Setting Up AAIs for the G/L Method

The G/L method uses the PXxxxx AAIs to retrieve the G/L account number ranges to use to accumulate the amounts for specific boxes on each 1099 form. In most cases, you set up one account range (two AAIs) to update one box on the form; however, if necessary, you can also set up AAIs to specify the same account in multiple ranges so that you can update more than one box for the same account range.

For example, the amount in Type of Return (TOR) 12 (Qualified dividends) must be included in the amount for TOR 11 (Total Ordinary dividends). When you use the same account within AAI range for items PX11xx and PX12xx, the system creates two records within the 1099 G/L Workfile (F045141) with the TOR for the first AAI and the TOR for the second AAI.

The following table consists of the six characters you use to set up AAI item PXxxxx:

Character |

Description |

|---|---|

1 and 2 |

Defines the AAI as a 1099 item. This is always PX. |

3 |

Defines the type of 1099 form. The system uses A, 1, 6 and B in the third position to identify the forms as follows:

|

4 |

Defines a box on the 1099 form. For example, PXA1xx is associated with box 1 on the 1099-MISC form; PXA2xx is associated with box 2, and so on. |

5 and 6 |

Defines the beginning and end of a range of object accounts. You use pairs of AAI items for each range. Odd numbers indicate the beginning of a range and even numbers indicate the end of a range. For example, PXA101 defines the beginning of the first range of accounts to use for box 1 of the 1099-MISC form, and PXA102 defines the end of the range of accounts to use for box 1 of the 1099-MISC form. |

Observe the following guidelines when you set up object account ranges for AAI item PXxxxx:

Set up AAIs for company 00000 only.

AAIs for PX ranges are not company-specific; therefore, your chart of accounts must be consistent among all companies you involve in the 1099 process.

Use odd numbers to specify the beginning of a range and even numbers to specify the end of a range (for example, 01-02, 03-04, and so on).

Ensure you do not specify a business unit; the system disregards it during processing.

Ensure you do not leave the object account blank.

The system does not continue reading subsequent AAIs if it encounters an AAI without an object account.

Enter both the object and subsidiary for the end of the range.

Use 99999999 for the subsidiary to ensure that you include all subsidiary accounts in the range of object accounts.

Ensure you do not overlap ranges.

For example, do not set up 01-02 and 02-03.

Ensure you do not skip ranges.

For example, do not use 01-02 and 05-06 without also using 03-04.

Delete any 1099 ranges not in use.

Ensure you do not specify object accounts for cash accounts, received not vouchered accounts, A/P trade accounts, or A/R trade accounts.

The system stores AAIs in the Automatic Accounting Instructions Master file (F0012).

Navigation

From Annual 1099 Setup (G0442), choose Automatic Accounting Instr.

Setting Up Additional PX AAI Ranges

The standard format of the PX AAI allows only two characters to define account ranges and, therefore, provides for only 49 ranges. If you need more than 49 ranges for a particular form/box combination, you can set up an additional 1-character, alphanumeric code in the UDC table 04/PX (1099 PX AAI Additional Ranges) and map it to an existing 1099 form type to create additional AAI ranges. You designate which 1099 form the code represents by specifying it in the first character in the Description field:

A (1099-MISC)

1 (1099-DIV)

6 (1099-INT)

B (1099-NEC)

For example, if you need more than 49 account ranges for the 1099-MISC form, add a code, for example, B to the UDC 04/PX table and enter A in the first character of the Description field.

After you set up the code in 04/PX UDC, add the new PX AAIs for the new values, such as PXCxxx. Create additional PX AAI ranges in the same manner as you do for standard PX AAIs, except that there is a new value for the third character. For example, C1 equals A1; C2 equals A2, and so on.

If you require more than 98 account ranges, set up another code in UDC 04/PX to provide you with 49 additional ranges. For example, set up code C and map it to 1099 form A.

Setting up codes in UDC 04/PX does not create additional 1099 form types; it merely provides mappings to the standard 1099 form types (A, 1, 6, and B) to accommodate additional PX AAI account ranges.

The system includes the amounts for all AAI ranges for each 1099 form and box when you run the Create 1099 Audit File Build program (P045144). For example, if you set up codes B and C and map them to 1099 form A, the system includes F0911 records for the range of accounts you specify in PXAx, PXBx, and PXCx in the workfile.

When you run the Build G/L Workfile program (P04514), the system summarizes the amounts from the account ranges in the standard and user-defined PX AAIs, and then updates the 1099 G/L Workfile (F045141) accordingly for the box and form specified. For example, if you map the standard and user-defined ranges for form A and box 1, such as PXA1xx, PXB1xx, PXC1xx, the system sums the amounts for the type of return code A1.

Examples: AAIs for the G/L Method

Review the following table for examples of PXxxxx AAI ranges.

AAI Item Range |

Explanation of Characters in the AAI Item |

|---|---|

PXA101 - PXA102 |

|

PXA103 - PXA104 |

|

PXA201 - PXA202 |

|

PX1101 - PX1102 |

|

PX1B01 - PX1B02 |

|

PX6101 - PX6102 |

|

PXB101 - PXB102 |

|

PXB201 - PXB202 |

|

PXB401 - PXB402 |

|

Relationship between AAIs and Boxes on the 1099 Forms

When you use the G/L Method for 1099 reporting, the amount that prints on 1099 returns depends on the form/box information that is in PXxxxx AAIs. The A/P Ledger Method does not use AAIs.

The following sample forms illustrate the relationship between the form/box specified by the AAI and the boxes on each of the 1099 forms. These are for informational purposes only. Do not reproduce them for filing.

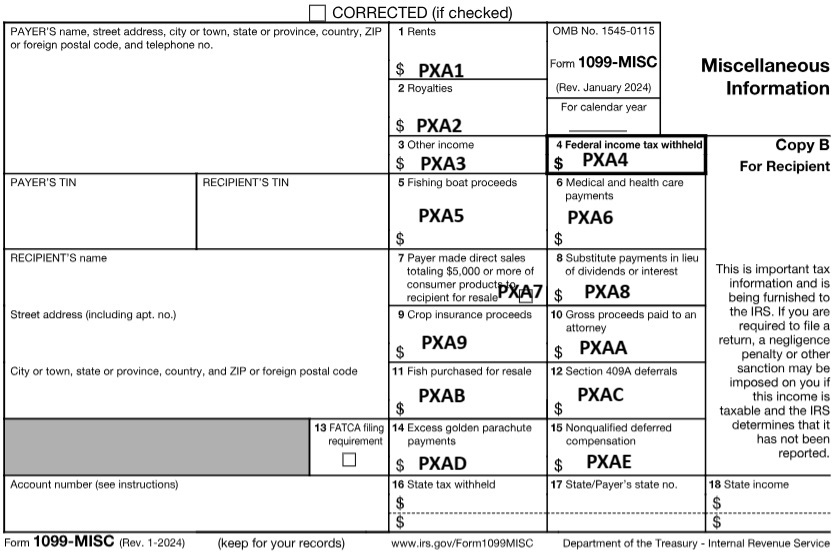

AAIs for Miscellaneous Income Form(Updated for 1099)

The system uses the PXA AAI ranges to print information in the corresponding boxes on this form.

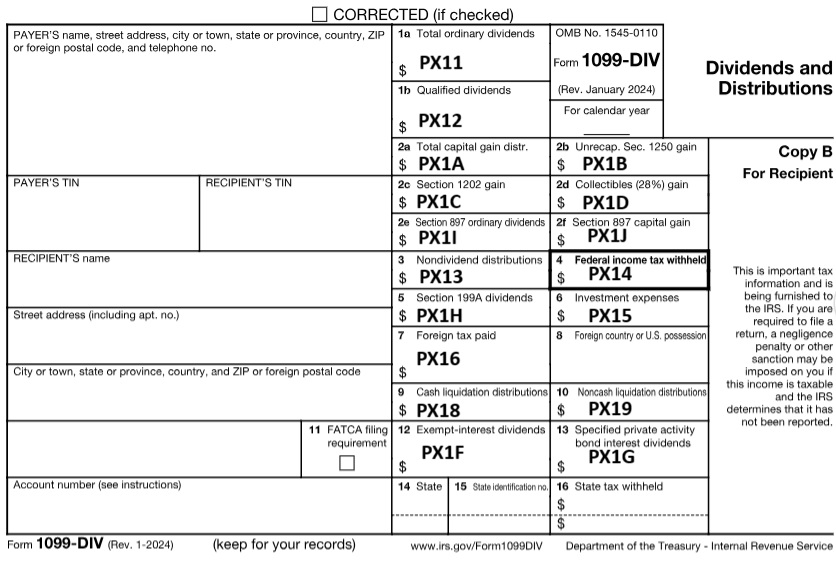

AAIs for Dividends and Distributions Form

The system uses the PX1 AAI ranges to print information in the corresponding boxes on this form.

(Updated for 1099) Box 8 on the Dividends and Distributions form is not an amount field. The system completes Box 8 with the foreign country associated with Box 7 when:

-

The address book record for the payee has an F in the Payables Y/N field.

-

The address book record for the payee has the country specified.

-

The Print Country (1/0) field in the Country Constants program (P0070) is set to 1.

-

The Data Specifics processing option is set to 1 in the Write Media program (P04515).

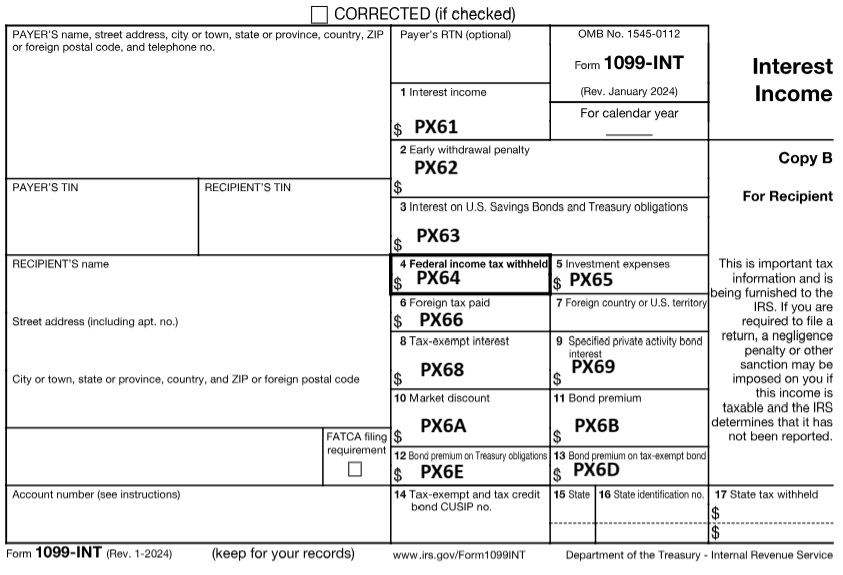

AAIs for Interest Income Form

The system uses the PX6 AAI ranges to print information in the corresponding boxes on this form.

Box 7 on the Interest Income form is not an amount field. The system completes Box 7 with the foreign country associated with Box 6 when:

-

The address book record for the payee has an F in the Payables Y/N field.

-

The address book record for the payee has the country specified.

-

The Print Country (1/0) field in the Country Constants program (P0070) is set to 1.

-

The Data Specifics processing option is set to 1 in the Write Media program (P04515).

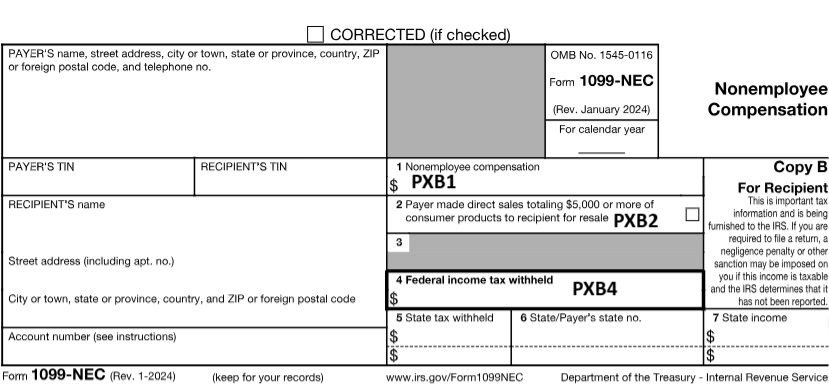

AAIs for Nonemployee Compensation Form

The system uses the PXB AAI ranges to print information in the corresponding boxes on this form.