Using Batch Verification

This section discusses how to:

Process batch consolidation.

View batch consolidated tax data.

Process batch verification.

Use batch verification results.

Use batch verification summary.

Use batch verification detail.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Batch Consolidation |

RUNCTL_FA_CONSL |

|

Set consolidation parameters for batch consolidation and run the process. |

|

Batch Consolidation Detail |

VERIF_CONSUL_SMRY |

|

View batch consolidation results at the student level from the Application Data Verification - Tax Consolidation Consolidated Tax Data page. |

|

Consolidated Tax Data – Fed |

SFA_VER_CSL_FED2 |

Click the Consolidated Tax Data link on the Batch Consolidation Detail inquiry page. |

View federal consolidated tax information for a student or parent. |

|

Consolidated Tax Data – Inst |

SFA_VER_CSL_INST2 |

Click the Consolidated Tax Data link on the Batch Consolidation Detail inquiry page. |

View institutional consolidated tax information for a student or parent. |

|

Batch Verification |

RUNCTL_FAPCMPR1_01 |

|

Set parameters to verify batches and to run the process. |

|

Batch Verification Results |

RUNCTL_VERIF_SEC |

Click the Results link on the Batch Verification Results page. |

View summary verification information. |

|

Batch Verification Summary |

VERIF_COMP_SMRY |

|

View summary verification information. |

|

Batch Verification Detail |

STDNT_VERIF_DTL1 |

|

View detail verification information from the Field Comparison Detail button on the Auto Verification page. |

Access the Batch Consolidation page ().

|

Field or Control |

Definition |

|---|---|

| Selection Criteria |

Select Unconsolidated or All Stdnts in Verification. |

| Tax Consolidation Type |

Select the Tax Consolidation Type you want to use. This field is active only if you do not select "Get Fed Data" or "Get Inst Data" for Household Verification. If you choose the Institutional Tax Consolidation Type, then the Institutional Marital Status Mapping is used. This field is display only if you use the "Get Fed Data" or "Get Inst Data" |

Access the Batch Consolidation Detail page ().

View Batch Consolidated Tax Data by clicking the Consolidated Tax Data link.

View Batch Non Custodial Parent Batch Consolidated Tax Data by clicking the NC Consolidated Tax Data link.

The Batch Consolidated Tax Data pages are the same as the Online Consolidated Tax Data pages except that the Batch pages are view–only. Refer to the documentation about the Online pages for information about the fields on the Batch pages.

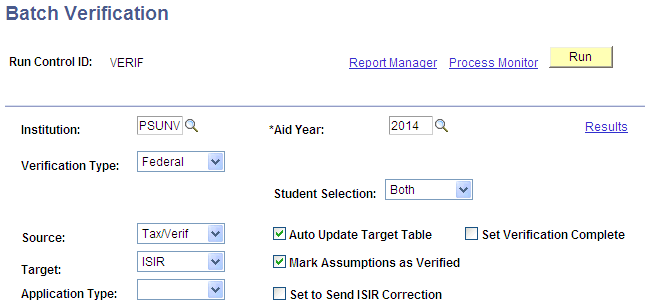

Access the Batch Verification page ().

Image: Batch Verification page

This example illustrates the fields and controls on the Batch Verification page. You can find definitions for the fields and controls later on this page.

Use the Batch Verification page to run verification for all students selected, according to the criteria that you establish.

|

Field or Control |

Definition |

|---|---|

| Verification Type |

Select from these values: Federal: Select to apply federal setup rules to this verification. Institutional: Select to apply institutional setup rules to this verification. |

| Source |

Verification is the process of comparing source data to a target set of data. This is a translate field, and translate values should not be adjusted. Select from these values: Inst App: Data from the Maintain Institutional Application tables ISIR: Data from the ISIR Data Corrections tables Tax/Verif: Selected data from the Application Data Verification pages created from the Consolidate routine |

| Target |

This is a translate field, and translate values should not be adjusted. Select from these values: Inst App: Data from the Maintain Institutional Application tables ISIR: Data from the ISIR Data Corrections tables |

| Application Type |

Values are valid with a source or target of Inst App only and include the following: Inst App: Institutional application PROFILE: PROFILE application FT – CSL: Full-time Canadian student loan PT – CSL: Part-time Canadian student loan |

| Student Selection |

Select from the following values: Both: Processes records with a verification status of either pending or required. Pending: Processes records with a verification status of pending only. Required: Processes records with a verification status of required only. |

| Auto Update Target Table |

Automatically updates the target table with verified data identified with a variance. |

| Mark Assumptions as Verified |

Use this check box only when the Source value is Tax/Verif and the Target value is ISIR. Select to tag fields originally identified as Assumption fields with a field status of Verified. Assumed ISIR data fields that result from the federal methodology calculation are maintained on secondary pages of the ISIR Data Corrections pages. |

| Set to Send ISIR Correction |

Select to set the Correction Status to Send on ISIR Corrections when the Auto Update Target Table is used. |

| Set Verification Complete |

Select to automatically set the Verification Status to Complete. This field is enabled only when the Auto Update Target table is activated. |

Access the Batch Verification Summary page ().

The system displays Institution, Aid Year, Process Instance, Verification Type, Date/Time, Source, User ID, Target, Students Selected, Students Skipped, Students Processed, Students Passed,Students Failed, and Verification options selected for the run: Mark Assumptions as Verified, Auto Update Target Table, Set Verification Complete, and Set to Send ISIR Correction.

Access the Batch Verification Detail page ().

Results

The system displays Pass or Fail, Tolerance, Verification Sequence, Verification Status, Variance, Verification Date, Review Status, Verification Type, User ID, Verification options selected for the run: Changes Applied to Target, Mark Assumptions as Verified, and Set to Send ISIR Correction.

Field Comparison Detail

The system displays the most recent verification results for the listed fields. Only fields that have differences appear.

The Done check box is activated when the process is run with the Auto Update Target Table option activated. Source data comes from the source table, tax/verification, ISIR, or institutional application. Target data comes from the target table, ISIR, or institutional application. There can be a difference between the source and target information.