Entering Third-Party Sick Pay Information

You enter third-party sick pay when an employee receives pay from an outside source that requires a separate W-2. For example, suppose that an employee's medical condition requires a short-term disability leave of two months. The disability insurance enables the employee to receive a partial salary for the leave period. You report the amount that the employee receives from the insurance company as third-party sick pay.

You must also enter third-party sick pay to meet the requirements of the SSA and the Internal Revenue Service (IRS). Both agencies require employers to report any federal income tax withheld by a third-party payer. Entering third-party sick pay information includes the following tasks:

Entering third-party sick pay records

Entering third-party sick pay for regular W-2 forms

Entering third-party sick pay for electronic filing reporting

Entering Third-Party Sick Pay Records

When you enter third-party sick pay information, you update or create tax history records to print this information on a separate W-2 form. When you enter this information, the system directly updates the Taxation Summary History table (F06136) for history type 1 (Third Party Sick Pay).

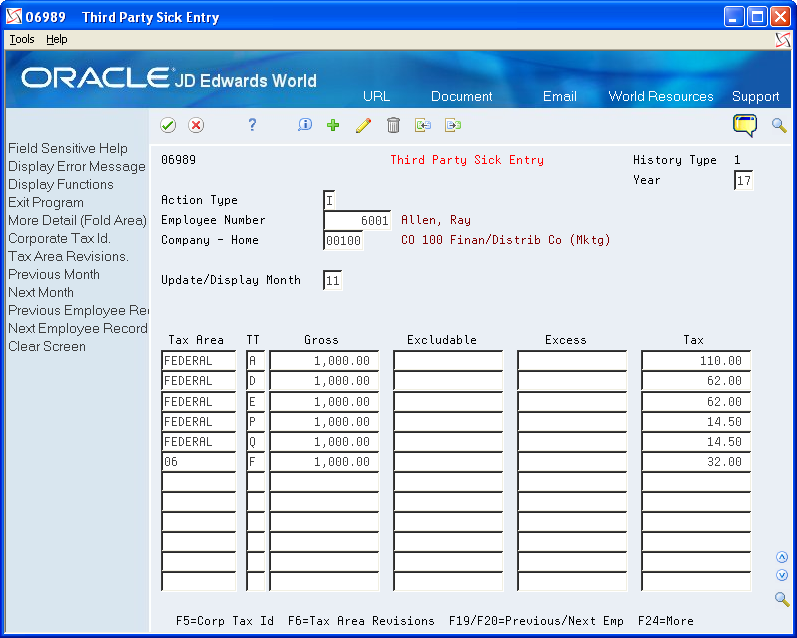

On the Third Party Sick Entry screen, enter the amounts by employee and by tax type and tax area. The SSA requires employers to report federal income tax withheld by a third-party payer. The system automatically reports Federal A tax amounts that you enter through the Third Party Sick Entry program on electronic filing.

The Third-Party Sick Entry program does not create journal entries. It updates history directly. You must enter any journal entries through the General Accounting system.

To enter third-party sick pay records

Navigation

From Integrity, Rollover & Repost (G072471), choose Third Party Sick Entry

On Third Party Sick Entry, complete the following fields:

Year

Employee Number

Company - Home

Update/Display Month

Tax Area

TT

Gross

Excludable

Excess

Tax

Field |

Explanation |

|---|---|

Update/Display Month |

The number of the month in which the history files were updated. |

Tax Area |

A code that identifies a geographical location and the tax authorities for the employee's worksite. Authorities include both employee and employer statutory requirements. In the Payroll Tax Calculation system payroll-number tax terminology, this code is synonymous with GeoCode. Refer to Payroll Tax Calculation System's Master GeoCode List for valid codes for your locations. |

TT |

A user defined code (07/TT) that identifies the type of payroll tax being processed. Refer to the associated user defined code records for the current descriptions of these codes. The values and meanings associated with this user defined code are predefined by JD Edwards World. You should not alter the values and meanings. Screen-specific information Refer to the user defined codes in table 07/TX. |

Gross |

This field represents the Gross Amount of the transaction. Depending on the type of transaction, the specific meaning will be as follows: A – Pay Types - The total amount of earnings related to the type of pay. B – D/B/A Types - The total amount of the deduction, benefit, or accrual. C – Payroll Taxes - The total amount of gross wages, before exclusions or paid-in-excess. The amount in this field represents the first month of the payroll year or calendar year, depending on the inquiry screen being used. |

Excludable |

For months 01 - 12, this is the amount of gross pay excluded from the tax calculation. This would include 401(k) deductions and so on. |

Excess |

The amount of wages earned, but in excess of the annual limit, for tax calculation. |

Tax |

For months 01 - 12, this is the amount of tax calculated. |

Entering Third-Party Sick Pay for Regular W-2 Forms

To include third-party sick pay in regular wages and have it print on the employee's regular W-2, you process the sick pay through interim checks. You can create a separate pay type for this sick pay for tracking purposes; however, a separate pay type is not necessary for W-2 reporting purposes.

You might not want to calculate the employer-paid portion of the taxes from these sick pay entries if your third-party administrator has already withheld these taxes. To prevent the system from calculating these taxes, enter tax overrides on the interim check for the employer-paid taxes withheld by your third-party administrator.

You must report the taxes withheld by your third party administrator separately to the SSA via electronic file. You must perform additional setup prior to entering third-party sick pay using interim checks in order to report this information correctly via the electronic file.

If you process sick pay through interim checks and then choose to report third-party sick pay on a separate W-2, you must void the interim checks for third-party sick pay before entering information in the Third Party Sick Entry screen.

If your third-party administrator provides only taxable wage amounts, you can enter the actual taxable wage amount in the Gross field on the Third Party Sick Entry screen. If you use a taxable wage, leave the Excludable and Excess fields blank because the system subtracts these amounts from the gross wage to determine the taxable wage for W-2 reporting.

Entering Third-Party Sick Pay for Electronic Filing Reporting for additional information

Entering Third-Party Sick Pay for Electronic Filing Reporting

You must report third-party sick pay taxes separately to the SSA via electronic file. When you enter third-party sick pay using the Third Party Sick Pay Entry screen, the system automatically reports this information correctly on EFW2 without the need for you to perform any additional setup.

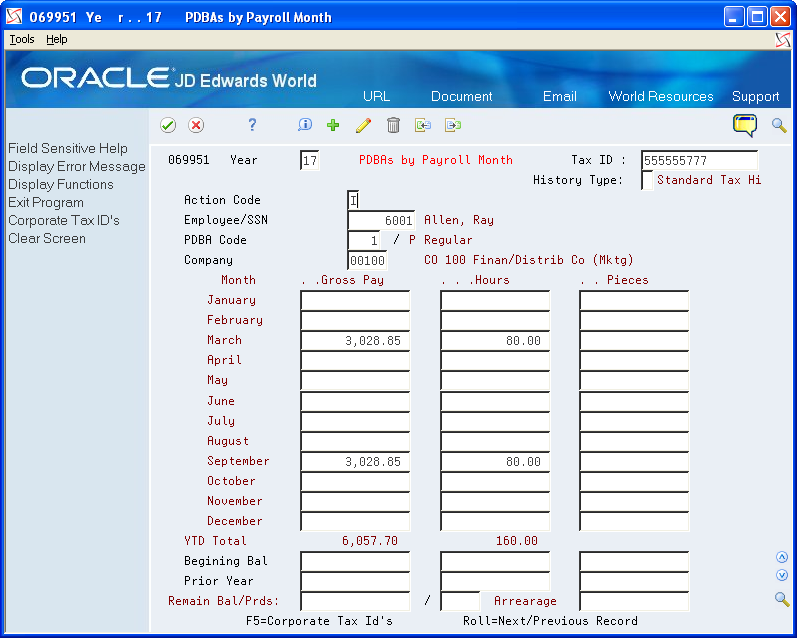

If you process interim checks to report third-party sick pay, you must perform special setup so that those third-party sick pay amounts are correct in electronic file. To meet SSA electronic filing reporting requirements for third-party sick pay that you enter using interim checks, set up a model PDBA for reporting purposes only. Then create a model record in the Payroll Month PDBA Summary History table (F06146). Next, for an employee who is already in your year-end workfile, enter the total tax for the third-party sick pay in one of the months of the F06146 table. You will receive these amounts from your third-party provider.

Entering third-party sick pay for electronic filing reporting includes the following tasks:

Set up a model PDBA for reporting purposes

Enter the federal income tax total for the company

Create special handling code tables that are specific to third-party sick pay

Attach the total to a special handling code table

To set up a model PDBA for reporting purposes

Navigation

From Pay/Deductions/Benefits Setup (G0742), choose Pay Type Setup

On Pay Type Setup, complete only the following fields and click Add:

Pay Type

Paystub Text

Pay Type Multiplier

To enter the federal income tax total for the company

Navigation

From Data Integrity & Global Updates (G0731), choose PDBAs by Payroll Month

On PDBAs by Payroll Month, complete the following fields to add the federal income tax amount to an employee record for the year-end workfile:

Year

Tax ID

Employee/SSN

Company

Complete the following field with the model PDBA code to report the third-party sick pay:

PDBA Code

Complete the following field with the company total amount of federal income tax and click Add.

Gross Pay

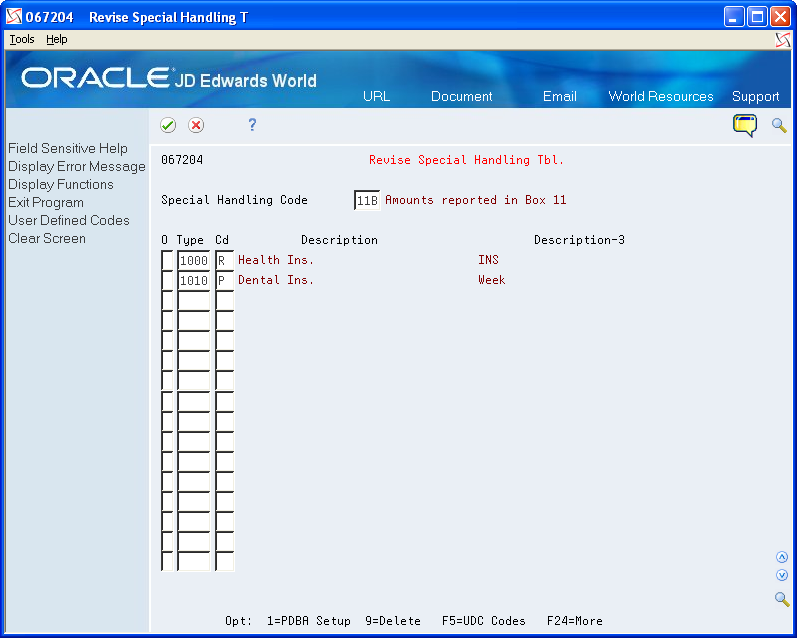

To create special handling code tables that are specific to third-party sick pay

Navigation

From W-2/1099 Setup (G072472), choose Revise Special Handling Tbl

On Revise Special Handling Tbl., complete the following fields:

Special Handling Code

Type

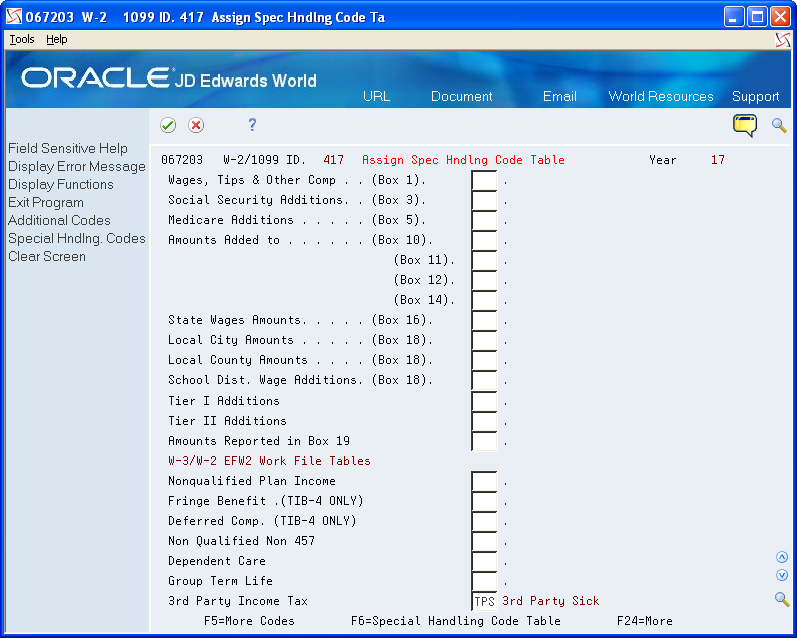

To attach the total to a special handling code table

Navigation

From W-2/1099 Setup (G072472), choose Assign Special Handling Code Tbl

On the first Assign Spec Hndlng Code Table screen, complete the following field and click Enter:

W-2/1099 ID

Click Enter to continue.

On the third Assign Spec Hndlng Code Table screen, complete the following field and click Enter:

3rd Party Income Tax

Field |

Explanation |

|---|---|

3rd Party Income Tax |

A code that identifies a table of pay, deduction, and benefit types that are used in reporting 3rd Party Sick Income Tax Paid on the W-3 Summary Form. |