Processing Indian Taxes for Sales Orders and Quotes

This topic provides an overview of Indian Tax processing.

Note: Indian taxes are calculated only during online sales order entry.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ORDENT_FORM_LINE |

Modify the tax transaction type and enter customer and order information pertaining to the entire order. You can also view total excise duty and sales tax amounts for each individual line and for the order. |

|

|

ORDENT_LINE_PRICE |

View and modify pricing information for the line. You can also enter manual adjustments. |

|

|

ORDENT_SCH_ENTRY |

Modify the tax transaction type. Define multiple order line shipments or change default information. |

|

|

ORDENT_EXS_TAX_PG |

View excise and sales taxes and modify the tax rate codes. |

|

|

ORDENT_SCH_PRICE |

View and modify pricing information for the schedule. You can also enter manual adjustments. |

|

|

ORDENT_SUMMARY |

Quickly view information about an individual sales order. You can view the excise duty and sale tax that is calculated for the order. |

In order to calculate excise and sales tax, the ship to customer's tax transaction type appears by default on the sales order header from the Customer Tax Applicability page when adding a sales order or quote. It then appears by defaults on the line and schedule. The tax transaction type can be changed at the header, line, or schedule level. If you change the ship to customer or ship to customer location, the tax transaction type is redetermined.

Note: If you change the tax transaction type at the header level after lines are added, it does not update existing lines or schedules. The system only updates new lines.

If the tax transaction type is for an export sale, you are required to select a benefit scheme for the export products on the order schedule to fulfill customs duty obligations. You can enter the benefit scheme on the order line. The benefit scheme is informational only and can help in the reporting of export sales.

Tax information is established for items that are associated to the product on the Item Tax Applicability page. For product kits, the tax information is established on the Product Tax Applicability page. Excise duties and sales taxes are calculated once when a product, quantity, unit of measure, ship from business unit, and ship to customer are entered and the order is priced. When a product kit is entered on a sales order and the entire product kit cannot be shipped, the excise invoices are not created. There can be only one ship ID for each product kit that is ordered on a sales order line.

The Tax Determination process is called to determine the excise tax rate code and sales tax rate code. Then the Tax Calculation process is called to calculate the excise and sales tax amounts. All taxes are calculated at the schedule level and appear on the Excise and Sales Tax page. You are able to change only the tax rate codes from this page. Excise duty and sales tax information can also be viewed on the Order Lines and Order Summary page.

Taxes are calculated in this order:

Excise duties.

Sales taxes.

Note: The Total Order/Load Adjust Option on the Accounting and Billing page for the Order Management Definition, controls how total order and weight, and volume pricing discounts and surcharges are sent to PeopleSoft Billing, and how they appear on invoices. For total order or load-based sales subject to India excise tax, pricing will be sent to PeopleSoft Billing as individual invoice lines so that PeopleSoft Billing will calculate taxes.

Copying Sales Orders and Quotes

Indian tax information is copied in the same manner as sales orders and quotes with this exception: excise duties and sales tax are not re-determined when you are copying lines or schedules, but the taxes will be recalculated.

Note: You can always click the Reprice button on the sales order to recalculate the taxes if you have added new lines/schedules or changed any fields.

Calculating Excise Duty when Multiple Pricing Schedules are in Use

If you have implemented tiered pricing rules in your pricing arbitration plan, the excise duty and sales tax on your shipping excise invoice is calculated based on the net unit price defined on the order schedule in the case where the excise duties should not be calculated based on the assessable value. The Net Unit Price field represents a weighted average price of all of the pricing schedules for a given order schedule.

Note: While the invoice will be correct it is important to note that it will not display the fact that customer paid a certain portion of the order schedule at price A and another portion at price B.

If an order with India Excise Duty has more than one pricing schedule it will be passed to Billing as if the Price Adjustment Detail Option, on the Accounting and Billing page for the Order Management Definition, is set to Netted with Revenue. This means that:

Adjustments are not sent to billing.

Only an invoice line where the list price and the net unit price both equal the net unit price after all adjustments is sent to billing.

Note: It is important to note that the bill reflects the final price after adjustments but the detail of how that price was arrived at is not reflected in the invoice.

Note: It is also important to consider the Excise Duty regulations in force if you decide to implement the Multiple Pricing Schedules.

Note: If you are not using tiered pricing, the system will use the Price Adjustment Detail Option you set on the Accounting and Billing page of the Order Management Definition.

Copying Sales Orders and Quotes

Indian tax information is copied in the same manner as sales orders and quotes with this exception: excise duties and sales tax are not redetermined when you are copying lines or schedules, but the taxes are recalculated.

Note: You can always click the Reprice button on the sales order to recalculate the taxes if you add new lines or schedules or change any fields.

Field or Control |

Description |

|---|---|

Benefit Scheme |

Benefit schemes are established on the Customs Duty Benefit Scheme page. The benefit scheme appears on the Order Lines page. A value is required if the transaction is identified as an export sale. These Tax Transaction Types are valid for export sales: DEB: (direct export with bond). DEWB: (direct export without bond). LEB (local export with bond) LEWB: (local export without bond). |

Tax Transaction Type |

Tax transaction type that is assigned to the transaction. Values are: DEB: (direct export with bond). DEWB: (direct export without bond). DOM: (domestic). IUT: (interunit transfer). LEB: (local export with bond). LEWB: (local export without bond). |

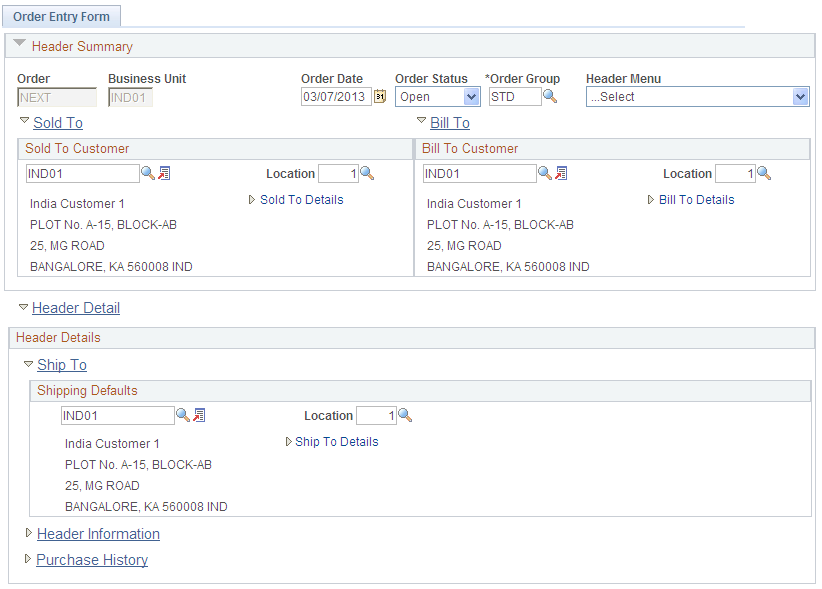

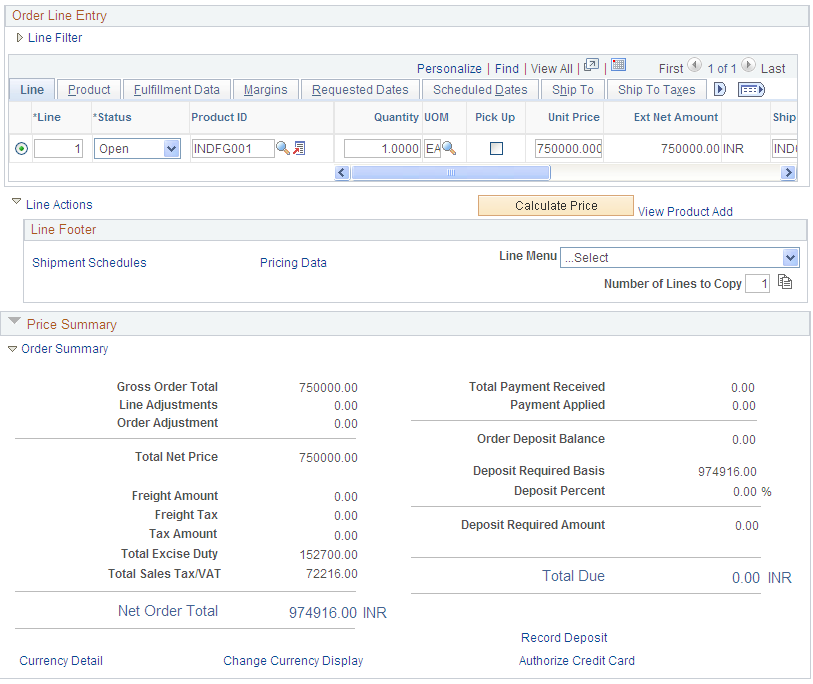

Use the Order Entry Form page (ORDENT_FORM_LINE) to modify the tax transaction type and enter customer and order information pertaining to the entire order.

You can also view total excise duty and sales tax amounts for each individual line and for the order.

Navigation:

This example illustrates the fields and controls on the Order Entry page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Order Entry page (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Total Excise Duty and Total Sales Tax/VAT |

You can view the values for the line from the Taxes tab and for the entire order in the Price Summary area. |

Total GST |

This field is visible only when the GST flag is enabled. You can view the values for the line from the Taxes tab and for the entire order in the Price Summary area. The Total GST will comprise of CGST, SGST, and IGST. |

Ship To |

Once Ship To Customer is selected, the system will default the GST Tax based on the Tax Setup defined in India GST. |

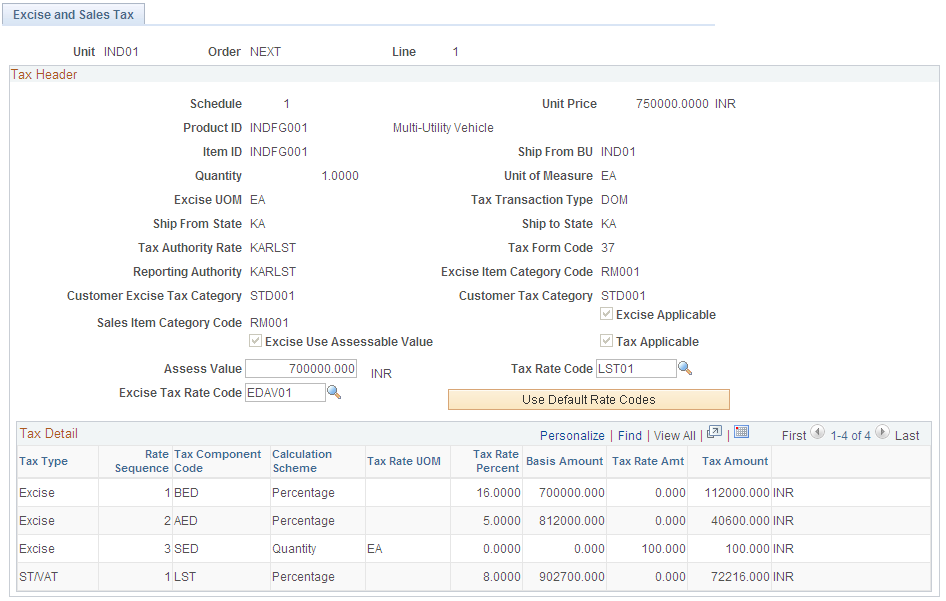

Use the Excise and Sales Tax page (ORDENT_EXS_TAX_PG) to view excise and sales taxes and modify the tax rate codes.

Navigation:

Select Excise and Sales Tax in the ...More field on the Shipment Schedules page.

This example illustrates the fields and controls on the Excise and Sales Tax page. You can find definitions for the fields and controls later on this page.

Note: If you change any of the values that can be edited (Assess Value, Sales Tax Rate Code, Excise Tax Rate Code, Use Default Rate Codes, Switch Currency Display), the Tax Calculation process uses the new values to determine or recalculate excise duty and sales tax.

Field or Control |

Description |

|---|---|

Excise UOM (excise unit of measure) |

Appears by default from the Item Tax Applicability page, Item Business Unit Tax Applicability page, or the Product Tax Applicability page. The calculated excise duty is multiplied by the conversion rate between the transaction unit of measure and the excise unit of measure to arrive at a final excise duty amount. |

Tax Authority Rate |

The tax authority rate is derived by using the tax determination process and assigned to the transaction. |

Tax Form Code |

Define form codes, which are groupings of form names. Form codes are assigned to tax rate codes. When a tax rate code is associated with a transaction, the form code helps determine the applicable forms for the transaction for form tracking purposes. Values are defined on the Sales Tax Form Codes page. |

Excise Use Assessable Value |

If the flag is selected, the assessable value is used to calculate the tax amounts. If the option is not selected, the Unit Price is used to calculate the tax amounts. |

Assess Value |

For items and products, this is the assessable value that is defined if you want to calculate duties based on a value other than the basic item or product value. If you edit this field, the Tax Calculation process uses this value to calculate tax amounts. |

Excise Item Category Code |

Default excise tax category code that is defined for the item. |

Sales Item Category Code |

Default sales tax category code that is defined for the item. |

Customer Excise Tax Category |

Appears by default from the Customer Tax Applicability page. |

Customer Tax Category |

Appears by default from the Customer Tax Applicability page. |

Excise Use Assessable Value |

If the flag is selected, the assessable value is used to calculate the tax amounts. If the option is not selected, the Unit Price is used to calculate the tax amounts. |

Excise Tax Rate Code and Tax Rate Code |

Taxes are recalculated if you change either the Excise Tax Rate Code or Tax Rate Code field values. |

Use Default Rate Codes |

Click the link to call the Tax Determination process to determine the default excise and sales tax rate codes. Then the Tax Calculation process is called to calculate the tax amounts. |

Tax Type |

Select a tax type with which to associate the tax component code. Defining this information filters tax component codes in the Tax Rate Code table to ensure that tax rate code definitions contain only tax component code lines of the same tax type. Values are Excise (this is the default value) and Sales Tax. Note: If GST flag is enabled, the tax type is GST only. |

Tax Component Code |

You define tax components on the Tax Component Code page. Use to group tax component codes of the same tax type under a common tax rate code. |

Calculation Scheme |

Assign a default calculation scheme to the tax component code. The value that you assign here appears by default to the Tax Rate Code page, where it can be overridden. Values are: Amount: Ad hoc amount-based tax calculation. Percentage: Percentage-based tax calculation. This is the default value. Quantity: Quantity-based tax calculation. |

Tax Rate UOM (tax rate unit of measure) |

The unit of measure that is associated with the corresponding rate code. Note: If the transaction unit of measure is different from the tax rate code unit of measure, the system performs the conversion using the PeopleSoft-delivered unit of measure conversion feature. |

Tax Rate Percent |

If the Calculation Scheme field value is set to Percentage, enter a percentage that is to be applied against the taxable amount. |

Basis Amount |

Base amount against which taxes are calculated. |

Tax Rate Amt (tax rate amount) |

If the Calculation Scheme field value is set to Quantity, amount to be applied against the transaction quantity, according to the transaction quantity in the Tax Rate UOM value. Note: If the transaction unit of measure is different from the tax rate code unit of measure, the system performs the conversion by using the PeopleSoft-delivered unit of measure conversion feature. If the Calculation Scheme is set to Amount, this is the calculated tax amount. If the Calculation Scheme is set to Percentage, this field is clear and the tax calculation parameter is the Tax Rate Percent field value. |

Tax Amount |

Tax amount for the tax rate sequence. |

Switch Currency Display |

Click to switch between the transaction and base currencies. |

Ship From State |

The location from where the item will be shipped. |

Ship To State |

The location to which the item will be shipped. |