Understanding the Types of Interunit Transfers

When you maintain warehouses and plants all over the world, you must be able to transfer goods among these locations and account for transfer prices, costs, currency changes, taxes, and invoicing for business units involved in the transfer. In PeopleSoft Inventory, a transfer of stock between two inventory business units is known as an interunit transfer. There are three approaches to interunit transfers:

Term |

Definition |

|---|---|

Interunit transfer using an intransit account only |

The transfer price of the inventory stock is entered into an intransit account while it is moved from one inventory business unit to another. This approach can be used when both inventory business units post to the same general ledger (GL). |

Interunit transfer with interunit receivables and interunit payables accounts |

An intransit account is used along with interunit accounts receivable (AR) and interunit accounts payable (AP) accounts recorded for each inventory business unit. Both inventory business units post to different GL business units. This approach can be used when transferring stock between separate legal entities or within the same legal entity. |

Interunit sales approach (intercompany) |

An intercompany sale is recorded with the source inventory business unit recording a sale and the linked billing business unit issuing an invoice for the stock transfer to the receiving business unit's payable unit. This approach can be used when transferring stock between separate legal entities or within the same legal entity. Intercompany is required if the (GL) business units are using different currencies. |

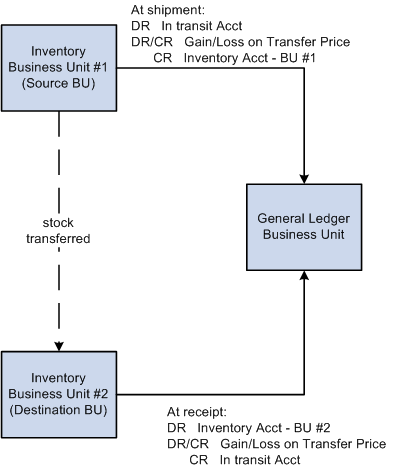

This diagram illustrates the flow of an interunit transfer using only an intransit account.

If the inventory business units transferring stock are linked to the same GL business unit, the system does not generate any affiliate interunit transactions. The intransit account must be defined as belonging to the source or destination business unit.

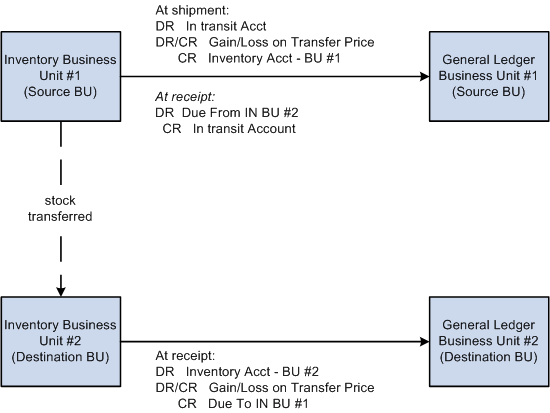

This diagram illustrates the flow of an interunit transfer with interunit receivables and interunit payables accounts when the source unit owns the intransit stock.

In a transfer for which the inventory business units are linked to two GL business units that may be part of the same legal entity, entries are recorded in the interunit receivables and payables accounts. Affiliate accounting is used, and the interunit receivables affiliate and interunit payables affiliate entries should equal each other.

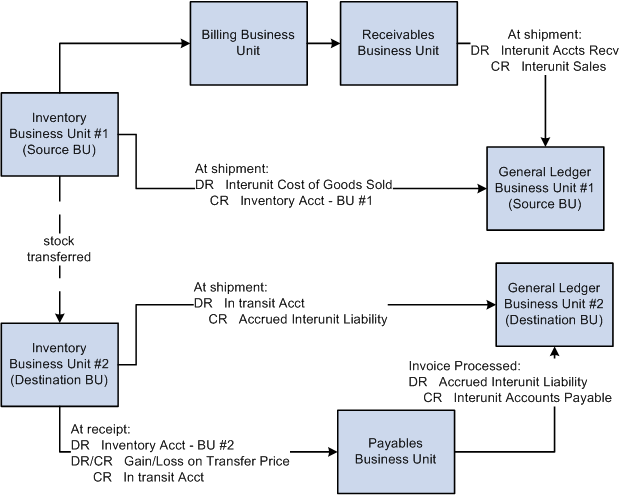

This diagram illustrates the cost flow of an intercompany sales transaction.

In an intercompany transfer, the inventory business units transferring stock want to transfer inventory in an "arm's length" manner. In this case, an intercompany sale is recorded. The destination inventory business unit must be defined as a customer and the source GL business unit must be defined as a supplier. The billing business unit linked to the source inventory business unit performs the additional tasks of calculating value-added taxes (VAT), invoice generation, legal shipping documentation, accounting line creation, and voucher initiation. The AP voucher is recorded in the interface tables of the destination payables business unit, where it can be processed and paid.

Before defining your transfer pricing structure, you must setup the overall interunit transfer structure. The PeopleSoft Inventory provides detailed instructions for setting up the system for interunit transfers.

Field or Control |

Description |

|---|---|

FERC Code (Federal Energy Regulatory Commission code) |

Appears only if you select FERC reporting on the PeopleSoft Inventory Options page. |

ChartFields |

Chart of accounts used to record accounting entries and journal entries in PeopleSoft applications. |

Cost Element |

Use this code to categorize the different components of an item's cost and define the debit and credit ChartFields for accounting entries. |

Transaction Group |

Predefined codes attached to different types of transactions, such as, stocking, issues, adjustments, and so on. |

Distribution Type |

User-defined codes that are a subset of transaction groups. This enables you to break down a transaction group into customized categories. |

Item Group |

A grouping of items that enable you to design the accounting structure for a group of similar items, such as, sporting equipment or dress shoes. The item group is attached to an item using the Item Definition - General page. |

Affiliate |

A ChartField used in interunit transactions or consolidation reporting to identify the other business unit in the transaction. Provides a way to map transactions between business units while using a single intercompany account. The use of an Affiliate ChartField is optional. |