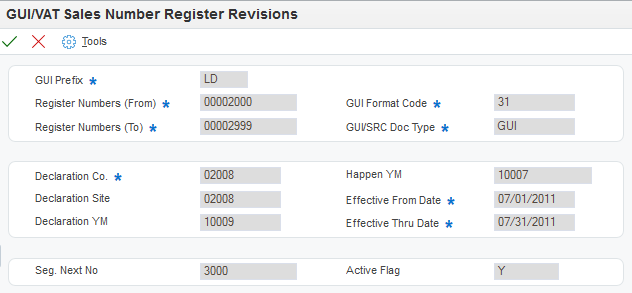

Adding a GUI/VAT Sales Number Register

Access the GUI/VAT Sales Number Register Revisions form.

- GUI Prefix

Enter the prefix for the GUI numbers that you obtained from the government.

- Register Numbers (From)

Enter the beginning number of a range of receipt register numbers. A valid register number has eight digits.

- Register Range

Enter the total number of the range. For example, if the range of numbers is 20000000 through 20005000, enter 5000. The number that you enter must be a multiple of 50.

You must complete this field.

- GUI Format Code

Enter a code that specifies the GUI format code for the transaction. The code that you enter must exist in the GUI/VAT Format Code (75T/F3) UDC table. Values are:

Blank: Blank

31: Triplicate GUI / Computer GUI

32: Duplicate / Duplicate Cash Register GUI

33: Triplicate Sales Return / Allowance

34: Duplicate Sales Return / Allowance

35: Triplicate Cash Register GUI

36: GUI-Exempt

37: Special Tax: Sales

38: Special Tax: Return, Allowance

99: Sales Receipt

The system completes the GUI/SRC Doc Type field based on the value that you specify in the GUI Format Code field.

- Declaration Co. (declaration company)

Enter the declaration company for which you set up the numbering. The company must exist in the Company Names & Numbers program (P0010).

- Declaration Site

Enter a code that identifies the site for which the VAT is declared. The code that you enter must exist in the GUI/VAT Declaration Site (75T/DS) UDC table, and must be associated with the declaration company in the GUI/VAT Declaration Site program.

- Declaration YM (year and month of VAT declaration)

Enter the Taiwanese calendar year and month of the GUI/VAT declaration. The value that you enter must exist as a reporting period in the GUI/VAT Declaration Site table (F75T001) for the declaration site that you specify. You set up reporting periods from which you select the declaration year/month in the GUI/VAT Declaration Site program.

The system completes the Effective From Date and Effective Thru Date fields based on the value that you specify in the Declaration YM field.

- Happen YM (year and month that tax document happened)

Enter the Taiwanese calendar year and month of the GUI/VAT transaction. This field is optional.

Complete this field to set up the segment numbering by month for additional control. Enter the date in the format YYMM, where YY is the two-digit Taiwan calendar year (the international calendar year minus 1911), and MM is the two-digit number of the month. For example, enter 9809 for September 2009.

- Effective From Date

The system completes this field with the beginning date of the declaration period.

- Effective Thru Date

The system completes this field with the ending date of the declaration period.