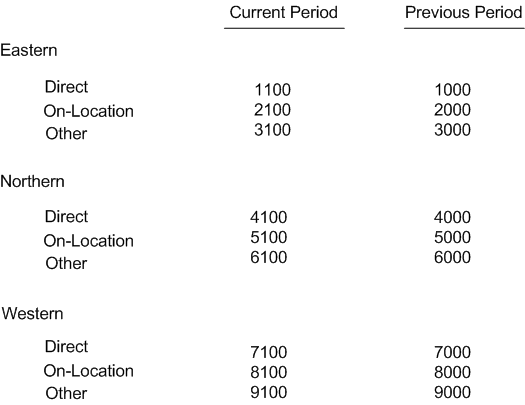

Example of Financial Statement Output with Balances Summarized by Grouping Elements

Because the system writes lines for each unique combination of the grouping elements, one row definition can cause the system to write multiple lines on a statement. For example, suppose that you selected grouping elements to return values for business units and account category code 1 for revenue accounts.

This table shows the row definition for the statement:

Selected Grouping Elements to Summarize |

Values for Example |

|---|---|

Business Unit |

Three business units: Eastern, Northern, and Western. |

Account Category Code 1 |

Account Category Code 1 has three values: Direct, On-Location, and Other. |

Suppose further that you set up your statement definition using these parameters:

The row definition described in the table above, along with data selection that includes the revenue accounts.

Columns for the current period and the previous period.

Data selection in the statement version for a specific company.

In this example, we'll assume that all three category code values are used in all of the business units. If that is true, then the system would write nine lines to the statement and would provide totals for each column for these unique combinations:

Business unit Eastern with the total for account category code 1 value Direct.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Direct in account category code 1 is 1100 for the current period and 1000 for the previous period.

Business unit Eastern with the total for account category code 1 value On-Location.

In this example, we'll assume that the total of the revenue accounts that are assigned the value On-Location in account category code 1 is 2100 for the current period and 2000 for the previous period.

Business unit Eastern with the total for account category code 1 value Other.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Other in account category code 1 is 3100 for the current period and 3000 for the previous period.

Business unit Northern with the total for account category code 1 value Direct.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Direct in account category code 1 is 4100 for the current period and 4000 for the previous period.

Business unit Northern with the total for account category code 1 value On-Location.

In this example, we'll assume that the total of the revenue accounts that are assigned the value On-Location in account category code 1 is 5100 for the current period and 5000 for the previous period.

Business unit Northern with the total for account category code 1 value Other.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Other in account category code 1 is 6100 for the current period and 6000 for the previous period.

Business unit Western with the total for account category code 1 value Direct.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Direct in account category code 1 is 7100 for the current period and 7000 for the previous period.

Business unit Western with the total for account category code 1 value On-Location.

In this example, we'll assume that the total of the revenue accounts that are assigned the value On-Location in account category code 1 is 8100 for the current period and 8000 for the previous period.

Business unit Western with the total for account category code 1 value Other.

In this example, we'll assume that the total of the revenue accounts that are assigned the value Other in account category code 1 is 9100 for the current period and 9000 for the previous period.

The row definition type, the elements that you select for grouping, and the data selection that you attach to the row definition determine the lines and values that the system writes to the statement.

The image below illustrates the columns, rows, and account balances that the system would write to the statement. Note that the formatting for the rows, such as indenting, must be set up in the layout that you associate with the statement definition.