Updating Production Costs

To update standards costs in the production tables, use the Update Production Costs component.

Once you have reviewed and approved the calculated product costs for manufactured and configured items, you can move them into the production cost records using the Cost Update/Revalue process page. This process:

Moves the item cost details from the temporary table CE_ITEMCOST_DET to the Production Cost details table CM_PRODCOST_DET.

The cost element summarizes the data and places it in the Production Cost table CM_PRODCOST. The data is stored by effective date, cost type, and cost version. The CM_PRODCOST_DET record captures the details for yield by operation transactions by storing yield-loss costs at the operation-sequence level and maintaining extended precision cost fields calculated by the Cost Rollup process.

Calculates the change in inventory value for all material in storage areas (including raw material, finished goods, inspection, and material issued to WIP inventory locations) based on the new standard costs at the time of the update and the existing standard production costs for the item. If you are using the negative inventory feature and at the time of a revaluation there is an item that has negative inventory (for example, WIP bin component with a negative inventory) then the system changes the item's standard cost and generates inventory revalue (transaction group 200) entries.

Revalues assemblies and subassemblies in process based on changes to an item's product structure, cost, routing, or rates.

The change in value reflects the revaluing of all outputs, including co-products, by-products, and teardown outputs. The revalue process only considers production IDs and schedules that have a status of In Process, Pending Complete, Complete, and Closed for Labor.

Updates the operation list with any new routing costing labor or machine times and run rates.

This occurs only if a match between the operation list and routing occurs for the operation sequence, work center, and task (optional).

Writes the difference in inventory value and WIP value to revaluation records for posting to the general ledger.

Copies the conversion rates and conversion overhead rates used to determine the production costs into a production rate record.

Once the system completes the update, it uses these rates to determine earned labor, machine, subcontracting, and overhead costs for WIP for any completions once the update is performed.

The Cost Update/Revalue process page does not move product costs for an engineering or simulated cost version into the production cost record. However, you can run the process in report-only mode. This enables you to determine the effects of proposed engineering changes on inventory value.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_CES5001 |

Updates the costs and performs inventory and WIP revaluation. |

Revaluing inventory is the process of updating an item's cost and accounting for the change in inventory value due to the change in standard cost for the item. The process involves calculating the difference in inventory value, recording the difference, and updating the standard costs for the items. Once you record the updated information, you can post it to the GL through the normal transaction accounting cycle. Because the system bases the revaluation on a snapshot of the inventory, you want to ensure that the inventory value is as correct and accurate as possible to reflect the correct financial picture.

Prior to running the Cost Update/Revalue process page to revalue inventory, you must:

Put away all pending inventory in the appropriate storage areas using the Complete Putaway process (INPPPTWY).

This includes all items that you received from vendors that require inspection, assemblies that have been completed in WIP and are issued back to stock or to another WIP location, as well as any receipts from another inventory business unit. This ensures that the system can account for all inventory and can calculate and post the correct revaluation amount.

Run the Deplete On Hand Qty process (IN_FUL_DPL) to ensure that the item's quantities at the business unit level match the item's quantities at the location level.

You must issue all staged items in order for the system to complete the update for the quantity on hand.

Run the Cost Accounting Creation process (CM_COSTING) to ensure that all transactions already created throughout the PeopleSoft applications have been costed.

The transactions do not need to be posted.

Prohibit material movement for the business unit by selecting the Prohibit Material Movement check box on the PeopleSoft Inventory Definition page.

No inventory transactions should take place while the Cost Update/Revalue process page is revaluing inventory. When it updates the standard costs, the system multiplies the change in standard cost by the quantity on hand for the item in each storage area. By prohibiting material movement, you ensure that the quantity on hand is accurate.

Check the Process Monitor to ensure that someone else in the organization is not running the Cost Update/Revalue process page.

If you are updating all item costs within the business unit, you should not run two Cost Update/Revalue processes simultaneously.

In-process inventory includes two parts:

Field or Control |

Description |

|---|---|

RIP |

Raw material or subassemblies that have been issued to the shop floor but have not yet been used in an assembly. RIP inventory value is part of the storage area location inventory and is fairly easy to calculate. It is derived by multiplying the quantity on hand for an item in the WIP storage location by its costs. |

WIP |

Items that are in various stages of assembly. Inventory value for material in process presents more of a challenge, because it involves incomplete sets of components associated with an assembly item. It also includes value-added material that has been scrapped and must take into account material that has been completed to stock and is no longer part of WIP. |

WIP value is not a value or amount that PeopleSoft Cost Management stores for end items using a frozen standard cost approach. It is calculated at any point in time using PeopleSoft records. To calculate WIP:

Add component costs.

Add earned conversion costs (labor, machine, subcontracting, and overhead).

Add waste by-products.

Subtract assembly scrap.

Subtract assembly completions (including co-products and recycled by-products).

Component Costs

PeopleSoft Cost Management bases the WIP component costs value on the quantity of the component issued to the production ID or production schedule. The quantity issued is stored on the component list. PeopleSoft Manufacturing updates the issue quantity when you record operation or assembly completions and the component is consumed from the WIP location or when the component is kitted directly to the production ID. PeopleSoft Cost Management derives the value for component costs by multiplying each component's issue quantity by the component's standard cost-by-cost element, then summarizing all the costs for all components. This enables the system to determine the lower-level costs for WIP. To calculate the old cost, PeopleSoft Cost Management uses the latest cost for the item in the Items Production Cost record. To determine the new cost, PeopleSoft Cost Management uses the item's cost for the cost type and version that you're using to update the cost.

Earned Conversion Costs

Earned conversion costs include the labor, machine, subcontracting, and overhead costs for this level only. Earned this level costs account for the value added to WIP. The system bases these costs on assemblies or operations that are complete. The WIP value report summarizes entries in the earned conversion cost record for each production ID or production schedule according to the cost category associated with the cost element. The WIP revalue first determines the old earned this level costs by summarizing the costs as stated in the Earned Conversion Cost record. Then, the new earned this level costs are calculated, taking into account any changes in routing times and their corresponding rates for the cost type and version that you select. PeopleSoft Cost Management posts any differences to the earned conversion cost record, so that when it summarizes, the old earned conversion costs plus the differences equal the conversion costs at the new standards.

Waste By-Product Cost

If the production ID or production schedule has multiple outputs, then include any waste by-product that has been reported complete and issued from the operation. Determine the waste by-product cost by multiplying the actual output quantity (quantity completed at the operation) by its standard cost. Any waste by-product costs are added to the overall cost of the WIP value. To determine the change in waste by-product cost, compare the current completion cost to the cost of the quantity completed and multiply by the new cost for the cost type and version selected for the update.

Assembly Scrap

Assembly scrap accounts for the value of partially completed assemblies that you have rejected. The cost must be subtracted, because the system does not include this assembly scrap value as part of WIP or finished goods. At the time the scrap occurs, the system determines the scrap cost by summarizing the components used up to that point, plus any value added up to the point that the scrap occurred. The system stores assembly scrap costs in an assembly scrap record and summarizes scrap costs in the WIP value report by cost category for the production ID or production schedule. As with components and earned conversion costs, the scrap cost for revaluation is recalculated based on the component costs using the cost type and version. These level scrap conversion costs are based on the new times and rates for the cost type and version.

Assembly Completions

Assembly completions take into account, for all outputs, the assemblies that are completed to stock, another production area, or issued directly to another production ID, and are therefore no longer part of the production ID or production schedule value. This includes the cost of co-products and recycled by-products. The value is derived by multiplying the quantity completed for all outputs as stated in the production header record by its cost from the item production cost record. To determine the new value of completions, the assembly quantity completed is multiplied by the cost for the selected cost type and version.

The inclusion or handling of a production ID or schedule in WIP depends on the production status. The system revalues any production ID or production schedule if the production status is not entered, firmed, released, canceled, or closed for accounting.

Processing Non-Matching Cost Elements

When processing non-matching cost elements, the WIP revalue involves matching cost elements from the old costs to cost elements for the new costs. In cases where there are no matches, the Cost Update/Revalue process still posts the difference to the variance record. In the case where the old cost record has a cost element that does not exist on the new cost record, the system posts a negative entry on the variance record for the entire old cost. If the new cost record has a cost element that does not exist on the old cost record, the system posts a positive entry for the entire new cost.

Processing Configurable Items

In the WIP revalue process, it is necessary to first determine if the item being revalued is a configured item that is using configured costing. When processing the component, the system verifies whether there is a configuration code on the component list for the item. If there is, the next check verifies whether the item is configured costed by reviewing the check box on the master item table. If the item is to be configured costed, the system matches the configuration code found on the component list to that on the item production cost record for the item and uses those costs to calculate any differences.

When the system processes assemblies, the same checks hold true. If the production order assembly item has a configuration code, the system verifies whether the item is to be configured costed. If the item is to be configured costed, then another match of the configuration code found on the header record is made to that on the item production cost record, and those costs are used to calculate any differences.

Processing Without Operation Lists

When a production ID or production schedule does not have an operation list, the conversion costs are earned by posting the this level costs from the item production cost record to the earned conversion cost record. Therefore, to calculate the earned conversion costs at the new standard, use this level costs for the cost type and version.

Floor Stock and Expensed Items

The system does not include floor stock or expensed items for purposes of inventory valuation and revaluation.

Operation List Updates

As part of the WIP revaluation process, the system updates the operation lists with the costing labor and machine set up, run, fixed run, and postproduction times and run rates. It makes an attempt to match the operations on the operation list to those on the items primary production routing or its referenced item routing. When the operation sequence, work center, and task code (if you use tasks) on the routing match the component list, the times and run rates in the operation list are updated with those from the routing. This ensures that the system does not create process change variances once you update the costs. If the item's reference routing changes and is different from the one that you used to create the operation list, no updates are made even if the operations, work centers, and task codes match.

The WIP Revaluation report displays the old cost, new cost, and variance.

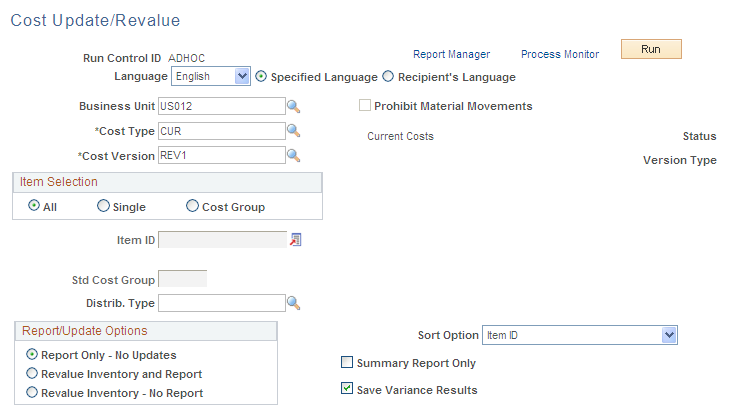

Use the Cost Update/Revalue page (RUN_CES5001) to updates the costs and performs inventory and WIP revaluation.

Navigation:

This example illustrates the fields and controls on the Cost Update/Revalue page. You can find definitions for the fields and controls later on this page.

Select the business unit, cost type, and cost version with which you want to update the standard costs. The status for the cost type and version type appears and must be set to Approved for versions related to manufactured and configured items.

The value in the Distrib. Type (distribution type) field changes to the distribution type associated with the inventory revaluation transaction group, but you can change it or you can leave it blank.

Note: PeopleSoft Cost Management copies to production the cost type and version's conversion rates and conversion overhead rates only when you have selected all items. The system copies these rates and uses them to calculate the earned labor and machine costs, as well as the applied overhead values for assembly completions and scrap. If you are updating a single item cost and have based that cost on new conversion rates, you must manually copy those rates into the production rate records.

Report/Update Options

You have three options for running this process:

Report Only - No Updates.

This is the only option available for versions related to engineering or simulation. Use this option to view the impact of the standard change without actually updating the costs and posting revaluation entries. Running this process in report-only mode gives you a preview of the financial impact of the standards change without affecting the current transaction costing or inventory valuation.

Revalue Inventory and Report.

This option updates the standard production cost record and calculates the change in all inventory values. Running this report enables you to analyze a specific item, production ID, or schedule quantity should a question arise regarding the revaluation.

Revalue Inventory - No Report.

This option updates all records discussed in this section but does not print a report detailing the changes to inspection, stores, WIP inventory locations, or to WIP inventory.

When reporting, you can also select to print a summary report only or to save variance results. When you choose to run the update in report-only mode and save variance results, you can review the revaluation results by viewing the Compare Cost Updates or the Cost Updates by Tolerance pages.