Creating Journal Entries for Overhead

After you review and recalculate (if need be) the overhead amount, you run the Create Overhead Journal Entry Transaction program (R09J409) to create a journal entry for the calculated overhead amount. The overhead journal entries are created with batch type JO (Joint Venture OH entries). These journal entries can then be processed by the joint venture distribution process.

The Create Overhead Journal Entry Transaction program (R09J409) processes the overhead records in the F09J100 table that you select using the data selection. The system processes only those selected records with transaction status as:

Available to Process

Journal Entry Creation in Error

If the journal entry creation results in error, you can review and resolve the error and rerun the R09J409 program for the same record.

To create journal entries, the system uses the general ledger date from the processing option specified in the R09J409 program. The journal entry transactions can be detailed or summarized. If you have set up the Transaction Summarization processing option to summarize the overhead amounts by account, the system creates a summarized journal entry line with the aggregated overhead amount for each account for the specific business unit for which the overhead is calculated. The remark in the summarized journal entry has the joint venture name and overhead. If you have set up the Transaction Summarization processing option to detail the overhead amount by account, the system creates a detailed journal entry line with the overhead amount for each account. The remark in the detailed journal entry line has the description of the overhead method used in calculating the overhead.

The system creates separate journal entries for each business unit that it processes. There will be a single batch number for the entire joint venture for that session. When the journal entry is created successfully, the transaction status is updated from “Available to Process" to “Process Complete". If the journal entry results in error, the system updates the transaction status to “Journal Entry Creation Error".

After the overhead journal entries are created and posted, you cannot change the setup information in the respective methods, except for the Active or Inactive option.

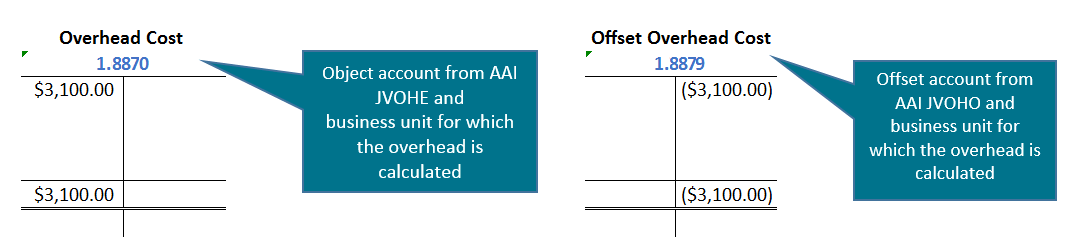

Debit and Credit Entries for Joint Venture Journal Entries in the F0911 Table

The overhead amount is debited to the account set up in the method. If the account is found at the method level, and if no business unit is specified and only object and, or subsidiary is found at the method level, then the system uses the business unit for which overhead is calculated to locate the account. If the account is not found at the method level, the system searches for the account from the JVOHE AAI. If you have specified a business unit in the JVOHE AAI, the system uses the AAI business unit to locate an expense account. If the business unit is not specified in the JVOHE, then the system uses the business unit for which the overhead is calculated.

The offset entry is made to the offset account from the JVOHO AAI. If the business unit is specified in the AAI, the system uses the AAI business unit to create an offset entry. If the AAI business unit it is blank, the system uses the recovery business unit that is mentioned in the Business Unit Attribute program (P09J0006). If the recovery business unit is blank, the system uses the business unit for which the overhead is calculated.

Example: G/L Accounting Entries when a Joint Venture Overhead Journal Entry Transaction is Entered for a Business Unit

Overhead amount can be a daily flat rate. For example, overhead for capital drilling for an oil well is charged a flat rate of 100 USD for each day from January through the end of March. An overhead journal entry is created for the business unit to which the overhead is charged. The journal entry uses the object account from the AAI item JVOHE and the overhead offset account for the credit side of the journal entry.

This diagram illustrates the G/L entries created for January month. Because the day rate is 100 USD and January has 31 days, overhead charged = 100 x31=3100.