location country. In the case of transactions involving goods or freight service transactions, this determines the VAT treatment. |

Ship To State |

If the ship to country is defined as tracking VAT by state or province, it displays the ship to location state. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

VAT Defaults

Field or Control |

Description |

|---|---|

Service Type |

If the transaction is for a service, it displays Freight or Other as the VAT service type. The value in this field determines whether or not the special rules for freight transport within the European Union apply. |

Place of Supply Driver |

If the transaction is for a service, displays the usual place of supply (such as the place where VAT is usually liable) for the service. This value is used to help determine the place of supply country and the VAT treatment. Values are: Buyer's Countries, Supplier's Countries, or Where Physically Performed. |

Reporting Country |

Displays the country for which this VAT will be reported. This is the VAT entity VAT registration country and determines many of the VAT defaults. |

Defaulting State |

If the reporting country requires that VAT be tracked by state or province, this field displays the state within the reporting country that is used to retrieve values from the VAT Defaults table. |

Supplier Registration Country and supplier Registration ID |

Displays the registration country and ID of the supplier. |

Exception Type |

Displays the exception granted to the VAT entity. Values are: None, Exonerated, or Suspended. This value is specified on the VAT entity registration. |

Certificate ID |

If applicable, displays the ID of the VAT exception certificate that may have been issued to the VAT entity. |

Calculate at Gross or Net |

Indicates how VAT is calculated. Values are: Gross: The system calculates VAT before it applies any early payment discounts. Net: The system calculates VAT after it deducts early payment discounts. If there are two percentage discounts, the system uses the larger of the two when it calculates VAT. The system does not use discount amounts, only discount percentages. The default value comes from the VAT entity driver. |

Recalculate at Payment |

Select this check box to enable the recalculation of VAT at payment time to allow for any early payment discounts, if you are calculating VAT at gross. This causes the system to adjust the VAT amount at the time of payment if the discount has been taken. This is set on the VAT entity driver in the VAT defaults table. |

Declaration Point |

Appears for a good or service when you want VAT transaction information to be recognized for reporting purposes. Values are:

This value may be set at several levels in the VAT hierarchy, that is, VAT entity registration, business unit options, supplier, or supplier location. |

Rounding Rule |

Displays the VAT rounding rule. The value comes from the VAT country, VAT Entity, supplier, or supplier location drivers. Values are: Nat Rnd (natural round): Amounts are rounded normally (up or down) to the precision specified for the currency code. For example, for a currency defined with two decimal places, 157.4659 would round up to 157.47 but 157.4649 would round down to 157.46. Down (round down): Amounts are rounded down. For example, for a currency defined with two decimal places, 157.4699 would round down to 157.46. Up (round up): Amounts are rounded up with a rounding precision to one additional decimal place. For example, for a currency defined with 2 decimal places, 157.4659 would round up to 157.47, but 157.4609 would round down to 157.46. |

Use Type |

Determines the split between recoverable (taxable) and non-recoverable (non-taxable) VAT. For the Canadian public sector, the use type also determines the rebate of the non-recoverable VAT. VAT rebates are calculated based on statutory rebate rates that are established for each public service body. The value comes from the VAT defaulting hierarchy, either from the item, item business unit, item category, supplier location, supplier, or purchasing options. |

Include Freight |

If selected, the system includes any freight amounts in the VAT basis by calculating VAT on the merchandise amount plus any freight amount. This option is only available for exclusive VAT calculation. The value comes from the VAT entity registration driver. |

Include Miscellaneous |

If selected, the system includes any miscellaneous charge amounts in the VAT basis by calculating VAT on the merchandise amount, plus any miscellaneous charge amount. This option is only available for exclusive VAT calculation. The value comes from the VAT entity registration driver. |

Place of Supply Country |

Displays the country in which the VAT liable (for services). Place of supply country is determined by algorithm. |

Treatment |

Displays the VAT treatment. VAT treatment is determined by a complex set of algorithms. Values are:

Within PeopleSoft, detail VAT treatment values on the transaction lines are used for applying the precise defaults applicable to the transaction lines. The treatment is determined based the rules applicable to the transaction. |

Applicability |

Displays the VAT status. Applicability is determined by an algorithm that makes use of the Applicable field in the VAT defaults table, the value of which may be set at almost every level in the PeopleSoft Purchasing VAT defaulting hierarchy. Values are:

|

VAT Code |

Displays the VAT code that defines the rate at which VAT is calculated for this schedule. The default value comes from the VAT country, purchase order options, supplier, supplier location, item category, and item levels in the PeopleSoft Purchasing VAT defaulting hierarchy. |

Record Output VAT |

Select this check box to enter vouchers where VAT is not included on the invoice but is payable to the VAT authority rather than the supplier. In this case, you account for both input and output VAT for the purchase. This is the case for an Intra-EU Acquisition or when you must account for output VAT on a service supplied by a foreign supplier. This is also referred to as self-assessing for VAT. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable value from the PeopleSoft-delivered VAT system setup data. |

Transaction Type |

Displays the code that categorizes and classifies this transaction for VAT reporting and accounting. The default value comes from the VAT entity registration, purchase order options, supplier, supplier location, item category, and item levels in the PeopleSoft Purchasing VAT defaulting hierarchy. |

Adjust/Reset VAT Defaults

Any changes that you make to fields on this page may affect VAT defaults on this page. For accuracy and consistency, use these fields to adjust affected VAT defaults or to reset all VAT defaults. Adjusting or resetting VAT defaults only affects fields within the VAT Defaults group box.

Field or Control |

Description |

|---|---|

Adjust Affected VAT Defaults |

Click this button to have the system adjust the VAT defaults that are affected by the changes. All changes that you have made to VAT defaults on this page that affect other VAT defaults on this page will be retained. Click the i button to list the fields that are to be adjusted. Note: You should always click the Adjust Affected VAT Defaults button after changing any defaults on the VAT page. |

Levels |

Enables you to specify the levels to reset when you click the Reset All VAT Defaults button. Values are: All lower levels: Resets all VAT defaults at lower levels for this page. This and all lower levels: Resets all VAT defaults on this page and at any lower levels of this page. This level only: Resets all VAT defaults on this page. |

Reset All VAT Defaults |

Click to have the system reset the VAT defaults based on the Levels value that you selected. Any changes that you previously made to VAT defaults will be lost. Note: Reset completely redetermines the VAT defaults. This does not necessarily mean they are reset to their original values. For example, the user may not have changed any VAT default values, but if a VAT driver field changes, you can click Reset All VAT Defaults to redetermine all defaults based on the new driver value. |

Use the Details for Schedule page (PO_SCHED_DTLS) to review or add schedule details to the selected schedule line.

Navigation:

Click the Schedule Details button on the Maintain Purchase Orders - Schedule page.

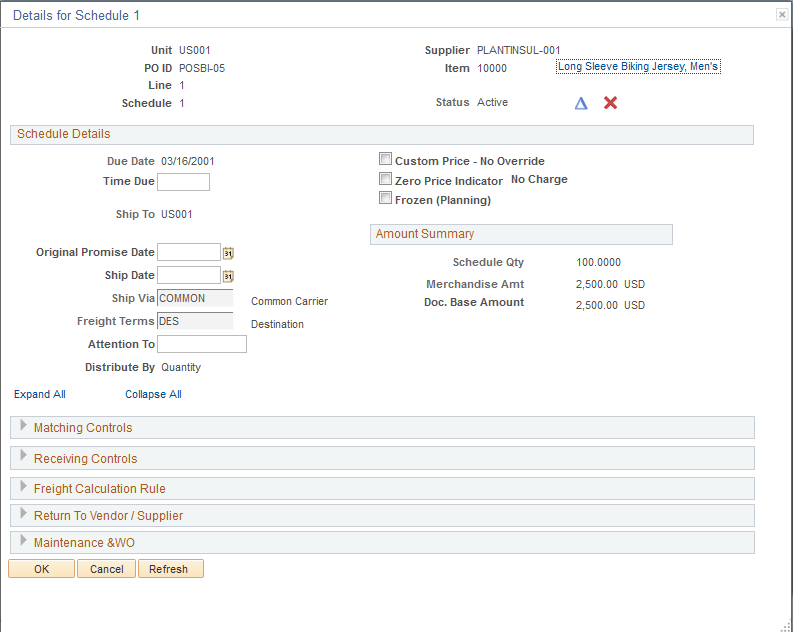

This example illustrates the fields and controls on the Details for Schedule page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Status |

Purchase order schedule status. Values are: Active, Canceled, or Closed. |

Schedule Details

Field or Control |

Description |

|---|---|

Custom Price - No Override |

Select this check box to indicate that you entered a custom price on the schedule. When the system needs to recalculate a price, it prompts you for approval before automatically recalculating the price. If you do not select this check box, but change the price on the schedule, the system selects it for you. |

Zero Price Indicator No Charge |

Select this check box to indicate that this is a zero-priced line and is considered a no charge item. |

Frozen (Planning) |

If selected, prevents PeopleSoft Supply Planning from changing the schedule. The two schedule changes PeopleSoft Supply Planning is allowed to recommend include:

|

Ship To Location |

Displays the ship to destination selected for the purchase order. |

Ship to GLN |

Displays the global location number for the corresponding ship to location, if available. Note: If the associated item has a preferred ship to location, the system displays the global location number for that preferred location. |

Original Promise Date |

Displays the supplier's original promised delivery date. Use this field to track when the supplier promised delivery against the date that the goods were actually received. Alternatively, you can use the due date on the schedule as the date against which to compare the receipt date for supplier performance tracking. |

Doc. Base Amount (document base amount) |

Displays the document base amount. This is the Amount value converted to the base currency of the purchase order. The base currency is the currency of the PeopleSoft General Ledger business unit for this PeopleSoft Purchasing business unit. |

Matching Controls

Field or Control |

Description |

|---|---|

Matching |

Select the matching method for the schedule. Values are ERS, Full Match, and No Match. |

Match Status PO |

Displays the match status of the schedule. Values are To Match, Part Matched, Fully Matched, and Unmatched. These are set based on the extent to which the matching process has been completed for the schedule. The system updates the match status, both from the matching process and from online purchase order maintenance. Online purchase order activity affects the match status if a schedule has already been fully matched and you increase the quantity. In that case, the system resets the match status to reflect a partial match. |

Matching Tolerance

When you use matching to verify supplier charges, the system uses price tolerances to determine whether the purchase order and voucher prices are within the tolerances and thus whether the purchase order and purchase order voucher match.

If you leave any of the tolerance fields set to zero or blank, the system interprets this to mean a zero tolerance.

If you don't want to use the tolerance fields, set the amount fields to 99999999.99999 and the percentage fields to 100%.

If you match vouchers against amount-only purchase order lines, multiple vouchers are likely to exist for the same purchase order schedule line. In this case, the under tolerance matching tolerances should not apply. To prevent under tolerance matching exceptions for non-received amount only lines you can do one of these options:

Enter 99999999.99999 in the under tolerance fields for matching to a purchase order.

Use Accounts Payable matching rules.

You can specify multiple matching rules on a purchase order, and on those rules, you can choose to use purchase order tolerances or not. You can modify existing delivered rules (by changing the SQL), or create your own rules that eliminate checking the purchase order lower tolerance percentages for amount only purchase order lines.

Field or Control |

Description |

|---|---|

Unit Price Tolerance Over/Tolerance Under |

Amount over and under the individual item price that you plan to allow on the voucher and still have the transaction qualify for a match. |

% Unit Price Tolerance Over/Tolerance Under |

Percent over and under the individual price that you plan to allow on the voucher and still have the transaction qualify for a match. |

Ext Price Tolerance Over/Tolerance Under (extended price tolerance over/tolerance under) |

Amount over and under the extended item price (price multiplied by quantity) that you plan to allow on the voucher and still have the transaction qualify for a match. |

% Ext Price Tolerance Over/Tolerance Under |

Percent over and under the extended item price (price multiplied by quantity) that you plan to allow on the voucher and still have the transaction qualify for a match. |

Receiving Controls

Field or Control |

Description |

|---|---|

Reject Qty Over Tolerance (reject quantity over tolerance) |

Select this check box to reject a shipment at receiving time if the quantity received is over the tolerance set in the Qty Rcvd Tolerance % (quantity received tolerance percentage) field. |

Early Ship Rjct Days (early shipment reject days) |

If you want to reject goods that arrive too early, enter the number of days early a shipment needs to be to qualify for rejection. For example, enter 3 to reject shipments automatically that arrive three or more days early. |

Qty Recv Tolerance % (quantity received tolerance percentage) |

Displays the quantity received tolerance percentage for the item on the purchase order. This field appears by default from the supplier's UOM and Pricing Info page. |

Close Under Quantity Percent |

Enter the percentage that represents the under quantity tolerance for receiving this purchase order line. |

Freight Calculation Rule

Field or Control |

Description |

|---|---|

Freight Charge Override |

Select this check box to override the freight charge set on the Purchase Order Defaults page with the values entered on this page. |

Maintenance WO (maintenance work order)

Displays the PeopleSoft Maintenance Management work order information that you previously entered on the Maintain Purchase Order - Schedules page. The Schedule Date, Amount, and currency fields are display fields from the WO schedule and not from the Purchase Order schedule details. If the Amount Only check box is selected for Purchase Order Line and Purchase Order Line is associated to Amount Only Work Order Schedule, only then the Schedule Date, Amount, Currency fields are displayed.

You can change the work order information field values on this page and the changed values will be reflected on the Maintain Purchase Order - Schedules page.

Note: The Maintenance WO section will not appear on this page if PeopleSoft Maintenance Management is not installed.

Use the Price Adjustments for Schedule page (PO_VAL_ADJ) to adjust the price of a schedule.

Navigation:

Click the Value Adjustment button on the Maintain Purchase Order - Schedules page.

Field or Control |

Description |

|---|---|

Adjusted Price |

Displays the sum of all value adjustments, including base price. |

Current Price |

Displays the current price on the schedule. |

Change Price |

Click this link to set the current price value to the adjusted price value. This difference in prices may have been introduced during a price override or if a custom price was set at on the schedule. This link is available only when the adjusted price is not equal to the current price. If you change the price directly on the schedule line, the current price reflects this change. If this change is made in error, you can click the Change Price link to change the current price back to the adjusted price. |

Sort Value Adjustments |

Click this link to sort the value adjustments by sequence number. |

Value Adjustments

Field or Control |

Description |

|---|---|

Seq (sequence) |

The order in which the system applies adjustments. This distinction can be important if there are percentage adjustments. The amount the percentage represents can vary depending on the order in which the adjustments are applied. You cannot change the sequence number of system-calculated adjustments for the base price of an item or supplier, nor for contract price adjustments. |

Type |

There are various types of adjustments available for purchase orders. Indicates the origin of the price adjustment amount. For example, the type is set to CNT (contract) if the purchase order line is associated with a contract and the contract has contract price adjustments defined. The system calculates some of the adjustments, including the base price adjustment. You can indicate whether the adjustment should be applied for all types, except the base price type. Base: Base price from the item's Purchasing Attributes page. This is either the item and supplier price or the standard item price. The base price is always the first adjustment and cannot be deleted. Unless the base price adjustment type is user defined, you cannot change it. User-defined base price adjustment types are possible only if you are ordering by description. Values are: CNT: The price adjustment is from the contract. TBL: The price adjustment (discount or surcharge) is from the item's Price Adjustments page. FRT: The price adjustment is from a freight charge. TAX: The price adjustment is from an SUT amount. OTH: Other miscellaneous adjustments. If selected, enter the adjustment description in the available text box. |

Base Price Type |

Identifies where the starting price came from when the value in the Type field is Base. Values are: Contract: From the contract for the item. Item Standard: From the standard item price on the item's purchasing attributes. Supplier Std: From the standard item and supplier pricing structure on the item Purchasing Attributes-Item/supplier page or Price Adjustments page. User: When the user-defined price is used because the staged row is created without selecting the Calculate Price check box. |

Adj Meth (adjustment method) |

Pct (percent): If selected, the Pct and Price To Base Percentage On fields become available for entry. Enter the adjustment percent and indicate whether you want the adjustment percentage applied to the base price or to the price as calculated. For example, suppose that you have a base price of 100 and two percentage adjustments of -10 percent each. If you select Base, the system applies each adjustment to the base price and totals the adjustments for a total adjustment of -20 and an adjusted price of 80. If you select Calculated, the system applies the adjustments incrementally according to the adjustment sequence number. The first adjustment of -10 percent is applied to the base price of 100 for an adjustment of -10 and an incremental price of 90. The second adjustment is applied to the calculated incremental price of 90 for an adjustment of -9 and an adjusted price of 81. Amt (amount): Enter an adjustment amount. Amount and percent adjustments can be either positive (surcharge) or negative (discount). |

System Adjustment Info

If you have a contract or an item-supplier relationship on the line, there may be price adjustments associated with the item. The price adjustments associated with the item appears in the System Adjustment Info group box.

Field or Control |

Description |

|---|---|

Ship To |

Location to which the adjustment pertains. |

UOM |

UOM for which the adjustment should be applied. |

Qty Needed (quantity needed) |

Displays the quantity needed to qualify for the adjustment. |

Actual |

Displays the actual quantity on the schedule. |

Use the Miscellaneous Charges for Schedule page (PO_SCHED_MISC) to change miscellaneous charges on this schedule.

Navigation:

Click the Miscellaneous Charges button on the Maintain Purchase Order - Schedules page.

Field or Control |

Description |

|---|---|

Adjusted Price |

Displays the price on the schedule including any price adjustment amounts. |

Current Price |

Displays the current price on the schedule. |

Misc. Charges

Field or Control |

Description |

|---|---|

Calculation Method |

If the charge type has appeared by default from the Miscellaneous Charges - Miscellaneous page, the calculation method associated with the default appears here. If the charge was entered on the schedule, the % Value method is selected and you can enter values in the Value % and Flat Amount fields. |

Value % (value percentage) |

If the miscellaneous charge is a percentage of the unit price, this is the percentage of the charge. |

Flat Amount |

If the miscellaneous charge is a flat amount, this is the amount of the charge. |

More Details

Select the More Details.

Field or Control |

Description |

|---|---|

Actual Chrg (actual charge) |

Select if this is an actual charge, rather than an estimate. The system displays the miscellaneous charge origin. Values are: Allocated: Charges are allocated from the header miscellaneous charges. Calculated: Charges are calculated from the item and supplier miscellaneous charges setup. Entered. |

LC Comp (landed cost component) |

If selected, indicates that the charge is a landed cost. This is a display-only field. |

Use the Schedule - 3rd Party supplier page (PO_SCHED_MISC_3RD) to select a third-party supplier to whom to pay the miscellaneous charge.

Navigation:

Click the Third Party link on the Miscellaneous Charges for Schedule page.

Field or Control |

Description |

|---|---|

Adjustment Amount |

The amount of the miscellaneous charge from the Schedule - Miscellaneous Charges page appears. |

Currency |

Currency of the charge amount appears by default from the supplier location default currency when the third-party supplier location is specified. |

Adj Base (adjustment base) |

Adjustment amount expressed in the base currency. |