Understanding the P2P Process for Goods Applicable for GST

Under the GST regime, the government levy taxes on the buyer of goods. The buyer pays the taxes for the goods that are procured from the supplier. The tax components that the buyer pay to the supplier are CGST, SGST, and GST Cess when the supplier is from the same state, and IGST and GST Cess when the supplier is from a different state. The supplier remits the collected tax to the tax authorities. The buyer can claim a credit for the tax paid during the purchase after the supplier remits the tax to the government following the statutory requirements. Buyers can claim a credit only when the purchased goods is used to run their business.

GST is applied to a wide range of goods. A purchase order is created and includes the details about the goods sold, as well as the price and tax. The vouchers are posted for the tax calculation. The landed cost component enables the calculation of GST for the purchase order. The GST is updated when the appropriate landed cost rule is associated with the purchase order.

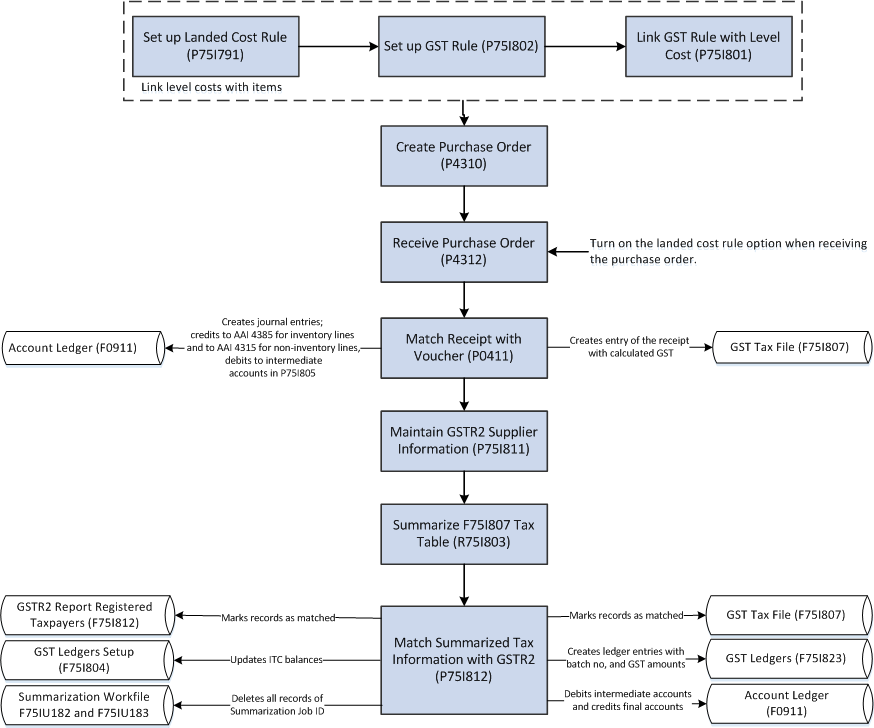

This illustration describes the procure to pay (P2P) process for GST applicable goods in the JD Edwards EnterpriseOne system.

To procure goods (stock items) in the GST regime:

Create purchase orders in the standard Purchase Orders program (P4310).

While creating a purchase order if the value you have provided for the document type exists in the Modified Documents UDC table (75I/MD), the system displays the Supplier Document Details form (P75I858). You must complete the Supplier Document Number, Supplier Document Date, and Remark fields on the P75I858 form.

Receive the items on the purchase orders using the standard PO Receipts program (P4312).

You can print a report to review the purchase order lines with GST amounts.

See Printing New Purchase Order Lines with GST Amounts.

If the GST rule is set up to apply reverse charge, the system distributes the tax liability between the supplier and the purchaser based on the provider and receiver percentages set up in the F75I802 table.

Create vouchers and match the receipt with the vouchers using the A/P Standard Voucher Entry program (P0411).

At the time of the voucher match process, you enter the tax deducted at source (TDS) information, if TDS applies to the transaction.

If the transaction is subject to TDS, calculate the TDS using the Calculate TDS program (R75I515).

Maintain the GSTR2 Information provided by the government using the GSTR2 Report program (P75I811).

Summarize the tax information in the GST Tax File table (F75I807) in a specific format using the GST Tax File Summarization program (R75I803).

Match the summarized tax information with GSTR2 information to claim input tax credit (ITC) on your purchases.

See Matching the Summarized Tax Data with GSTR2A to Claim ITC

Procuring Non-Stock Items Applicable for GST

To procure non-stock items in the GST regime:

Set up landed cost rules in the Work With Landed Cost program (P75I791).

Access the Purchase Orders program (P4310) to create a purchase order.

On the Order Detail form for the P4310 program, complete the required fields to create a purchase order.

You enter a landed cost rule for each item on the purchase order.

You create purchase orders for GST applicable non-stock items with properties same as line type J (Job Cost).

Select each line item that you entered in the grid and click Regional Info on the Row menu.

The system displays the Additional Information form.

Complete these fields for each item on the purchase order:

GST Category Type

GST Category Value

Item Type

The system saves the additional information for GST non-stock items in the Additional Information - P4310 table (F75I843).

Receive the items on the purchase orders using the standard PO Receipts program (P4312).

The system calculates GST for each item on the purchase order. If the GST rule is set up to apply reverse charge, the system distributes the tax liability between the supplier and the purchaser based on the provider and receiver percentages set up in the F75I802 table.

Create vouchers by matching the receipts with the invoices using the A/P Standard Voucher Entry program (P0411). During the voucher match process, you enter the tax deducted at source (TDS) information, if TDS applies to the transaction.

The system creates journal entries for the transactions and updates the Account Ledger table (F0911). The system debits the intermediate accounts in the GST Account Master Setup program (P75I805) and credits the accounts that you have specified during the purchase order creation. If the GST rule for the GST unit is set as nonrecoverable in the P75I805 program, the system updates the nonrecoverable accounts and does not affect the intermediate accounts.