Verifying Resource and Household Information

Use the pages in the Application Data Verification component to verify the number of persons in the household, the number enrolled in post-secondary education, the AGI, income tax paid for the base year, and certain untaxed income and benefits for the base year.

This section provides an overview of calculating Federal Variance and discusses how to:

View Financial Aid Administrator Information.

Verify household information.

Verify tax data.

Verify W-2 information.

Verify federal untaxed income.

Verify federal additional financial information.

Verify institutional untaxed income.

Verify institutional other taxable income.

Consolidate forms.

View consolidated federal tax data.

View consolidated institutional tax data.

Note: The navigation paths for the pages listed in the following table are for aid year 20nn-20nn. Oracle supports access for three active aid years.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

FAA Information |

SFA_VER_FAA_INFO |

|

Displays financial aid administrator information. |

|

Household Info |

VERIF02_FORM1 |

|

Enter documented information about the student and members of the student's household. |

|

TIV School Information |

VERIF_SCHL_CD_SEC |

Click the TIV Information link on the Household Info page. This link appears when you enter a valid school code. |

View Title IV school information. |

|

Get Institutional Data |

VERIF_APP_SRC_CODE |

Click the Get Inst Data button on the Household Info page. |

Indicate which Application Source code to use to populate fields with institutional data. |

|

Tax Form Data |

VERIFnn_FORM2 |

|

Enter information reported on the filer's tax form. |

|

Student's Income from Wages |

VERIF_WAGES_STDNT |

Click the Student/Spouse Wages link on the Tax Form Data page. |

View detail information about wages reported by the person whose data is being verified. |

|

Parent Income from Wages |

VERIF_WAGES_PARENT |

Click the Parent's Wages link on the Tax Form Data page. |

View detail information about wages reported by the person whose data is being verified. |

|

Other Taxable Income |

SFA_OTHER_INC1_nn |

Click the Other Taxable Income link on the Tax Form Data page. |

Enter 1040, 1040A or 1040EZ taxable income line items other than wages. |

|

Income Adjustments |

SFA_INCOME_ADJ_09 |

Click the Income Adjustments link on the Tax Form Data page. |

Record 1040 or 1040A adjustments to income. The tax form recorded as filed determines which fields activate. Values entered here write to Tax Form Data/Income Adjustments and may affect Federal and Institutional specific verification pages. |

|

Tax, Credits and Payments |

SFA_TAXCREDIT_nn |

Click the Tax, Credits, and Payments link on the Tax Form Data page. |

Enter or view tax and credit data. The filed tax form determines which fields are active. With the exception of Earned Income Credit and Additional Child Tax Credit, credits entered are subtracted from the tax amount. The net calculated amount writes to Tax Form Data - US Income Tax Paid field. |

|

W-2 Form |

VERIF03_FORM3 |

|

Enter or view information reported on a person's W-2 form. |

|

Verification W2 - Box 12 |

VERIF03_W2_BOX12 |

Click the Box 12 link on the W-2 Form page. |

Enter or view information from Box 12 on the W-2 form. |

|

Fed Untax Income |

SFA_FED_UNTAX_INC |

|

Enter or view federal untaxed income data. Displays only field values that originate from Total Other Income or Income Adjustment pages. The family member row determines which fields are active. |

|

Fed Add Fin Info |

SFA_FEDADFIN_IN_nn |

|

Enter or view federal additional financial information. Display only field values originate from U.S. Income Tax Paid page. |

|

Inst Untax Income |

SFA_INST_UTX_IN_nn |

|

Enter or view Institutional untaxed income data. Display only field values originate from Untaxed Income or Income Adjustment pages. The family member row determines which fields are active. |

|

Inst Other Taxable |

SFA_INSTOTH_TAX_nn |

|

Enter or view institutional other taxable income. Display only field values originate from Total Other Income page. The family member row determines which fields are active. |

|

Tax Data Consolidation |

VERIF_TAX_CONSL_nn |

|

Combine the income and resources of all family members of the individual being verified. |

|

Consolidated Tax Data — Federal |

SFA_VER_CSL_FEDnn |

Click the Consolidated Tax Data link on the Tax Data Consolidation page. |

View or edit consolidated federal tax and resource information. |

|

Consolidated Tax Data – Inst |

SFA_VER_CSL_ISTnn |

Click the Consolidated Tax Data link on the Tax Data Consolidation page. |

View or edit consolidated institutional tax and resource information. |

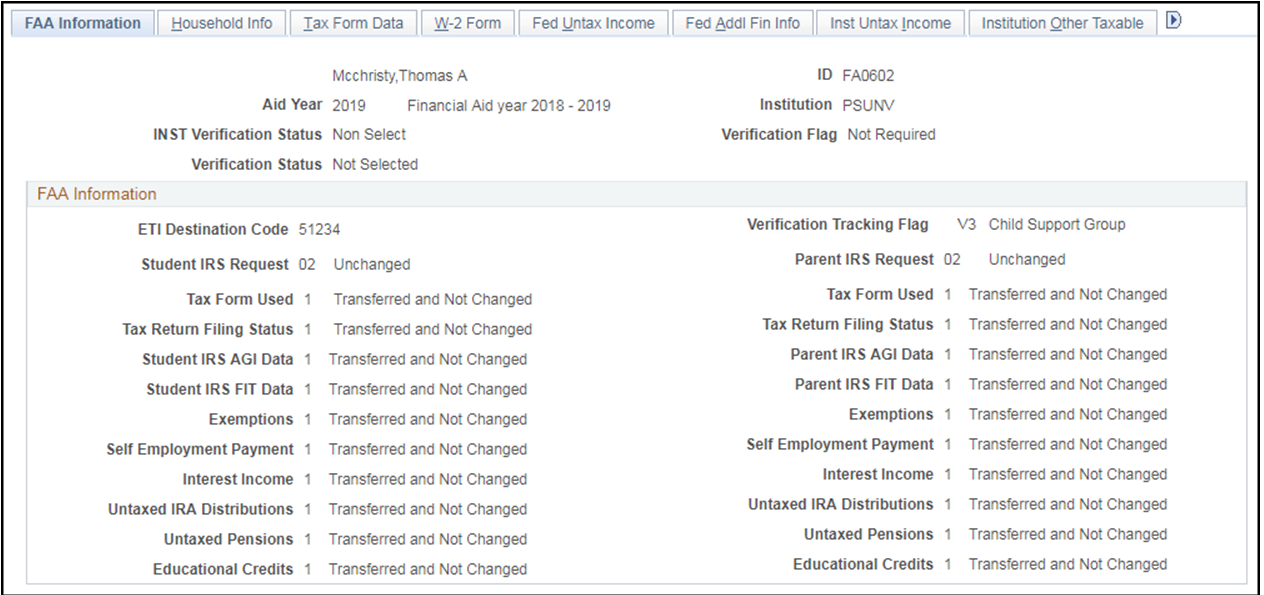

Access the FAA Information page ().

Image: FAA Information page

This example illustrates the fields and controls on the FAA Information page. You can find definitions for the fields and controls later on this page.

For field descriptions of the header information on this page,

See Reviewing the Student's Packaging Status.

For field descriptions of the FAA Information,

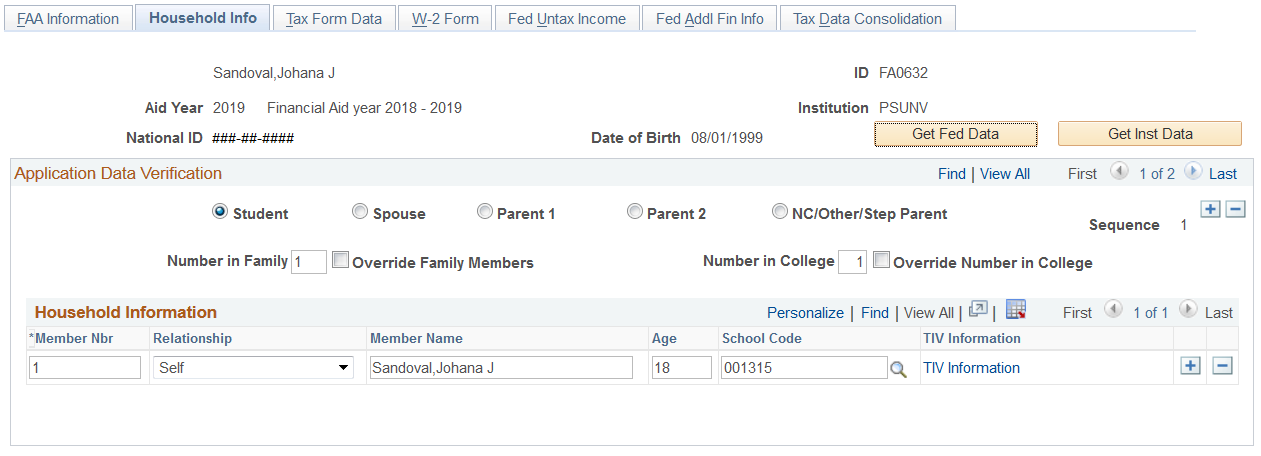

Access the Household Info page ().

Image: Household Info page

This example illustrates the fields and controls on the Household Info page. You can find definitions for the fields and controls later on this page.

Note: Use the arrow on the right to scroll to the hidden pages. After you click on either the Get Fed Data button or the Get Inst Data button, only the relevant pages display.

The system displays the student information, including National ID. For students in the United States, the National ID is the Social Security number (SSN).

The page maintains a separate row for each household member. Ensure that you are accessing the correct row for the person you are verifying.

|

Field or Control |

Definition |

|---|---|

| Get Fed Data (get federal data) |

Click this button to populate fields with the most recent Institutional Student Information Record (ISIR) record data. When federal data is retrieved, the Inst Untax Income page and Inst Other Taxable page are hidden. |

| Get Inst Data (get institutional data) |

Click this button to populate fields with institutional record data. The system prompts you to enter an application source code. When institutional data is retrieved, the Fed Untax Income page and Fed Add Fin Info page are hidden. |

Note: You are required to Get Inst Data for all institutional records. You are required to Get Fed Data for all records with a Student or Parent IRS Request not equal to "02" .

If the Student or Parent IRS Request is “02”, data was transferred from the IRS and not changed prior to submission of the application. For these records, using Get Fed Data is optional.

Application Data Verification

Select the radio button for Application Data that you want to verify:

Student

Spouse

Parent 1

Parent 2

NC/Other/Step Parent (non-custodial parent/other/step-parent)

Note: If a non custodial parent file (HHB) only is present, verification cannot be performed.

|

Field or Control |

Definition |

|---|---|

| Sequence |

Sequence number for the row of information to be verified. A separate row of verification data is maintained for each person verified. |

| Number in Family |

Enter the number in the student's family. |

| Override Family Members |

Select to override the number of family members used to calculate the expected family contribution (EFC). |

| Number in College |

Enter the number of the student's family members in college. |

| Override Number in College |

Select to override the number of family members in college used to calculate the EFC. |

Household Information

|

Field or Control |

Definition |

|---|---|

| Member Nbr (member number) |

Displays the household member counter. The system increases this field by one for each row inserted at the household member level. |

| Relationship |

Select the relationship to the student of the person selected in Sequence. For example, the sequence for an independent student might be, self, spouse, son. Data verification for the parent of a dependent student might be self (Parent 1), spouse, son (student applicant), daughter. You would not complete the family grid or enter number in family or college values for a dependent student row. All dependent students must be listed as a relation with only Parent 1, Parent 2, or NC/Other/Step Parent to be counted in the parent household. Recording the student in more than one of these categories results in over counting. Members listed for student and spouse household categories are compared to household size and the value for number in college for the student. Members listed for Parent 1, Parent 2, and NC/Other/Step Parent are compared to household size and the value for the number in college for parent (dependent students are always included in the parent household in an aid application). |

| School Code |

Enter a valid school code, if applicable. Entering a valid school code enables the system to calculate a value for the Number In College field. If the school code remains blank, the system does not calculate the number in college. A TIV Information link becomes available when you enter a valid college code. It displays demographic information for the school. |

| TIV Information |

This link only appears when a valid School Code is selected. Click the link to open the TIV School Information page. |

Getting Institutional Data

Access the Get Institutional Data using page (click the Get Inst Data button on the Household Info page).

|

Field or Control |

Definition |

|---|---|

| Application Source Code |

Select from these values: FT Canada Student Loan (full-time Canadian student loan) Institutional Application Profile PT Canada Student Loan (part-time Canadian student loan) |

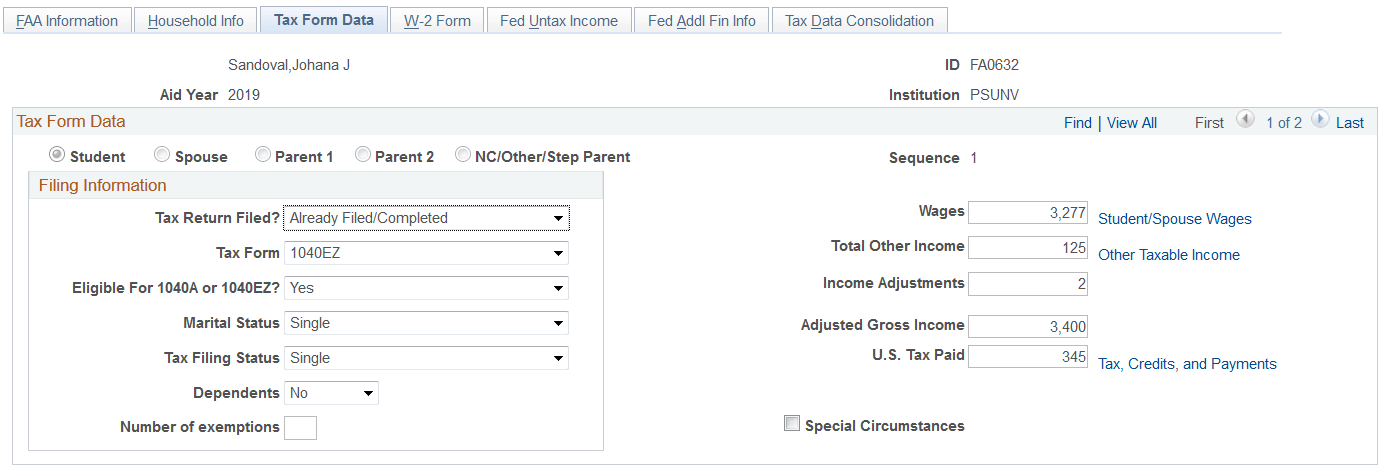

Access the Tax Form Data page ().

Image: Tax Form Data page

This example illustrates the fields and controls on the Tax Form Data page. You can find definitions for the fields and controls later on this page.

Note: This page is for a federal dependent student. Therefore the Inst Untax Income and Inst Other Taxable pages are not available.

|

Field or Control |

Definition |

|---|---|

| Sequence |

Displays the sequence number for the row of information to be verified. A separate row of verification data is maintained for each person verified. The selected button indicates the person whose information is being verified. Note: If a spouse row is created, the values from the student are always used in consolidation for Tax Return Filed, Tax Form, Eligible For 1040A or 1040EZ, and Marital Status. However, if a student value for one of these fields is blank, the student’s Filing Status is not Separate, and the corresponding spouse value is non-blank, then the spouse value is used. If more than one parent row is created, the Marital Status of Parent 2 overrides that of Parent 1 in consolidation. Tax Return Filed, Tax Form, and Eligible For 1040A or 1040EZ are consolidated according to the sequence number. If a value is blank for one parent and non blank for the other then the non blank value is used. For example, if the Parent 1 sequence number is 2 with a Tax Return Filed of blank and the Parent 2 is sequence number 3 and Tax Return Filed is Will File, then the Parent 2 value for Tax Return Filed is used in consolidation. If both parents have a Tax Return Filed value and they happen to differ, then the parent with the lower sequence number value is used. |

Filing Information

|

Field or Control |

Definition |

|---|---|

| Tax Return Filed |

Select values are dependent on verification type, Federal or Institutional. |

| Tax Form |

Select values are dependent on verification type, Federal or Institutional. The value that you select determines which fields are activated on the Tax Form Data, Other Taxable Income, Income Adjustments and Tax, Credits and Payments pages. |

| Eligible For 1040A or 1040EZ (eligible to file 1040A or 1040EZ) |

Select whether the filer is eligible to file the tax form 1040A or 1040EZ. |

| Marital Status |

Select the marital status of the person whose documents are being verified. |

| Tax Return Filing Status |

Select the tax filing status of the person whose information is being verified. The value that you select determines which fields the system activates in the Wages page. Select from the following values: Don’t Know, Head of Household, Married-Joint, Married-Separate, Single, and Widow(er). |

| Dependents |

Select Yes if the person whose information is being verified has dependents and select No if not. |

| Number of exemptions |

Enter the number of exemptions for the person whose information is being verified. |

| Wages |

Enter the amount of wages for the person whose information is being verified. |

| Total Other Income |

Enter any taxable income besides wages reported by the person whose information is being verified. |

| Income Adjustments |

Enter any allowable adjustments to income as reported by the person whose information is being verified. |

| Adjusted Gross Income |

Enter the total of wages and other income less income adjustments for the person whose information is being verified. |

| U.S. Income Tax Paid |

Enter the total of U.S. income tax paid by the person whose information is being verified. |

| Special Circumstances |

Select this checkbox to indicate special circumstances may exist for the student. |

Note: You can enter data in the Total Other Income, Income Adjustments, and U.S. Income Tax Paid fields to override information on the associated detail pages. However, overriding information is not recommended.

Entering Student or Parent Income from Wages

Access the Student's Income from Wages page (click the Wages link on the Tax Form Data page).

The wage information displayed on this page depends on which Sequence row is active and the selections made for Filing Status.

|

Field or Control |

Definition |

|---|---|

| Wage Income Student |

Displays the student's wage income or the Parent 1 wage income. |

| Wage Income Spouse |

Displays the spouse's wage income or the Parent 2 wage income. |

| Wages |

Displays the total wages from the wage income entries. The system uses this amount to populate the Wages field on the Tax Form Data page. |

Entering Other Taxable Income

The elements that appear on the Other Taxable Income page are determined by the tax form indicated on the Tax Form Data page. For the 1040 tax form, fields for Schedules B, C, D, E, F are available. For the 1040A form, a field for Schedule 1 is available.

Access the Other Taxable Income page – 1040 Tax Form (click the Other Taxable Income link on the Tax Form Data page).

The Add to Total Wages check box for Business Income Loss and the Add to Total Wages check box for Farm Income/Losses are selected by default if you perform 'Get Fed Data' to pre-populate the component with ISIR data. If selected, income or loss to wages is calculated to the total wages.

Entering Income Adjustments

Access the Income Adjustments page (click the Income Adjustments link on the Tax Form Data page).

The fields on this page match the order of the fields on the 1040 form.

Note: For a 1040A filer, the available fields are Educator Expenses, Filer's IRA deduction, Student loan interest, and Tuition and fees deduction.

An Income Adjustments page is not available for a 1040EZ filer. Enter the total income adjustment value in the Income Adjustments field on the Tax Form Data page.

Entering Tax, Credits, and Payments

Access the Tax, Credits and Payments page (click the Tax, Credits, and Payments link on the Tax Form Data page).

Tax Credits and Payments allows entry of pertinent data from forms 1040, 1040A, and 1040EZ. It captures Line xx Income Tax Amount and uses that value to update U.S. Tax Paid on the Tax Form Data entry page for use in the compare process. Other fields used in compare available in Tax, Credits, and Payments are Schedule A itemized Deductions (1040 only), Education Credits, Additional Medicare Form 8959, Earned Income Credit, and Additional Child Tax Credit.

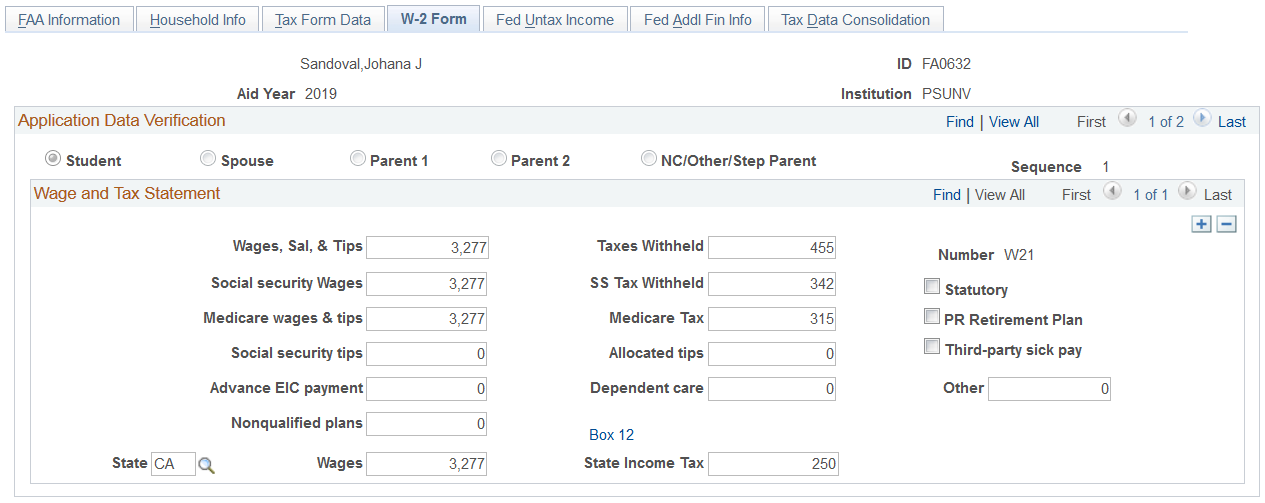

Access the W-2 Form page ().

Image: W-2 Form page

This example illustrates the fields and controls on the W-2 Form page. You can find definitions for the fields and controls later on this page.

Application Data Verification

|

Field or Control |

Definition |

|---|---|

| Sequence |

Displays the sequence number for the row of information to be verified. A separate row of verification data is maintained for each person verified. Ensure that you entering and viewing data for the correct row. |

Wage and Tax Statement

|

Field or Control |

Definition |

|---|---|

| Box 12 |

Click this link to enter or view information from Box 12 on the W-2 form. |

Viewing W-2 Box 12 Information

Access the Verification W2 - Box 12 page (click the Box 12 link on the W-2 Form page).

|

Field or Control |

Definition |

|---|---|

| Code |

Refer to the W-2 instructions for details on valid values for the code. |

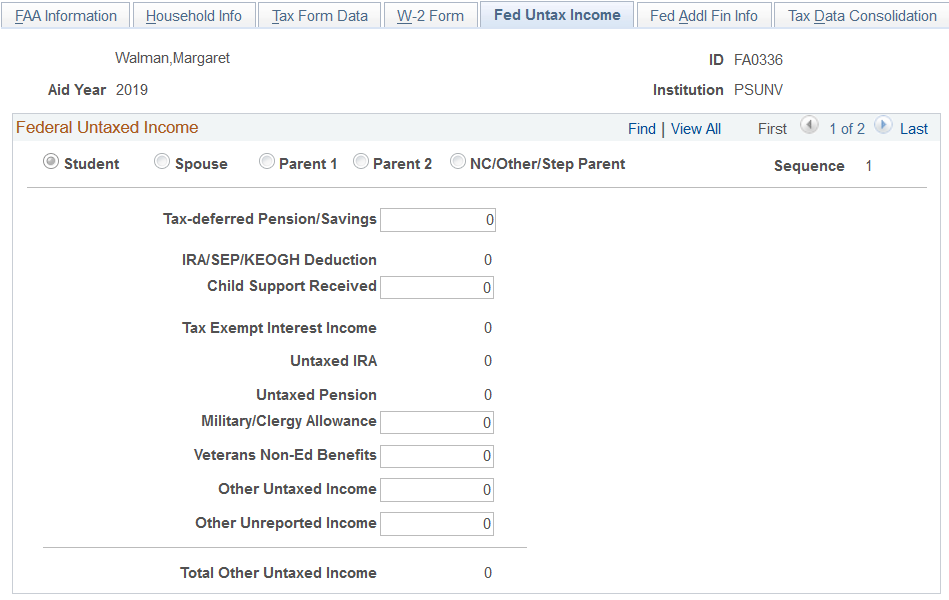

Access the Fed Untax Income page ().

Image: Fed Untax Income page

This example illustrates the fields and controls on the Fed Untax Income page. You can find definitions for the fields and controls later on this page.

Federal Untaxed Income

You can view and enter data in some fields on this page. Other fields are display only.

The Other Unreported Income field is not included for parent rows.

The following fields are display only fields. For all other fields on the page, you can view and enter data.

|

Field or Control |

Definition |

|---|---|

| IRA/SEP/KEOGH Deduction (Individual Retirement Account/Self Employment Plan/Keogh Deduction) |

Displays the combined amounts for IRA, SEP and KEOGH deductions. This amount writes from the Income Adjustments page. |

| Tax Exempt Interest Income |

Displays interest income that is tax exempt. This amount writes from the Other Taxable Income page. |

| Untaxed IRA (Untaxed Individual Retirement Account) |

Displays the amount of funds disbursed from an IRA that is nontaxable. This amount writes from the Other Taxable Income page and is the difference between Total IRA payments and Taxable IRA payments. |

| Untaxed Pension |

Displays the amount of pension earnings that are untaxed. This amount writes from the Other Taxable Income page and is the difference between Total Pension and Taxed Pension. |

| Total Other Untaxed Income |

Displays the total of the amounts in the untaxed income fields on this page. |

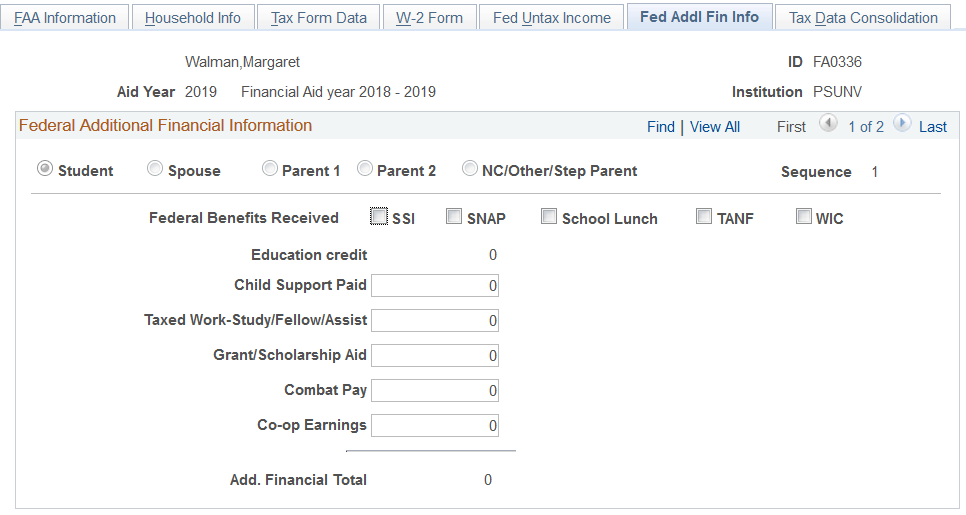

Access the Fed Addl Fin Info page ().

Image: Fed Addl Fin Info page

This example illustrates the fields and controls on the Fed Addl Fin Info page. You can find definitions for the fields and controls later on this page.

Federal Additional Financial Information

You can view and enter data in some fields on this page. Other fields are display only.

|

Field or Control |

Definition |

|---|---|

| Federal Benefits Received |

Select each Federal benefit that the student received. If you fetch Federal data, these fields populate as recorded on the student's ISIR. |

| Education credit |

Displays the Education Credit. This amount writes from the Tax, Credits, and Payments page. |

| Add. Financial Total (additional financial total) |

Displays the total for all additional financial information fields on this page. |

You can enter and view data in the other fields.

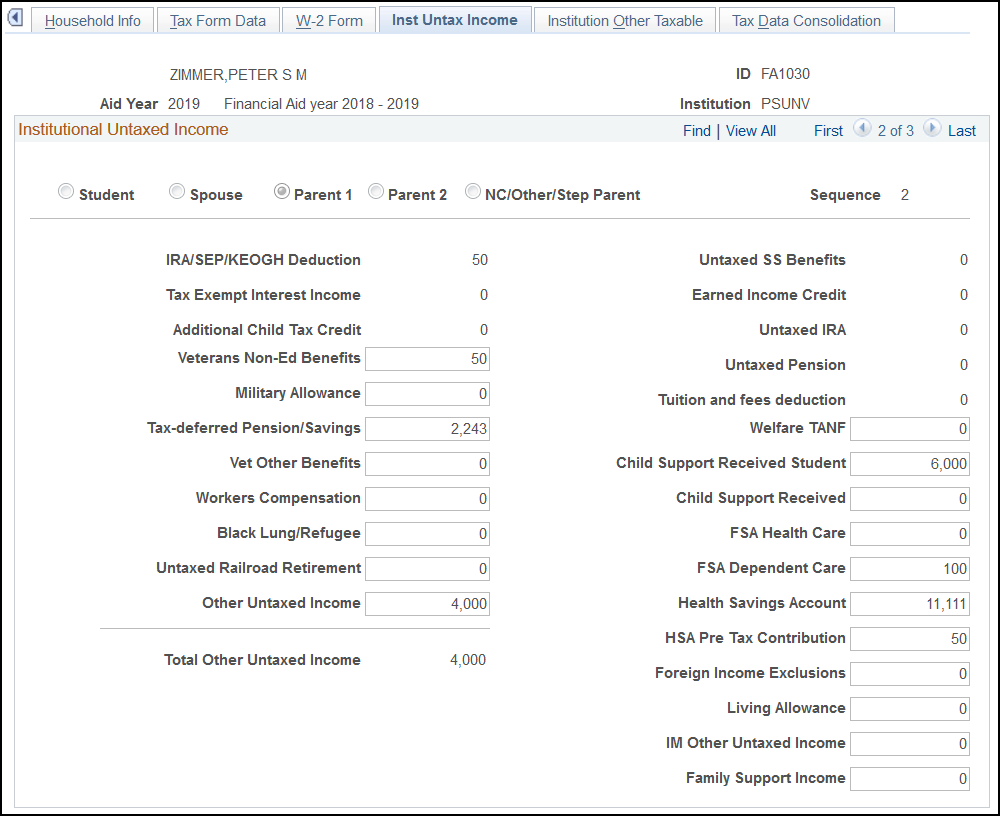

Access the Inst Untax Income page ().

Image: Inst Untax Income page

This example illustrates the fields and controls on the Inst Untax Income page. You can find definitions for the fields and controls later on this page.

Institutional Untaxed Income — Student

You can view and enter data in some fields on this page. Other fields are display only.

|

Field or Control |

Definition |

|---|---|

| IRA/SEP/KEOGH Deduction (Individual Retirement Account/Self Employment Plan/Keogh Deduction) |

Displays the combined amounts for IRA, SEP and KEOGH deductions. This amount writes from the Income Adjustments page. |

| Tax Exempt Interest Income |

Displays interest income that is tax exempt. This amount writes from the Other Taxable Income page. |

| Additional Child Tax Credit |

Displays additional child tax credit. This amount writes from Tax, Credits and Payments page. |

| Untaxed SS Benefits (Untaxed Social Security Benefits) |

Displays untaxed social security benefits. This amount writes from the Other Taxable Income page and is the difference between Social Security benefits and Taxed Social Security Benefits. |

| Earned Income Credit |

Displays earned income credit. This amount writes from Tax, Credits and Payments page. |

You can enter and view data in the other fields on this page.

Institutional Untaxed Income — Parent

|

Field or Control |

Definition |

|---|---|

| IRA/SEP/KEOGH Deduction (Individual Retirement Account/Self Employment Plan/Keogh Deduction) |

Displays the combined amounts for IRA, SEP and KEOGH deductions. This amount writes from the Income Adjustments page. |

| Tax Exempt Interest Income |

Displays interest income that is tax exempt. This amount writes from the Other Taxable Income page. |

| Additional Child Tax Credit |

Displays additional child tax credit. This amount writes from Tax, Credits and Payments page. |

| Untaxed SS Benefits (Untaxed Social Security Benefits) |

Displays untaxed social security benefits. This amount writes from the Other Taxable Income page and is the difference between Social Security benefits and Taxed Social Security Benefits. |

| Earned Income Credit |

Displays earned income credit. This amount writes from Tax, Credits and Payments page. |

| Untaxed IRA (Untaxed Individual Retirement Account) |

Displays the amount of funds disbursed from an IRA that is nontaxable. This amount writes from the Other Taxable Income page and is the difference between Total IRA payments and Taxable IRA payments. |

| Untaxed Pension |

Displays the amount of pension earnings that are untaxed. This amount writes from the Other taxable Income page and is the difference between Total Pension and Taxed Pension. |

| Tuition and fees deduction |

Displays the amount of tuition and fees deduction derived from entries on the Income Adjustments page. |

You can enter and view data in the other fields.

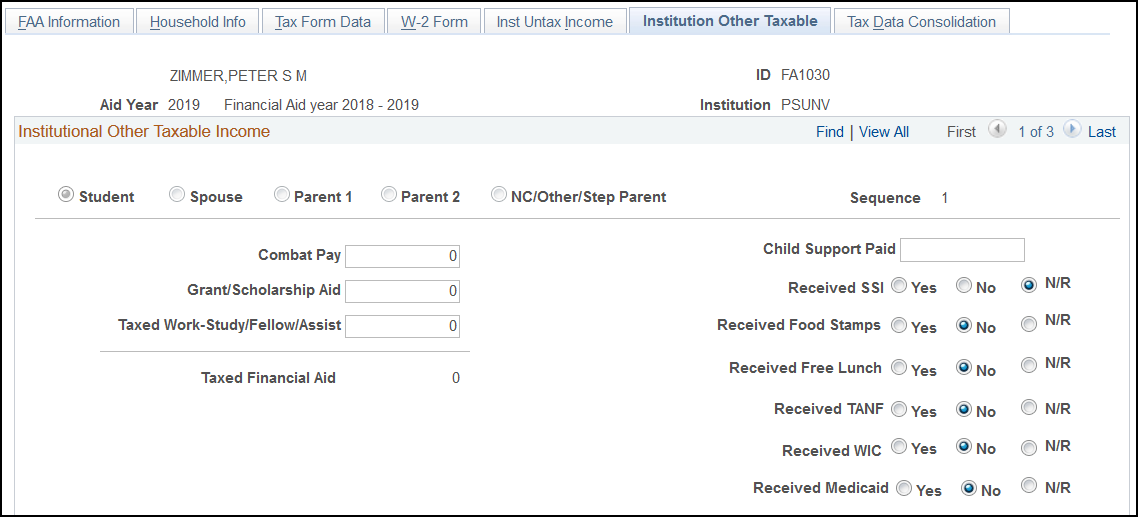

Access the Inst Other Taxable page ().

Image: Inst Other Taxable page

This example illustrates the fields and controls on the Inst Other Taxable page. You can find definitions for the fields and controls later on this page.

Institutional Other Taxable Income — Student

|

Field or Control |

Definition |

|---|---|

| Taxed Financial Aid |

Displays total for Grant/Scholarship Aid and Taxed Work-Study/Fellow/Assist fields. Combat Pay is not included in this total. |

You can enter and view data in the other fields.

Institutional Other Taxable Income — Parent

|

Field or Control |

Definition |

|---|---|

| Taxable Refund |

Displays taxable refunds. This amount writes from the Other Taxable Income page. |

| Alimony Income |

Displays alimony income. This amount writes from the Other Taxable Income page. |

| Capital Gains/Loss |

Displays capital gains/loss. This amount writes from the Other Taxable Income page. |

| Other Gains/Losses |

Displays other gains/losses. This amount writes from the Other Taxable Income page. |

| Taxable IRA/Keogh |

Displays other taxable IRA/Keogh. This amount writes from the Other Taxable Income page. |

| Taxed Pension |

Displays taxed pension. This amount writes from the Other Taxable Income page. |

| Unemployment Benefits |

Displays unemployment benefits. This amount writes from the Other Taxable Income page. |

| Taxed Social Security Benefits |

Displays taxed social security. This amount writes from the Other Taxable Income page. |

| Other Taxed Income |

Displays other taxed income. This amount writes from the Other Taxable Income page. |

| Combat Pay |

Enter or view the combat pay amount. |

| Total Other Income |

Displays total for other taxable fields on this page. Combat Pay is not included in this total. |

Institutional Other Taxable Income — NC/Other/Step Parent

This page differs from the Parent 1 and Parent 2 pages in the following way:

Includes Child Support Paid for Student and Alimony Paid fields.

Does not include Child Support Received for Student field.

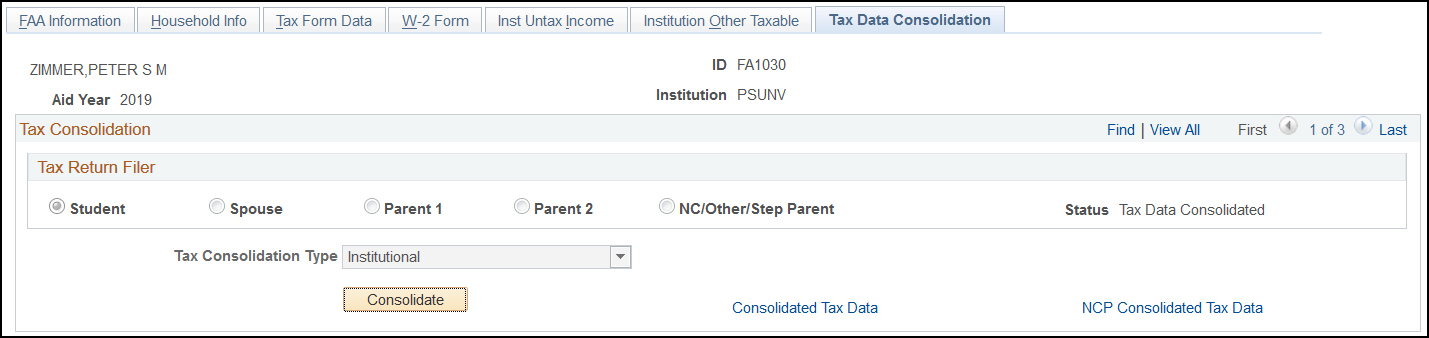

Access the Tax Data Consolidation page ().

Image: Tax Data Consolidation page

This example illustrates the fields and controls on the Tax Data Consolidation page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Sequence |

Displays the sequence number for the row of information to be verified. |

| Tax Consolidation Type |

Select the Tax Consolidation Type you want to use. This field is active only if you do not select "Get Fed Data" or "Get Inst Data" for Household Verification. If you choose the Institutional Tax Consolidation Type, then the Institutional Marital Status Mapping is used. This field is display only if you use the "Get Fed Data" or "Get Inst Data". |

| Consolidate |

Click the Consolidate button to combine all income and resources. Consolidation takes whatever you have entered in the prior Application Verification pages of this component and consolidates pertinent information. Consolidation only captures the fields from Verification Setup. |

| Consolidated Tax Data |

Click this link to view or edit all tax and resource information on the Consolidated Tax Data page. Values that appear should represent the tax form information entered for each verified person. You can make bottom-line changes to tax information here, but your changes are not saved if you re-run consolidation after the changes are made. |

| NCP Consolidated Tax Data (non custodial parent consolidated tax data) |

Click this link to view or edit all tax and resource information on the Non-Custodial Parent Consolidated Tax Data page. Values that appear should represent the tax form information entered for each verified person. You can make bottom-line changes to tax information here, but your changes are not saved if you re-run consolidation after the changes are made. Note: This link only appears for PROFILE applicants. |

Access the Consolidated Tax Data – Federal page (click the Consolidated Tax Data link on the Tax Data Consolidation page).

Note: The fields on this page compare to your target tables.

For descriptions of the fields in this section, please refer to the United States Department of Education's Electronic Data Exchange Technical Reference or

Student's Tax Data

|

Field or Control |

Definition |

|---|---|

| Marital Status |

Displays the marital status of the student based on ISIR values. |

| Federal Benefits Received |

Check boxes indicate which Federal benefits were received. |

Parent's Tax Data

|

Field or Control |

Definition |

|---|---|

| Marital Status |

Displays the marital status of the Parent based on ISIR values. |

| Federal Benefits Received |

Check boxes indicate which Federal benefits were received. |

Access the Consolidated Tax Data – Inst page (click the Consolidated Tax Data link on the Tax Data Consolidation page).

Note: The fields on this page compare to your target tables.

For descriptions of the fields in this section, please refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation.

See Maintaining Institutional Financial Aid Applications.

Student's Tax Data

|

Field or Control |

Definition |

|---|---|

| Marital Status |

Displays the marital status of the student based on Institutional values. |

| Benefits Received |

Displays federal benefits received based in Institutional values. |

Parent's Tax Data

|

Field or Control |

Definition |

|---|---|

| Marital Status |

Displays marital status of the Parent based on Institutional values. |

| Benefits Received |

Displays federal benefits received based on Institutional values. |