Understanding the O2C Process for Supply of Services in the GST Regime

Suppliers are responsible for issuing invoices and charging GST at a specific rate of tax on the services they provide to the customers. The GST amount is included in the price paid by the recipients of the services. The supplier must pay the GST amount to the tax authority after offsetting it with the available ITC

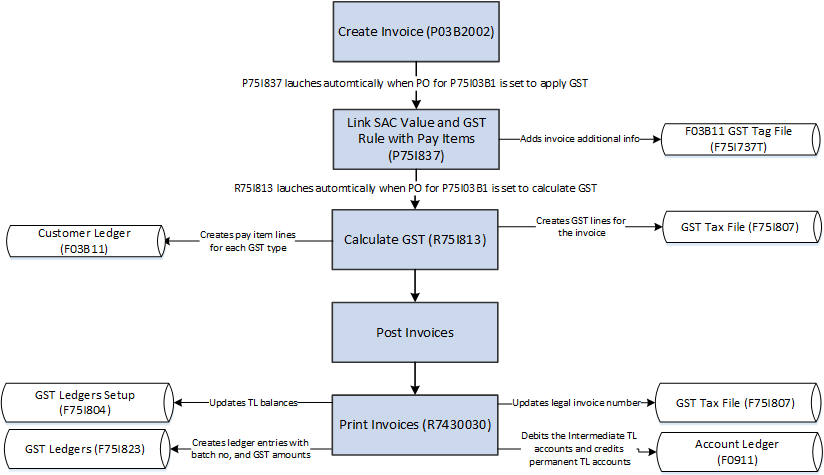

This illustration shows the order-to-cash (O2C) process for GST applicable services in the JD Edwards EnterpriseOne system.

To provide services in the GST regime:

Create the invoice using the standard Customer Ledger Inquiry program (P03B2002).

After you create the invoice, the system enables you to associate the GST SAC value and GST rule with the invoice. The GST SAC value determines the rate of tax that applies to services.

Calculate GST using the Calculate GST for A/R Invoices program (R75I813).

Post the invoice using the General Ledger Post program (R09801).

Print the invoice for the customer using the standard Legal Document Print Process program (R7430030).