Creating Vouchers to Process Cash Call Closure

If you have chosen to close a cash call and refund the amount to the partner by creating a voucher, you must run the Create JV Cash Call Vouchers program (R09J640). You can access and run this batch process for a specific cash call using the Submit Close option on the Row menu of the Work with Cash Call Definition form. You can also run this process for multiple cash calls through the standard Batch Versions form by using the data selection for the program to select the records to process.

The system processes only those records that have the cash call status Pending Closure (91) and cash call close transaction type equal to Voucher (1). The program creates a voucher document for each cash call and a batch for each managing company that is associated with the processed cash calls. The batches are created with the batch type JV (Joint Venture Vouchers).

In case an agreement default charge is specified, the refund amount is the open cash call amount minus the agreement default charge.

Cash Call Information Updated as a Result of the Closure and Refund

The system closes the cash call and updates the F09J40 table with the cash call open amount equal to 0, the cash call status equal to 99 (Closed), and cash call close date with today's date.

The system also adds a ledger record for the cash call in the Cash Call Ledger table (F09J41) with the transaction type 30 (Close - Voucher) and stores the A/P voucher transaction information (Document Number, Document Type, Document Company, and G/L Date). For the closed cash call, the system also updates the F09J41 table with the reversed transaction amount to indicate the amount removed from the cash call.

To access the cash call transaction documents associated with the cash call, such as the voucher document created for the closure, use the Review Ledger option on the Row menu of the Work with Cash Call Definition form of the P09J40 program.

Debit and Credit Entries for Cash Call Vouchers in the F0911 Table

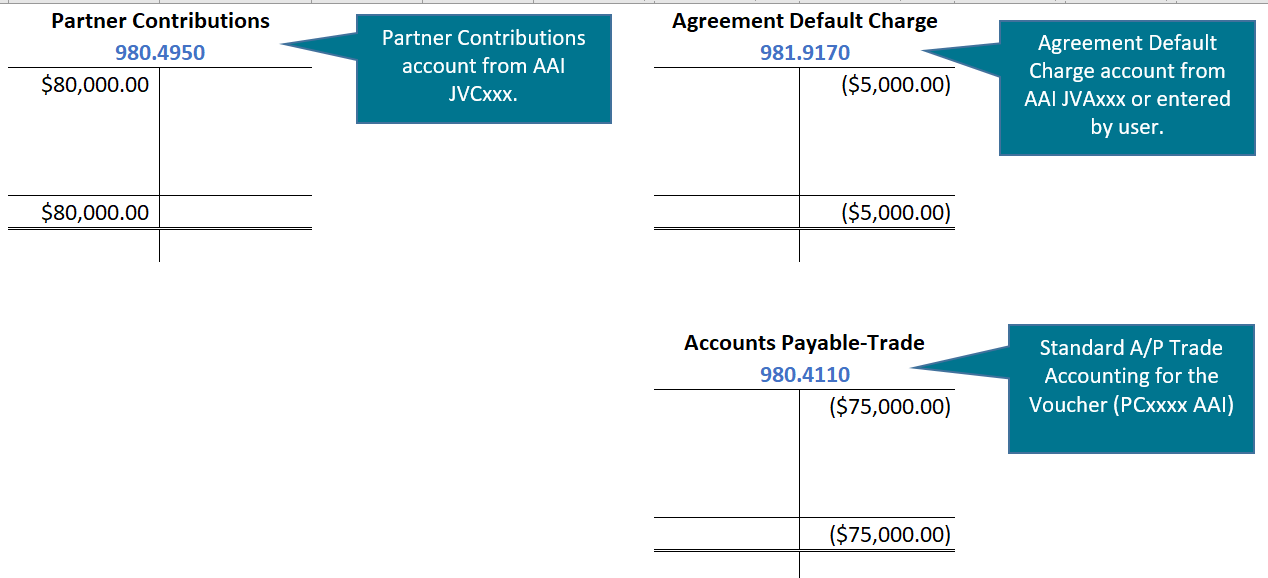

The cash call open amount is debited to the partner contribution account.

The system determines the partner contributions debit account for the close transaction using the cash call managing company and the AAI item JVCxxx (Partner Contributions) where xxx is the G/L offset code that can be used to define a different account for a joint venture. If you have specified a G/L offset code in the Joint Venture Master program (P09J30), the system concatenates the G/L offset code to the AAI Item JVC to locate the account. Also, if you have setup the Joint Venture Master program (P09J30) to create cash calls by subledger, the system uses the subledger type A (Address Book) to add the subledger information to the partner contributions account. The outside partner's address book number is used as a subledger, and if the partner is an insider business unit, the address book number of the business unit is used as the subledger.

The refund amount is credited to the Account Payable (A/P) trade account.

If there is an amount to be retained when closing the cash call, this amount is credited to the Agreement Default Charge account. The agreement default charge account is defined by the JVA AAI or entered by the user when the cash call is closed using the Cash Call Definition program (P09J40). The system determines this account for the close transaction using the managing company and the AAI item JVJxxx (Journal Entry Offset) where xxx is the G/L offset code assigned to the joint venture. If you have specified a G/L offset code in the Joint Venture Master program (P09J30), the system concatenates the G/L offset code to the AAI Item JVA to locate the account. If the account is not found using the managing company, the system uses the company 00000. Also, if you have setup the Joint Venture Master program (P09J30) to create cash calls by subledger, the system uses the subledger type A (Address Book) to add the subledger information to the partner contribution account. The outside partner's address book number is used as the subledger value, and if the partner is an insider business unit, the address book number associated with the business unit is used as the subledger value.

The system populates the Explanation/Remark column in the F0911 table with the value Refund Cash Calls, enabling you to identify that the transactions are for a cash call refund.

Example: G/L Accounting Entries when a Joint Venture Cash Call is Closed with a Voucher

A cash call for a partner and joint venture is closed to refund the partner.

Joint venture: A-GREENACREHOLDINGS

Partner: 7500010 (Thomson Company)

Cash call open amount: 80,000.00 USD

Agreement default charge: 5,000.00 USD

A voucher is created for the closed cash call. The voucher uses the cash call Partner Contributions account, the A/P Trade account, and the Agreement Default Charge account if there is an amount to be retained.

This diagram illustrates the G/L entries for the cash call close voucher.

The system prints a report listing the number of voucher documents created and the batch numbers generated during the process. The report also includes a message if there are records with warnings or errors. You can review the errors or warnings in the work center, correct the issue, and rerun the process.

Voucher Currency

When the currency of the partner and the managing company is different, the voucher amounts are in the currency of the managing company for the domestic side of the transaction and in the partner's currency for the foreign side of the transaction.

Override Tax Information in Supplier Master Record

The R09J640 program does not calculate tax on the voucher amount even if the supplier master record for the partner is set up with tax information in the Supplier Master table (F0401).

Payment Terms for Cash Call Vouchers

The payment terms, if specified on the legal entity record for the partner, will be used on the cash call voucher instead of the payment terms on the partner's Supplier Master record.