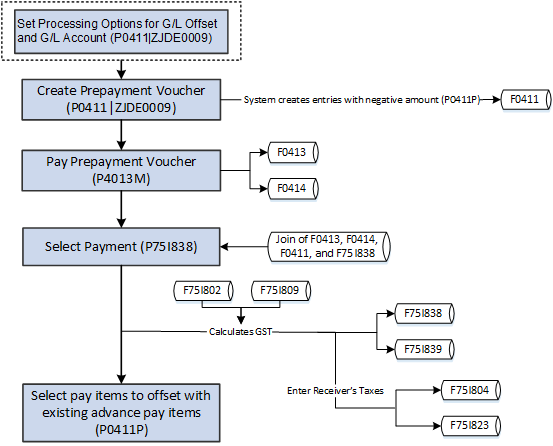

Calculating Reverse Charges for Advance Payments

Reverse charge on advance payment is the tax amount you are liable to pay to the tax authority on the advance payment you make for goods or services. The tax amount is calculated based on the provider and receiver percentages set up in the GST Rule Setup program (P75I802). You use the Work With Reverse Charge on Advance Payment P2P program (P75I838) to calculate reverse charge amounts for advance payments that you must make to the supplier and to the tax authority. The system saves this information in the Reverse Charge Advance Payment Header File table (F75I838) and Reverse Charge Advance Payment Details File table (F75I839).

You cannot void a GST prepayment voucher after GST has been calculated. To void such vouchers, you must cancel the payment transaction from the P75I838 program.

You must print the self-invoice for advance payment transactions on which reverse charge is applicable. See Printing a Self-Invoice for Reverse Charges for more information.

The following image describes the process flow for reverse charge on advance payments: