Entering Additional Year-End Form Information

You enter additional year-end form information to add PDBA amounts to the wage and tax information that automatically prints in various boxes on the W-2 form. The wage and tax information comes from the Taxation Summary History table (F06136) while the additional PDBA amounts come from the Payroll Month PDBA Summary History table (F06146).

You create special handling code tables to group PDBA codes that you must report for your employees in a specific box on the W-2 form.

You can add special handling codes to an existing table if you need to include additional PDBAs.

The Payroll system reserves the following special handling codes for year-end purposes for W-2 tables.

Amounts added to box 1 (01B)

Amounts added to box 3 (03B)

Amounts added to box 5 (05B)

Amounts added to box 10 (10B)

Amounts added to box 11 (11B)

Amounts added to box 12 (12B)

Amounts added to box 14 (14B)

Amounts added to box 16 (16B)

Amounts added to box 18 (18B)

Allocated tips (ALC)

Amounts added to box 18, County Wages (COU)

Amounts added to box 18, City Wages (LOC)

School district taxes (SCH)

School district wages (SCW)

New Jersey Family Leave (FLI)

For W-3/electronic filing, the Payroll system reserves the following:

Fringe benefit (FRB) (TIB-4 only)

Nonqualified plan amounts (NQP)

Deferred compensation (DFC) (TIB-4 only)

Nonqualified non-457 (NQ4)

Dependent care (DEP)

Group term life (GTL)

For 499R-2 tables, the Payroll system reserves the following:

Wages (WAG)

CODA plans (COD)

Commissions (COM)

Concessions (CON)

Reimbursed expense (REM)

Retirement (RET)

Employer Health Coverage (EHC)

Charitable Contributions (CCS)

For 1099 forms, the Payroll system reserves the following:

Employee contributions for the 1099-R (ECT)

Gross distributions for the 1099-R (GRD)

Medical and health care for the 1099-MISC (MHC)

Nonemployee compensation for the 1099-NEC (NEC)

Pension pay for the 1099-R (PNS)

Other income for the 1099-MISC (OTH)

Rents for the 1099-MISC (RTS)

Royalty payments for the 1099-MISC (RYT)

Substitute payments for the 1099-MISC (SPY)

Excess golden parachute payments for the 1099-MISC (EPP)

Entering additional year-end form information includes the following tasks:

Creating special handling code tables

Adding special handling codes to an existing table

Creating Special Handling Code Tables

You create special handling code tables to group balances from PDBA codes that you must add to a specific box on the W-2 form.

When you create special handling code tables for boxes 1, 3, 5, 16, and 18, do not include pay types. The system automatically adds wages to those boxes when it processes the workfile build. If you include pay types in the special handling codes tables for those boxes, double gross wages print on the W-2.

For processing 1099 forms, you must enter all of the pay types in the special handling table for gross distributions. You must enter these to generate a form for 1099-R forms and electronic filing purposes for 1099-MISC forms.

On the 1099-R form, you report any amount that is a federal wage in the Federal A record of the Taxation Summary History table (F06136) in box 2a as long as the gross distribution is taxable. If no federal wages exist, you report the amount of gross distribution, as set up in special handling from box 1, in box 2a if the gross distribution is an IRA. The system also derives the federal tax withheld amount from the F06136 table.

To create special handling code tables

Navigation

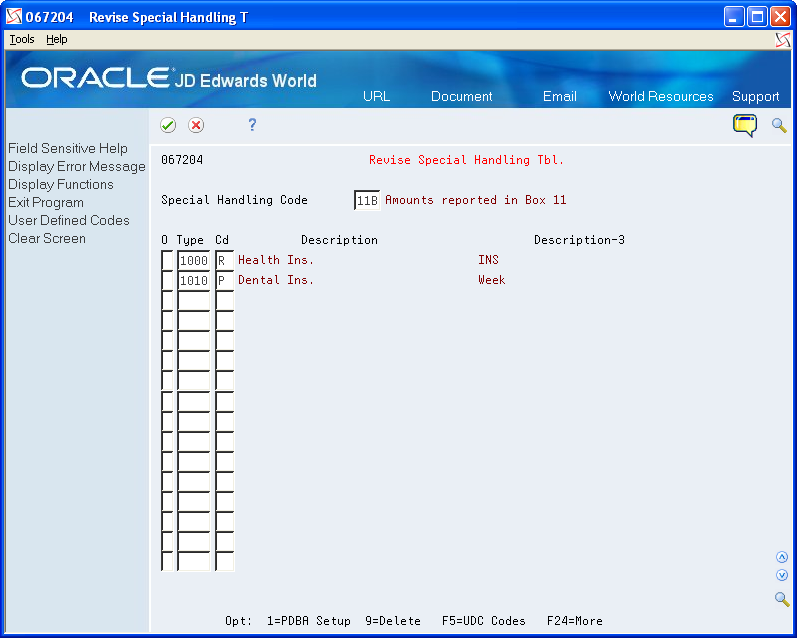

From W-2/1099 Setup (G072472), choose Revise Special Handling Tbl

On Revise Special Handling Tbl, complete the following field:

Special Handling Code

Complete the following field with a pay type, deduction, or benefit number:

Type (PDBA code)

Repeat step 2 until you finish entering PDBAs for this special handling code table.

Field |

Explanation |

|---|---|

Type |

The number and description of the PDBA that you want the system to use to calculate the corresponding PDBA. This number is the ending number in the range that is the basis of the calculation. Screen-specific information Enter the number and description of the PDBA that you want the system to calculate for the specified special handling code table. |

Adding Special Handling Codes to an Existing Table

You can add special handling codes to an existing table if you need to include additional PDBAs.

To add special handling codes to an existing table

Navigation

From W-2/1099 Setup (G072472), choose Revise Special Handling Tbl

On Revise Special Handling Tbl., choose User Defined Codes (F5).

User Defined Code Revisions displays with UDC 07/IP (Basis Table Codes).

On User Defined Code Revisions, add the necessary codes to the table.