Working with Special Handling

You use special handling to add amounts and describe the amounts in a specific box on a year-end form.

You can add amounts to specific boxes on each year-end form using special handling codes for pay types, deductions, benefits, and/or accruals (PDBAs). This creates an association between the special handling codes and the specific boxes to which they apply. Each year-end form can have a unique special handling setup.

You use these associations to:

-

Report additional PDBA amounts for wages and taxes to existing taxable wages

-

Report separately for the detail boxes on year-end forms

JD Edwards World software does not provide any pre-existing special handling code setup. You must setup special handling codes for each form.

For each special handling code, enter all of the PDBAs that you want to add to a taxable wage or that you want to report in a particular box on the year-end form. You must enter PDBAs individually.

Special handling codes for Canadian year-end forms must correspond to the box numbers specified by the CRA or Québec.

You set up special handling codes in UDC 07/IP.

To use special handling, you must:

-

Set up the special handling code table.

-

Assign PDBAs to the special handling codes.

-

Assign special handling codes to boxes on the forms.

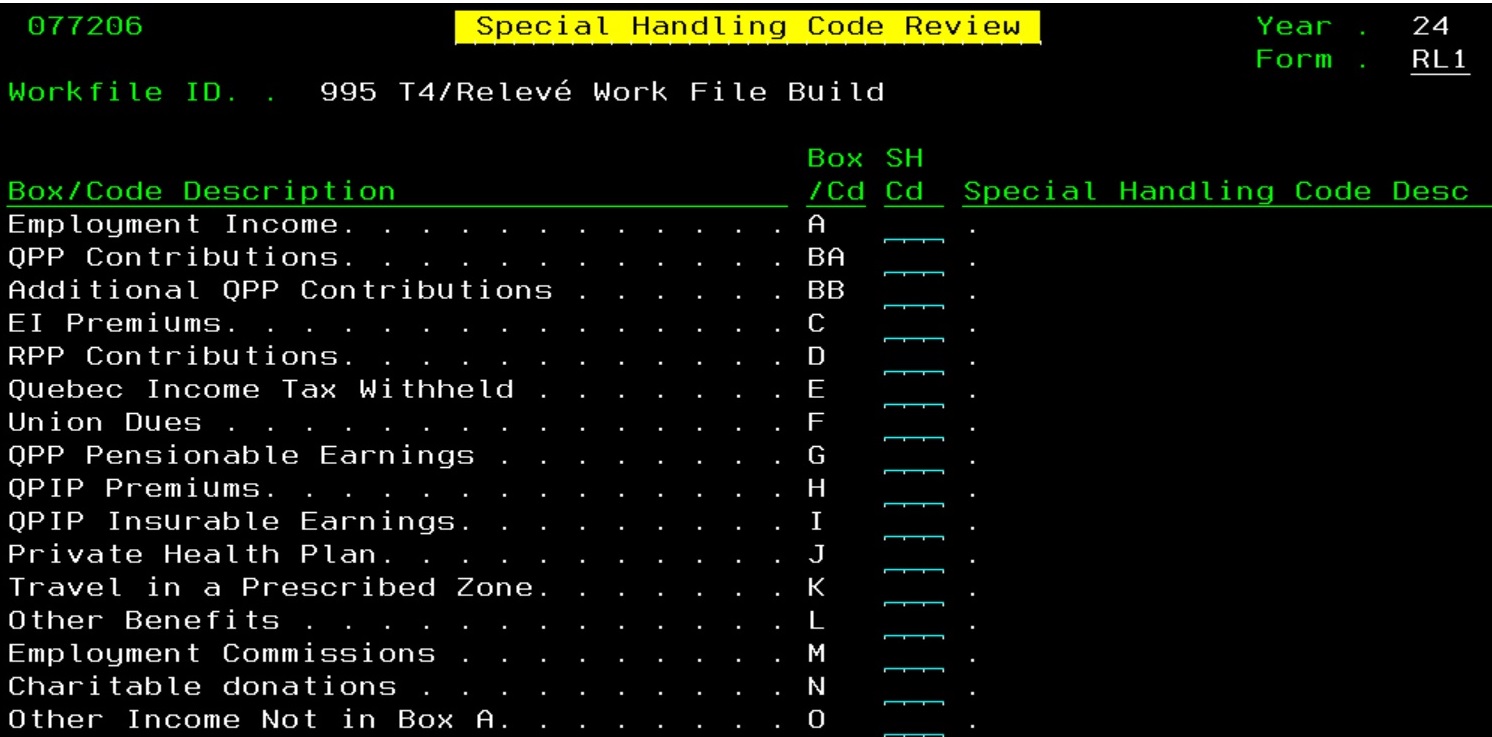

You can also access special handling code screens from the second Build T4/Relevé Workfiles screen. Use Special Handling Review (F15) to access the Special Handling Code Review screen and Special Handling Table (F16) to access the Special Handling Code Table screen.

You must repost using PDBAs to Tax Area Sum. F06148 on the Data Integrity & Global Updates menu (G7731) before performing any special handling or running a workfile build. See Reposting Tax Area Information for more information.

Working with Special Handling includes the following tasks:

-

Set up the special handling codes table

-

Assign PDBAs to special handling codes

-

Assign special handling codes to boxes on the forms

To set up the special handling codes table

Navigation

From T4/Relevé Setup (G772472), choose Special Handling Pay Codes

-

On Special Handling Pay Codes, complete the following fields:

-

Code

-

Description-2

-

-

Repeat these steps to enter all of the special handling codes for all forms.

|

Field |

Explanation |

|---|---|

|

Code |

A list of valid codes for a specific user defined code list. Screen-specific information This value is user defined and corresponds to the box number on the form. |

|

Description - 2 |

Additional text that further describes or clarifies a field in the J.D. Edwards systems. Program-Specific Information This column must contain a numeric value that represents the value of the alphanumeric code. Screen-specific information This value corresponds to the form with which the code is associated, as you can use the UDC table for several types of forms: Canadian Relevés, Canadian T4, Canadian T4A, and US W-2. |

To assign PDBAs to special handling codes

Navigation

From T4/Relevé Setup (G772472), choose Revise Special Handling Tables

-

On Revise Special Handling Tables, complete the following field and click Enter:

-

Special Handling Code

-

-

Enter a pay type, deduction, or benefit number in the following field:

-

Type (PDBA Code)

-

-

Repeat the previous step until you enter PDBAs for this special handling code.

-

For Box O on the Relevé 1 form only, to associate an explanatory code with the PDBA code, complete the following field and click Enter:

-

Cd (Box O Code)

-

|

Field |

Explanation |

|---|---|

|

Type |

The number and description of the PDBA that you want the system to use to calculate the corresponding PDBA. This number is the ending number in the range that is the basis of the calculation. Program-Specific Information Enter the number and description of the PDBA that you want the system to calculate for the specified special handling code table. Screen-specific information To review or change the details of a specific PDBA, enter 1 in the Option field to access the Pay Type Setup screen. |

|

Cd |

The codes that you can enter in this field are defined by Ministere du Revenu du Québec and supplied by JD Edwards World software in user defined code table 07/S2. You use these codes only to group similar PDBAs in Box O (other taxable income) on the Relevé 1 form. If only one code is associated with the amount in Box O, the code appears in Code (Case O) on the form. If more than one code is associated with the amount in Box O, the code RZ appears in Code (Case O) on the form and the descriptions of the codes also appear on the form. |

Processing Options

See Special Handling Code Table (P067204)

To assign special handling codes to boxes on the forms

Navigation

From T4/Relevé Setup (G772472), choose Assign Special Handling Code Tables

The default for the Assign Special Handling Code Tables screen is the T4 form, however you can set which form displays in several ways. You can set the processing option or you can enter the form type (RL1, NR4) in the Form field. You can use the following functions to access the codes for other forms for special handling:

-

F19 to display the special handling codes for the previous form

-

F20 to display the special handling codes for the next form

-

On Assign Special Handling Code Tables, enter the associated workfile build ID version and click Enter twice.

On the second Assign Special Handling Code Tables screen, enter a special handling code in any of the fields for each form and click Enter.

Processing Options