Changing the Markup for a Workfile Transaction

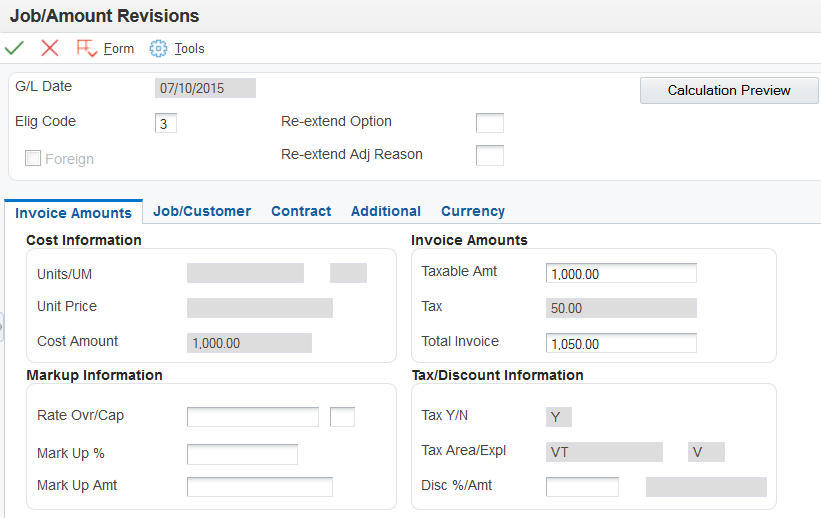

Access the Job/Amount Revisions form.

To change the markup for a workfile transaction:

To change the markup for invoice amounts, if applicable, select the Invoice Amounts tab and complete any combination of the Rate Ovr/Cap (rate override/cap), Mark Up % (mark up percentage), and Mark Up Amt (mark up amount) fields.

To change the markup for revenue amounts, if applicable, select the Revenue Amounts tab and complete any combination of the Rate Ovr/Cap, Mark Up %, and Mark Up Amt fields.

Click the Calculation Preview button.

The system calculates the markup and displays the changes.

Complete the Re-extend Option and Re-extend Adj Reason (re-extend adjustment reason) fields.

Note: You can also change the Re-extend Option and Re-extend Adj Reason fields by selecting Trans. Re-extend (transaction re-extend) from the Row menu for a specific transaction on the Work With Workfile form.Click OK.

The system displays the Work With Workfile form and automatically displays the record with the changes that you just made.

Important: If you change the markup information on Job/Amount Revisions and do not enter 3 in the Re-Extend Option field before you click OK, the default markup information will come from the Billing Rate / Mark up Table (F48096). To prevent this, enter 3 in the Re-Extend Option field.

- Rate Ovr/Cap (rate override/cap)

Enter the rate that the system uses to mark up the invoice amount that is reflected in the billing of professional services workers such as draftsmen, engineers, or consultants. This rate does not affect the employee's paycheck. You can use the markup rate as an override rate or a maximum rate.

The calculation of the override rate for the total invoice markup is:

(Override Rate × Unit) × (1 + Markup Percent) + Markup Amount

When you specify a maximum or cap rate, the system compares the rate override with the rate from the cost transaction. The system then uses the lower rate as the override rate.

You set up the override or maximum unit rate using the Billing Rate / Markup Table program (P48096).

Within Contract and Service Billing, you can mark up the revenue amount at a different rate from the invoice amount. The Independent Revenue/Invoice Amounts option in the Billing System Constants table (F48091) controls this function. Use generation type 1 to specify a table for invoice, revenue, and component markup rates and use generation type 2 to specify a table for revenue and component markup rates.

Use generation type 1 to specify the invoice and revenue markup rates only when the independent revenue and invoice amounts are set to not equal in the Billing Constants.

- Mark Up %

Enter a number that specifies the percentage that the system uses to mark up the revenue amount that is reflected in the billing of professional services, such as fees for draftsmen, engineers, and consultants. Enter the percentage as a whole number. For example, 50.275 percent would be entered as 50.275. This percentage rate does not affect the employee's payment.

You set up this percentage in the Billing Rate / Markup Table program (P48096). Use generation type 1 to specify a table for invoice, revenue, and component markup rates.

With Contract and Service Billing, you can mark up the revenue amount at a different rate than the invoice amount. The Independent Revenue/Invoice Amounts option in the Billing Constants program (P48091) controls this function. Use generation type 2 on the Billing Rate/Markup Revisions form to specify a table for revenue and component markup rates.

- Mark Up Amt

Enter an amount that the system uses to mark up the invoice amount for the billing of professional services, such as the services of draftsmen, engineers, or consultants. This amount does not affect the employee's payment.

You use the Billing Rate / Markup Table program (P48096) to set up the amount. Use generation type 1 to specify a table for invoice, revenue, and component markup amounts.

With Contract and Service Billing, you can mark up the revenue amount by a different amount than the invoice amount. The Independent Revenue/Invoice Amounts option in the Billing System Constants table (F48091) controls this function. Use generation type 2 to specify a table for revenue and component markup amounts.

- Re-extend Option

Enter a code to specify how the system should reextend a transaction. You reextend a transaction when you want to change or reapply the markup for the transaction based on specific overrides or on the information that you have defined in the markup tables. Values are:

1: Reapply the established invoice markup rates from the Billing Rate/Markup table (F48096). The revenue amount is not changed.

2: Reapply the established revenue markup rates from the F48096 table. The invoice amount is not changed.

3: Use the rates or amounts that are entered on the Amounts/Units Information window or on the Billing Rate/Markup Revisions form. Do not apply the established invoice or revenue markup rates from the F48096 table.

Blank: Reapply both the invoice and revenue markup rates using the established rates from the F48096 table.

Note: You cannot use codes 1 or 2 when the Independent Revenue/Invoice Amounts option in the system constants specifies that the invoice and revenue amounts must be equal.- Re-extend Adj Reason (re-extend adjustment reason)

Enter a code from UDC 48/AR to specify the reason for a revision to a single or a group of billing detail transactions in the Billing Workfile (F4812). The system updates the historical billing detail transaction with this reason for audit purposes.