Understanding the Revenue Recognition Program

You use the Revenue Recognition program to:

Review invoices and pay items that are included in the revenue recognition process.

Revise invoices and pay items.

Remove invoices from the revenue recognition process.

Create revenue recognition schedules for pay items.

Recognize revenue.

When you select an invoice or invoice pay item in the grid, you can use the selections on the Row menu to:

Review the invoice batch in the Batches program (P0011).

Review receipts for the invoice in the Standard Invoice Entry program (P03B11).

Review the invoice in the Customer Ledger Inquiry program (P03B2002).

You can also select G/L Distribution on the Row menu to review Account Ledger information. The system displays the PLA and revenue entries that are created in Account Ledger table (F0911).

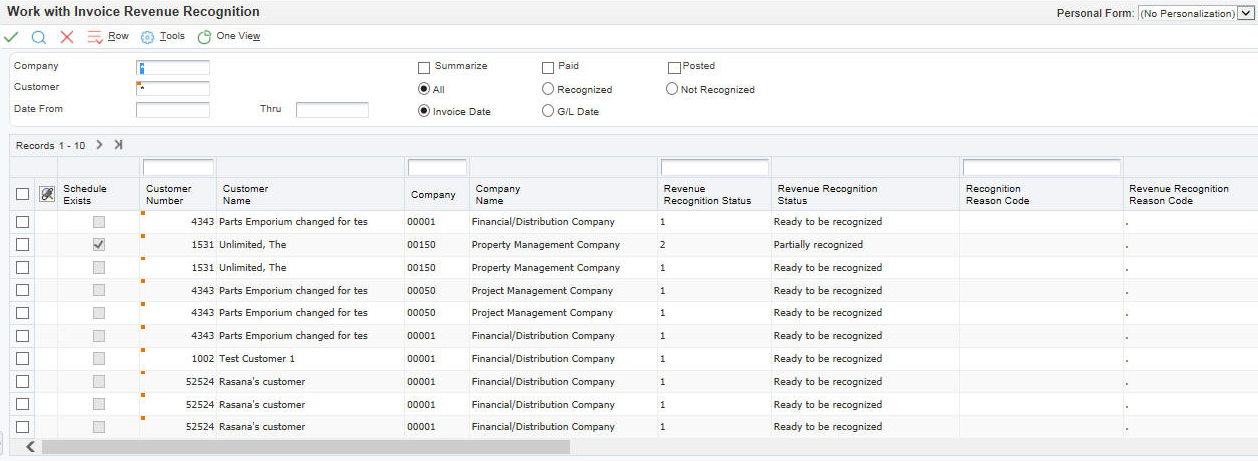

You can use the options in the header of the field to determine how the invoices and pay items are displayed.

- Summarize

Use this check box to specify whether the system displays summary invoice information for an invoice in the grid.

If you select this check box, the system summarizes all pay items for an invoice into a single line in the grid. The invoice amount is the total of the all pay items for the invoice. If you do not select this check box, the system displays each pay item for an invoice on an individual line in the grid.

- All, Recognized, and Not Recognized Options

Use these option to specify whether the system displays all, recognized, or not recognized invoice pay items.

If you select All, the system displays records with a status of 0 (Not to be recognized), 1 (Ready to be recognized), 2 (Partially recognized), or 3 (Recognition Complete) in the Revenue Recognition Status field.

If you select Recognized, the system displays records with a status of 3. If you select Not recognized, the system displays records with a status of 0, 1, or 2.