Reviewing and Changing Item Costing and Accounting Entries

PeopleSoft Cost Management provides several interactive pages to help you analyze, compare, and review the item costs generated in a manufacturing or distribution environment. You can monitor the transactions as they are processed through the Transaction Costing, Accounting Line Creation, and Journal Generator processes. In a manufacturing environment, you can analyze the production costs at every stage of the production ID, enabling you to identify cost fluctuations early in the process.

This section discusses how to review the inventory transactions as they flow through the accounting system.

Reviewing Item Setup

PeopleSoft provides you with inquiry pages to help you review the costing status of an item. Use the:

Item Cost Inquiry component to review every part of an item's costing definition.

This ten page component provides information about how the item is set up for costing within the business unit.

Inventory On Hand page to identify the basic costing setup for an item and the current quantity on hand.

Monitoring the Costing Flow

PeopleSoft provides inquiry pages to enable you to monitor the transactions at each stage as they flow through the accounting processes of the Transaction Costing, Accounting Line Creation, and Journal Generator processes.

The Message Log inquiry page checks for the successful completion of all processes, including the Transaction Costing, Accounting Line Creation, and Journal Generator processes.

The Cost Tolerance Control page identifies possible cost errors for all transactions that have completed the Transaction Costing process.

The Pending Transactions page identifies the number of transactions at each stage of the costing flow.

Predefined queries give detailed transaction information about each area.

The Insufficient Qty Tool (insufficient quantity tool) page identifies depletion transactions (in environments using the negative inventory feature) where accounting entries are not created due to insufficient quantity.

Comparing and Analyzing Manufacturing Costs

PeopleSoft Cost Management enables you to monitor the costing of items produced in PeopleSoft Manufacturing for all types of costing (frozen standard, actual, and average costing methods). Use the:

Actual Cost Inquiry page to review the actual costs of production for a manufactured item.

Costs are broken down by business unit, item ID, operation sequence, cost category, production conversion codes, and other criteria.

Proactive Production Cost - PID Cost to take a snapshot of the production costs at any stage in the production process.

Then, these captured costs can be compared and analyzed using the Compare Cost Measures component.

Compare Cost Measures component to identify costing flow issues by comparing the production costs at various stages for production for a single production ID or production schedule.

Pending Transactions page to identify the number of production completions that have been putaway in inventory, partially or completely, and the number of production completions that have not been costed by Transaction Costing process.

Predefined queries give detailed transaction information about each area.

Verifying the Creation of Accounting Entries

Once you generate accounting entries using the Accounting Line Creation process, you can review or change the entries before they are picked up by the Journal Generator process for posting in the general ledger.

Use the:

Accounting Line Errors page, the Edit Unposted Accounting Lines page, and the Detail Accounting page to review and change accounting entries.

From the Edit Unposted Accounting Lines page, you can link to the Change Accounting Date page to redirect the accounting entry to an earlier accounting period by changing the accounting date of the transaction before it is sent to the general ledger.

Pending Transactions page, Unposted Accounting Lines page, Posted Accounting Line page, and the Accounting Entries page to inquire about the accounting entries.

Verifying Your Entries Passed Budget Checking

If you are using commitment control, the accounting entries must pass budget checking before you can pass them to the general ledger system using the Journal Generator process. Entries that do not pass budget checking appear on the CM Transaction Exceptions component, where you can determine the action necessary to resolve the error. The Pending Transactions page also has a query for transactions not posted to the general ledger that identifies the transaction's budget checking status. If you change a line that has already been budget checked, the budget status is set to N, and the line must run through budget checking again.

Verifying Your Entries Passed ChartField Balancing

If you are using intraunit ChartField balancing, the intraunit accounting entries must be balanced before passing them to the general ledger system using the Journal Generator process. Also, if you are using commitment control, the accounting entries must pass budget checking before they are available to perform ChartField balancing. The system assigns an error status to entries that cannot be balanced. They appear on the Edit Unposted Accounting Lines page, where you can resolve the problem. The Pending Transactions page also has a query for transactions not posted to the general ledger that identifies the transaction's status. When the accounting entries have successfully passed the Intraunit ChartField Balancing process, you can no longer change the interunit receivables and payables accounting lines.

Note: If you use commitment control and intraunit accounting (fund accounting), budget checking and intraunit ChartField balancing must be completed successfully before the accounting entries can be passed to the general ledger system. Once the accounting entries have been processed by the Journal Generator, you can no longer change any information on the accounting entries.

Using Reports

Use the Accounting Register report and the Transaction Register report to review both transaction costing and accounting entries.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Item Cost Inquiry - General: Common Page |

CM_INQ_GEN |

View general cost information about any item within the business unit, including default cost element, standard cost group, book names, cost profiles, default actual cost, current purchase cost, last price paid, and quantity on hand. |

|

Item Cost Inquiry - General: Transfer Costs Page |

CM_INQ_XFER |

Displays transfer information about the item within the business unit. Also displays the item's transfer price or markup percentage. Information for the item appears by default in the Default Unit Transfer Attributes section. Planning attributes appear as defined at the business unit and item level. |

|

Item Cost Inquiry - General: Supplier Costs Page |

CM_INQ_VNDR |

Displays the vendors defined for this item on the Purchasing Attributes - Item Supplier component, including supplier ID, supplier location, unit of measure (UOM), currency, minimum order quantity, supplier price and effective date of the price. |

|

Item Cost Inquiry - General: Additional Costs Page |

CM_INQ_ADD |

Displays any additional costs added to the item using the Additional Item Costs page. Also displays the cost type, cost version, cost element, application method, and expense rate or percentage defined for the item and business unit. |

|

Item Cost Inquiry - General: Pricing Info Page |

CM_INQ_PRC |

Displays pricing information for this item as defined in PeopleSoft Order Management, including product ID, list price, and any price lists for this item. |

|

Item Cost Inquiry - Standard Page |

CM_INQ_STD |

Displays the current frozen standard costs for this item in this business unit. These standard costs are broken down by cost element and level. The standard costs are determined by the Cost Rollup process and applied to the production environment using the Update Production process. |

|

Prod'n/Standard Cost Detail Page |

CM_PRODCOST_DET |

Displays the detailed costs maintained by component ID and operation sequence. |

|

Item Cost Inquiry - Actual Page |

CM_INQ_ACT |

Displays information about the item's actual costs with this business unit. The deplete cost method (from the cost profile) is identified for each book set up for this item. The item's cost history appears along with every receipt number with unit cost, supplier, the source of the receipt, and the storage area where the item was received. |

|

Item Cost Inquiry - Perpetual Avg Page |

CM_INQ_PERP |

Displays the computed perpetual weighted average for this item within this business unit. The date and time of the computation also appears. Perpetual averages are calculated with each putaway of the item. |

|

Item Cost Inquiry - Retroactive Avg Page |

CM_INQ_PERR |

If retroactive perpetual averaging is used for this item within this business unit, then this inquiry page displays the item's perpetual weighted average and the date and time to which it is applied. Retroactive perpetual averages are applied when you run the Transaction Costing process (within the Cost Accounting Creation process) in the regular Cost Mode. Multiple averages are computed and applied for each putaway. |

|

Item Cost Inquiry - Periodic Avg Page |

CM_INQ_PERD |

Displays the periodic weighted averages for this item within this business unit and the date and time it was applied. Periodic weighted averages are applied when you run the Transaction Costing process (within the Cost Accounting Creation process) in the regular Cost Mode and are applied to all putaways in the period. |

|

Inventory On Hand Page |

CM_OH_INQUIRY |

View the accounting profile and current on-hand quantity for any item within a business unit. Also displays the item's book names, costing methods, on-hand quantity, and the value of the on-hand quantity. |

|

On Hand by Receipt Line Page |

CM_RCPT_LINEDET_SP |

View the quantity available and its value according to the storage location for the business unit, item ID, and book name. This inquiry page also displays the receipt and deplete quantities. Click the column heading to sort the data in ascending order based on the column. |

|

CM_CTC_INQ |

Review costed inventory transactions for possible costing errors based on user-defined tolerance levels. To be viewed on this inquiry, the transactions must have successfully completed the Transaction Costing process of the Cost Accounting Creation process. |

|

|

Message Log Page |

MESSAGE_LOG |

Find any messages created during the Transaction Costing, Accounting Line Creation and Journal Generator processes. |

|

CM_NPOSTED |

View inventory accounting transactions that have not yet been posted to PeopleSoft General Ledger. This inquiry page enables you to monitor transactions before and after the Transaction Costing and Accounting Line Creation processes. Click the Details links to view current transaction information generated by predefined queries. This page also provides links to the Accounting Line Errors page and the Query Viewer. |

|

|

RUN_CM_NEG_INV |

This PeopleSoft Application Engine program, (CM_NEG_INV), provides you with a query of the accounting line entries that would be generated for those transactions held back in CM_DEPLETIONS due to insufficient quantities. |

|

|

Actual Cost Inquiry Page |

CM_ACTUALCOST_INQ |

(Manufacturing environment only) For makeable items, you can view the actual cost of production based on the production ID or the combination of production area and item ID. Also displays the actual costs of production broken down by operation sequence, cost category, and conversion code. The production status, item ID, book name, and completed quantity also appear. The actual costs are calculated by the Transaction Costing process within the Cost Accounting Creation process. |

|

Proactive Production Cost - PID Cost Page |

CE_PRDNID_COSTING |

For makeable items, this page provides advanced proactive visibility into the costing of a production ID during each phase of production. You can save the current costs under a cost measure type for reviewing and comparing on the Compare Cost Measure component. |

|

Primary Products & Co-Product Cost Page |

CE_OUTPUT_COST_SEC |

View the projected costs for the primary product and co-products of this production ID. |

|

Compare Cost Measures - Output Analysis Page |

CE_COST_ANALYTICS |

Review and compare the cost calculations for the output from a production ID (products, co-products, and so on) at various stages of production. Cost comparisons can include the production ID as planned, as produced, the frozen standard costs, the actual production costs, or other stages of production. |

|

Compare Cost Measures - Input Analysis Page |

CE_COST_ANALYTICS2 |

Review and compare the cost calculations for the input into a production ID (components, direct, and indirect costs) at various stages of production. Cost comparisons can include the production ID as planned, as produced, the frozen standard costs, the actual production costs, or other stages of production. |

|

Sequences for the Cost Measure Page |

CE_COST_MEASUR_SEC |

Select the sequence number for viewing costs for this business unit, production ID, and item ID combination. |

|

Accounting Line Errors Page |

CM_ACCTG_LN_ERR |

Find any accounting lines that could not be created because of missing accounting rules. |

|

CM_ACCTG_LN_UNPOST |

After you run the Accounting Line Creation process, use this page to review and make changes to the accounting entry line information for a transaction prior to generating journal entries. For any transaction, you can correct the ChartFields and also change the accounting date. For example, you can adjust or redirect charges to other accounts, change the budget period for the transaction, or redirect the entry to a prior accounting period. |

|

|

Change Accounting Date Page |

CM_ACCTG_UNPST_TRX |

Enables you to redirect an accounting entry to an earlier accounting period by changing the accounting date of the transaction before it is sent to the general ledger system. The system displays all the debit and credit lines for the selected accounting entry. Enter the new date in the Accounting Date field and click the OK button to change the accounting date for this transaction. If commitment control is enabled, you cannot change the transaction if any line has passed budget checking. |

|

Unposted to GL Page |

CM_DRILL_UNPST_DET |

View accounting entries that have not yet been picked up by the Journal Generator process for posting to the general ledger system. ChartField security can be applied to this page. |

|

Posted Accounting Lines Page |

CM_DRILL_JRNL_DET |

View accounting entries that have already been picked up by the Journal Generator process for posting to the general ledger system. ChartField security can be applied to this page. |

|

Accounting Entries Page |

CM_ACCTG_LINE |

View accounting entries, by entering the search criteria and click the Refresh button. Displays the both the debit and credit sides of the accounting entry and the complete ChartField combinations. ChartField security can be applied to this page. |

|

KK_XCP_HDR_CM1 |

View budget checking errors or warning messages for PeopleSoft Cost Management transactions. Users who have authority can override the budget exceptions on this page. |

|

|

Cost Management Line Drill Down Page |

KK_DRL_CM1_SEC |

View line details for PeopleSoft Cost Management transactions with budget exceptions. |

|

CM Transaction Exceptions - Line Exceptions Page |

KK_XCP_LN_CM1 |

View individual lines in transactions with budget checking errors or warning messages. |

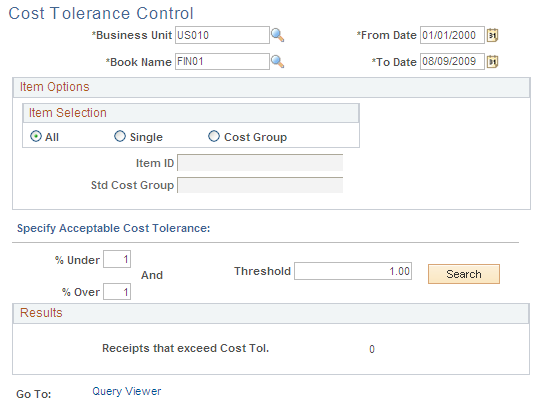

Use the Cost Tolerance Control page (CM_CTC_INQ) to review costed inventory transactions for possible costing errors based on user-defined tolerance levels.

To be viewed on this inquiry, the transactions must have successfully completed the Transaction Costing process of the Cost Accounting Creation process.

Navigation:

This example illustrates the fields and controls on the Cost Tolerance Control page. You can find definitions for the fields and controls later on this page.

PeopleSoft Cost Management receives transactions from a variety of sources. The Cost Tolerance Control page helps you to monitor transactions flowing into your cost management system and identifies possible cost errors from any of the sources of incoming inventory. Use the inquiry page to view costed inventory transactions that exceed your cost tolerance parameters. The inquiry results can be viewed on screen or downloaded into a spreadsheet such as Microsoft Excel for further analysis.

In order to be evaluated by this inquiry, an inventory transaction must have successfully completed the Transaction Costing process of the Cost Accounting Creation process.

Search Criteria

Enter your search criteria to select the inventory transactions to be examined for cost tolerance exceptions. Your search criteria determine the sample population to be used.

Field or Control |

Description |

|---|---|

Business Unit |

(Required) Enter the PeopleSoft Inventory business unit. |

Book Name |

(Required) Enter the name of the cost book used. |

From Date and To Date |

(Required) Enter a date range for the transaction date. The default range is from 01/01/1900 to the current system date. |

All Items |

Select to include all items within the business unit and cost book. |

Single Item |

Select to run this inquiry only for transactions with the item identified in the Item ID field. |

Standard Cost Group |

Select to run this inquiry only for a specific standard cost group defined in the Std Cost Group field. Standard cost groups, or cost groups, enable you to group together a set of items using the Define Business Unit Item -General: Common page. Inventory transactions with items included in the defined cost group are included in this search. |

Cost Tolerances and Searching

To qualify as an exception, a transaction must exceed either the % Under or % Over tolerance and also exceed the Threshold tolerance. Cost tolerances are:

Field or Control |

Description |

|---|---|

% Under |

Enter a percentage of the average cost. If an individual transaction is less than this percentage of the average cost of the sample then it is tagged as a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the % Under value is 10 percent, then any transaction with an item cost of less than 90 USD is a possible exception. This field must be less than 100 percent. The default value is zero percent. |

% Over |

Enter a percentage of the average cost. If an individual transaction is greater than this percentage of the average cost of the sample then it is tagged as a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the % Over value is 15 percent, then any transaction with an item cost of greater than 115 USD is a possible exception. The default value is 100 percent. |

Threshold |

Enter the amount that the costed inventory transaction must fluctuate from the average cost. If any individual transaction differs from the average cost of the sample by more or less than this amount, then the transaction is a possible exception. For example, if the average cost in the sample for business unit US008/cost book FIN/item ID 10001 is 100 USD and the Threshold value is 25 USD, then any transaction with an item cost of greater than 125 USD or less than 75 USD is a possible exception. This cost tolerance is useful if you wish to prevent small value items from appearing as exceptions. The default value for this field is zero. |

Click the Search button to identify transactions that exceed your cost tolerance parameters. The exception transactions are based on the following calculation:

Based on the business unit, book, date range, and item selection entered on this page, the system finds all costed inventory transactions that meet these parameters and creates a sample population.

An average cost is calculated for each business unit/cost book/item ID combination based on the sample population.

Note: This average cost could differ from the average cost used in PeopleSoft Cost Management transactions since the search criteria on this page could limit the number of transactions used.

Each individual transaction in the sample population is then compared to the average cost of the sample for the business unit/cost book/item combination using the cost tolerances to find exceptions. Remember, to qualify as an exception, a transaction must exceed either the % Under or % Over tolerance and also exceed the Threshold tolerance.

Viewing Search Results

Field or Control |

Description |

|---|---|

Receipts that exceed Cost Tol |

Identifies the number of rows found by the search that exceed the defined cost tolerances. If too many or too few inventory transactions are found, the user can change the search criteria and cost tolerances then launch another search. |

Details |

Select this link to access the results of the query. This link becomes available only when search results are found. |

Query Viewer |

Use this link to access the Query Viewer where you can run queries or schedule them to run at a later time. |

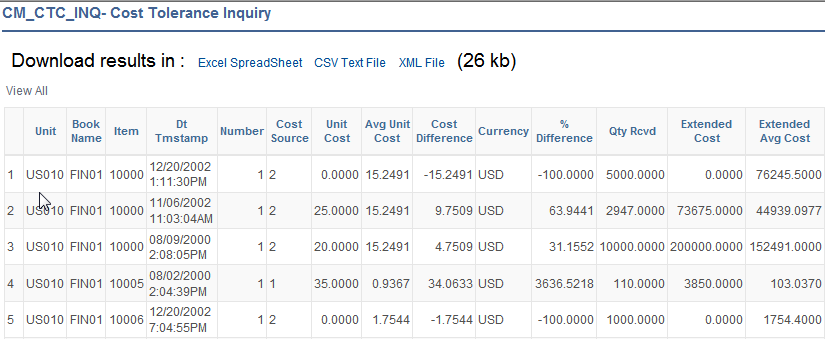

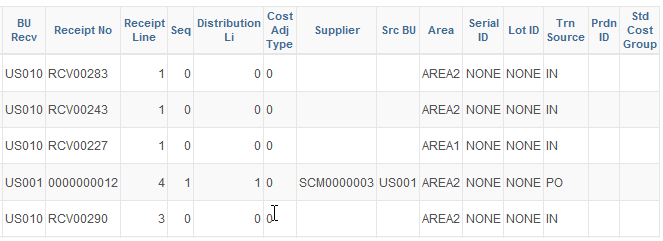

Click the Details link to access the query results:

This example illustrates the fields and controls on the Viewing results online (part 1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Viewing results online (part 2 of 2). You can find definitions for the fields and controls later on this page.

Values displayed include:

Field or Control |

Description |

|---|---|

Unit Cost |

The unit cost of the individual transaction that has exceeded the cost tolerance parameters. |

Avg Unit Cost |

The average unit cost of the sample population. |

Cost Difference |

"Unit Cost" – "Avg Unit Cost" |

% Difference |

("Unit Cost" - "Avg Unit Cost") / "Avg Unit Cost" * 100 |

Extended Cost |

"Unit Cost" * "Qty Rcvd" |

Extended Avg Cost |

"Avg Unit Cost" * "Qty Rcvd" |

Costs are viewed with four decimal places; however, the intermediate calculations and comparisons utilize the full precision values available.

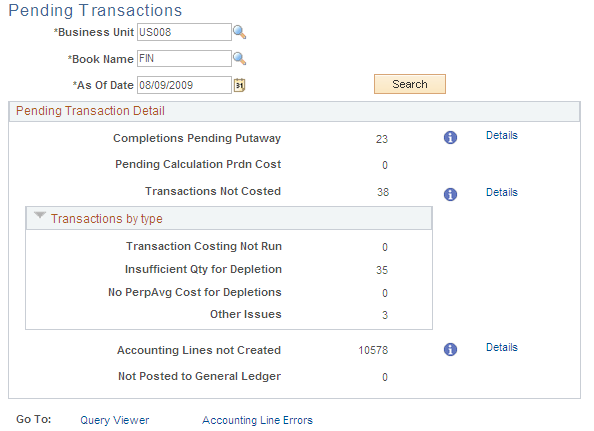

Use the Pending Transactions page (CM_NPOSTED) to view inventory accounting transactions that have not yet been posted to PeopleSoft General Ledger.

This inquiry page enables you to monitor transactions before and after the Transaction Costing and Accounting Line Creation processes. Click the Details links to view current transaction information generated by predefined queries. This page also provides links to the Accounting Line Errors page and the Query Viewer.

Navigation:

This example illustrates the fields and controls on the Pending Transactions page. You can find definitions for the fields and controls later on this page.

Use this inquiry page to review inventory accounting transactions that have not yet been posted to the PeopleSoft General Ledger. This inquiry enables you to monitor pending transactions in these stages of the costing flow:

Before production completions from PeopleSoft Manufacturing have been putaway into PeopleSoft Inventory.

Before production completions from PeopleSoft Manufacturing have been costed.

Before the Transaction Costing process.

Before the Accounting Line Creation process.

Before the Journal Generator process.

Click the Details links to view current transaction information generated by predefined queries for each of these three stages: (TRANSACTION_INV, CM_PENDING_COSTING, CM_PENDING_ACCTG_LINE, and CM_PENDING_GL_DISTRIB). This page also provides a link to the Query Viewer, where you can run queries or schedule them to run at a later time.

Field or Control |

Description |

|---|---|

Search |

Select after entering the business unit, book name, and as of date for the inventory transactions that you want to review. The system displays the number of transactions at each stage of the accounting flow. |

Completions Pending Putaway |

Displays the number of WIP completions and scrap from PeopleSoft Manufacturing that have been partially putaway or not yet been putaway into an inventory storage location˙. This query is especially useful when using actual or average costing for make items. |

Pending Calculation Prdn Cost |

Displays the number of production completions from PeopleSoft Manufacturing that have been putaway into inventory but not yet costed by the Transaction Costing process. There are a number of reasons why the Transaction Costing process would not have costed these transactions; for a complete list, see the Generating Costs for Transaction Records section of this topic. |

Transactions Not Costed |

Displays the number of inventory transactions, other than production completions, that have not been processed by the Transaction Costing process. This number is further broken down into three sections in the Transactions by Type group box. |

Transaction Costing Not Run |

Displays the number of inventory transactions that have not been costed, because the Transaction Costing process has not been run to include them. |

Insufficient Qty for Depletion (insufficient quantity for depletion) |

Displays the number of inventory transactions that did not complete the Transaction Costing process successfully, because the inventory business unit did not have a sufficient on-hand quantity to satisfy the depletion. The stock quantity of an item may physically exist in inventory however the quantity is not yet recorded in PeopleSoft Inventory due to timing issues or entry errors. The negative inventory feature enables you to move or ship the stock that sends the item's quantity balance into negative numbers within the PeopleSoft system. You can record a negative quantity within PeopleSoft Inventory, however, you could choose not to cost a transaction based on a negative quantity. If you choose not to cost negative inventory transactions, then the Transaction Costing process holds costing the depletion transaction. Each time the Transaction Costing process is run, the depletion transactions on hold are examined to determine if there is sufficient quantity available to satisfy the depletion. Once sufficient quantity exists, the transaction is costed. Note: The negative inventory feature is activated by selecting the Allow Negative Inventory check box on the Inventory Definition-Business Unit Options page. The Insufficient Qty Cost Option on the Cost Profiles page determines how the Transaction Costing process applies costing to negative inventory transactions. |

Other Issues |

Displays the number of inventory transactions that did not successfully complete the Transaction Costing process due to other issues besides insufficient depletion quantity. Other issues include:

|

Accounting Lines Not Created |

Displays the number of inventory transactions that have completed the Transaction Costing process successfully, but have not yet been processed by the Accounting Line Creation job. The costed transactions may not have completed the Accounting Line Creation job simply because you have not run the process for the business unit, book name, and as of date combination. Also, these costed transactions may not have completed the Accounting Line Creation process successfully, because the transactions are missing an accounting rule. Click the Accounting Line Errors link at the bottom of this page to view costed transactions without accounting rules. Accounting rules must be added before you can create accounting entries for costed transactions. |

Not Posted to General Ledger |

Displays the number of inventory transactions that have completed both the Transaction Costing process and the Accounting Line Creation job successfully, but have not yet been picked up by the Journal Generator process and posted to the general ledger. There are several reasons why the accounting entries may not have been picked up and posted as journal entries:

|

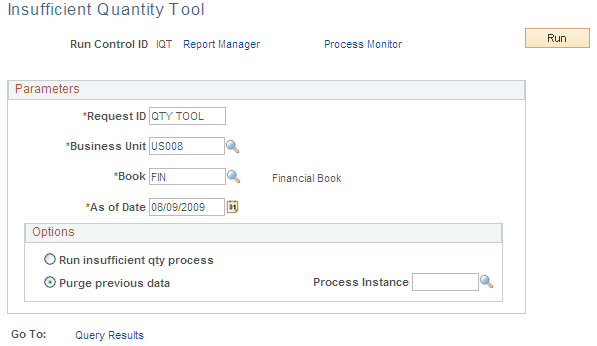

Use the Insufficient Qty Tool (insufficient quantity tool) page (RUN_CM_NEG_INV) to this PeopleSoft Application Engine program, (CM_NEG_INV), provides you with a query of the accounting line entries that would be generated for those transactions held back in CM_DEPLETIONS due to insufficient quantities.

Navigation:

This example illustrates the fields and controls on the Insufficient Quantity Tool page. You can find definitions for the fields and controls later on this page.

This PeopleSoft Application Engine program (CM_NEG_INV) provides you with a query of the accounting line entries that would be generated for those transactions held in CM_DEPLETIONS_VW due to insufficient quantities.

The negative inventory feature is activated by selecting the Allow Negative Inventory check box on the Inventory Definition-Business Unit Options page. Use the Insufficient Qty Cost Option on the Cost Profile page to specify how the negative inventory feature should be applied; select Hold to delay costing the entire depletion transaction that drives the item quantity to a negative balance until sufficient stock is putaway to cover the depletion transaction, or select Partial to split the depletion transaction that drives the item quantity to a negative balance and costs part of the depletion transaction up to the currently available stock quantity. The remaining depletion transaction is held until sufficient stock is putaway.

By Business Unit, Book, and As of Date this process collects the rows in CM_DEPLETIONS that are held back due to insufficient quantities and creates a query displaying the accounting entries that would be generated. The system saves the information into CM_NEG_SNP2_TBL where it is keyed by process instance, business unit, transaction group, accounting date, and line number. It includes the field, CM_ERROR_CODE, to identify rows where an accounting entry could not be determined, because a transaction accounting rule was not found.

After you run this process click the Query Results link to view the results. Using the query, the results can be exported to a Microsoft Excel spreadsheet or a CSV text file.

Field or Control |

Description |

|---|---|

Run insufficient qty process |

Select to run the CM_NEG_INV PeopleSoft Application Engine process to populate the CM_NEG_SNP2_TBL record with entries based on the business unit, cost book, and as of date entered on this page. |

Purge previous data |

Select to purge rows from the CM_NEG_SNP2_TBL record based on the business unit, cost book, and as of date entered on this page. |

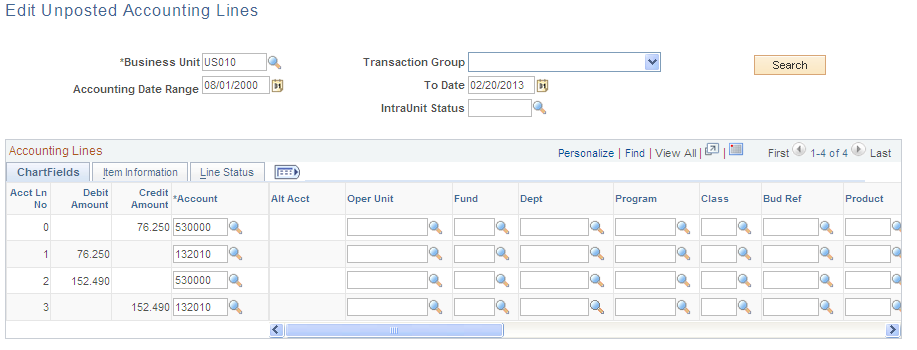

Use the Edit Unposted Accounting Lines page (CM_ACCTG_LN_UNPOST) to after you run the Accounting Line Creation process, use this page to review and make changes to the accounting entry line information for a transaction prior to generating journal entries.

For any transaction, you can correct the ChartFields and also change the accounting date. For example, you can adjust or redirect charges to other accounts, change the budget period for the transaction, or redirect the entry to a prior accounting period.

Navigation:

This example illustrates the fields and controls on the Edit Unposted Accounting Lines page. You can find definitions for the fields and controls later on this page.

After you run the Accounting Line Creation process, use this page to review and make changes to the accounting entry line information for a transaction prior to generating journal entries. For any transaction, you can correct the ChartFields and also change the accounting date. For example, you can adjust or redirect charges to other accounts, change the budget period for the transaction, or redirect the entry to a previous accounting period.

Field or Control |

Description |

|---|---|

|

Click the Budget Check Details button to view the budget details for the current accounting line. This button displays when commitment control is selected for PeopleSoft Inventory on the Installation Options-Products page. |

ChartFields

Field or Control |

Description |

|---|---|

|

Click to access the Change Accounting Date page where you can enter a new accounting date for the transaction before the Journal Generator process picks up the transaction. If commitment control is enabled, you cannot change the transaction, if any line has passed budget checking. |

Line Status

Select the Line Status tab.

Field or Control |

Description |

|---|---|

Budget Status |

Displays the transaction's budget checking status. |

IntraUnit Status |

If you are using intraunit accounting, the transaction's ChartField balancing status appears. |

IU Balancing Entry (intraunit balancing entry) |

If you are using intraunit accounting, this check box is selected if the line is an intraunit receivable or intraunit payable that balances the transaction. These lines are added by the ChartField balancing process. |

GL Dist Status (general ledger distribution status) |

Indicates whether or not the accounting entry has been passed to the general ledger system. |

PC Status (project costing status) |

Indicates whether or not the accounting entry has been passed to PeopleSoft Project Costing. Only entries coded for project costing are passed. |

To view and change unposted lines:

Enter the business unit, transaction group, and accounting date range.

If you do not enter a date range, all unposted transactions relating to the transaction group appear. If you do not enter a transaction group, all transaction groups appear related to the business unit that you entered.

(Commitment control only) Enter the budget status.

Values are: E (error in budget check), N (not budget checked), and V (valid budget check).

(ChartField balancing only) Enter the IU status (intraunit ChartField balancing status).

Values are: B (balanced), E (error), I (ignore. The line is not an intraunit transaction), N (not balanced), H (hold for other business unit affiliates), P (in process), S (staged), and X (balancing not required).

Click the Search button to populate the account line information on the lower portion of the page.

To alter the accounting date of a transaction, click the Change Accounting DT button to access the Change Accounting Date page, where you can enter a new accounting date for accounting entry. If commitment control is enabled, you cannot change the transaction if any line has passed budget checking. Accounting date is determined by the transaction date, open periods, and lag days. If the transaction date is greater than the last open date, then the accounting date is set to the first date in the next open period. If the transaction date is less than the first open date it will be set to the first open date.

Select the ChartFields tab or Line Status tab to display information for any accounting line.

Change any incorrect data in the editable fields.

Click the Budget Check Details button, if available, at the beginning of the account line to access the Commitment Control page for that line.

Note: For any line in error, changing information on the line resets the budget status. Rerun the GL Dist Status and the Accounting Line Creation process. Balancing ChartFields will not be available in balanced rows; therefore, you cannot make changes for those ChartFields.

Use the CM Transaction Exceptions - Header Exceptions page (KK_XCP_HDR_CM1) to view budget checking errors or warning messages for PeopleSoft Cost Management transactions.

Users who have authority can override the budget exceptions on this page.

Navigation:

Field or Control |

Description |

|---|---|

Override Transaction |

Select to enable the entire transaction to update the control budget, even if error exceptions exist. This option is available for Super Users with Budget Override security access only. This option is not available if the transaction passed budget checking with only warning exceptions. Select it prior to budget checking or after you run the Budget Processor process, and it returns errors. |

Inquiry Criteria |

Click to access the Refine Inquiry Criteria page, where you can restrict rows to specific business units, ledger groups, and accounts. Leave these fields blank to return all values. |

Budget Override Available Info |

Click the Budget Override Available Info (budget override available information) button to determine why you can't override an exception for a budget. |

Budget Check |

Click the Budget Check button to run the Budget Processor process again after you override the transaction or a budget. Run the process again, if you changed the transaction. |

Budget Check Details |

Click the Budget Check Details button to access the Commitment Control page, where you can view the commitment control transaction ID, commitment control transaction date, budget checking process status, process instance, source transaction type, commitment control amount type, and budget checking header status for the transaction. |

View Exception Detail |

Click the View Exception Details button to access the CM Transaction Exceptions - Line Exception page, where you can view the reason for the exception for each line and navigate to line details. |

Exception |

Limits the rows to transactions with either Error or Warning exception. You must select an exception type. |

More Budgets Exist |

If selected, the transaction has more exceptions than the number that you entered in the Maximum Rows field. Enter different search criteria to shorten the list or increase the maximum number of rows. |

The Budgets with Exceptions group box on the lower portion of the page displays all the commitment control budgets that had exceptions for the transaction. You can limit the number of budget rows the system displays by entering selection criteria.

Field or Control |

Description |

|---|---|

Override Budget |

Select to update the control budget ledger, even though the transaction exceeds the budget. This field is available only if the budget transaction failed budget checking and if you have authority to override a budget entry. It is not available if the source transaction type does not permit overrides and the budget header status is Not Checked. If the budget header status is Not Checked, you changed the source transaction after the Budget Processor process issues the error exceptions, and you have not run the Budget Processor process again. When you override the budget, the system populates the Override User ID field with the user ID for the user who overrode budget checking and the Override Date field with the date and time the budget was overridden. |

Note: The ChartFields that appear might not match the budget ChartFields, because the Budget Processor process translates the transaction ChartFields into the corresponding budget ChartFields using the control budget definition.