Relationships Between AAIs and Boxes on 1099 Forms

When you use the G/L method for 1099 reporting, the data that prints on 1099 returns depends on the item number in AAIs. The A/P Ledger method does not use AAIs.

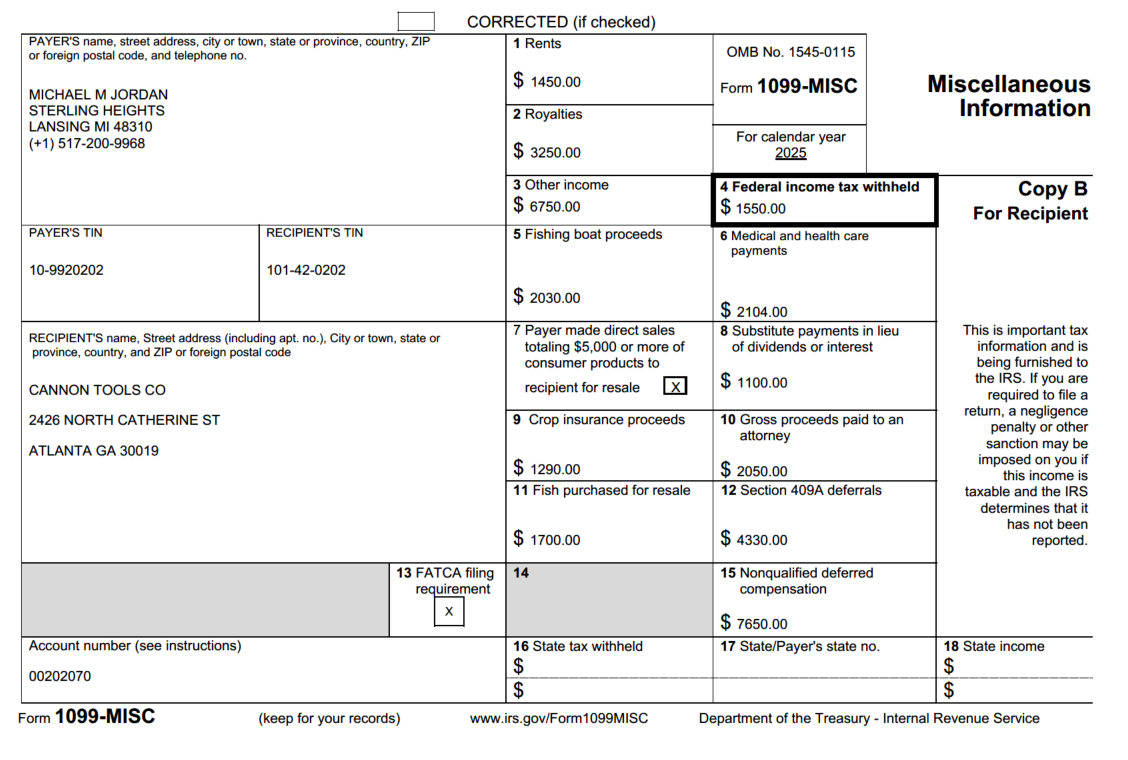

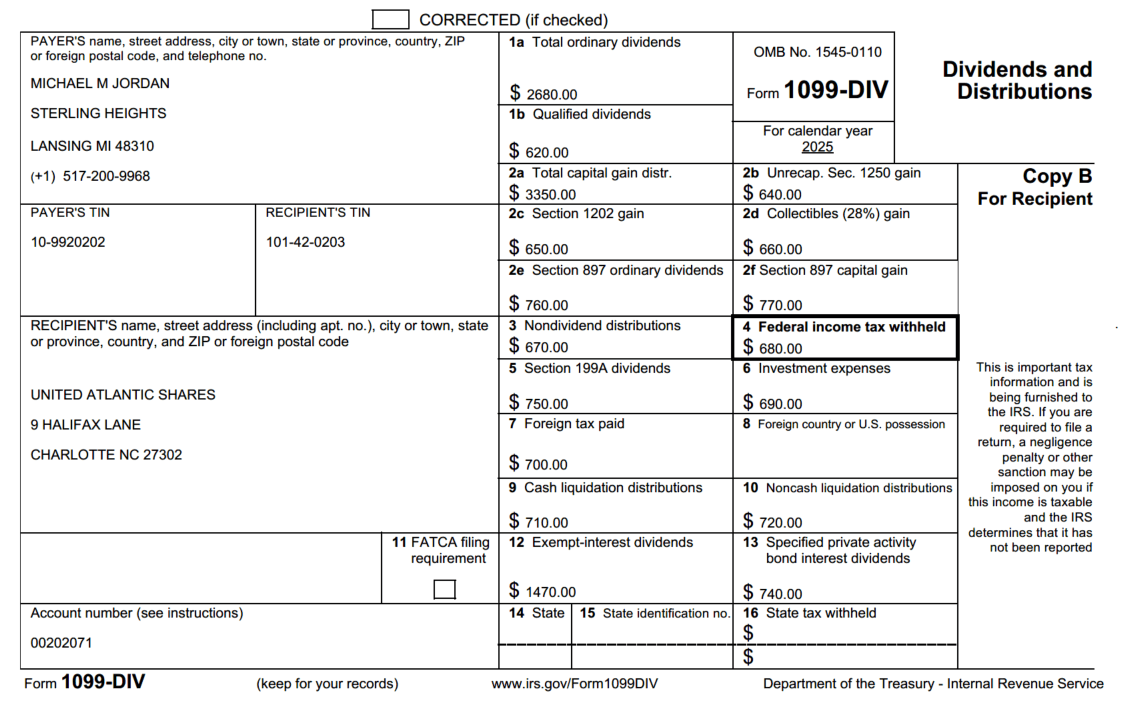

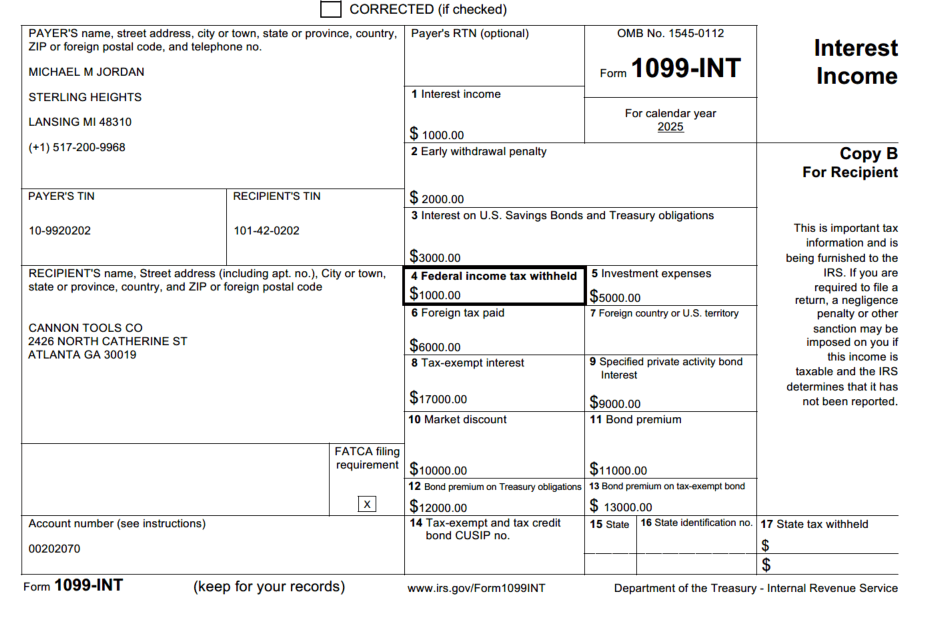

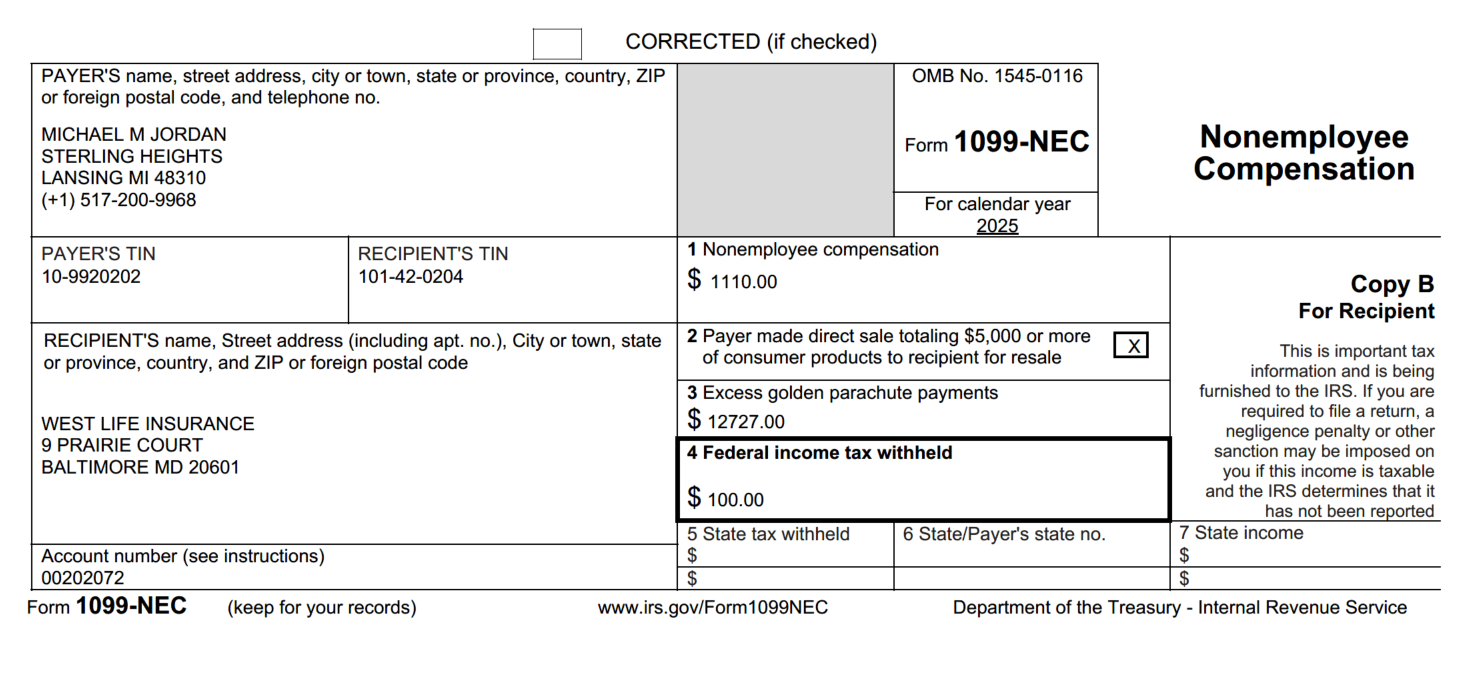

These example forms are provided for informational purposes only. Do not reproduce them for filing.

We offer and support Copy B forms, to submit 1099s to the IRS. You can use the Electronic filing process even if less than 10 1099 returns. On February 21, 2023, the Department of the Treasury and the Internal Revenue Service published final regulations reducing the threshold for filing returns and other documents electronically (e-file). These regulations require filers of 10 or more information returns in a calendar year beginning in 2024, tax year 2023, to file those information returns electronically.

Box Number |

AAI |

|---|---|

1. Rents |

PXA1 |

2. Royalties |

PXA2 |

3. Other Income |

PXA3 |

4. Federal income tax withheld |

PXA4 |

5. Fishing boat proceeds |

PXA5 |

6. Medical and health care payments |

PXA6 |

7. Payer made direct sales totalling $5,000 or more of consumer products to recipient for resale |

PXA7 |

8. Substitute payments in lieu of dividends or interest |

PXA8 |

9. Crop insurance proceeds |

PXA9 |

10. Gross proceeds paid to an attorney |

PXAA |

| 11. Fish purchased for resale | PXAB |

12. Section 409A deferrals |

PXAC |

14. Nonqualified deferred compensation |

PXAE |

Box Number |

AAI |

|---|---|

1a. Total ordinary dividends |

PX11 |

1b. Qualified dividends |

PX12 |

2a. Total capital gain distr. |

PX13 |

2b. Unrecap. Sec. 1250 gain |

PX14 |

2c. Section 1202 gain |

PX15 |

2d. Collectibles (28 percent) gain |

PX16 |

| 2e. Section 897 ordinary dividends | PX1G |

| 2f. Section 897 capital gain | PX1H |

3. Nondividend distributions |

PX17 |

4. Federal income tax withheld |

PX18 |

5. Section 199A Dividends |

PX1F |

6. Investment expenses |

PX19 |

7. Foreign tax paid |

PX1A |

9. Cash liquidation distributions |

PX1B |

10. Noncash liquidation distributions |

PX1C |

11. Exempt interest dividends |

PX1D |

12. Specified private activity bond interest dividends |

PX1E |

Box Number |

AAI |

|---|---|

1. Interest income |

PX61 |

2. Early withdrawal penalty |

PX62 |

3. Interest on U.S. Savings Bonds and Treas. obligations |

PX63 |

4. Federal income tax withheld |

PX64 |

5. Investment expenses |

PX65 |

6. Foreign tax paid |

PX66 |

8. Tax-exempt interest |

PX67 |

9. Specified private activity bond interest |

PX68 |

Market Discount |

PX6A |

Bond Premium |

PX6B |

Bond Premium on Tax Exempt Bond |

PX6D |

Bond Premium on Treasury Obligation |

PX6E |

Box 7 on the Interest Income form is not an amount field. The system completes box 7 with the foreign country that is associated with box 6 when the payee's payable type is F and the country code is not blank.

|

Box Number |

AAI |

|---|---|

|

1. Nonemployee compensation |

PXB1 |

| 2. NEC Payer made direct sales | PXB2 |

| 3. Excess golden parachute payments | PXB3 |

|

4. Federal income tax withheld |

PXB4 |