Understanding Interunit Transfers

A transfer of stock between two inventory business units is known as an interunit transfer. To create an interunit transfer:

Add a material stock request (MSR) with the request type of Interunit Transfer. The MSR includes a destination (receiving) inventory business unit.

Complete the demand fulfillment steps within the source (sending) Inventory business unit to ship the stock.

Run the Deplete On Hand Quantity (Depletion) process in the source unit. In addition to other functions, this process calculates the transfer price (transfer cost) of the stock and any additional transfer costs.

When the items are received in the destination business unit, run the Load Staged Items process (INPSSTGE).

Run the Cost Accounting Creation process page to create the accounting entries for the interunit transfer. These accounting entries record the changes to the inventory stock accounts, intransit accounts, and record any additional transfer expenses or gain/loss on transfers.

While using this topic, please note the following points:

The terms transfer price and transfer cost both refer to the same value.

The setup of an interunit transfer can be divided into several parts. In this topic, we discuss the transfer pricing and accounting entries related to a transfer. Before defining your transfer pricing structure, you must set up the overall interunit transfer structure. The PeopleSoft Inventory provides detailed instructions for setting up the system for interunit transfers.

PeopleSoft Cost Management does not support interunit pricing for non-cost items.

This topic discusses transferring stock between two Inventory business units. For information about shipping stock to internal departments or on behalf of another GL unit, see the PeopleSoft Cost Management, Setting Up the Accounting Rules Structure topic. Read the sections "Designing Shipment On Behalf Of" and "Creating and Reversing Interunit Expensed Issues."

The Deplete On Hand Qty (Depletion) process uses a default hierarchy to determine the transfer price for each line of a interunit material stock request. In the default hierarchy, the more specific information overrides the more general information. Transfer prices can be derived from:

Override values entered on the material stock request line. If you selected the Allow Price/Markup Overrides check box on the Setup Fulfillment page of the source business unit, then you can change the transfer price on the line.

The Transfer Pricing table. This table includes the material portion of the transfer price and the additional transfer costs. The Deplete On Hand Qty process looks for a transfer price specified for the item ID. This transfer price can be broken up into multiple cost elements. The setup and use of the Transfer Pricing table is optional.

The Transfer Pricing Definition component. If the Transfer Pricing table contains no entry for the specific item ID, then the Deplete On Hand Qty process calculates a transfer price using the data in the Transfer Pricing Definition component.

A value based on the cost of the item. If the transfer price cannot be derived from the transfer pricing definition, then the Deplete On Hand Qty process uses a value based on the item cost.

Details of the Transfer Price Default Hierarchy

The Deplete On Hand Qty process uses the following steps to determine the material transfer price and additional transfer costs included in an item's transfer price:

Use the override values (transfer price, markup percentage, or zero cost) entered on the MSR line using:

The Create/Update Stock Request component.

The Express Issue component.

The Maintain Stock Requests component.

The Inventory_Create_Stock_Request, Inventory_Front_End_Shipping, or Inventory_Shipping EIPs.

Find a transfer price for the specific item ID based on the source and destination business unit pair in the Transfer Price table. If no row contains this data, then:

Find a transfer price for the specific item ID in the Transfer Price table for which the source business unit is specified and the destination business unit is blank. If no row contains this data, then:

Use the Transfer Pricing Definition component to calculate the material portion of the transfer price using information defined for the specific source and destination unit pair.

Search for item specific information at the detail level. If no item ID information is found, then:

Search for item group information at the detail level. If no item group information is found and the Price Overrides Only check box has not been selected, then:

Search for header level information (this step is skipped if the Price Overrides Only check box has been selected). If no Transfer Pricing Definition component is defined for the specific source and destination unit, then:

Use the Transfer Pricing Definition component to calculate the material portion of the transfer price using information defined for the specific source unit and a blank destination unit.

Search for item specific information at the detail level. If no item ID information is found, then:

Search for item group information at the detail level. If no item group information is found and the Price Overrides Only check box has not been selected, then:

Search for header level information (this step is skipped if the Price Overrides Only check box has been selected). If no Transfer Pricing Definition component is defined for the specific source unit and a blank destination unit, then:

Use a value based on the item's cost as the transfer price. This value would record just a material portion of the transfer price with no additional transfer costs.

For standard cost items, the transfer price is the current frozen standard cost located in the CM_PRODCOST table.

For actual cost items, the transfer price is the value in the Default Actual Cost field (DFLT_ACTUAL_COST) in the Define Business Unit Item - General page.

For perpetual weighted average items, the transfer price is the current perpetual average cost located in the CM_PERPAVG_COST table. If there is no value in CM_PERPAVG_COST table, then the transfer price is taken from the AVERAGE_COST field in the BU_ITEMS_INV table.

For items using Periodic Weighted Average or Retroactive Weighted Average, the transfer price is the value in the Average Purchase Price field (AVERAGE_COST) in the Define Business Unit Item - General page.

Note: Rounding differences could create a small gain or loss when using the current perpetual average cost (located in the CM_PERPAVG_COST table) as the transfer price.

The following costs can be included in an interunit transfer price:

Material transfer prices

Landed costs

Additional transfer costs

Determining the Material Transfer Price

The transfer price includes the material cost of the transferred item determined by the transfer price default hierarchy. Create a cost element with the cost category of Material to be used for the transfer price. The item's default material cost element is stored in the Default Cost Element field in the Define Business Unit Item - General page. Additional material cost elements can be established on the transfer pricing definition or in your PeopleSoft Manufacturing setup.

There are four different methods to value the material portion of an transfer price:

At a Transfer Price.

The system transfers the item using a fixed transfer price.

At a Percent Markup of Cost or Transfer Price.

The system creates the new transfer price by increasing the cost or transfer price of the inventory stock by a percentage markup.

At Zero Price.

The system values the intransit stock at zero. The zero cost method records the entire cost of the stock in the source business unit's interunit transfer gain or loss account. You can use this method for the shipment of promotional or sample items. You can change the default value for the zero price option on the material stock request line using the Material Stock Request - Accounting/Interunit Detail page or the Express Issue - Detail Override/Exceptions page. You can also change the zero price option on the Par Location Definition - Line Details page for issues to the par location.

At a value based on the item's cost.

The system transfers the item using a value based on the item's cost in the source inventory business unit.

Note: PeopleSoft Cost Management does not support interunit pricing for non-cost items.

Recording Landed Costs

The cost of obtaining inventory stock includes more than just the material costs of the items. Landed costs include some of the charges that are associated with getting items into a warehouse and available for use or sale. In the destination business unit, landed costs are absorbed into the material cost of the item for actual and weighted average items. For standard items, a variance is recorded. For information on setting up landed costs, see the "Structuring Landed Costs" topic.

Creating Additional Transfer Costs

In addition to the item's material cost and landed costs, you can also record additional transfer fees for an interunit transfer. To define additional transfer costs:

Establish a cost element for additional transfer by using the cost category of Addl Trans.

Define a fixed cost or percentage markup to calculate the additional transfer cost using the Transfer Pricing Definition component. Additional transfer costs can be defined at the header level or detail level (item ID or item group).

Determine if your additional transfer costs should be added to the cost of the item in the destination business unit or written off in an expense account. Select the Expense Transfer Fees check box on the Inventory Definition - Business Unit Definition page to write off the additional transfer costs.

Populate the Transfer Price table (CM_TRAN_PRICE) with the transfer prices (material and additional transfer costs) by running the Calculate Transfer Price (CM_TRANS_PRC) process. Additional transfer costs can only be used from the Transfer Price table. The Deplete On Hand Qty (Depletion) process does not calculate additional transfer costs directly from the Transfer Pricing Definition component.

During demand fulfillment, the MSR is located in the IN_DEMAND table. Once the transfer price has been calculated by the Deplete On Hand Qty process, the transfer price is located in a child table, IN_DEMAND_TPRC, where it is broken out into several parts by cost elements. Cost elements can be created for material costs, landed costs, and additional transfer costs. Estimated transfer price details can be viewed using the Transfer Price Inquiry component. While the stock is in the intransit account, the material, landed, and additional transfer costs are all included in the total transfer price. The transfer price details are retained when the stock is received by the destination business unit. During putaway, the additional transfer costs can be included in the material cost of the stock or the additional transfer costs can be expensed.

The following transaction groups can be used for an interunit transfer:

022 IBU Transfer Receipts

025 InterCompany Receipts

031 InterBU Transfer Shipments

035 InterCompany Transfers

042 IBU Transfer Adjustments

300 Gain/Loss on Transfer Price

301 InterCompany Cost of Goods

Transfer prices and additional transfer costs can also be used for Shipment On Behalf Of transactions using the following transaction groups:

034 Shipments on Behalf of Other BU

302 ShipOnBehalf Gain/Loss

See Designing Shipment On Behalf Of.

Transfer prices only can be used with interunit expense issues using the following transaction groups:

036 InterUnit Expensed Issue

026 Expensed Issue Return

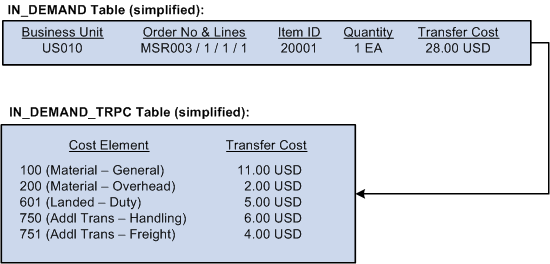

Example of the Transfer Pricing Table

Once the Deplete On Hand Qty process calculates the transfer price for a standard, actual, or average cost item, the total transfer price is stored in the TRANSFER_COST field of the IN_DEMAND table; the transfer price details, broken out by cost element, are stored in the IN_DEMAND_TRPC table. To record the material cost of the transferred items, the system used the cost element in the Default Cost Element field in the Define Business Unit Item - General: Common page.

The following diagram illustrates a simplified example of a material stock request with an interunit transfer price (transfer cost).

Note: The terms transfer price and transfer cost both refer to the same value.

The above example displays an item with more than one material cost element, a landed cost element, and two additional transfer cost elements. Your purchased items may only have one material cost element, however, your make (manufactured) items may have multiple material cost elements. The setup for landed cost is located in the "Structuring Landed Costs" topic.

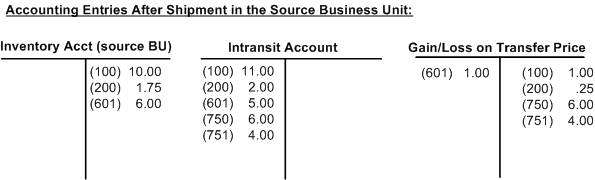

Example of an InterBU Transfer Shipment (Transaction Group 031)

The following diagram illustrates a simplified example of the accounting entries generated in the source business unit after the Deplete On Hand Qty process and the Cost Accounting Creation process are complete. For the transaction group 031 (InterBU Transfer Shipments), the Cost Accounting Creation process determines any difference between the item's cost and the transfer price by comparing cost element to cost element. The typical shipping accounting entry debits the intransit inventory account at the item's transfer price and credits the inventory account at the item's cost. Any difference between the transfer price and cost creates an additional entry associated with the transaction group 300 (gain or loss on transfer price).

The following diagram illustrates a gain on transfer price for the source business unit.

In the above example, note that the cost element detail is included in the accounting entry. The Cost Accounting Creation process uses the IN_DEMAND_TRPC table when creating accounting entries for interunit transactions.

Note: The above example does not address an intercompany transfer or an interunit transfer using interunit receivable and payable accounts. More detailed examples are given later in this topic.

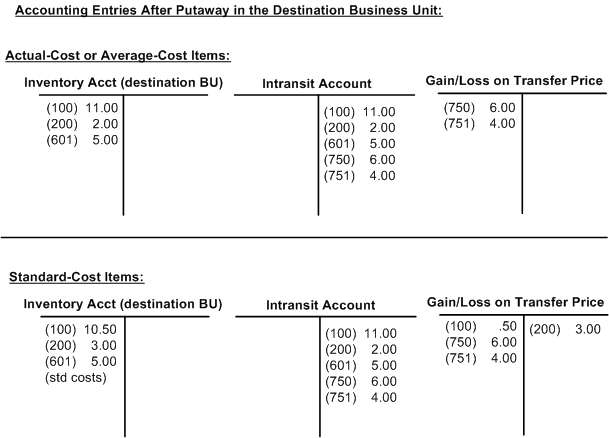

Examples of Inventory Business Unit Transfer Receipts (Transaction Group 022)

The following diagram illustrates a simplified example of the accounting entries generated in the destination business unit after the Load Staged Items process (INPSSTGE) and the Cost Accounting Creation process are complete. The Cost Accounting Creation process uses the transaction groups 022 (IBU Transfer Receipts) and 300 (gain or loss on transfer price).

In both of these examples:

The source business unit owns the stock while it is in the intransit account.

The destination business unit has elected to write-off the additional transfer costs rather than include them in the inventory stock's cost.

For items using one of the weighted average costing methods, the material and landed cost portions of the transfer price are weighted into the new average cost for the item in the destination business unit. For items using the actual cost method, the material and landed cost portions of the transfer price becomes the actual cost for the receipts at the destination business unit. Note that for both the actual and average cost methods, you can choose to include the additional transfer costs in the cost of the item rather than write off these amounts.

For standard cost items, a gain or loss is calculated for the difference between the transfer price (material and landed cost portions only) and the item's standard cost maintained in the destination business unit. This difference is recorded in a gain/loss on transfer price account. The interunit stock is recorded into the inventory account at the standard cost, and the additional transfer costs are written off to a gain and loss on transfer price account.

Note: The previous example does not address an intercompany transfer or an interunit transfer using interunit receivable and payable accounts. More detailed examples are given later in this topic.