Incorporate 3D-Secure support

The generic payment gateway’s credit card payment method includes optional support for 3D-Secure for shopper verification.

If 3D-Secure is required, then before the merchant authorizes a payment, the shopper is redirected to a page provided by the card issuer for authentication. If the shopper authenticates successfully, the card issuer and merchant then determine whether to authorize the transaction.

Note that whether 3D-Secure is required depends on the merchant and the card issuer, and is not controlled by Oracle Commerce. The gateway described in this section invokes 3D-Secure only when it is required, and can process non-3D-Secure payments as well.

Understand 3D-Secure support

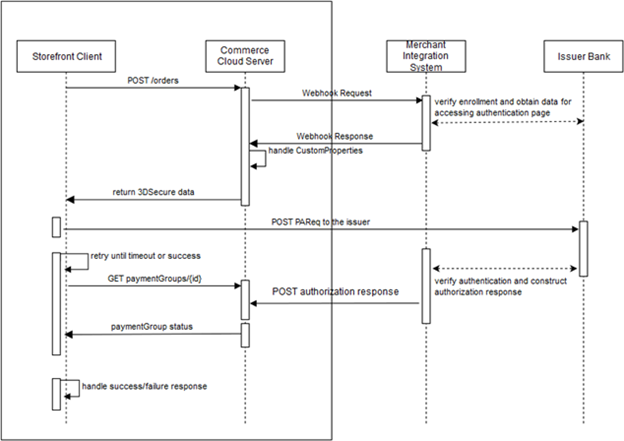

The following diagram illustrates how credit card payments are handled in a generic payment gateway integration that implements 3D-Secure support:

The payment processing involves the following steps:

- When the shopper clicks Place Order, the storefront invokes the

createOrderendpoint of the Store API. The endpoint sends the order information to the Commerce server. - When the server receives the order submission, it invokes the Generic Payment webhook, which posts an authorization request to the merchant.

- The merchant and the card issuer communicate to determine whether 3D-Secure is required, and whether the shopper is enrolled in the card issuer’s 3D-Secure program. If 3D-Secure is required and the shopper is enrolled, the card issuer sends an ACS (access control server) URL to the merchant.

- The merchant sends the webhook response to the Commerce server. If 3D-Secure is required for the transaction, the merchant includes the

response code

10000 (PAYER_AUTH_REQUIRED). The merchant supplies the ACS URL and other data needed for invoking the 3D-Secure authentication page on the card issuer’s website. - The Commerce server sends the data it receives in the webhook response, including the 3D-Secure

data, to the storefront in the

createOrderendpoint response. TheuiInterventionproperty for the payment group is set totruein the response to indicate that 3D-Secure authentication is required. - The storefront posts a payment request to the card issuer’s website to invoke the 3D-Secure authentication page. The request includes data returned from the merchant in the webhook response.

- The card issuer displays the authentication page.

- The shopper fills out the authentication form and submits it.

- The card issuer and the merchant communicate to determine if the shopper authenticated successfully, and if so, whether to authorize the transaction.

- The merchant constructs an authorization response and sends it to the Commerce server using the

POST /ccstore/v1/payment/genericCardResponsesendpoint. - Meanwhile, after posting the payment request to the issuer’s website, the

storefront begins polling the Commerce server using the

getPaymentGroupendpoint to detect when the server receives the authorization response from the merchant. - When the Commerce server receives the authorization response from the merchant, the server includes the

data from the merchant in the

getPaymentGroupendpoint response it sends to the storefront.

These steps are described in greater detail below.

Note: 3D-Secure is not applicable to payment requests that originate from the Oracle Commerce Agent Console. If the value of the channel property in a Generic Payment

webhook request is agent, the merchant should map the transaction

appropriately in the gateway so the card issuer bypasses 3D-Secure.

Create the gateway extension

As discussed in Supported payment methods and transaction types, the payment and transaction types are specified in the gateway.json file. For a credit card gateway that supports 3D-Secure, the gateway.json file should be similar to the following:

{

"provider": "Generic Card 3DS Provider",

"paymentMethodTypes": ["card"],

"transactionTypes": {

"card": ["authorization", "void", "refund"]

},

"processors" : {

"card": "card3ds"

}

}Note that the card3ds processor is needed to provide 3D-Secure

support.

In addition to configuring user interface controls, the config.json file must include a shared secret key specified by the merchant. The key is used to generate a signature that the POST /ccstore/v1/payment/genericCardResponses endpoint uses for authentication:

...

{

"id": "secretKey3DS",

"type": "passwordType",

"name": "secretKey",

"helpTextResourceId": "secretKeyHelpText",

"labelResourceId": "secretKeyLabel",

"defaultValue": "5ad0f437X6af6X4d4eXb08cX729a310843ce",

"required": true,

"public": true

},

...See Generate the signature for more information about how the secret key is used.

Send the webhook response

If 3D-Secure is required for a transaction, the merchant returns a

responseCode value of 10000 (PAYER_AUTH_REQUIRED) when

it sends the Generic Payment webhook response to the Commerce server. The payment group is not updated.

The merchant uses the additionalProperties map in the webhook

response to supply data needed for invoking the 3D-Secure authentication page on the card

issuer’s website. This data typically includes values such as acsURL (the

issuer’s URL to direct the shopper to for authentication), paReq (the payer

authentication request), MD (merchant data), and TermURL

(the URL to return the shopper to after authentication). The exact set of properties, and

the names for these properties, may differ depending on the card issuer. The merchant can

also include maxRetryCount and delayInMillis properties as

part of the additionalProperties map to configure the storefront’s polling

behavior.

The webhook also returns a customPaymentProperties array that specifies a list of the properties from the additionalProperties map that should be returned to the storefront. For example:

{

"transactionType": "0100",

"orderId": "o140451",

"siteId": "siteUS",

"channel": "preview",

"locale": "en",

"currencyCode": "USD",

"authorizationResponse": {

"additionalProperties": {

"delayInMillis": "10000",

"payerAuthEnrollReply_proxyPAN": "1078787",

"amount": "000000003499",

"orderId": "o140451",

"channel": "storefront",

"maxRetryCount": "5",

"locale": "en",

"transactionId": "o140451-pg140415-1480662437847",

"transactionTimestamp": "2016-12-02T07:07:17+0000",

"transactionType": "0100",

"payerAuthEnrollReply_paReq": "eNpVkctuNBgiESLAKGWnXGsJiUPcByU/n3thQd",

"paymentId": "pg140415",

"payerAuthEnrollReply_acsURL":

"http://www.example.com/ccstore/v1/genericCardAuth3DS",

"paymentMethod": "card",

"displayMessage": "Please wait .....",

"payerAuthEnrollReply_xid": "Skh0MTRsZGsxYXZPbEd4a2I1VjA=",

"TermUrl":

"http://www.example.com/ccstore/v1/payment/genericCardResponses",

"currencyCode": "USD",

"gatewayId": "gateway3DS"

},

"customPaymentProperties": ["delayInMillis",

"payerAuthEnrollReply_proxyPAN", "amount", "decision", "orderId",

"channel", "maxRetryCount", "locale", "transactionId",

"transactionTimestamp", "transactionType", "payerAuthEnrollReply_paReq",

"paymentId", "payerAuthEnrollReply_acsURL", "paymentMethod",

"displayMessage", "reasonCode", "payerAuthEnrollReply_xid", "TermUrl",

"currencyCode", "gatewayId"],

"responseCode": "10000"

}

}Authorize the payment

The Commerce server sends the data from the webhook response, including the 3D-Secure data, to the

storefront in the createOrder endpoint response. The storefront then posts

a payer authentication request to the card issuer’s website using data received from the

merchant. The issuer displays an authentication page in an inline frame on the Commerce storefront. (See Create a custom payment authorization widget for information about how

to customize the storefront to do this.)

After the shopper fills out the authentication form and submits it, the card issuer

and the merchant communicate to determine if the shopper authenticated successfully, and if

so, whether to authorize the transaction. The merchant then sends an authorization response

to the Commerce server, using the POST /ccstore/v1/payment/genericCardResponses

endpoint.

The following table describes the POST properties:

| Property | Description |

|---|---|

| transactionType | Match value from webhook request. |

| currencyCode | Match value from webhook request. |

| locale | Match value from webhook request. |

| channel | Match value from webhook request. |

| orderId | Match value from webhook request. |

| signedKeys | A comma-separated list of the properties that are used to generate the signature. See Generate the signature. |

| signature | The Base64 signature returned by the merchant. See Generate the signature. |

| authorizationResponse | A JSON map of key/value pairs containing authorization data |

For example, the body of the POST might include:

<input id="transactionType" name="transactionType" type="hidden" value="0100"/>

<input id="currencyCode" name="currencyCode" type="hidden" value="USD"/>

<input id="locale" name="locale" type="hidden" value="en"/>

<input id="channel" name="channel" type="hidden" value="preview"/>

<input id="orderId" name="orderId" type="hidden" value="o120419"/>

<input id="signedKeys" name="signedKeys" type="hidden" value="transactionType,

currencyCode,locale,channel,orderId,paymentId,transactionId,paymentMethod,

gatewayId,amount,merchantTransactionId,authCodes"/>

<input id="signature" name="signature" type="hidden"

value="5ad0f437X6af6X4d4eXb08cX729a310843ce"/>

<input id="authorizationResponse" name="authorizationResponse" type="hidden"

value="authorization_response_JSON_map"/>The following table lists the properties of the JSON map that the authorizationResponse property in the POST is set to. All properties are required unless specified otherwise:

| Property | Description |

|---|---|

| paymentId | Match value from webhook request. |

| transactionId | Match value from webhook request. |

| transactionTimestamp | Match value from webhook request. |

| paymentMethod | Match value from webhook request. |

| gatewayId | Match value from webhook request. |

| siteId | Must match the value from the request. |

| amount | The amount authorized. The value of this property is a positive,

12-digit number that is expressed in base currency. For example, $125.75 is

represented as 000000012575 |

| merchantTransactionId | The transaction reference ID from the merchant |

| merchantTransactionTimestamp | The timestamp of the transaction from the merchant (in milliseconds) |

| hostTransactionId | The transaction reference ID from the payment gateway (optional) |

| hostTransactionTimestamp | The timestamp of the transaction from the gateway, in milliseconds (optional) |

| responseCode |

The authorization decision from the payment provider as interpreted by the merchant. Must be one of the following values: |

| responseReason | Information about why the authorization succeeded or failed |

| responseDescription | Information from the payment gateway about the response |

| authCode | The authorization code for the transaction |

| token | The payment token used by the payment provider (optional) |

| additionalProperties | Key/value pairs for additional properties sent by the merchant (optional) |

| customPaymentProperties | A list of the properties in the additionalProperties object that should be returned to the storefront (optional) |

The following is an example of the JSON map that is supplied as the value of the authorizationResponse property in the POST. Note that you need to use HTML entities to replace certain characters such as quotation marks before including the map in the POST:

{

"paymentId": "pg130411",

"transactionId": "o120419-pg130411-1478862352044",

"transactionTimestamp": "2016-08-05T12:24:54+0000",

"paymentMethod": "card",

"gatewayId": "gateway3DS",

"siteId": "siteUS",

"amount": "000000009349",

"merchantTransactionId": "mID1470399894815",

"merchantTransactionTimestamp": "1470399894815",

"hostTransactionId": "hID1470399894715",

"hostTransactionTimestamp": "1470399894715",

"responseCode": "1000",

"responseReason": "AuthResponseReason",

"responseDescription": "AuthResponseDescription",

"authCode": "AUTH-ACCEPT",

"token": "token-success",

"additionalProperties":

{

"sample-addnl-property-key1": "sample-payment-property-value1",

"sample-addnl-property-key2": "sample-payment-property-value2"

},

"customPaymentProperties": ["sample-addnl-property-key2"]

}Generate the signature

The merchant uses the shared secret key to generate a signature that it supplies when

it sends the authorization response using the POST

/ccstore/v1/payment/genericCardResponses endpoint. When the Commerce server receives authorization response, it applies the same logic that the merchant uses

to calculate the signature, and accepts the authorization only if both signatures match.

The signature is generated on the merchant server by performing an HmacSHA256 hash of the signedKeys properties using the shared secret key. The minimum recommended set of properties to include in signedKeys is:

signedKeys=transactionType,currencyCode,locale,channel,orderId,paymentId,

transactionId,paymentMethod,gatewayId,amount,merchantTransactionId,authCodeUsing the properties listed in signedKeys, construct a comma-separated list of key/value pairs. For example, using the signedKeys value from the authorizationResponse data in the example above, the list would be:

transactionType=0100,currencyCode=USD,locale=en,channel=preview,orderId=o120419,

paymentId=pg130411,transactionId=o120419-pg130411-1478862352044,

paymentMethod=card,gatewayId=gateway3DS,amount=000000009349,

merchantTransactionId=mID1470399894815,authCode=AUTH-ACCEPTNote: Do not include any URL-encoded characters in the list.

Using the list of key/value pairs and the shared secret key, perform the hash to generate the signature. For example:

...

// secretKey - shared secret Key provided by merchant in the gateway extension

// dataToSign - comma separated key/value string

SecretKeySpec secretKeySpec = new SecretKeySpec(secretKey.getBytes("UTF-8"),

"HmacSHA256");

Mac mac = Mac.getInstance("HmacSHA256");

mac.init(secretKeySpec);

byte[] rawHmac = mac.doFinal(dataToSign.getBytes("UTF-8"));

Base64.getEncoder().encodeToString(rawHmac).replace("\n", "");Retrieve the authorization response

After posting the payment request to the issuer’s website, the storefront begins

polling the Commerce server using the getPaymentGroup endpoint to determine if the server has

received the authorization response from the merchant. When the Commerce server receives the authorization response, it includes the data from the merchant in the

getPaymentGroup endpoint response it sends to the storefront.

Create a custom payment authorization widget

In order for your storefront to use 3D-Secure, you need to write a custom widget and use it to replace the CyberSource Payment Authorization Widget on the Payer Authentication Layout. The custom widget must manage various communications between the storefront, the Commerce server, and the credit card issuer.

The widget.json file should be similar to the following:

{

"name": "Generic Card 3DS Widget",

"javascript": "genericCard3DS",

"jsEditable": true,

"global": false,

"i18nresources": "genericCard3DS",

"imports": [

"payment",

"paymentauthorization",

"order",

"site"

],

"pageTypes": ["payment"]

}Write the widget JavaScript

The widget’s JavaScript code should implement the following logic:

- Listen for the

ORDER_AUTHORIZE_PAYMENTevent and initiate payer authentication. - Populate the authentication form and submit it to the issuer’s URL.

- Publish a

PAYMENT_GET_AUTH_RESPONSEevent to trigger polling the Commerce server to detect when it receives the authorization response from the merchant. - Handle timeout and error cases.

This section includes examples of code that implements these operations.

Listening for the ORDER_AUTHORIZE_PAYMENT event and initiating payer authentication:

$.Topic(pubsub.topicNames.ORDER_AUTHORIZE_PAYMENT).subscribe(function(obj) {

if (obj[0].details) {

widget.authDetails = obj[0].details;

widget.createSignatureIfIframeIsLoaded(widget.authDetails, 0);

}

});Populating the authentication form and submitting it to the issuer’s URL:

widget.injectFormValuesForPayerAuth(

uiIntervenedPaymentGroup.customPaymentProperties);

widget.injectActionURL(

uiIntervenedPaymentGroup.customPaymentProperties.payerAuthEnrollReply_acsURL);

widget.postForm();Publishing a PAYMENT_GET_AUTH_RESPONSE event to trigger polling the

Commerce server to detect when it receives the authorization response from the merchant:

var messageDetails = [{message: "success",

orderid: authDetails.orderDetails.id,

orderuuid: authDetails.orderDetails.uuid,

paymentGroupId: uiIntervenedPaymentGroup.paymentGroupId,

numOfRetries: uiIntervenedPaymentGroup.customPaymentProperties.maxRetryCount,

delay: uiIntervenedPaymentGroup.customPaymentProperties.delayInMillis

}];

$.Topic(pubsub.topicNames.PAYMENT_GET_AUTH_RESPONSE).publish(messageDetails);Handling the error cases, such as being unable to access the issuer URL, or receiving an authentication error from the issuer. For example:

widget.handleErrors = function() {

try {

$.Topic(pubsub.topicNames.ORDER_SUBMISSION_FAIL).publish([{message: "fail"}]);

}

catch(e) {

log.error('Error Handling Order Fail');

log.error(e);

}

try {

widget.handleTimeout();

}

catch(e) {

log.error('Error Handling Timeout');

log.error(e);

}

};