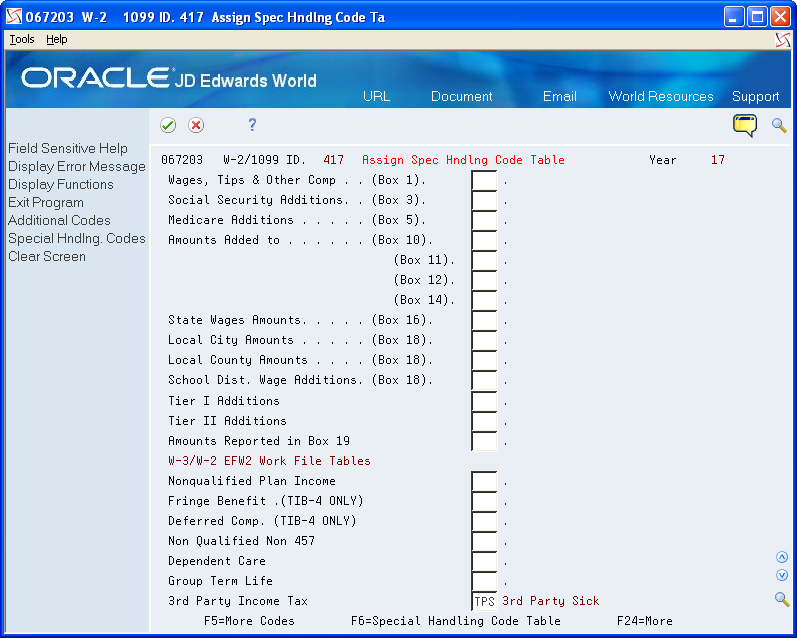

Assigning Special Handling Code Tables

You assign special handling code tables when you want to specify amounts to add to existing taxable wages or amounts that you want to report separately in the W-2 detail boxes, such as boxes 10, 11, 12, and 14. You can also identify the table codes that you use to supplement the taxable wages from the Taxation Summary History table (F06136). The table codes represent amounts that you add to the taxable wage amounts. Do not use the table codes to accumulate the taxable wages that you ultimately report on the year-end form.

The 499R-2 form contains special boxes for reporting amounts. To identify these amounts, JD Edwards World reserves the following special handling codes:

-

WAG (Wages)

-

COD (CODA Amounts)

-

COM (Commission Amounts)

-

CON (Concession Amounts)

-

REM (Reimbursed Expenses)

-

RET (Retirement)

-

EHC (Employer Health Coverage)

-

CCS (Charitable Contributions)

Do not add pay types back to boxes 1, 3, 5, 16, and 18. The system adds wages to these boxes using the Taxation Summary History table (F06136).

In addition, you no longer need to special handle amounts to the Deferred Compensation table for 2024 for W-3 and W-2 Electronic Filing Tables. The system calculates deferred compensation amounts using employee detail history records. However, the box remains on the Assign Spec. Handlng Code Tables screen for the 2024 tax year so that you can make corrections for previous years.

The Fringe Benefit box no longer exists on the W-2 form. However, the box remains on the Assign Spec. Hndlng Code Tables screen so that you can make corrections for years prior to 2001, if necessary.

To assign special handling code tables

Navigation

From Year End Processing (G07247), choose Build W-2/1099 Workfiles

-

On the first Build W-2/1099 Workfiles screen, complete the steps for setting up your year-end workfile.

-

On the second Build W-2/1099 Workfiles screen, choose Special Handling Code Review (F15).

-

On Assign Spec Hndlng Code Tables, complete any of the following fields:

-

Wages, Tips, & Other Comp (Box 1)

-

Social Security Additions (Box 3)

-

Medicare Additions (Box 5)

-

Amounts Added to (Box 10)

-

(Box 11)

-

(Box 12)

-

(Box 14)

-

State Wages Amounts (Box 16)

-

Local City Amounts (Box 18)

-

Local County Amounts (Box 18)

-

School Dist. Wage Additions (Box 18)

-

Tier I Additions

-

Tier II Additions

-

Amounts Reported in Box 19

-

Nonqualified Plan Income

-

Fringe Benefit (TIB-4)

-

Deferred Comp (TIB-4)

-

Nonqualified Non 457

-

Dependent Care

-

Group Term Life

-

3rd Party Income Tax

-

-

To access additional special handling codes, choose Additional Codes (F5).

-

On Assign Spec Handling Code Tables, complete any of the following fields and click Enter:

-

Pension Amount

-

Gross Distribution

-

Employee Contributions

-

1099 Rent Amounts/499 Health Coverage

-

1099 Royalties/499 Charitable Cont

-

1099 Rent Amounts

-

1099 Royalties

-

1099 Excess Golden Parachute

-

Prizes & Awards

-

Non-Employee Compensation

-

Medical & Health Care

-

Substitute Payments

-

Allocated Tips

-

Wages

-

Commissions

-

Concession

-

Reimbursed Expenses

-

Retirement Funds

-

CODA Fund

-

New Jersey Family Leave

-

|

Field |

Explanation |

|---|---|

|

Wages, Tips & Other Comp (Box 1) |

A code that identifies a table of pay, deduction, and benefit types that are added to Wages, Tips and Other Compensation (Box 1). |

|

Social Security Additions (Box 3) |

A code that identifies a table of pay, deduction, and benefit types that are added to Social Security Wages (Box 3). |

|

Medicare Additions (Box 5) |

A code that identifies a table of pay, deduction and benefit types that are added to Medicare Wages and Tips (Box 5). |

|

Amounts Added to (Box 10) |

A code that identifies a table of pay, deduction and benefit types that are used to report Dependent Care Benefits (Box 10). |

|

(Box 11) |

A code that identifies a table of pay, deduction and benefit types that are used to report Nonqualified Plans (Box 11). |

|

(Box 12) |

A code that identifies a table of pay, deduction and benefit types that are used to report in Box 12 (See Instructions for Form W-2). |

|

(Box 14) |

A code that identifies a table of pay, deduction and benefit types that are used to report in Box 14 (Other). |

|

State Wages Amounts (Box 16) |

A code that identifies a table of pay, deduction and benefit types that are added to State Wages, Tips, etc. (Box 16). |

|

Local City Amounts (Box 18) |

A code that identifies a table of pay, deduction and benefit types that are added to Local Wages, Tips, etc. (Box 18). |

|

Local County Amounts (Box 18) |

A code that identifies a table of pay deduction, and benefit types that are added to Local County Wages, Tips, etc. (Box 18). |

|

School Dist. Wage Additions (Box 18) |

A code that identifies a table of pay, deduction, and benefit types that are used in the calculation of various W-2 and 1099 amounts added to Box 18. |

|

Tier I Additions |

A code that identifies a table of pay, deduction and benefit types that are added to Tier I Wages. |

|

Tier II Additions |

A code that identifies a table of pay, deduction and benefit types that are added to Tier II Wages. |

|

Amounts Reported in Box 19 |

A code that identifies a table of pay, deduction, and benefit types that are added to Local Income Tax (Box 19). |

|

Nonqualified Plan Income |

A code that identifies a table of pay, deduction, and benefit types that are used in reporting Nonqualified Plan Income on W-2 Magnetic Media. |

|

Fringe Benefit. (TIB-4 ONLY) |

This code identifies a table of pay, deduction and benefit types which are used in reporting Fringe Benefits on W-2 Magnetic Media. |

|

Deferred Comp. (TIB-4 ONLY) |

This code identifies a table of pay, deduction and benefit types which are used in reporting Deferred Compensation on W-2 Magnetic Media. |

|

Non Qualified Non 457 |

This code identifies a table of pay, deduction and benefit types which are used in reporting Nonqualified Non 457 on W-2 Magnetic Media. |

|

Dependent Care |

This code identifies a table of pay, deduction and benefit types which are used in reporting Dependent Care Benefits on W-2 Magnetic Media. |

|

Group Term Life |

This code identifies a table of pay, deduction and benefit types which are used in reporting Group Term Life on W-2 Magnetic Media. |

|

3rd Party Income Tax |

A code that identifies a table of pay, deduction and benefit types that are used in reporting 3rd Party Sick Income Tax Paid on the W-3 Summary Form. |

|

Pension Amount |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Pension Amounts on the 1099-R forms. |

|

Gross Distribution |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Gross Distributions on the 1099-R Form. |

|

Employee Contributions |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Employee Contributions on the 1099-R Form. |

|

1099 Rent Amounts |

A code that identifies a table of pay, deduction, and benefit types that are used in reporting Rents on the 1099-MISC Form. This is also used for 499 R-2 Cost of Employer Health Coverage. |

|

1099 Royalties |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Royalties on the 1099-MISC Form. This is also used for 499 R-2 Charitable Contributions. |

|

1099 Excess Golden Parachute |

A code that identifies a table of pay, deduction, and benefit types that are used in reporting special handling on the year-end forms. |

|

Prizes & Awards |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Prizes and Awards on the 1099-MISC Form. |

|

Non-Employee Compensation |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Non-Employee Compensation on the 1099-NEC Form. |

|

Medical & Health Care |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Medical and Health Payments on the 1099-MISC Form. |

|

Substitute Payments |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Substitute Payments on the 1099-MISC Form. |

|

Allocated Tips |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Allocated Tips on the W-2 Form. |

|

Wages |

A code that identifies a table of pay, deduction, and benefit types that are used in reporting wages on the 499R-2 Form. |

|

Commissions |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Commissions on the 499R-2 Form. |

|

Concession |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Concessions on the 499R-2 Form. |

|

Reimbursed Expenses |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Reimbursed Expenses on the 499R-2 Form. |

|

Retirement Funds |

A code that identifies a table of pay, deduction and benefit types that are used in reporting Retirement Funds on the 499R-2 Form. |

|

CODA Fund |

A code that identifies a table of pay, deduction and benefit types that are used in reporting CODA Plans on the 499R-2 Form. |

|

New Jersey Family Leave |

A code that identifies a table of pay, deduction, and benefit types that are used in the calculation of various W-2 and 1099 amounts. |