Using a BOE

This section provides overviews of BOE, BOE processing rules, BOE Statuses, and BOE customs duty determination and calculation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BILL_OF_ENTRY |

Enter BOEs. |

|

|

BOE_SELECT |

Select source rows to add to a BOE. |

|

|

BOE_HDR |

Access BOE header details. |

|

|

RUN_POY5070 |

Enter parameters for the Bill of Entry Worksheet process (POX5070) and run the process. |

There are two ways in which BOEs are used in customs processing:

With bonding.

When using BOEs with bonding, you begin tracking customs-applicable goods using BOEs when the supplier delivers the goods to customs. Although the goods are not physically in your organization's possession, you receive the goods into a business unit you have created to represent the customs warehouse, or a bonded warehouse.

Without bonding.

When using BOEs without bonding, you begin tracking customs-applicable goods after the goods are released from customs and are delivered to you. You receive the goods for putaway to an inventory business unit or inventory warehouse.

The bonded scenario is designed for use when the legal responsibility for the goods transfers from the supplier to your organization upon delivery to customs. Use the nonbonded scenario if the transfer of responsibility occurs upon delivery to you after customs assessment.

The following procedure provides the basic process flow for the nonbonded BOE scenario.

Nonbonded BOE

You must submit a BOE worksheet to customs authorities when a supplier delivers your goods to customs. In addition, customs uses original shipping documents for assessment and confirmation of customs duties.

To create nonbonded BOEs:

Create a BOE with a type of Home Consumption using a purchase order with a tax transaction type of Import.

Use the pro forma invoice from the supplier to provide details needed on the BOE.

Set the BOE status to Ready.

This designates that the BOE is ready for printing and submission to customs.

Save the BOE.

Upon saving, customs duties are determined and calculated.

Print the BOE worksheet and submit to customs.

Customs authorities assess the BOE and related goods and return an updated BOE to you.

Apply the updates from customs and set the BOE status to Assessed.

Use PeopleSoft Payables to pay customs duties using a third-party voucher.

Receive and put goods away to the appropriate inventory warehouse.

Receipt lines must be associated with an assessed BOE line.

Reopen the third-party voucher and enter the receipt ID associated with each voucher line.

This enables the system to calculate and apply any variance between the estimated and actual nonrecoverable customs duties. This variance is applied to the item in PeopleSoft Inventory.

Change the BOE line and header statuses to Closed.

Create an internal supplier excise invoice for the goods using the BOE.

Run the Register Update process to update Indian tax registers and record accounting entries.

The bill of entry processing rules are:

The system does not apply receiving tolerance percentages when creating BOEs; therefore, the total purchase order schedule BOE quantity cannot be greater than the purchase order quantity.

You cannot create BOEs based on amount-only purchase order lines.

You can add purchase order schedules from multiple purchase orders and suppliers to one BOE.

When you select a warehousing BOE to copy to an ex-bonded BOE, you can copy lines from any number of warehousing BOEs to one ex-bonded BOE.

However, you can only select lines from warehousing BOEs for copying.

Consignment orders do not require special handling for BOE or receiving processing.

Consignment orders are processed in the same way as non consignment orders.

The system uses default values, such as those on the BOE_HDR, only when inserting child rows and are not used for overriding values on existing rows.

For example, suppose that you change the rate value (RT_RATE) on the BOE_HDR record and there are existing BOE_LN records, the rate values on those BOE_LN records are not overridden. However, new BOE_LN records added after the change to the rate value on the BOE_HDR record receive the new rate value.

The following table provides details about available BOE header and line statuses:

|

Header Statuses |

Possible Line Statuses |

Details |

|---|---|---|

|

Open |

Hold, Ready, Assessed, or Closed |

When BOE headers and lines are initially added, the BOE status is set to Open. After all lines have reached a status of Ready, Assessed, or Closed, you can change the BOE header status to Ready and print the BOE worksheet. |

|

Ready |

Ready, Assessed, or Closed |

You can print BOE worksheets only for BOEs in Ready status. |

|

Assessed |

Assessed or Closed |

Only BOE lines in Assessed status can be associated with receipt lines. After all lines have reached a status of Assessed or Closed, you can change the BOE header status to Assessed. You can apply updates to the BOE worksheet until the header status is changed to Assessed. |

|

Closed |

Closed |

After receiving BOE goods, you can manually change the BOE line status to Closed. After a BOE line has reached a status of Closed, no information on the BOE line can be modified, including the line duty. After all lines have reached a status of Closed, you can change the BOE header status to Closed. After a BOE header has reached a status of Closed, no information on the BOE can be modified. Only BOE lines in Closed status are picked up when creating an internal supplier excise invoice with a type of BOE. After information has been copied from the BOE transactions to the internal supplier excise invoice, the CENVAT Posting process creates the CENVAT entries. |

When source transaction lines (purchase order schedules or BOE lines) are copied to a BOE, the common Customs Duty Determination process (CSD_TAX_DETERM) and Customs Duty Calculation (CSD_TAX_CALC) process are triggered. These processes are also triggered when you change BOE field values that affect tax calculations.

Before calling the Customs Duty Determination process (CSD_TAX_DETERM), the line tax defaults (CSD_TAXDF_LN_RS) must be populated. After the customs duty determination is complete, the process populates the line tax default rows with default values to be transferred to the BOE_LN_DUTY record.

The Customs Duty Calculation process (CSD_TAX_CALC) is then triggered to calculate duty amounts using the line tax defaults populated by the Customs Duty Determination process. After customs duty calculations are complete, the system uses the line tax calculation detail rows to update corresponding fields on the BOE_LN_DUTY record. Corresponding amounts in BOE_LN_DUTY are also updated to reflect amounts in both base and reporting currencies.

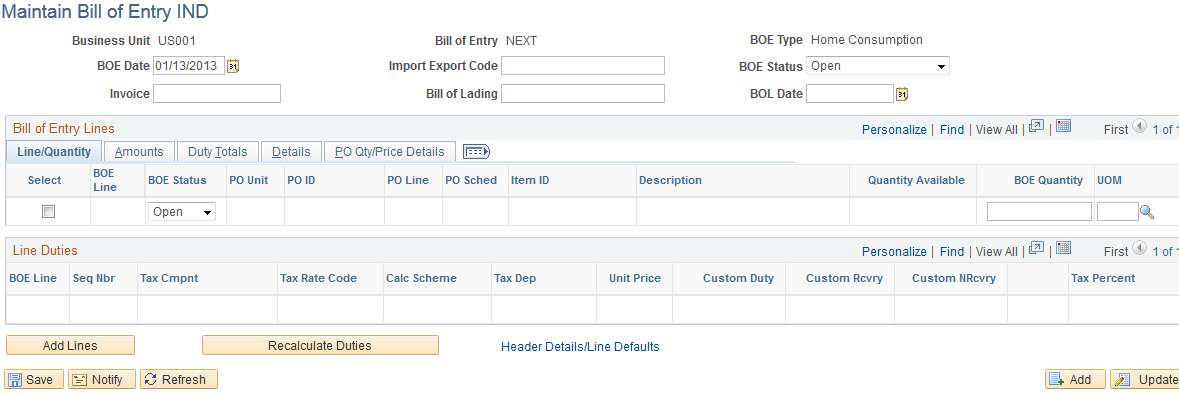

Use the Maintain Bill of Entry IND page (BILL_OF_ENTRY) to enter BOEs.

Navigation:

This example illustrates the fields and controls on the Maintain Bill of Entry IND page. You can find definitions for the fields and controls later on this page.

You can create a BOE for a single purchase order, multiple purchase orders, or a portion of a purchase order. BOEs are associated with a purchasing business unit.

Field or Control |

Description |

|---|---|

Import Export Code |

This field appears by default from the import export code defined for the organization assigned to the selected tax location. |

BOE Status |

Select the bill of entry header status. Values are: Hold, Closed, and these values: Open: This is the default value. Ready: Indicates that the BOE worksheet is ready for printing. Assessed: Indicates that all BOE worksheet details are final and goods can be received by the importer. |

Bill of Lading and BOL Date (bill of lading date) |

Enter a bill of lading and bill of lading date. |

Bill of Entry Lines

Use the Bill of Entry Lines scroll area to access and enter BOE line details.

Line/Quantity Tab

Field or Control |

Description |

|---|---|

Select |

Select the BOE line for which you want to display details in the Line Duties scroll area. |

BOE Status |

Select the bill of entry line status. Values are: Hold, Closed, and these values: Open: This is the default value. Ready: Indicates that the BOE line is ready for printing. Assessed: Indicates that all BOE line details are final and goods can be received by the importer. |

Quantity Available |

Quantity available to be assigned to the BOE. If the purchase order schedule is associated with another BOE, this quantity is the purchase order schedule quantity less the quantity associated with the other BOE. |

BOE Quantity |

Quantity assigned to the BOE. The default value is the purchase order quantity. You can modify this quantity; however, the quantity can never exceed the purchase order quantity available to be associated with a BOE. This purchase order quantity is expressed in the BOE unit of measure, which may be different from the purchase order unit of measure. |

UOM (unit of measure) |

The default value is the value entered on the Bill of Entry - Header Details page. If you do not enter a value on that page, this value is set to the purchase order quantity unit of measure. You can modify this value. |

Amounts Tab

Select the Amounts tab.

Field or Control |

Description |

|---|---|

Amount |

The default value is the purchase order merchandise amount expressed in the reporting currency defined for the line. This value changes according to the value that you enter in the BOE Quantity field. |

Currency |

The default value is the reporting currency defined on the Bill of Entry - Header Details page. If you do not enter a value on that page, this value is set to the purchase order currency. |

Rate Type |

The default value is derived from the BOE header. |

Rate (RPT => PO) (exchange rate from reporting to purchase order currency) |

This is the exchange rate applied between the reporting and purchase order currencies using the rate type defined at the BOE header. You can modify this value. |

Freight |

Enter any applicable freight costs. |

Insurance |

Enter any applicable insurance costs. |

Other Cost |

Enter any other costs. |

CIF Amount (charge-in-full amount) |

This is the sum of the merchandise amount expressed in the reporting currency, and the amounts in the Freight, Insurance and Other Cost fields, also expressed in the reporting currency. |

Landing Charges |

Generally, this is one percent of the CIF amount, expressed in the reporting currency. You can modify this value. If the value in the CIF Amount field changes at any point due to a modified quantity or changes to the Freight, Insurance, and Other Cost field values, the existing landing charge based on the one percent of the CIF amount is overridden and the overriding value is used. |

Assess Value |

This is the sum of the CIF and landing charges amounts and is used to calculate customs duties. |

Duty Totals Tab

Select the Duty Totals tab.

Field or Control |

Description |

|---|---|

Custom Duty |

Total customs duty amount for the BOE line. The amount reflects the sum of corresponding amounts in the Line Duties scroll area. |

Custom Rcvry (custom recovery) |

Total recoverable customs duty amount for the BOE line. The amount reflects the sum of corresponding amounts in the Line Duties scroll area. |

Custom NRcvry (custom nonrecovery) |

Total nonrecoverable customs duty amount for the BOE line. The amount reflects the sum of corresponding amounts in the Line Duties scroll area. |

Details Tab

Select the Details tab.

Field or Control |

Description |

|---|---|

Benefit ID |

The default is the purchase order benefit scheme ID. |

Exempt ID |

Enter an applicable customs duty exemption ID. |

PO Qty/Price Details Tab

Select the PO Qty/Price Details tab.

The PO Qty/Price Details (purchase order quantity/price details) tab displays purchase order details for each BOE line.

Field or Control |

Description |

|---|---|

Unit Price |

The default value is the purchase order unit price. |

Line Duties

Field or Control |

Description |

|---|---|

Seq Nbr (sequence number) |

The sequence appears by default from the Schedule - Miscellaneous Charges page. |

Misc Chg (miscellaneous charge) |

All customs duty-related miscellaneous charge codes associated with each line item appear by default on the page. |

Calc Method (calculation method) |

Method by which the miscellaneous charge is calculated. For customs duty-related miscellaneous charges, the following values apply: Flat Amt (flat amount): Charge is a flat amount. This amount can be entered on the Miscellaneous Charges - Miscellaneous page. Unit Amt (per unit amount): Used to calculate the charge based on a unit price multiplied by the number of units. You can enter the unit price on the Miscellaneous Charges - Miscellaneous page. % Value (percentage of value): Used to calculate the charge based on a percentage of the assessable value on the purchase order schedule. This percentage is defined on the Misc Charge/Landed Cost Defn (miscellaneous charge/landed cost definition) page, but can be overridden on the Miscellaneous Charges - Miscellaneous page. |

Value % (value percent) |

If the calculation method is set to % Value, it displays the percentage defined on the Misc Charge/Landed Cost Defn page to be applied to the assessable value of the item. You can modify this value. |

Flat Amount |

If the calculation method is Flat Amt, it displays the flat amount of the charge entered on the Miscellaneous Charges - Miscellaneous page. You can modify this value. |

Dependency Code |

Dependency code associated with the customs duty-related miscellaneous charge. |

Unit Price |

If the calculation method is Unit Amt, it displays the unit price for the item's miscellaneous charge |

Custom Duty |

Miscellaneous charge amount based on the calculation method and applicable values. |

Custom Rcvry (custom recovery) |

Displays the recoverable customs duty amount based on the recoverable tax percent. |

Custom NRcvry (custom nonrecovery) |

Displays the nonrecoverable customs duty amount based on the recoverable tax percent. |

Page Actions

Field or Control |

Description |

|---|---|

Add Lines |

Click this button to access the Select Lines page, where you can select purchase order schedules to add to the BOE. |

Header Details/Line Defaults |

Click this link to access the Header Details page, where you can access BOE header details. |

Recalculate Duties |

Click this button to recalculate customs duties based on any changes made to BOE worksheet. The system recalculates all lines on the BOE. When calculations are complete, the BOE worksheet is ready for printing. Set the header status to Ready. Note: Saving the BOE also triggers recalculation. |

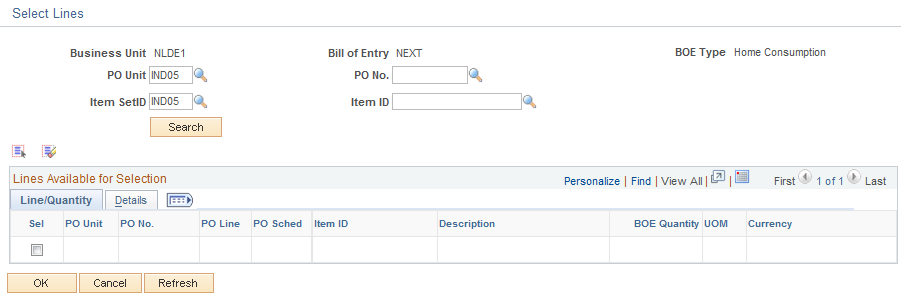

Use the Select Lines page (BOE_SELECT) to select source rows to add to a BOE.

Navigation:

Click the Add Lines button on the Maintain Bill of Entry IND page.

This example illustrates the fields and controls on the Select Lines page. You can find definitions for the fields and controls later on this page.

Note: Available fields on this page appear based on the BOE Type field value.

Field or Control |

Description |

|---|---|

Business Unit |

Displays the PeopleSoft Purchasing business unit for the BOE. This is the business unit that initiated the purchase of the customs duty-applicable goods for which you are creating the BOE. |

Bill of Entry |

Displays the system-generated BOE reference number. |

BOE Type |

Displays the BOE type. Values are: Home Consumption: Select to designate that the goods are to be transferred from customs authorities directly to your inventory warehouse for consumption. Warehousing: Select to designate that the goods are to be transferred from customs authorities to a bonded customs warehouse for storage until you need to consume them. These goods are to be received in your system using an inventory business unit representing the bonded warehouse. When you are ready to consume the goods, you create an ex-bonded BOE worksheet and do an interunit transfer to move the goods from the customs bonded warehouse to the inventory warehouse. If Home Consumption or Warehousing is selected, the system populates the Lines Available for Selection scroll area with purchase order schedules that meet the selection criteria and the following requirements when you click the Search button:

The BOE quantity that appears is the purchase order schedule quantity less the sum of the BOE quantities for all BOEs for the purchase order schedule that have a BOE type of Home Consumption or Warehousing. You can select one or more rows to copy to the BOE. After you select source rows and click OK, information from the source purchase order schedules is copied to the new BOE line and BOE line duty records. The Customs Duty calculation routine is triggered to calculate duties based on the quantity that appears by default to the BOE lines. Ex-Bond: Select to designate that goods are being moved from a bonded customs warehouse to the inventory warehouse for consumption. If selected, the system populates the Lines Available for Selection scroll area with BOE lines that meet the selection criteria and the following requirements when you click the Search button:

You can select one or more rows to copy to the ex-bond BOE. After you select source rows and click OK, information from the source warehousing BOE is copied to the new ex-bond BOE line and BOE line duty records. The customs duty calculation routine is triggered to calculate duties based on the quantity that appears by default to the ex-bonded lines. |

Bill of Lading |

This field appears when the BOE Type field is set to Ex-Bond. |

BU From (from business unit) |

This field appears when the BOE Type field is set to Ex-Bond. This is the business unit representing the bonded customs warehouse from which the goods are being transferred to the ex-bonded warehouse. |

BOE Ref ID (BOE reference ID) |

This field appears when the BOE Type field is set to Ex-Bond. This is the warehousing BOE used as the source transaction for the ex-bonded BOE. |

License |

This field appears when the BOE Type field is set to Ex-Bond. This is the license assigned to the bonded customs warehouse that stored the ex-bonded goods. |

Item SetID |

Enter the item SetID for which you want to return applicable transaction lines. |

Item ID |

Enter the item for which you want to return applicable transaction lines. |

Exempt ID |

This field appears when the BOE Type field is set to Ex-Bond. This is the exemption ID on the source BOE line. |

Search |

Select to display qualifying BOE source lines in the Lines Available for Selection scroll area. |

Line/Quantity

Field or Control |

Description |

|---|---|

BU From (from business unit) |

This field appears when the BOE Type field is set to Ex-Bond. This is the business unit representing the bonded customs warehouse from which the goods are being transferred to the ex-bonded warehouse. |

BOE Ref ID (BOE reference ID) |

This field appears when the BOE Type field is set to Ex-Bond. This is the warehousing BOE used as the source transaction for the ex-bonded BOE. |

BOE Ref Line |

This field appears when the BOE Type field is set to Ex-Bond. This is the warehousing BOE line used as the source transaction for the ex-bonded BOE. |

BOE Quantity |

Quantity to assign to the BOE expressed in unit of measure entered in the UOM field. This is the purchase order quantity, which may have been converted if the UOM field value is different from the purchase order unit of measure. You can modify this quantity on the BOE; however, the quantity can never exceed the purchase order quantity available to be associated with a BOE. |

UOM (unit of measure) |

The default value is the value entered on the Bill of Entry - Header Details page. If you do not enter a value on that page, this value is set to the purchase order quantity unit of measure. You can modify this value on the BOE. |

Amount |

This field appears when the BOE Type field is set to Ex-Bond. This is the merchandise amount from the source BOE line. |

Currency |

The default value is the reporting currency defined on the Bill of Entry - Header Details page. If you do not enter a value on that page, this value is set to the purchase order currency. This currency must be the same currency defined in the miscellaneous charge setup for the selected item. The system issues an error for rows for which the currency codes do not match, because it is unable to calculate customs duty amounts. Use the currency override on the Bill of Entry - Header Details page to set the reporting currency to the correct value. |

OK |

Click to copy selected lines to the BOE worksheet. |

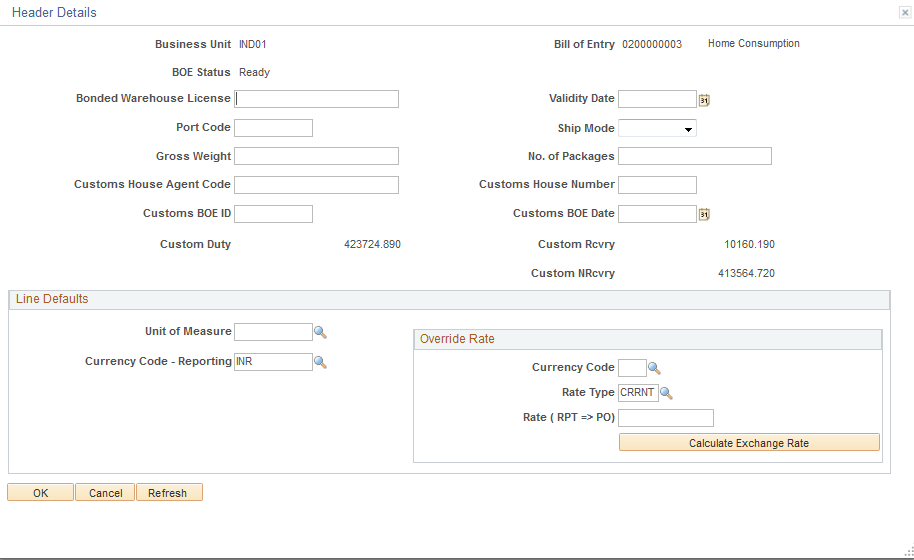

Use the Header Details page (BOE_HDR ) to access BOE header details.

Navigation:

Click the Header Details/ Line Defaults link on the Maintain Bill of Entry IND page.

This example illustrates the fields and controls on the Header Details page. You can find definitions for the fields and controls later on this page.

Default values, such as those available for entry on this page are used only when inserting new rows and are not used for overriding values on existing rows. For example, suppose that you change the rate value (RT_RATE) on this page and there are existing BOE_LN records, the rate values on those existing BOE_LN records are not overridden. However, new BOE_LN records inserted after you change the rate value receive the new rate value.

Amount fields appear in the reporting, or local currency.

Field or Control |

Description |

|---|---|

Bill of Entry |

Displays the BOE ID and type. |

BOE Status |

Displays the BOE header status. |

Bonded Warehouse License |

This field is available for entry for warehousing BOEs. |

Validity Date |

This field is available for entry for warehousing BOEs. |

Port Code |

Enter an applicable port code. This value is stored for informational purposes. |

Ship Mode |

Select the applicable mode of shipment. This value is stored for informational purposes. Values are: Air Land Sea |

Gross Weight |

Enter the gross weight of the shipment. This value is stored for informational purposes. |

No. of Packages (number of packages) |

Enter the number of packages included in the shipment of goods on the BOE. This value is stored for informational purposes. |

Customs House Agent Code |

Following BOE assessment, enter the code for the customs agent responsible for the BOE assessment. |

Customs House Number |

Following BOE assessment, enter the number for the customs house responsible for the BOE assessment. |

Customs BOE ID |

Following BOE assessment, enter a BOE reference number issued by customs authorities. |

Customs BOE Date |

Following BOE assessment, enter a BOE assessment date issued by customs authorities. |

Custom Duty |

Reflects the sum of corresponding amounts on BOE lines. |

Custom Rcvry (customs recovery) |

Reflects the sum of corresponding amounts on BOE lines. |

Custom NRcvry (customs nonrecovery) |

Reflects the sum of corresponding amounts on BOE lines. |

Line Defaults

The Line Defaults group box does not appear for ex-bonded BOEs. In this case, you can perform necessary overrides at the line level.

Field or Control |

Description |

|---|---|

Unit of Measure |

Enter a unit of measure to be used as a line default line value for new rows that you insert. This value does not override the default unit of measure for existing lines. |

Currency Code - Reporting |

This field appears by default from the currency code assigned to the selected tax location. |

Override Rate

Field or Control |

Description |

|---|---|

Currency Code |

Enter a currency code to override the default reporting currency code on new rows that you insert. |

Rate (RPT => PO)) |

Exchange rate between the default reporting currency code and the override currency code that you enter using the selected rate type. Click the Calculate Exchange Rate button to have the system calculate the rate for you. This rate is to be used as a line default line value for new rows that you insert. This value does not override the default rate for existing lines. |

Rate Type |

Rate type to use to calculate the exchange rate between the default reporting currency code and the override currency code that you have entered. This rate type is to be used as a line default line value for new rows that you insert. This value does not override the default rate type on existing lines. |

Calculate Exchange Rate |

Click to calculate the exchange rate between the default reporting currency code and the override currency code that you have entered. |

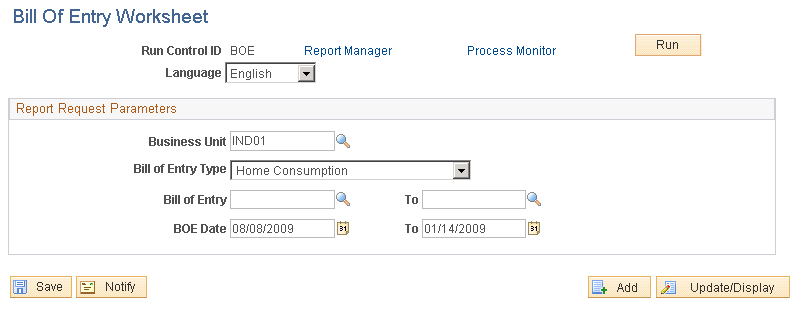

Use the Bill of Entry Worksheet page (RUN_POY5070) to enter parameters for the Bill of Entry Worksheet process (POY5070) and run the process.

Navigation:

This example illustrates the fields and controls on the Bill of Entry Worksheet page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

Enter the purchasing business unit for which you want to print BOE worksheets. To print BOE worksheets for all business units, do not enter a value. |

Bill of Entry Type |

Select the type of BOE worksheets that you want to print. To print BOE worksheets for all types, do not select a value. Values are: Ex-Bond Home Consumption Warehousing |

Bill of Entry/To |

Enter the range of BOE numbers that you want to print. Only BOEs in Ready status are available for selection. |

BOE Date/To |

Enter the date range for the BOEs that you want to print. The system prints BOEs in Ready status that have BOE dates that meet the date range criteria. |

Use the Bill of Entry page (Purchasing, Receipts, Maintain Bill of Entry IND).

You update a BOE worksheet in the system after it has been assessed by customs authorities. The custom authorities for the imported goods return the BOE to you (the importer) for confirmation of the assessable value and customs duty amounts assigned.

You make updates to BOEs in Ready status according to the assessment by customs authorities with the intention of changing the status to Assessed. As you update each BOE line, you change the line status to Assessed, which indicates that information on the BOE line is correct and final. You can change the BOE header status to Assessed after each line is in Assessed status.

Common updates resulting from customs authority assessment of BOEs include the application of the following:

A different exchange rate, which affects the assessable value of goods.

A different customs duty rate.

An additional customs duty.