Printing Audit Reports

After you create the workfile, but before you print year-end forms, carefully verify the amounts on the audit reports. You can run audit reports as many times as necessary without affecting the workfiles that the system creates in the W-2 workfile build process. Additionally, you can review the amounts online using the W-2/1099 Review program on the Year-End Processing menu.

The first time that you access the Audit Report version screen, the system automatically displays all of the available DREAM Writer versions. The next time you access this screen; the system displays only the versions that you have run previously. By choosing the Reload all available Reports for select (F10), you can redisplay all versions. To identify the specific versions to process, you can enter the version number or choose Field Sensitive Help (F1) in the Version field to review the valid versions. To create a new version of the report, choose Field Sensitive Help (F1) in the Version field, and then choose Call DREAM Writer from the Functions menu to access the DREAM Writer version list screen.

For W-2 purposes only, you can enter more than one version number for a form ID. This action allows you to submit different versions of the same report to process simultaneously. For example, you can run version 001 and 002 of DREAM Writer form P06740. When identifying your versions for the first time, enter version numbers for only those forms that you want the system to process. The system does not add remaining forms to the W-2 Audit Report table (F06723).

After you print audit reports, compare them with their corresponding history reports. Many audit reports have summary and detail versions. You must choose the appropriate report from the versions list.

You must use the Audit Reports program (P06721) to print audit reports. You cannot print audit reports from the W-2 Reports & Forms Setup menu (G072473), but you can choose the Versions List option on Audit Reports program to access a versions list for each report. Use the W-2/1099 Setup menu (G072472) or the Additional Year-End Reports & Forms menu (G072474) to set up versions of these reports for your environment.

Printing audit reports is similar to using the Reports Only menu selection in the payroll cycle.

Each audit report contains different information and displays totals at company levels, as well as all information that is in the year-end workfile. You cannot change the data sequence for any of the audit reports.

The following includes the type of totals that each report includes:

Audit Report |

Displays totals |

Displays grand totals |

|---|---|---|

W-2 Summary Report (P06746) |

YES |

YES |

Tax History/W-2 Workfile Integrity Report (P06790) |

NO |

NO |

W-2 Federal Detail Report (P06740A) |

YES |

YES |

State/Local Detail Report (P06741A) |

YES |

YES |

W-2 Special Handling Detail Report (P067421) |

YES |

YES |

Employee Form Count Detail Report (P06754) |

YES |

YES |

W-2 Federal Control Detail Report (P06740) |

YES |

YES |

W-2 Federal Adjusted Wage Detail Report (P06743) |

YES |

NO |

W-2 State/Local Adjusted Wage Detail Report (P06744) |

YES |

NO |

W-2 Restaurant Control Report (P06749) |

YES |

YES |

W-2 Benefit Statement Report (P06750) |

YES |

NO |

W-2 Box 13 Flag Audit Report (P06776) |

NO |

NO |

W-2 Summary Report (P06746) |

YES |

YES |

To print audit reports

Navigation

From Year End Processing (G07247), choose Audit Reports

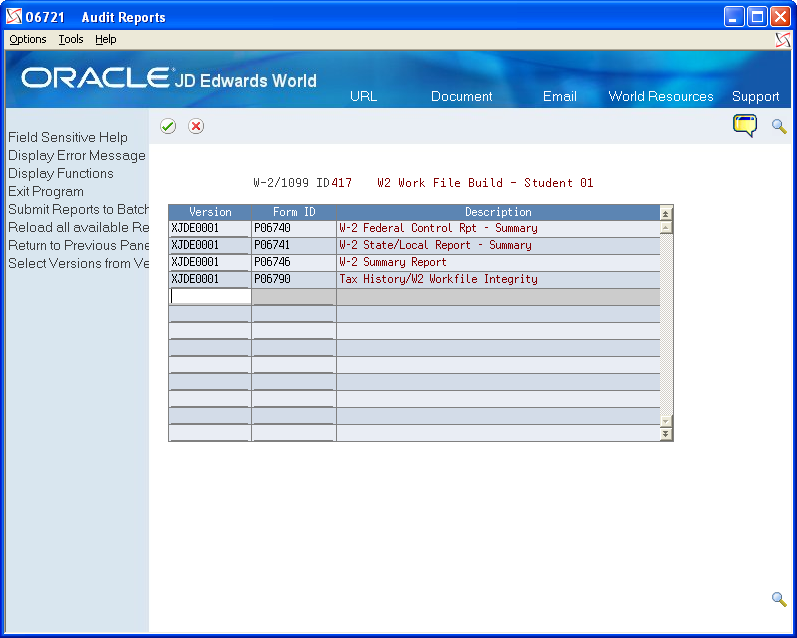

On the first Audit Reports screen, complete the W-2/1099 ID field and then click Enter twice.

The second Audit Reports screen displays.

On the second Audit Reports screen, enter a valid DREAM Writer version in the Version field for each report that you want to print

Click Enter to load the reports.

If you do not click Enter before submitting, the system does not print your reports.

The system verifies each version and displays the report name in the Description field.

Choose Submit (F6) to print the reports.