Designing Shipment On Behalf Of

Shipment On Behalf Of is an order that issues stock to a customer from an inventory business unit on behalf of an order management business unit when each unit posts to a different general ledger unit. In a centralized order-taking environment, the order management business unit taking the customer order may or may not have a corresponding inventory business unit from which to ship the order. The customer order is then passed to the appropriate inventory business unit to fulfill the customer demand. When the order is shipped and inventory is depleted, the system checks to see whether the general ledger business unit associated with the order management and billing unit matches that of the inventory business unit. When they differ, the system posts the shipment as transaction group 034 - Shipment on Behalf Of Other Business Unit. To correctly match the revenue recognition in the billing business unit's general ledger with the cost of goods sold for the inventory, the Accounting Line Creation process generates accounting entries using interunit accounts.

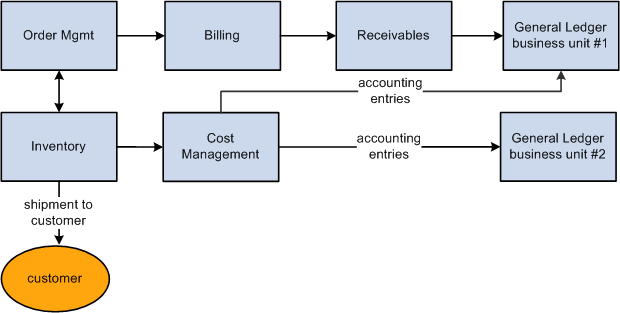

Shipment on Behalf Of process flow where the Order Management business unit reports to a different General Ledger business unit than the shipping Inventory business unit

This diagram illustrates the shipment on behalf of process flow. The stock is shipped from the inventory business unit to the customer and the associated PeopleSoft Cost Management business unit creates accounting entries for the revenue-side general ledger and the expense-side general ledger.

Determining the Amounts for a Shipment On Behalf Of Transaction

The Shipment On Behalf Of transactions are created in two parts:

The Deplete On Hand Qty process calculates the cost of the items shipped, the transfer price, and any additional transfer costs.

The Accounting Line Creation process generates the accounting entries using the inventory account, interunit accounts, cost of goods sold account, and any gain or loss accounts.

The interunit accounts include an accounts receivable (A./R) or Due From account in the shipping organization and an accounts payable (A/P) or Due To account in the organization recording the sale. The amount entered in the interunit A/R or A/P accounts can be the item cost or the transfer price. Additional transfer costs can also be added. In the shipping inventory business unit, your entry in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page determines if the Deplete On Hand Qty process uses item cost or transfer price.

Using Item Cost: The item cost based on the item's deplete cost method defined on the cost profile.

Using a Transfer Price: The transfer price can be a flat amount, price markup, or both. The Transfer Pricing Definition page determines the transfer price. If no transfer pricing definition has been established for the shipping Inventory business unit, then the system uses item cost. The difference between the transfer price and the item cost is recorded as in a gain/loss account using the transaction group 302 (ShipOnBehalf Gain/Loss).

Using Additional Transfer Costs: Additional transfer costs, such as freight or handling, can be added to the shipment using the Transfer Pricing Definition component. These additional costs are added to the gain/loss account and the interunit accounts.

During demand fulfillment, the MSR is located in the IN_DEMAND table. Once the transfer price has been calculated by the Deplete On Hand Qty process, the transfer price is located in a child table, IN_DEMAND_TPRC, where it is broken out into several parts by cost elements. Cost elements can be created for material costs and additional transfer costs. The transfer price details can be viewed using the Transfer Price Inquiry component. The material and additional transfer costs are both included in the total transfer price. The transfer price details are retained by cost element in the accounting entries recorded for the Shipment On Behalf Of transaction.

The following information is used:

Transfer price (material portion): 10.00

Freight costs: 5.37

Item cost: 8.25

Cost element 100 (Material- General)

Cost element 751 (Addl Trans- Freight)

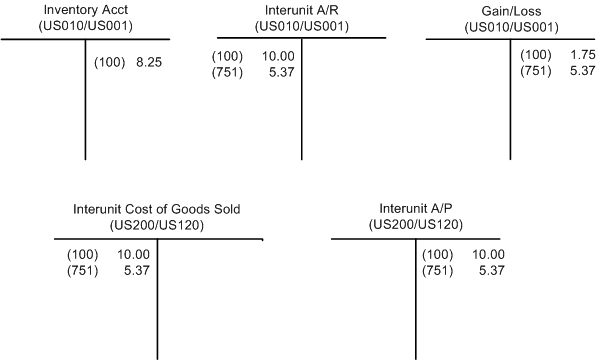

The following diagram illustrates a Shipment On Behalf Of transaction shipping stock from the inventory business unit US010 on behalf of the order management business unit US200. The inventory business unit, US010, reports to the general ledger business unit US001. The order management business unit, US200, is linked to the billing unit, US200, receivables unit US120, and general ledger unit US120. In the inventory business unit, transfer price has been chosen using the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page.

The above diagram illustrates the accounting entries for a Shipment On Behalf Of transaction using the transaction group 034 (Ship on Behalf Of Other BU) and the transaction group 302 (ShipOnBehalf Gain/Loss). The inventory account is credited for the material costs. The interunit A/R and A/P accounts contains the transfer price of material and additional transfer costs. The gain and loss account contains the additional transfer cost plus any difference between the transfer price and the cost of the item. The cost of goods sold account and interunit A/P account move the cost of the item to the correct OM/BI/GL business unit chain that contains the revenue from the sale.

Setting Up Shipment On Behalf Of Transactions

To setup your organization for Ship On Behalf Of transactions:

Select to use item cost or transfer price for the interunit accounts. In the shipping inventory business unit, select Use Item Cost or Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page.

(Optional) If you have selected Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page, then you should create a transfer pricing definition for the shipping inventory business unit. The information on the Transfer Pricing Definition component should be defined for the source unit (inventory business unit) and a blank destination unit. This component provides the calculation of the item cost, transfer price, and any additional transfer costs. In addition, the transfer pricing definition gives the cost elements to be used for additional transfer costs plus any additional material costs. The transfer price default hierarchy is used to determine the transfer price.

Define the ChartField combinations for the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. The entry type interunit customer shipments is for the cost of goods sold for shipments on behalf of.

Where you define these entry types depends on the value that you selected in the InterUnit Method field on the General Options - Overall page. If the value is:

Direct: The ChartField combinations for the entry types are entered on the InterUnit Template page defined for both GL business units.

Indirect: The ChartField combinations for the entry types are entered on the InterUnit Template page defined for both GL business units.

Pairs: The ChartField combinations for the entry types are entered on the InterUnit Pair page. The sending GL unit must be entered in the From GL Unit field and the receiving unit must be defined in the To GL Unit field. A separate pair is defined for every combination of GL units using the Shipment on Behalf Of feature.

If you use the direct or indirect interunit methods, then enter the interunit template ID on the General Ledger Definition - Inter/IntraUnit page.

Define the ChartField combinations for your inventory account:

For environments not using location accounting, define the ChartFields on the Accounting Rules page using the transaction group 034 (Shipments on Behalf of Other Business Unit).

For environments using location accounting, define the ChartFields on the Storage Area Accounting page for each location that can ship goods.

If you have selected Use Transfer Price on the Inventory Definition- Business Unit Definition page, then define the ChartField combinations for your gain or loss account for the transaction group 302 (ShipOnBehalf Gain/Loss) using the Accounting Rules page.

Determining ChartField Combinations

For the transaction group 034 (Ship on Behalf of Other BU), the system uses these pages to derive ChartField combinations (accounts) for each accounting line. It uses different pages based on the choice of interunit method (selected on the General Options - Overall page in the installation setup) and location accounting (selected on the Inventory Options page when defining the inventory business unit):

|

InterUnit Method |

Location Accting |

Page for DR Source BU |

Page for CR Source BU |

Page for DR Dest BU |

Page for CR Dest BU |

|---|---|---|---|---|---|

|

Direct |

Off |

InterUnit Template (defined on the source GL) |

Accounting Rules |

InterUnit Template (defined on the destination GL) |

InterUnit Template (defined on the destination GL) |

|

Direct |

On |

InterUnit Template (defined on the source GL) |

Storage Area Accounting |

InterUnit Template (defined on the destination GL) |

InterUnit Template (defined on the destination GL) |

|

Indirect |

Off |

InterUnit Template (defined on the destination GL) |

Accounting Rules |

InterUnit Template (defined on the source GL) |

InterUnit Template (defined on the source GL) |

|

Indirect |

On |

InterUnit Template (defined on the destination GL) |

Storage Area Accounting |

InterUnit Template (defined on the source GL) |

InterUnit Template (defined on the source GL) |

|

Pair |

Off |

InterUnit Pair |

Accounting Rules |

InterUnit Pair |

InterUnit Pair |

|

Pair |

On |

InterUnit Pair |

Storage Area Accounting |

InterUnit Pair |

InterUnit Pair |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_INV1 |

Define the basic attributes of a PeopleSoft Inventory business unit including the amount to be used in a Shipment On Behalf Of transaction. Select Use Item Cost or Use Transfer Price in the Ship on Behalf Transfer Price field of the Inventory Definition- Business Unit Definition page. |

|

|

CM_TRAN_PRICE_DEFN |

Define the transfer prices, markup percentages, and additional transfer costs to be used for a source business unit or a source and destination unit pair. |

|

|

General Options - Overall Page |

INSTALLATION_FS1 |

Select an interunit method. |

|

BUS_UNIT_TBL_GL1 |

If using interunit templates, identify the template for both receiving and sending GL units. |

|

|

IU_INTER_TMPLT |

Set up the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. Define the ChartField combinations (accounts) for each of these entry types. |

|

|

IU_INTER_PR_BASIC |

If the pairs method is selected on the General Options - Overall/GL page, then set up the following entry types of your inventory transaction code; interunit receivable, interunit payable, and interunit customer shipments. Define the ChartField combinations (accounts) for each of these entry types. |