Using the Financial Inquiry Pages

Viewing financial transaction detail and its associated accounting entries is necessary when investigating a suspect entry in the general ledger or when performing daily monitoring of production activity. PeopleSoft Cost Management enables you to see this transaction information on different pages depending on the type of transaction that you are investigating.

The financial inquiry pages consist of:

Field or Control |

Description |

|---|---|

Review Accounting Lines menu |

Under this menu, three components enable you to review accounting entries, including, the Accounting Entries page, the Unposted Accounting Entries page, and the Posted Accounting Entries page. |

Review Transaction Entries menu |

Under this menu, nine separate pages give you the ability to view the most relevant information pertaining to the different types of transactions. |

Review Transaction Details menu |

Under this menu, nine separate pages give you the ability to review detailed information about the transaction that you select. |

The Review Transaction Entries menu and the Review Transaction Details menu both include pages for you to review these types of entries:

Inventory transactions.

Earned conversion costs.

Production variances.

Production scrap costs.

Production actual costs.

Standard cost revaluations.

Average cost adjustments.

Actual cost adjustment.

Non-stock shipment transactions.

You choose how you want to view accounting entries on the pages that display them. Entries can display debits and credits in one column or two separate columns based on the selection of the Display Debit/Credit Amounts in Subsystems check box on the Overall Preferences page. This default is applied by user ID. In addition, ChartField security can be applied to these pages.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

OPR_DEF_TABLE_FS1 |

Based on user ID, specify overall default preferences, including the display of debits and credits in one column or two separate columns for the inquiries under the Review Transaction Entries menu and the Review Transaction Details menu. Select the Display Debit/Credit Amounts in Subsystems check box to display accounting entries in separate columns for debits and credits. Do not select this check box to display accounting entries in a single Monetary Amounts column that uses positive numbers to represent debits and negative numbers to represent credits. |

|

|

Inventory On Hand Page |

CM_OH_INQUIRY |

View the accounting profile and current on-hand quantity for any item within a business unit. This inquiry page displays the item's book names, costing methods, on-hand quantity, and the value of the on-hand quantity. |

|

Unposted to GL Page |

CM_DRILL_UNPST_DET |

View unposted accounting lines. Unposted accounting lines represent financial transactions that are not yet processed by the Journal Generator process so they are not posted in the journal in PeopleSoft General Ledger. The general ledger has no record of these transactions at this point. ChartField security can be applied to this page. |

|

Posted Accounting Lines Page |

CM_DRILL_JRNL_DET |

View posted accounting lines. Posted accounting lines represent financial transactions that are processed by the Journal Generator process originating from PeopleSoft Order Management, Purchasing, Inventory, and Manufacturing. These entries can now be posted to the appropriated journal in the general ledger. ChartField security can be applied to this page. |

|

Accounting Entries Page |

CM_ACCTG_LINE |

To view accounting entries, enter the search criteria and click the refresh button. This page displays the both the debit and credit sides of the accounting entry and the complete ChartField combinations. ChartField security can be applied to this page. |

|

Inventory Transactions - Transaction Entries Page |

CM_DRILL_ACCT_INV |

View the accounting entries for inventory transactions and the accounting entries for route to production transactions. ChartField security can be applied to this page. |

|

Earned Conversion Costs - Transaction Entries Page |

CM_DRILL_ACCT_ERN |

View the accounting entries for earned-cost transactions. ChartField security can be applied to this page. |

|

Production Variances - Transaction Entries Page |

CM_DRILL_ACCT_VAR |

View the accounting entries for variance transactions. ChartField security can be applied to this page. |

|

Production Scrap Costs - Transaction Entries Page |

CM_DRILL_ACCT_SCP |

View the accounting entries for scrap-cost transactions. ChartField security can be applied to this page. |

|

Production Actual Costs - Transaction Entries Page |

CM_DRILL_ACCT_MFG |

View the accounting entries for actual-cost transactions in PeopleSoft Manufacturing. ChartField security can be applied to this page. |

|

Standard Cost Revaluations - Transaction Entries Page |

CM_DRILL_ACCT_REV |

View the accounting entries for revaluation transactions. ChartField security can be applied to this page. |

|

Avg Cost Adjustment Entries- Transaction Entries Page |

CM_DRILL_ACCT_ADJ |

View accounting entries for cost adjustment transactions to perpetual average and retroactive perpetual average items. This includes value adjustments and change average adjustments stored in the CM_COST_ADJ record. ChartField security can be applied to this page. |

|

Actual Cost Adjustment Entries- Transaction Entries Page |

CM_DRILL_ACCT_UADJ |

View accounting entries for value adjustment transactions to actual cost items. This includes only value adjustments stored in the CM_USER_CST_ADJ record. ChartField security can be applied to this page. |

|

Non Stock Shipment - Transaction Entries Page |

CM_DRILL_ACCT_NSS |

View the accounting entries for non-stock shipment transactions. ChartField security can be applied to this page. |

|

Inventory Transactions - Transaction Details Page |

CM_DRILL_INV_DET |

View detailed information about inventory transactions and the accounting entries for route to production transactions. ChartField security can be applied to this page. |

|

More Transaction Details Page |

CM_DRILL_INV_IN |

Displays additional information that is associated with the transaction. |

|

Earned Conversion Costs - Transaction Details Page |

CM_DRILL_ERN_DET |

View transaction detail that is associated with the earned-cost transaction. ChartField security can be applied to this page. |

|

Production Variances - Transaction Details Page |

CM_DRILL_VAR_DET |

View transaction detail that is associated with the variance transaction. ChartField security can be applied to this page. See |

|

Production Scrap Costs - Transaction Details Page |

CM_DRILL_SCP_DET |

View transaction detail associated with the scrap-cost transaction. ChartField security can be applied to this page. |

|

Production Actual Costs - Transaction Details Page |

CM_DRILL_MFG_DET |

View transaction detail that is associated with actuals costs of production. ChartField security can be applied to this page. |

|

Standard Cost Revaluations - Transaction Details Page |

CM_DRILL_REV_DET |

View transaction detail that is associated with the revaluation transaction. ChartField security can be applied to this page. |

|

Avg Cost Adjustment Detail - Transaction Details Page |

CM_DRILL_ADJ_DET |

View transaction detail associated with the cost adjustment transaction for perpetual average and retroactive perpetual average items. This includes value adjustments and change average adjustments stored in the CM_COST_ADJ record. ChartField security can be applied to this page. |

|

Actual Cost Adjustment Detail - Transaction Details Page |

CM_DRILL_UADJ_DET |

View transaction detail associated with value adjustment transactions for actual cost items. This includes only value adjustments stored in the CM_USER_CST_ADJ record. ChartField security can be applied to this page. |

|

Non Stock Shipment - Transaction Details Page |

CM_DRILL_NSS_DET |

View transaction detail that is associated with the non-stock shipment transaction. ChartField security can be applied to this page. |

By using the financial inquiry pages, you can track financial transactions throughout the audit trail by drilling up to the journal entries and drilling down to the accounting entries. You can analyze financial transactions in a few different ways, including:

Viewing an entry in the general ledger and drilling down to the actual transaction details or entries that created the entry.

Viewing the financial transaction details or entries and drilling up to the journal entries that are created in the general ledger.

Drilling between the actual transaction detail and the accounting entries for the transaction before or after you perform the Journal Generator process.

Viewing accounting entries that are created without using the drill-up and drill-down functionality.

Generating reports that display the accounting register, inventory value, and transaction register.

Note: If you have purge or archive production data, you cannot view production-related costs such as earned labor, scrap costs or variances.

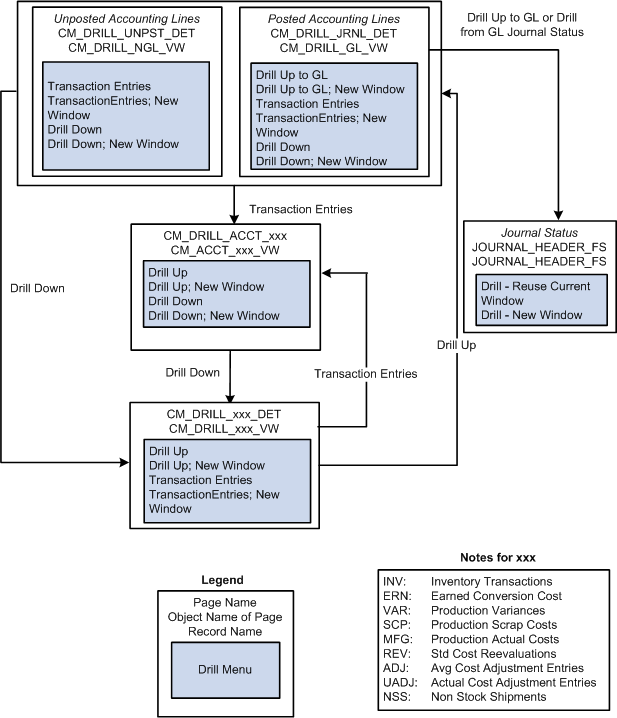

This diagram illustrates the drill up and drill down flow between transactions and accounting entries.

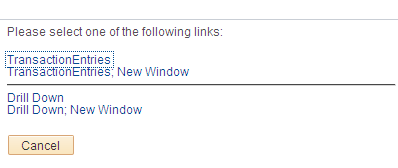

Understanding the Transfer Menu

Transfer menus enable you to navigate between the different inquiry pages. The transfer menus can vary, depending on the inquiry page. To access the transfer menu, click the View Related Links button for any account line number. This example illustrates the transfer menu that is available from the Posted Accounting Lines page in PeopleSoft Cost Management.

This example illustrates the fields and controls on the Transfer Menu Example. You can find definitions for the fields and controls later on this page.

The new window option in the transfer menu gives you the ability to have more than one window open at a time, enabling you to analyze several transactions at one time.

Drilling Down from PeopleSoft General Ledger to PeopleSoft Cost Management

The drill-down feature begins at the General Ledger inquiry pages in PeopleSoft General Ledger. Select an entry and click its View Related Links button to access a transfer menu. Select a drill option from the menu, and you can navigate to the Posted Accounting Lines page in PeopleSoft Cost Management. After you select a posted accounting line, you can use another transfer menu to access the originating transaction detail page or the transaction accounting entry page. These transaction pages give you the ability to see the transaction details or accounting entries for a selected transaction.

Drilling Up from PeopleSoft Cost Management to PeopleSoft General Ledger

When you want to trace an originating entry up to the general ledger, you can drill up. You begin by viewing the transaction detail or transaction accounting entries in PeopleSoft Cost Management. Then select the transaction and click the View Related Links button to access a transfer menu. Select Drill Up from the menu to drill up to the Posted Accounting Lines page (if the transaction is processed by the Journal Generator process) or to the Unposted Accounting Lines page (if it is not yet processed by the Journal Generator process). From the Posted Accounting Lines page in PeopleSoft Cost Management, you can drill up to journal entries by using a transfer menu. You cannot drill up to the journal entries from the Unposted Accounting Lines page because the journal entries do not yet exist for those accounting lines.

Drilling Between the Transaction Details and Transaction Accounting Entries

When you are interested in viewing the transaction detail and transaction accounting entries only within PeopleSoft Cost Management, you can drill between the different types of information. To go from the transaction details to the transaction accounting entries, you select Transaction Entries from the transfer menu. To go from the transaction accounting entries to the transaction details, you select Drill Down from the transfer menu.

Inventory transactions are any material movement transactions that have a financial affect on inventory balances, such as purchase receipts, adjustments, and issues. Inventory transactions include route to production kits transactions. Route to production kits transactions occur when an assembly item is completed on a production ID or schedule, and it can be routed to another production ID, where it is used as a component on the next-higher-level assembly. The component's issue method must be set to Kit in order for you to route directly to production. This inventory transaction information is derived from the transaction history records (TRANSACTION_INV and TRANS_INV_CM). Transactions that can be viewed on the Inventory Transactions inquiry pages are these transaction groups:

|

Transaction Group |

Description |

|---|---|

|

010 |

Receipt to Inspection. |

|

012 |

Return to Vendor. |

|

013 |

Return to Vendor from Inspection. |

|

020 |

Putaway. |

|

021 |

Receipts from Production. |

|

022 |

IBU Transfer Receipts. |

|

024 |

Customer Returns. |

|

025 |

InterCompany Receipts. |

|

026 |

Expensed Issue Return. |

|

030 |

Usages & Shipments. |

|

031 |

InterBU Transfer Shipments. |

|

032 |

Non Stock Shipments. |

|

034 |

Ship on Behalf of Other BU. |

|

035 |

InterCompany Transfers. |

|

036 |

InterUnit Expensed Issue. |

|

037 |

VMI Interunit shipment |

|

038 |

VMI Consumption |

|

040 |

Physical Count Adjustments. |

|

041 |

Cycle Count Adjustments. |

|

042 |

IBU Transfer Adjustments. |

|

050 |

User Adjustments. |

|

051 |

Inventory Scrap. |

|

052 |

Shipping Adjustment. |

|

053 |

Floor Stock Issues/Ret. |

|

054 |

Inventory Scrap for RTV. |

|

060 |

Bin-To-Bin Transfers. |

|

220 |

Component Kit |

|

221 |

Route To Production Kit |

|

222 |

Waste Completion. |

|

223 |

Component/Output Transfers. |

|

230 |

Component Consumption. |

|

231 |

WM Usage (Maintenance Management Usage). |

|

300 |

Gain/Loss on Trans Price. |

|

301 |

InterCompany Cost of Goods. |

|

302 |

ShipOnBehalf Gain/Loss. |

|

400 |

Std Cost Variance Receipts. |

|

402 |

Std Cost Exchange Rate Var. |

|

461 |

PO Voucher Variance. |

Earned conversion costs account for all earned labor, machine, subcontracting, and overhead costs. The information that is on the Earned Conversion Costs inquiry pages is derived from the Earned Conversion Cost record (SF_EARNCONCOST). The transactions that create entries in this table are:

|

Transaction Group |

Description |

|---|---|

|

240 |

Earned Labor |

|

211 |

WIP Revalue (Conv Costs) |

Production variance transactions represent material variances and conversion variances that are incurred on a production ID or schedule when production is closed for accounting. The information is derived from the Production Variance record (SF_VARIANCES). The Production Variances inquiry pages use these variances:

|

Transaction Group |

Description |

Comprised of Variance Type |

Description |

|---|---|---|---|

|

261 |

Material Variances. |

01 |

Configuration Variance. |

|

|

|

02 |

Usage Variance. |

|

|

|

03 |

Component Yield Variance. |

|

|

|

08 |

Material Lot Size Variance. |

|

262 |

Conversion Variances. |

04 |

Labor Lot Size Variance. |

|

|

|

05 |

Routing Process Variance. |

|

263 |

Rework Expense. |

09 |

Material Rework Expense. |

|

|

|

10 |

Labor Rework Expense. |

|

264 |

Outside Processing PPV. |

11– For standard cost makeable items, this transaction group records the variance between the standard cost and the purchase order price of the subcontracted service. |

Outside Processing PPV. |

|

265 |

Teardown Variance. |

13 |

Teardown Material Expense. |

|

|

|

14 |

Teardown Conversion Expense. |

|

407 |

Subcontract Standard Cost PPV2 |

For subcontracted purchases using standard costing, this is the purchase price variance that records the price difference between the purchase order and the voucher. |

|

|

408 |

Subcontract Standard Cost PPV2 ERV |

For subcontracted purchases using standard costing, this is the purchase price variance that records the exchange rate difference between the purchase order and the voucher. |

|

|

415 |

RTV Variances. |

Records the difference between the inventory value of goods being returned and the amount of the supplier refund recorded in accounts payable. |

Return to Vendor Variance. |

|

601 |

Wt Avg Upd Production Var. |

|

Weighted Average Update Production Variance. |

|

661 |

Actual Cost Variances. |

For actual cost makeable items, this transaction group records the variance between the actual cost of the components and the standard cost of the end items. |

Production Actual Cost Writeoff. |

|

664 |

Subcontracted Cost. |

For actual cost makeable items, this transaction group records the variance between the purchase order price and the voucher price of the subcontracted service for actual cost components. |

Subcontracted Cost |

Production scrap cost transactions account for the cost of assemblies that are scrapped in process while recording operation and assembly completions. The information that appears on the Production Scrap Costs inquiry pages is derived from the Assembly Scrap Cost record (SF_SCRAPCOST). The transaction groups that are used to record scrap are:

|

Transaction Group |

Description |

|---|---|

|

212 |

WIP Revaluation (Scrap) |

|

250 |

Assembly Scrap |

Production actual cost transactions account for the actual cost of production when the make item uses an actual or average cost method. Actual production costs include the actual cost of materials, conversion costs, conversion overhead costs, subcontracted components, and additional costs. The information that appears on the Production Actual Costs inquiry pages is derived from the CE_ACTUAL_COST record. These transaction groups are used:

|

Transaction Group |

Description |

|---|---|

|

622 |

Actual Waste Cost |

|

630 |

Overhead |

|

640 |

Actual Labor Costs |

|

645 |

Actual Machine Costs |

|

651 |

Production Cost Writeoff |

|

661 |

Actual Cost Variances |

|

664 |

Subcontracted Cost |

Standard cost revaluation transactions occur when you change standard costs and update the production cost record with the new version of costs. At that time, the system:

Calculates the change in inventory value by determining the change in cost and multiplying that difference by the quantity on hand in inspection, stores, and WIP locations.

Determines the change in WIP inventory by calculating the change in cost of components that are remaining in process, as well as the associated labor, machine, subcontracting, and overhead costs that are earned to that point.

The WIP revaluation information that appears in the Standard Cost Revaluations inquiry pages is associated with the revaluation of the components that are issued to the production ID or schedule as well as the revaluation of the assembly item itself. Detail information is derived from the Posted Item Cost Variance record (CE_ITEMCVAR_PST). The transaction groups are:

|

Transaction Group |

Description |

|---|---|

|

200 |

Inventory Revalue. |

|

201 |

Inventory Reval-Inspection. |

|

210 |

WIP Revalue (Comps, Assys). |

Average cost value adjustment transactions occur when adjusting the cost of the perpetual weighted average cost or the retroactive perpetual weighted average cost items and the resulting change in inventory value. Value adjustments for items using perpetual weighted average costing or retroactive perpetual weighted average costing can be:

Manually created using the Adjust Average Cost page or the Adjust Retro Costs page.

System created by the Transaction Costing subprocess within the Cost Accounting Creation process.

The information that appears in the Average Cost Adjustment inquiry pages is derived from the CM_COST_ADJ record. The transaction groups are:

|

Transaction Group |

Description |

|---|---|

|

205 |

Value Adjustment. |

|

401 |

Wt Avg Updates from AP. |

|

403 |

Wt Avg Cost Updates - ERV. |

|

405 |

Wt Avg Update Writeoffs. |

Actual cost value adjustment transactions occur when adjusting the cost of the actual cost items and the resulting change in inventory value. Actual cost items are adjusted using the Adjust Actual Cost component. The information that appears in the Actual Cost Adjustment inquiry pages is derived from the CM_USER_CST_ADJ record. The transaction group is:

|

Transaction Group |

Description |

|---|---|

|

206 |

Value Adjust/ActCost Items. |

Non-stock shipment transactions occur when you specify a non-stocked item on a sales order in PeopleSoft Order Management and mark it for PeopleSoft Billing. The information on the Non Stock Shipment inquiry pages is derived from the Non-Stock Shipments record (CM_CST_NSSHIP). The transaction group is:

|

Transaction Group |

Description |

|---|---|

|

032 |

Non Stock Shipments. |