Understanding the Process for Drawing on Cash Calls

If your joint venture uses cash calls to manage the joint venture expenses, you will draw on the cash calls instead of invoicing the partners. The cash calls will be applied to the distributed expenses for the joint venture and partner.

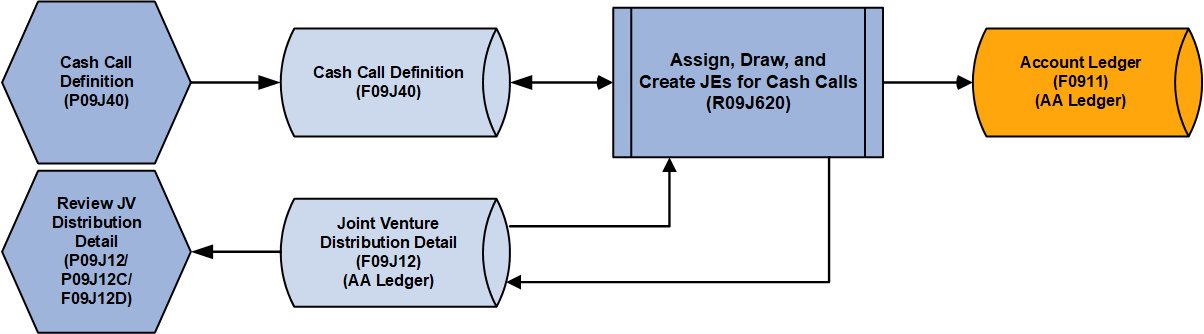

You use the Assign, Draw, and Create JEs for Cash Calls program (R09J620) to draw on the cash calls.

When you run the R09J620 program, it performs the following tasks simultaneously:

Assigns cash calls to the distributed expenses for each partner in the Joint Venture Distribution Detail table (F09J12)

Reserves distributed expenses to their associated exclusive cash calls

Draws on cash calls by calculating the difference between the previous cash call open amount and the distributed amount from the distribution detail transactions

Creates journal entries for the assigned distributed expenses to debit the partner contributions account and credit the joint venture cutback expense or cutback capital cost account

When attempting to assign cash calls to expense transactions, the system uses the joint venture business unit hierarchy and the cash call definition to apply the exclusive cash calls first and then the non-exclusive cash calls. Similar to the DOI and overhead rules assignments, the system assigns the cash call starting with the most specific (business unit) to the least specific (joint venture and partner) information.

This list is in order from the least specific to the most specific:

Joint Venture and Partner

Joint Venture, Partner, and Joint Venture Parent Business Unit

Joint Venture, Partner, and Business Unit

Note that each cash call definition can have an account group assigned to it. These cash calls will only be assigned to the distribution details that have the accounts that are included based upon the account group definition as well as the joint venture, partner, joint venture parent business unit, and business unit.