Setting Up Component Calculation Rules

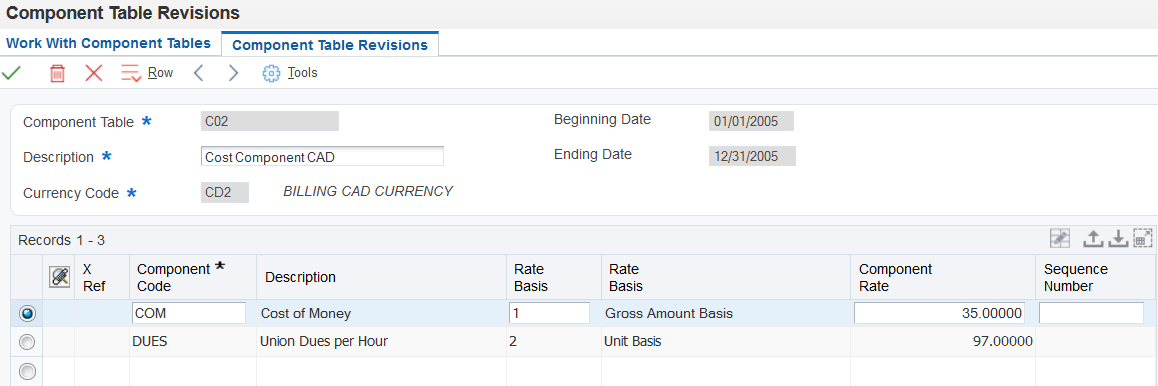

Access the Component Table Revisions form.

- Component Table

Enter the name that you will use to identify the component table elsewhere in the system. Component tables enable you to set up provisional burdens which are attached at the billing detail transaction level. You can base the component calculations on any combination of the cost, invoice (including taxes), or revenue amounts of the base billing detail transaction.

For example, components based on the cost amount would enable you to apply additional overhead to costs incurred by the organization. Components based on the invoice amount would enable you to apply charges in addition to the markup amount for billing.

You control the amount basis for this calculation on the Billing Rate / Markup Revisions form. If you enter the name of the component table in the Cost Comp Tbl (cost component table) field, the system bases all calculations on the cost amount. Similarly, if you enter the name of the component table in the Inv/Rev Comp Tbl (invoice/revenue component table) field, the system bases all calculations on the invoice or revenue amounts or both, depending on the generation type of the Billing Rate / Markup table and the Journal Generation Control flag setting in the system constants.

- Component Code

Enter the component code to identify the component rule.

- Rate Basis

Enter 1 to base the calculation of the component on the gross amount of the base billing detail transaction. The number in the Component Rate field is treated as a percentage. The system calculates the component amount by multiplying the component rate percentage by the cost, total invoice, or revenue amount from the base billing detail transaction.

Enter 2 to base the calculation of the component on the number of units from the base billing detail transaction. The number in the Component Rate field is treated as a flat rate amount. The system calculates the component amount by multiplying the component flat rate amount by the number of units from the base billing detail transaction.

Enter 3 to base the calculation of the component on the net amount of the base billing detail transaction. The number in the Component Rate field is treated as a percentage. The system calculates the component amount by multiplying the component rate percentage by the cost, taxable invoice, or revenue amount from the base billing detail transaction.

- Component Rate

Enter the rate that the system should use when it creates the individual component records. This value can be either a percentage or a flat amount, depending on the value entered in the Component Rate Basis (UORC) field.

If the component rate basis is units, then the component rate is a flat amount which is multiplied by the number of units from the base billing detail transaction.

If the component rate basis is amount, then the component rate is a percentage which is multiplied by the cost, invoice, or revenue amount from the base billing detail transaction.