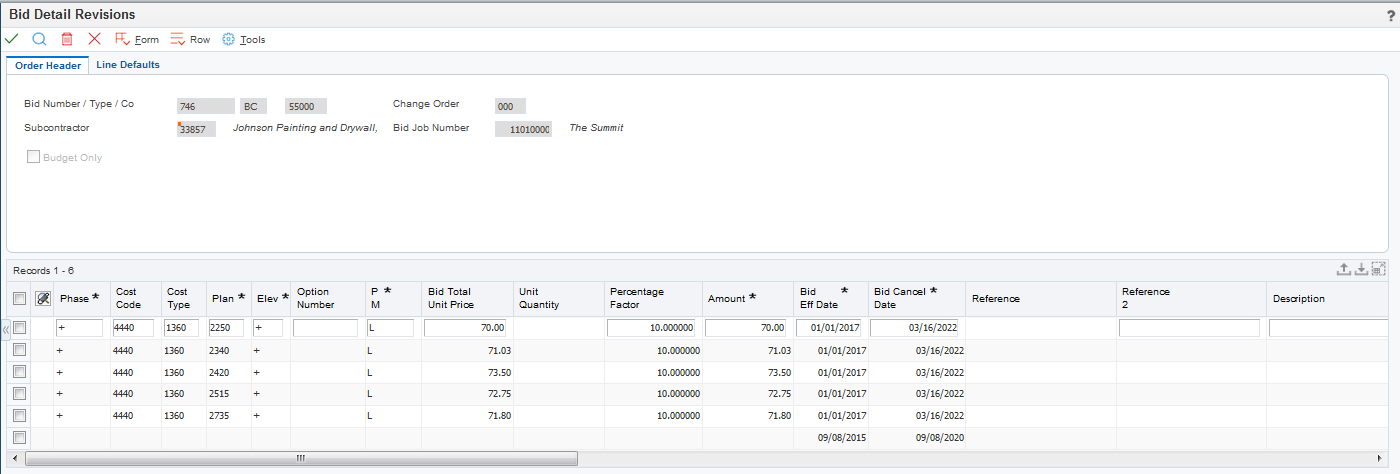

Entering Bid Detail Information

Access the Bid Detail Revisions form.

You can set up bid detail records at the phase, plan, and elevation levels. Bid detail records contain the actual costs associated with a bid.

- Cost Code

Enter a value that specifies a subcategory of the cost type. For example, a subcategory for the cost code for labor could be regular time, premium time, and burden.

- Cost Type

Enter the cost type. This is the portion of a general ledger account that refers to the division of the cost code (for example, labor, materials, and equipment) into subcategories. For example, you can divide the cost code for labor into regular time, premium time, and burden. The system validates this field against the cost code structure that is set up for the area.

- Option Number

Enter a value for a specific upgrade that is not included in the base house price and cost.

- PM (purchasing method)

Enter a code from UDC 44H6/PM that specifies the bid purchasing method. Values are:

L: Lump sum purchase

U: Unit-based purchase

- Bid Total Unit Price

Enter the unit cost of one item, as purchased from the supplier, excluding freight, taxes, discounts, and other factors that might modify the actual unit cost you record when you receive the item.

- Bid Eff Date (bid effective date)

Enter the effective date for the bid. The Lot Start process compares the commitment start date for the lot with the bid effective date to determine which bids to select for processing.

- Bid Cancel Date

Enter the cancel date for the bid. If you leave this field blank, the system enters a date that represents 60 months from the current system date.

- Reference 2

Enter a value to record a reference number, such as the supplier's bid document number, quote document, sales order, work order, or job number.

- Tax Y/N

Enter a code from UDC H00/TV that specifies whether the item is subject to sales tax when you purchase it. The system calculates tax on the item only if the supplier is also taxable.

- Tax Expl (tax explanation code)

Enter a hard-coded value from UDC 00/EX that specifies the algorithm that the system uses to calculate tax and general ledger distribution amounts. The system uses the tax explanation code in conjunction with the tax rate area and tax rules to determine how the tax is calculated.

- Tax Rate Area

The system retrieves this value from the line default tax area. If the alternate tax rate/area assignment functionality is enabled and you change the subcontractor or bid job number, the system assigns the alternate tax rate/area and recalculates the value.