Setting Up Minimum and Maximum Adjustments and Adjustment Factors

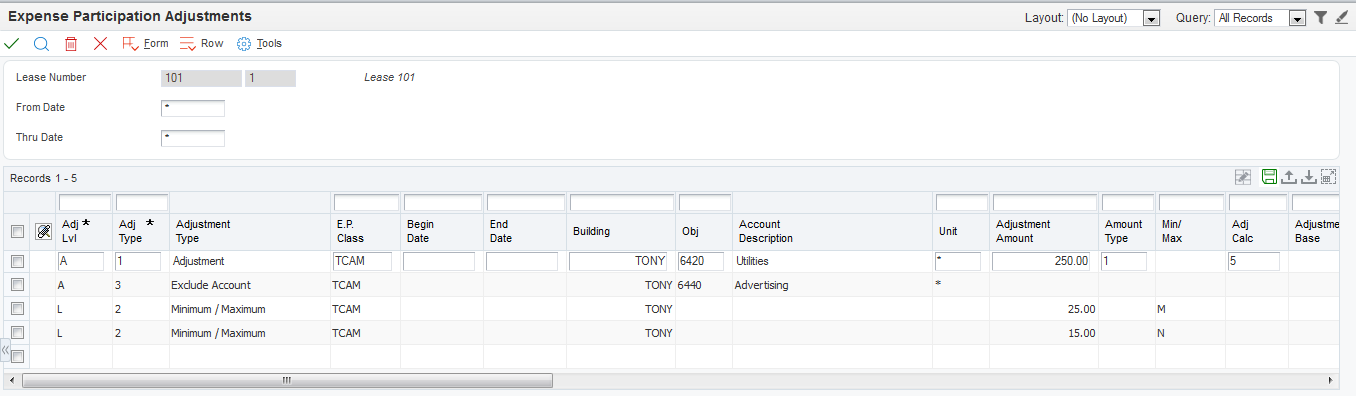

Access the Expense Participation Adjustments form.

When you enter an adjustment on this form, the system displays the text Lease Adjustments Exist on the E.P. Information Revisions form.

To enter an adjustment at the lease level, complete the following fields:

- Adj Lvl (adjustment level)

Enter a code from user-defined code (UDC) table 15/EL that specifies where the system uses the adjustment within the expense participation calculation. Values are:

A: Account level. The system uses the adjustment to calculate the total exposure by excluding all or a portion of the account balance for the account specified for the billing period that is used in the expense participation calculation. Account level adjustments are limited to adjustment calculation codes 5 and 6.

C: Class level. The system uses the adjustment to calculate the net exposure amount. Depending on whether the adjustment amount is used as a minimum or maximum amount for comparison to the total exposure, the system uses either the adjustment amount or the total exposure amount as the adjusted exposure amount. For example, if the adjustment amount is 100,000, and it is defined as a minimum amount, the system uses it as the adjusted exposure amount if the total exposure amount is less than 100,000. Class level adjustments are limited to adjustment calculation codes 1, 2, 3, 4, and F.

L: Lease level. The system uses the adjustment to calculate the adjusted share amount. Depending on whether the adjustment amount is used as a minimum or maximum amount for comparison to the gross share, the system uses either the adjustment amount or the gross share amount as the adjusted share amount. For example, if the adjustment amount is 10,000, and it is defined as a maximum amount, the system uses it as the adjusted share amount if the gross share amount is greater than 10,000. Lease level adjustments are limited to adjustment calculation codes 1, 2, 3, 4, and F.

- Adj Type (E.P. lease adjustment level type)

Enter a code from UDC table 15/AJ that specifies the type of adjustment. The system uses the value in this field and the adjustment level to determine which fields on the E.P. Adjustments form are relevant for the adjustment level and adjustment type combination. Irrelevant fields are disabled. Values are:

1: Adjustment

2: Minimum / Maximum

3: Exclude Account

4: Gross Up Override

- E.P. Class (expense participation class)

Enter a code that specifies the expense participation class for the shared expenses.

- Begin Date

Enter the beginning date of the adjustment.

You can set up multiple E.P. lease adjustments with different date ranges.

- End Date

Enter the ending date of the adjustment.

You can set up multiple E.P. lease adjustments with different date ranges.

- Building

Enter a value that specifies a business unit. If you do not enter a value in this field, the system enters the first building on the lease.

- Obj (object account)

Enter a value that specifies an object account.

- Sub (subsidiary)

Enter a value that specifies a subset of that object account.

- Subledger Type

Enter a code from UDC table 00/ST that, with the Subledger field, identifies the subledger type and how the system performs subledger editing. Values include:

A: Alphanumeric field, do not edit.

N: Numeric field, right-justify and zero fill.

C: Alphanumeric field, right-justify and blank fill.

- Subledger

Enter a code that identifies a detailed, auxiliary account within a general ledger account. If you enter a subledger, you must also specify the subledger type.

- Unit

Enter a value that identifies the actual space within a building that is or can be leased, such as an apartment, office, retail space, and parking space. The default value is *, which signifies that the value applies to all units.

- Adjustment Amount

Enter a value that represents an amount or percentage, depending on the value of the Adjustment Calculation field (CLCY), that the system calculates and either adds to or subtracts from the class exposure. If you specify a positive adjustment amount, the system adds it to the class exposure. If you specify a negative amount, the system subtracts it from the class exposure.

If you enter A for the adjustment level and specify an adjustment amount, the system adds or subtracts the amount from the account balance that corresponds to the property (business unit), object, and subsidiary that you specify. If you want to exclude an entire account balance, leave this field blank.

Note:If you enter a percentage, enter it as a whole number. For example, enter 50 to specify 50 percent.

- Amount Type

Enter a code from UDC table 15/EA that specifies the type of adjustment amount.

- Min/ Max (minimum or maximum amount)

Enter a code from UDC table 15/ET that specifies whether the system uses the adjustment amount as a minimum or maximum amount for comparison purposes. Depending on the adjustment level, the system compares the adjustment amount to a different value in the expense participation calculation. If the adjustment level is C or L, you must specify whether the amount represents a minimum or maximum amount. Values are:

Blank: None. The adjustment amount is not used for comparison purposes. This value is valid for account-level adjustments only.

M: Maximum. The adjustment amount represents a maximum amount that the system uses when either the total exposure (for class adjustments) or the gross share (for lease adjustments) is greater than the adjustment amount.

N: Minimum. The adjustment amount represents a minimum amount that the system uses when either the total exposure (for class adjustments) or the gross share (for lease adjustments) is less than the adjustment amount.

- Adj Calc (adjustment calculation)

Enter a code from UDC table 15/CE that determines whether the EP adjustment is applied to the base amount or is a cumulative value based on the base amount, base month, and base year. This code specifies whether the number entered in the Adjustment Amount field (ADJE) represents an amount or a percentage, and whether the system uses it in relation to the adjustment base amount. Values are:

1: The number represents an adjustment amount to the base adjustment amount, if specified.

If an adjustment base amount is specified, the system either adds the adjustment amount to or subtracts the adjustment amount from the adjustment base amount. For example, if you enter –500 as the adjustment amount and 15,000 as the adjustment base, the system uses an adjustment amount of 14,500 in the expense participation calculation.

If an adjustment base amount is not specified, the system uses only the adjustment amount entered.

2: The number represents a percentage of the base adjustment amount, which is required. The system multiplies the percentage specified by the adjustment base amount and uses the result in the expense participation calculation.

3: The number represents a compounded adjustment amount for the base adjustment amount. The system uses the adjustment start year to determine whether to compound the adjustment amount for the base adjustment amount. For example, if the adjustment amount is 2000, and the base adjustment amount is 10,000, the system calculates an adjustment amount of 12,000 for the first year, 14,000 for the second year, 16,000 for the third year, and so on.

4: The number represents a compounded percentage of the base adjustment amount. The system uses the adjustment start year to determine whether to compound the adjustment percentage for the base adjustment amount. For example, if the adjustment percentage is 20, and the base adjustment amount is 10,000, the system calculates an adjustment amount of 2000 the first year, 4000 for the second year, 8000 for the third year, and so on.

5: The number represents an adjustment amount to the account balance for the specified account for the billing period that the system uses to calculate expense participation. The system adds or subtracts the adjustment amount from the class exposure, depending on whether you enter a positive or negative amount.

6: The number represents a percentage that the system uses to adjust the account balance for the account specified for the billing period that it used in the expense participation calculation. The system multiplies the percentage by the account balance, subtracts that result from the account balance, and uses the result as the account exclusion.

F: The number represents a fixed amount. The system does not use a base adjustment amount with this calculation method. The system uses the amount entered as the adjustment amount in the expense participation calculation.

- Adjustment Base

Enter the amount that is the base amount for other adjustments, depending on the calculation method. You can enter an amount for calculation methods 1, 2, 3, and 4 only.

If you specify an adjustment base amount, the system applies the adjustment amount to the adjustment base amount. If you specify an adjustment base amount, you must also specify an adjustment amount.

The system does not use the adjustment base amount with adjustment level A.

- Adj St Yr (adjustment start year)

Enter the four-digit number that represents either the lease year or the fiscal year, depending on the value of the Adj Calc (adjustment calculation) field.

If the value of the adjustment calculation is 1 or 2, enter the lease year for which the adjustment applies. For example, enter 0001 to specify the first year of the lease.

If the value of the adjustment calculation is 3 or 4, enter the fiscal year for which the adjustment applies. For example, enter 2007 to specify the fiscal year for which the adjustment applies.

Do not enter a value in this field when the value of the adjustment calculation is 5,6, or F.

- Adjustment Factor (class adjustment factor)

Enter the percentage by which the total expenses for the expense class (class exposure) is multiplied to adjust the amount in which tenants participate. For example, if the landlord agrees to pay 10 percent of the operating expenses, you can adjust the class exposure accordingly by multiplying it by 90 percent.

Enter the percentage as a decimal. For example, enter 0.05 to specify 5 percent.

- Adjustment Reason

Enter an explanation of the adjustment.

- Exclude from Admin. Fee (exclude from administration fee)

Select this check box to exclude amounts for this account from administration fee calculations.

- Occupancy Type

Enter a code from UDC 15/OT that specifies the type of occupancy. Values are:

E: Economic occupancy.

P: Physical occupancy.

- Re-distribute (redistribute expense)

Select this check box to redistribute the expense for an account to participating tenants if a tenant rule indicates that the account is excluded for a tenant.

- Exclusion Percent

Enter a value that specifies full or partial exclusions based on the percentage at the class or the account level.

Enter the percentage as a decimal. For example, enter 0.05 to specify 5 percent.

- Exclusion Amount

Enter a value that specifies full or partial exclusions based on the percentage at the class or the account level.

Note:You can enter a value in either the Exclusion Percent field or the Exclusion Amount field, but not both.

To exclude specific account balances, complete the Building, Obj (object account), and Sub (subsidiary) fields if you entered an adjustment level of A.

The system returns to the E.P. Information Revisions form and displays an informational message, ***LEASE ADJUSTMENTS EXIST***, next to the detail line for the expense class to indicate that an adjustment level exists.

You can also attach a media object to each adjustment.