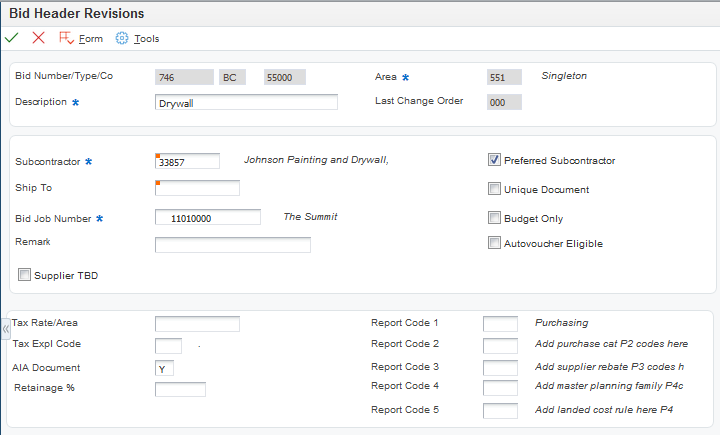

Entering Bid Header Information

Access the Bid Header Revisions form.

- Bid Type

Leave this field blank. The system displays the default value that you set in the Cost Type processing option. If you did not specify a default, the system uses AAI item CD.

- Order Company

Enter the company number. If you leave this field blank, the system uses the company number that is assigned to the value the Bid Job Number field.

- Subcontractor

Enter a number that identifies an entry in the address book.

- Bid Job Number

Enter an alphanumeric code that identifies a separate business unit for which you want to track costs, such as the community or subdivision.

Note:You must have previously set up the bid job number as a community or area job.

- Supplier TBD (supplier to be determined)

Select this check box if the supplier is undetermined and if changes to the supplier are allowed in the F44H711 table. This check box applies to bid contracts only. If you select this check box, the Recalculate TBD Cost check box appears on this form.

During the Lot Start process, the system generates workfile records for this bid and updated with the value T in the F44H711 workfile. The system does not create commitment records in the Purchase Order Detail File (F4311) from these workfile records until you enter the supplier.

- Recalculate TBD Cost (recalculate to be determined cost)

Select this check box to recalculate the bid using the bid prices for the newly assigned supplier during the Lot Start process.

Note:The system displays this check box only if you select the Supplier TBD check box.

- Preferred Subcontractor

Select this check box to indicate that a preferred subcontractor is attached to this bid.

When this check box is selected, the system selects the bid during the Lot Start process before any supplier assignments are made for the trade code and cost codes in the area, community, phase, lot, or option. When the system locates a preferred subcontractor's bid during the Lot Start process, the search is finished. If two preferred subcontractors exist for the same cost code, the system selects the first preferred subcontractors that are found.

- Unique Document

Select this check box to generate a unique document number for the commitment records that are created for this bid during the Lot Start process. The system automatically selects this check box if the bid subcontractor is to be determined or if the bid job number is an area job.

If you do not select this check box, the actual commitment document number will be the same as the bid document number and each lot will be a change order.

- Budget Only

Select this check box if the bid is strictly for budgeting purposes. If you select this check box, the system creates a budget for the appropriate cost codes during the Lot Start process, but it does not create a commitment for the bid.

- Autovoucher Eligible

Select this check box if the bid is eligible for automatic vouchering. You must select this check box if you use the Auto Voucher program (R44H702).

- AIA Document (American Institute of Architects document)

Enter a code from UDC H40/FU that specifies whether the system prints an AIA format turnaround document, a Waiver of Lien document, or both documents during the payment processing cycle.

The system prints these documents only when a contract payment is printed. If you print progress payments for contracts, the system does not print an AIA document or a Waiver of Lien document.

- Retainage % (retainage percentage)

Enter the rate of retainage that applies to the contract. The retainage rate is expressed as a decimal fraction and cannot be greater than 99.9 percent (.999) or less than zero. For example, a retainage rate of 10 percent is represented as 10.

- Tax Expl Code

Enter a value from the Tax Explanation Codes (00/TX) UDC to identify how the system calculates tax and general ledger distribution amounts. The system uses the tax explanation code in conjunction with the tax rate area and tax rules to determine how the tax is calculated. Each transaction pay item can be defined with a different tax explanation code.

- Tax Rate Area

Enter a value from the Tax Areas table (F4008) that identifies a tax or geographic area that has common tax rates and tax authorities. The system uses the tax rate area in conjunction with the tax explanation code and tax rules to calculate tax and general ledger distribution amounts when you create an invoice or voucher.

If the bid belongs to a company with the alternate tax rate/area assignment company constant enabled, the system assigns the alternate tax rate/area based on the bid job number and subcontractor country information. Otherwise, the system uses the default tax rate/area you set up for the subcontractor.

For further information about alternate tax rate/area assignments, please refer to "Setting Up Alternate Tax Rate/Area Assignment Functionality" in the JD Edwards EnterpriseOne Applications Tax Processing Implementation Guide.