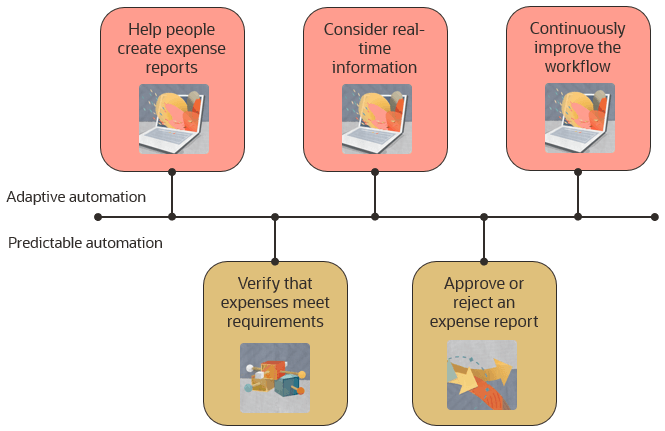

Example: Predictable and Adaptive Automation

A company must reimburse their employees for their business expenses. Understand how this process works when employees, predictable automation, and adaptive automation complete the tasks.

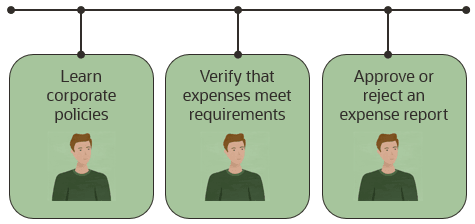

No Automation

When you process expense reports without automation, employees complete all tasks themselves.

-

The finance team acquires detailed knowledge about the company's policies for expenses, including region-specific and level-specific guidelines and requirements for expense reports.

-

For each expense report, a team member verifies that receipts are attached, the values match, and the expenses meet the policies.

-

Depending on whether the expenses meet the requirements, the employee approves or rejects the expense report.

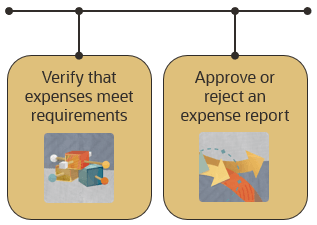

Predictable Automation

Predictable automation allows you to reliably automate much of the work of processing expense reports.

-

Every time an employee files an expense report, an integration runs and verifies the information that a human previously checked.

-

The integration passes the information to a decision, which evaluates the information.

-

Depending on the outcome, the decision approves or rejects the expense report.

Adaptive Automation

If your predictable automation solution is successfully automating the processing of expense reports, you don't need to introduce adaptive automation. However, if you expand your goals, adaptive automation might be able to help.

For example, if you need to accommodate any of the following requirements, you might want to introduce adaptive automation:

-

Fix mistakes before they happen: Allow employees who are submitting expenses to interact with agentic AI so they can ask questions and receive advice about the expenses they're submitting.

-

Detect patterns and update policies: Use agentic AI to monitor historical and real-time expense data and provide recommendations for optimizing expense policies.

-

Reduce manual approvals: When predictable automation flags expense reports for employee review, bottlenecks can occur. Agentic AI can complete this review work by analyzing historical decisions, collecting additional information, and documenting its reasoning along with a decision or recommendation.

-

Consider real-time information: Predictable automation struggles to accommodate real-world events, such as travel disruptions and currency fluctuations. Agentic AI can incorporate external information and adapt to real-time circumstances, such as approving higher expenses during emergencies.

-

Continuously improve the workflow: Improving predictable automation can be time consuming, but agentic AI can adapt in real time. Agentic AI can solicit feedback from employees after each transaction and use this input to improve user experiences and refine policy enforcement.

For example, consider the following workflow, which includes adaptive and predictable automation.