Using Transfer Pricing Definitions

This topic provides an overview of transfer pricing definitions and discusses them.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CM_TRAN_PRICE_DEFN |

Define the transfer prices, markup percentages, and additional transfer costs to be used for a source business unit or a source and destination unit pair. |

|

|

CM_TRAN_PRC_COPY |

Enter a source inventory business unit and a destination business unit (optional) to copy an existing transfer pricing definition to another inventory business unit. |

|

|

CM_TRAN_PRICE_CE |

Add or change additional costs at the header level of the transfer pricing definition. |

|

|

CM_TRAN_PRICE_CEDT |

Add or change additional costs to a item group or item ID (detail level). |

To define transfer prices, use the Transfer Pricing Definition component (CM_TRAN_PRICE_DEFN). Use the Transfer Pricing Definition component interface (CM_TRAN_PRICE_CI) to load data into the tables for this component.

The key to establishing your transfer price is the Transfer Pricing Definition component, where you can establish transfer prices by:

Inventory Business Unit Pairs: A combination of the source business unit, destination business unit, and pricing effective date.

Source Business Unit Only: A combination of the source business unit and pricing effective date. By leaving the destination business unit blank, you can create transfer prices for all items in the source unit that transfer to any destination business unit that is not already defined in a business unit pair.

The Transfer Pricing Definition component defines the transfer prices for all items within a source business unit or an inventory business unit pair. When a transfer pricing definition has not been setup for certain business units, the system transfers the items at the cost in the source inventory business unit. When a transfer pricing definition is created, setting all transfer prices at the business unit level (header level) may be too broad; therefore, the Transfer Pricing Definition component allow you to override the header level settings with transfer prices specific to the item group or item ID itself. The specific information is used instead of the more general information.

Once you define your transfer pricing definitions, you can:

Populate the Transfer Pricing table with your transfer prices and additional transfer costs by running the Calculate Transfer Price process. The Deplete On Hand Qty process looks to this table first to find a match and to retrieve transfer data.

Leave the Transfer Pricing table blank for some or all items. If the Deplete On Hand Qty process cannot find a match in the Transfer Pricing table, then it looks to the setup in the Transfer Pricing Definition components. The detail level overrides are used instead of the header level information. Header level information is used when no detail level overrides exist and the Price Overrides Only check box is not selected.

The Transfer Pricing Definition component can be used by both:

The Calculate Transfer Price process to populate the Transfer Price table.

The Deplete On Hand Qty process to calculate a transfer price for an MSR line directly using the data in the Transfer Pricing Definition component. Use this option if the Transfer Price table does not contain a transfer price for the MSR line.

Not all options on the Transfer Pricing Definition component are available when the Deplete On Hand Qty process is calculating a transfer price directly from the component. Look carefully at the field definitions for information about the Calculate Transfer Price process and the Deplete On Hand Qty process.

Note: PeopleSoft Cost Management does not support interunit pricing for non-cost items.

For additional details about applying transfer prices to an MSR, see the Understanding Interunit Transfers topic.

Use the Transfer Pricing Definition page (CM_TRAN_PRICE_DEFN) to define the transfer prices, markup percentages, and additional transfer costs to be used for a source business unit or a source and destination unit pair.

Navigation:

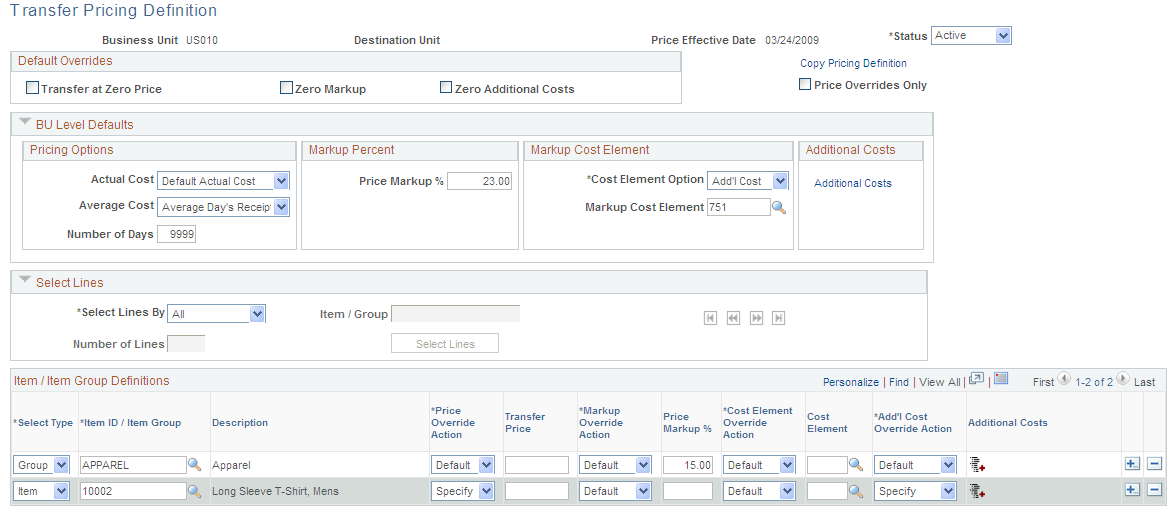

This example illustrates the fields and controls on the Transfer Pricing Definition page. You can find definitions for the fields and controls later on this page.

New Transfer Pricing Definitions

In add mode, you enter the source inventory business unit in the Business Unit field and the destination inventory business units in the Destination Unit field. The Pricing Effective Date field defaults to today's date if there is no entry. The Destination Unit field is not required. If you leave the Destination Unit field blank, then the parameters set up on this component apply to the source business unit, regardless of the inventory business unit receiving the stock. The transfer pricing definition with the source business unit and no destination unit is used as the default for all business unit pairs that are not defined. The source business unit must be valid and an open inventory unit.

Field or Control |

Description |

|---|---|

Copy Pricing Definition |

Click this link to access the Copy Pricing Definition page, where you can copy an existing transfer pricing definition to this source inventory business unit, destination unit, and price effective date combination. This link is only available if you creating a new transfer pricing definition by entering this page in the add mode. |

Header Levels and Detail Levels

On the Transfer Pricing Definition page, overrides and default values can be entered at both the header level or the detail level.

Overrides and default values defined at the header level apply to the entire transfer pricing definition. The header level includes the Default Overrides group box and the BU Level Defaults group box. These values are used with transfers from this source inventory business unit (or source unit and destination unit combination) and for this price effective date. Information added at the header level is used to determine the transfer price for all items that are not overridden at the detail level as long as the Price Overrides Only check box has not been selected.

Overrides and default values defined at the detail level apply to an item group or item ID within the transfer pricing definition. The detail level includes the Item / Item Group Definitions group box. These values can be added to override the values defined at the header level.

Field or Control |

Description |

|---|---|

Price Overrides Only |

Select this check box to have the system use only the data in the Item / Item Group Definitions group box. The overrides and default values defined at the header level are not used unless the detail level selects the default option for a specific item ID or item group. |

Default Overrides Group Box

The values defined in this group box apply to the header level of this transfer pricing definition. The following zero check boxes prevent the system from performing a particular calculation. These check boxes are not mutually exclusive with their associated value. For example, both a Zero Markup Percent can be entered and the Zero Markup Percent flag checked, though once the Transfer at Zero Price field is selected, selecting the Zero Markup Percent has no additional effect. These check boxes control what is done for any items not overridden at the detail level. Keep in mind that these check boxes are never used for items defined in the detail level of this component. In addition, if the Price Overrides Only check box is selected, then this group box is not used.

Field or Control |

Description |

|---|---|

Transfer at Zero Price |

Select this check box if all items in this transfer pricing definition are to be transferred at no cost; unless overridden at the detail level. If you select this check box, the transfer price row (in IN_DEMAND_TPRC) for each transferred item is created using the item's default cost element with a cost of 0.00. |

Zero Markup |

Select this check box if all items in this transfer pricing definition are to be transferred at with no markup percentage; unless overridden at the detail level. |

Zero Additional Costs |

Select this check box if all items in this transfer pricing definition are to be transferred at with no additional transfer costs added to the base transfer price; unless overridden at the detail level. |

The check boxes in this group box are used by both:

The Calculate Transfer Price process to populate the Transfer Price table (CM_TRAN_PRICE).

The Deplete On Hand Qty process to calculate a transfer price for an MSR line using the data in the Transfer Pricing Definition component. This option is used if the Transfer Price table does not contain a transfer price for the MSR line.

BU Level Defaults Group Box

The default values defined in this group box apply to the entire transfer pricing definition (that is, the header level). These default values are used with transfers from this source inventory business unit (or source unit and destination unit combination) and for this price effective date. When setting up a Transfer Pricing Definition component, keep in mind that your entry in the Price Overrides Only check box changes the use of this group box.

Field or Control |

Description |

|---|---|

Actual Cost |

Select the method for calculating the transfer price for items using the actual cost method on the Cost Profiles page. If this field is left blank, then the system uses the Default Actual Cost value. The options are:

PeopleSoft Cost Management does not support interunit pricing for non-cost items. |

Average Cost |

Select the method for calculating the transfer price for items using an average cost methods on the Cost Profiles page. If this field is left blank, then the system uses the Average Purchase Price value. The options are:

This option is the default value when creating a new transfer pricing definition. If the Deplete On Hand Qty process is calculating a transfer price for an MSR line by directly using the data in the Transfer Pricing Definition component, then this option is the only available choice. PeopleSoft Cost Management does not support interunit pricing for non-cost items. |

Number of Days |

Enter the past number of days' worth of receipts to be used to calculate the weight average for the transfer price. This field is required when the Average Day's Receipts value is selected for the Actual Cost field or the Average Cost field. |

Price Markup % (price markup percentage) |

Define the percentage increase to the initial transfer price of the item. The markup percentage is applied to all cost elements. For example, if you enter a value of 25 in this field and the item includes 75 USD in the cost element 100 (material) and 25 USD in the cost element 601 (landed costs), then the markup is applied to 100 USD for a total markup of 25 USD (100 USD × 25% = 25 USD). The markup amount can be applied to the material cost element or to an additional transfer cost element, depending on your entry in the next field (the Cost Element Option field). Be sure to enter a 25% markup as 25, not .25. In addition, you can enter a percentage greater than 100. For the source inventory business unit, a gain is recorded for the difference between the marked up transfer price and the cost of the item. The destination business unit can include the markup in the cost of the item or expense it to another account. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Cost Element Option |

Select the type of cost element to which the markup percentage should be applied. This is the Cost Category defined for the cost element. The options are:

This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Markup Cost Element |

If you have entered the value of Addl Cost in the Cost Element Option field, enter a cost element with the cost category of Addl Trans (Additional Transfer Costs). When the price markup is calculated, it is applied to this cost element. If this field is blank, then the system retrieves the material cost element for the item from the Default Cost Element field defined on the Define Business Unit Item - General: Common page. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Additional Costs |

Click the Additional Costs link (in the BU Level Defaults group box) to access the Additional Transfer Price (Header Level) page, where you can define or change additional transfer costs at the header level of this transfer pricing definition. These costs use a cost element with the cost category of Addl Trans (Additional Transfer Costs). This link and the underlying Additional Transfer Price (Header Level) page can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

Select Lines Group Box

Use the Select Lines group box to enter search criteria for displaying existing items and item group definition in the Item / Item Group Definitions group box.

Field or Control |

Description |

|---|---|

Select Lines By |

Select to search for rows by Item Group, Item ID, or All. |

Item / Group |

Enter the item ID or item group ID to be used when selecting data for the Item / Item Group Definitions group box. The search returns rows with a value equal to or greater than the item ID or item group defined. If this field is left blank, the search returns both item IDs and item groups. |

Number of Lines |

Enter the number of rows to be displayed in the Item / Item Group Definitions group box. If this field is blank, then the search uses a default of 100 rows. This field is populated by a default value from the Transfer Price Lines Displayed field on the Installation Options - Inventory page. |

Select Lines |

Click this button to search for rows previously created for items and item groups in the Item / Item Group Definition group box. The rows that appear are limited by your search criteria (Select Lines By field, Item / Group field, and Number of Lines field). To display other rows, change your search criteria and then click this button to initiate a new search; a warning message is displayed asking if you want to save changes to the existing date. |

Item / Item Group Definitions Group Box

The detail level overrides and default values defined in this group box apply to the specific item ID or item group in the row. The values entered here override the same values entered at the header level. To create a new row to override header level attributes for a specific item ID or item group, add a new row to the grid.

Field or Control |

Description |

|---|---|

Select Type |

When adding a new row, select to add an Item or Group to specify what type of value will be entered in the Item ID / Item Group field. |

Item ID / Item Group |

Enter either an item ID or an item group depending on your entry in the Select Type field. An row in this grid overrides the header level parameters used to calculate the transfer price. If a destination business unit has been specified, the item ID must be valid in both business units. |

Description |

Displays the description of the item ID or item group. |

Price Override Action |

Enter a value to determine the origin of the transfer price. The options are:

|

Transfer Price |

Enter a transfer price to override the calculation at the header level of this transfer pricing definition. To use this field, you must select the value of Specify for the Price Override Action field in this row. If the field is blank, then the system uses a zero price for the transfer. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Markup Override Action |

Enter a value to determine the origin of the markup percentage applied to the transfer price. The options are:

|

Price Markup % |

Enter a markup percentage to be applied to the transfer price. This field overrides the markup percentage at the header level of this transfer pricing definition. To use this field, you must select the value of Specify for the Markup Override Action field in this row. If the field is blank, then the system does not use a markup percentage on the transfer price. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Cost Element Override Action |

Select the type of cost element to which the markup percentage should be applied. The options are:

|

Cost Element |

Enter a cost element with a cost category of Addl Trans (additional transfer costs). The markup percentage is applied to this cost element if you have selected the value of Specify for the Cost Element Override Action field on this row. This field is used by both the Calculate Transfer Price process (to populate the Transfer Price table) and the Deplete On Hand Qty process (to calculate a transfer price directly from this component). |

Add'l Cost Override Action (additional cost override action) |

Enter a value to determine the origin of the Addl Trans cost elements applied to the transfer price. The options are:

This field can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

|

Click the Additional Costs icon to access the Additional Transfer Price (Detail Level) page, where you can add or change additional costs to a item group or item ID (detail level). This link and the underlying Additional Transfer Price (Detail Level) page can only be used by the Calculate Transfer Price process to populate the Transfer Price table. |

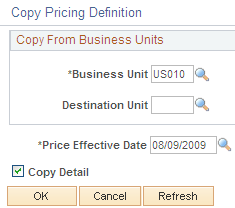

Use the Copy Pricing Definition page (CM_TRAN_PRC_COPY) to enter a source inventory business unit and a destination business unit (optional) to copy an existing transfer pricing definition to another inventory business unit.

Navigation:

Click the Copy Pricing Definition link on the Transfer Pricing Definition page.

This example illustrates the fields and controls on the Copy Pricing Definition page. You can find definitions for the fields and controls later on this page.

When setting up the transfer pricing definitions for each of your source unit, destination unit, and price effective date combinations, you can reduce data entry time by using the copy feature on the Copy Pricing Definition page. Enter a source inventory business unit and a destination business unit (optional) Use this page to copy an existing transfer pricing definition to your new combination of source business unit, destination unit, and price effective date. This page is only available if you are adding a new transfer pricing definitions.

Field or Control |

Description |

|---|---|

Business Unit |

Enter the source business unit for an existing transfer pricing definition that you wish to copy. The default value for this field is the source business unit defined on the new Transfer Pricing Definition page. |

Destination Unit |

(Optional) Enter the destination business unit for an existing transfer pricing definition that you want to copy. The default value for this field is the destination unit defined on the new Transfer Pricing Definition page. |

Price Effective Date |

Enter the effective date for the existing transfer pricing definition that you want to copy. The Look Up icon displays existing price effective dates based your entries in the Business Unit and Destination Unit fields. |

Copy Detail |

Select this check box to copy the item and item group overrides (the Item / Item Group Definitions group box) from the existing transfer pricing definition to your new definition. The Additional Transfer Price (Detail Level) page is also copied. Note: In order to copy item and item group details, the business units must share the same available items. Item groups are not edited. |

The copy action immediately saves the new data and overrides any existing information that you may have entered on the new transfer pricing definition.

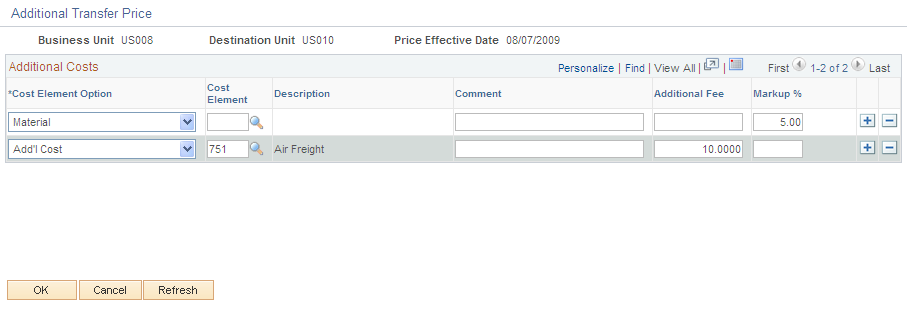

Use the Additional Transfer Price (Header Level) page (CM_TRAN_PRICE_CE) to add or change additional costs at the header level of the transfer pricing definition.

Navigation:

On the Transfer Pricing Definition page, click the Additional Costs link in the BU Level Defaults group box.

This example illustrates the fields and controls on the Additional Transfer Price page at the header level. You can find definitions for the fields and controls later on this page.

This page displays the cost element detail for the header level of the transfer pricing definition and allows you to enter additional transfer costs using cost elements with a cost category of Addl Trans. This page can only be used by the Calculate Transfer Price process to populate the Transfer Price table.

Field or Control |

Description |

|---|---|

Cost Element Option |

Select the cost category of the cost element for this row. The options are Material or Add'l Cost. If you select the Material option, the Cost Element field must remain blank. |

Cost Element |

Select a Addl Trans cost element for this row. The cost element does not have to be unique. If the cost element field is blank, then the system retrieves the material cost element for the item from the Default Cost Element field defined on the Define Business Unit Item - General: Common page. |

Description |

Displays the description of the cost element. |

Comment |

(Optional) Enter a comment about this additional charge. |

Additional Fee |

Enter a amount to be applied to transfers using the cost element specified on this row. |

Markup %(markup percentage) |

Define the percentage increase to the initial transfer price of the item. The markup percentage is applied to all cost elements. For example if you enter a value of 25 in this field and the item includes 75 USD in the cost element 100 (material) and 25 USD in the cost element 601 (landed costs) then the markup is applied to 100 USD for a total markup of 25 USD (100 USD x 25%= 25 USD). The markup amount can be applied to the material cost element or to an additional transfer cost element depending on your entry in the Cost Element Option field of this row. Be sure to enter a 25% markup as 25, not .25. In addition, you can enter a percentage greater than 100. |

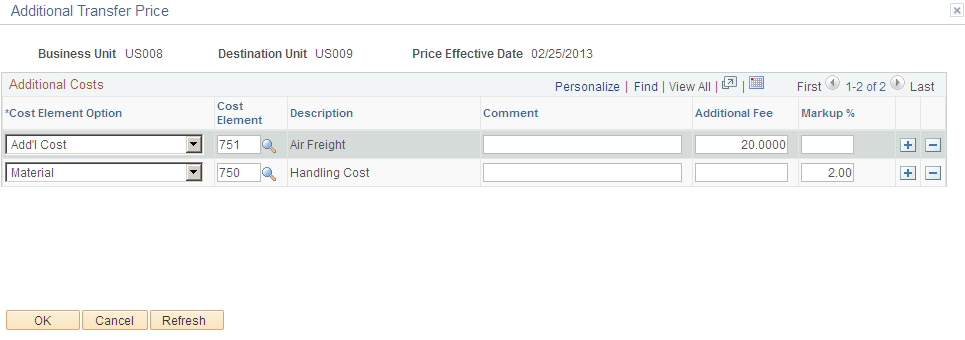

Use the Additional Transfer Price (Detail Level) page (CM_TRAN_PRICE_CEDT) to add or change additional costs to a item group or item ID (detail level).

Navigation:

On the Transfer Pricing Definition page, click the Addl Costs icon in the Item / Item Group Definitions group box.

This example illustrates the fields and controls on the Additional Transfer Price page at the detail level. You can find definitions for the fields and controls later on this page.

This page displays the cost element detail for the detail level of the transfer pricing definition and allows you to enter additional transfer costs using cost elements with a cost category of Addl Trans. The top section of this page displays the item ID or item group for these additional prices. The field definitions are the same as the Additional Transfer Price (Header Level) page defined above. This page can only be used by the Calculate Transfer Price process to populate the Transfer Price table.

The following examples show how the transfer price default hierarchy uses the Transfer Pricing Definition component. In the examples below, the fields used on the Transfer Pricing Definition component can be used by the Calculate Transfer Price process to build the Transfer Pricing table and by the Deplete On Hand Qty process to directly calculate the MSR line transfer price.

Transfer Pricing Definition 1: Source business unit: US001, Destination business unit: (blank), and Price Effective Date: 10/15/2009

Header Level:

Price Overrides Only check box

Price Markup %

Cost Element Option

Markup Cost Element

Not selected

20%

Add'l Cost

751

Detail Level:

Item ID

Transfer Price

Price Markup %

Cost Element

80200

Specify: 4.00

Specify: 4%

Specify: 750

Transfer Pricing Definition 2: Source business unit: US001, Destination business unit: US014, and Price Effective Date: 10/15/2009

Header Level:

Price Overrides Only check box

Price Markup %

Cost Element Option

Markup Cost Element

Not selected

15%

Add'l Cost

750

Detail Level:

Item ID

Transfer Price

Price Markup %

Cost Element

80400

Specify: 18.18

Specify: 10%

Default

80500

Specify: 7.00

Specify: 5%

Specify: 751

The following item and cost information are used in these examples:

|

Item ID |

Cost Method |

Cost Element |

Cost |

|---|---|---|---|

|

80100 |

Perpetual Average |

Material: 100 |

11.00 (current perpetual average) |

|

80200 |

Perpetual Average |

Material: 100 |

10.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

1.00 |

|

80300 |

Actual |

Material: 100 |

10.10 (default actual cost) |

|

80400 |

Perpetual Average |

Material: 100 |

10.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

1.00 |

|

80500 |

Perpetual Average |

Material: 100 |

5.00 (current perpetual average) |

|

|

|

Landed Cost- Duty: 601 |

.25 |

|

80600 |

Standard cost |

Material: 100 |

10.00 (current standard) |

Example 1

In this example, the following results will occur (for the US001/US014 combination only) when the Calculate Transfer Price process populates the Transfer Pricing table or when the Deplete On Hand Qty process calculates the transfer prices directly for MSR lines. In both cases, to populate transfer prices and cost elements for the source business unit US001 and the destination business unit US014, the processes (using the transfer price default hierarchy) look first to the transfer pricing definition 2; if data cannot be found then the processes look to the transfer pricing definition 1.

|

Item ID |

Cost Element |

Transfer Price |

Comments |

|---|---|---|---|

|

80100 |

100 |

11.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current perpetual average cost and added to the 750 cost element. |

|

|

750 |

1.65 |

|

|

80200 |

100 |

10.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current perpetual average cost and added to the 750 cost element. In addition, the landed costs in the cost element 601 is added to the transfer price. |

|

|

601 |

1.00 |

|

|

|

750 |

1.50 |

|

|

80300 |

100 |

10.10 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the default actual cost and added to the 750 cost element. |

|

|

750 |

1.515 |

|

|

80400 |

100 |

18.18 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 18.18 is applied to the material cost element and a 10% markup of the transfer price is applied to the 750 cost element. |

|

|

750 |

1.81 |

|

|

80500 |

100 |

7.00 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 7.00 is applied to the material cost element and a 5% markup of the transfer price is applied to the 751 cost element. |

|

|

751 |

.35 |

|

|

80600 |

100 |

10.00 |

On the transfer pricing definition 2 no detail information for this item is found, so the header information is used. A 15% markup is applied to the current frozen standard cost and added to the 750 cost element. |

|

|

750 |

1.50 |

|

Example 2

In this example, all information is the same as example 1 except the Price Overrides Only check box is selected on the transfer pricing definition 2. The following results will occur (for the US001/US014 combination only) when the Calculate Transfer Price process populates the Transfer Pricing table or when the Deplete On Hand Qty process calculates the transfer prices directly for MSR lines. Since the transfer pricing definition 2 is more specific, the processes (using the transfer price default hierarchy) look first to it. If data cannot be found then the processes look to the transfer pricing definition 1.

|

Item ID |

Cost Element |

Transfer Price |

Comments |

|---|---|---|---|

|

80100 |

100 |

11.00 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the current perpetual average cost and added to the 751 cost element. |

|

|

751 |

2.20 |

|

|

80200 |

100 |

4.00 |

No detail information for this item is found on the transfer pricing definition 2, so the detail information is used from the transfer pricing definition 1. A transfer price of 4.00 is applied to the material cost element and a 4% markup of the transfer price is applied to the 750 cost element. |

|

|

750 |

.16 |

|

|

80300 |

100 |

10.10 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the default actual cost and added to the 751 cost element. |

|

|

751 |

2.02 |

|

|

80400 |

100 |

18.18 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 18.18 is applied to the material cost element and a 10% markup of the transfer price is applied to the 750 cost element. Note that the detail level of the transfer pricing definition 2 instructs the system to use the header level default for the cost element even though the Price Overrides Only check box has been selected. |

|

|

750 |

1.81 |

|

|

80500 |

100 |

7.00 |

Detail information for this item is found on the transfer pricing definition 2. A transfer price of 7.00 is applied to the material cost element and a 5% markup of the transfer price is applied to the 751 cost element. |

|

|

751 |

.35 |

|

|

80600 |

100 |

10.00 |

No detail information for this item is found on the transfer pricing definition 2, so the header information is used from the transfer pricing definition 1. A 20% markup is applied to the current frozen standard cost and added to the 751 cost element. |

|

|

751 |

2.00 |

|

(Addl Costs)

(Addl Costs)