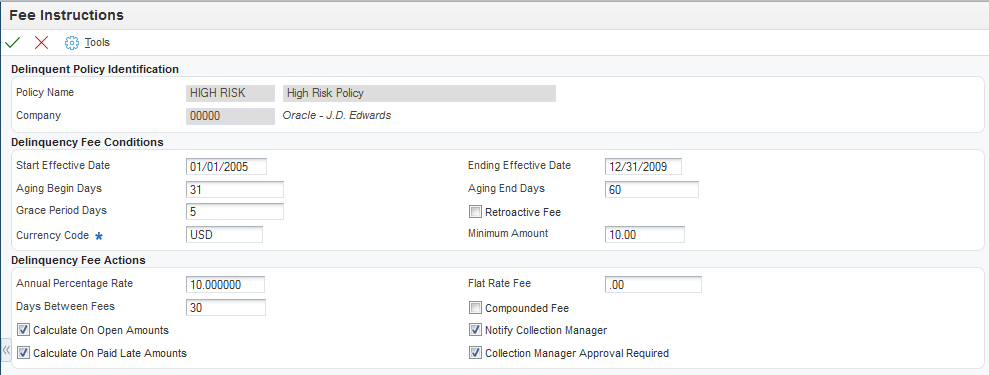

Setting Up Fee Instructions

Access the Fee Instructions form.

- Start Effective Date and Ending Effective Date

Enter the dates on which the fee becomes active and inactive.

- Aging Begin Days and Aging End Days

Enter the beginning and end of a range of days that the system uses to determine whether an invoice is subject to fees that are specified by the policy. The system calculates fees on invoices when the due date is exceeded by the number of days that are entered in this field, but does not exceed the number that are specified in the Aging End Days field.

You can increase fees as an invoice becomes more delinquent by creating multiple fee instructions. Specify the appropriate begin days and end days to create a fee for only the days that you specify beyond the start of the fee period.

For example, you might set up the instructions to charge a 15 percent rate for days 1 through 30, and an 18 percent rate from days 31 through 60.

- Retroactive Fee

Select this option to calculate delinquency fees based on the invoice due date. The system calculates the fee based on the invoice due date, but not until the grace-period days have expired. The system uses this option only when the fee is calculated for the first time. The system generates subsequent fees based on the Date - Last Fee Calculated field and does not consider grace days.

- Minimum Amount

Enter the smallest amount that the system must calculate for a fee to create a fee record. If the system calculates a fee for an invoice pay item that is less than the amount specified in this field, the system does not generate the fee record.

- Annual Percentage Rate

Enter the rate to calculate delinquency fees on the open amount of an overdue invoice. The system prorates the fee for each day the invoice is late based on the number of days in the year. The system uses this formula to determine a daily rate:

((Interest Rate/365 x 01) x open amount of invoice) x number of days late

For example, if the annual rate is 15 percent and an invoice is open for 1000.00 and is 20 days late, the system calculates a fee of 8.22.

If you do not specify a rate, the system uses the amount that is specified for the flat rate fee only.

- Flat Rate Fee

Enter an amount that the system uses in conjunction with the annual percentage, if specified, to generate a delinquency fee. If you do not specify an annual percentage, the system uses the amount in this field for the delinquency fee.

- Days Between Fees

Enter a number that specifies how many days must elapse before subsequent delinquency fees or notices can be generated for an invoice.

For fees, the system uses the value in the Date - Last Fee Calculated field (LFCJ) and the date that you generate fees to determine the number of days that have passed, and compares that date to the value in this field to determine whether the invoice is eligible for another fee.

For notices, the system uses the value in the Date - Last Sent Reminder field (RDDJ) and the date that you generate notices to determine the number of days that have passed, and compares that date to the value in this field to determine whether the invoice is eligible for another notice.

- Compounded Fee

Select this option to calculate fees on unpaid delinquent fees that were previously generated.

- Calculate On Open Amounts

Select this option to calculate fees that are based on the open delinquent invoices.

- Calculate On Paid Late Amounts

Select this option to calculate fees on invoices that were paid after the due date. The system compares the Date Closed field (JCL) with the Due Date field (DDJ) on the invoice record and prorates the fee amount for each day the invoice was not paid past the due date.