About Joint Venture Receivables Invoices

After you schedule the Create Joint Venture Distributions process to generate distributions, you can schedule the "Create Joint Venture Invoices and Journal Entries" process to create receivables invoices for the distributed costs. With this touchless processing, you don’t have to perform any steps between running these processes other than using the Joint Venture Distributions work area to review and update information if needed.

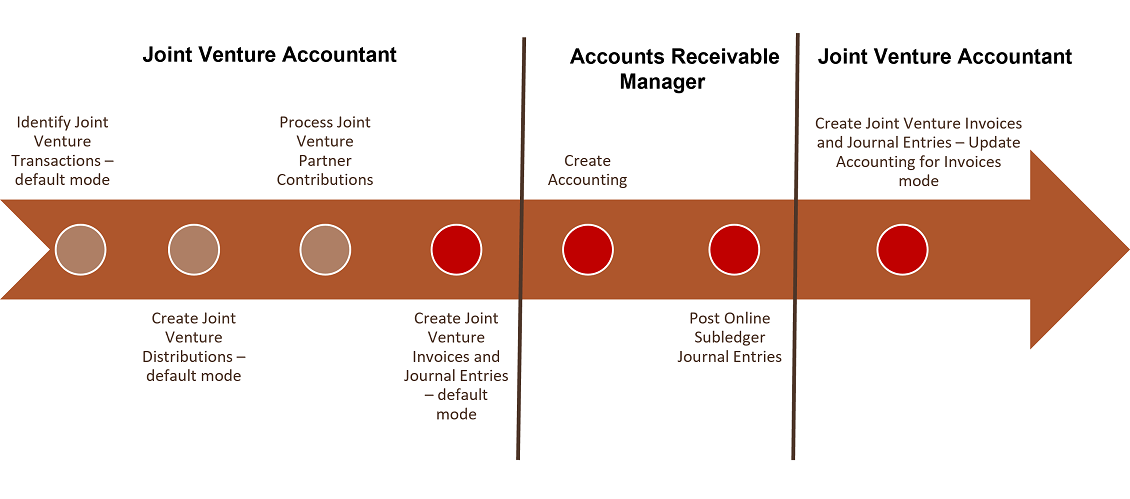

After invoices are created, an accounts receivable manager must run the standard processes to create accounting entries in Oracle Receivables and post the invoices to Oracle General Ledger. To help ensure consistent accounting across all systems that integrate with Oracle Joint Venture Management, a joint venture accountant then runs this process: Create Joint Venture Invoices and Journal Entries process - Update Accounting for Invoices mode. This mode stores information to retrieve the accounts from General Ledger to the joint venture distributions.

Before you run the preceding processes to create invoices and complete the accounting, you must run these initial Joint Venture Management processes:

- Identify Joint Venture Transactions - default mode

- Create Joint Venture Distributions - default mode

- Process Joint Venture Partner Contributions (if applicable)

The following illustration shows the workflow of running these processes with the processes to create joint venture invoices and complete the accounting:

Remember that the "Create Joint Venture Distributions" process splits both the entered and accounted amounts in transactions. Both amounts are recorded in the generated distributions, but only the accounted amount is used to create invoices and for other downstream processes.

-

The distributions are at the "Available to Process" status and aren't identified as "Distribution Only" in the Joint Venture Distributions work area.

-

The distributions are associated with operating expenses, capital expenditures, overhead, fees and other charges.

These are recorded as account types Expense, Assets, Overhead, and Fees and other charges in the Joint Venture Distributions work area.

-

The stakeholder preference for the distributions is specified as "Create Invoices" in the Joint Venture Distributions work area.

-

The distribution amount is equal to or greater than the minimum amount required to create an invoice.

The minimum receivables invoice amount is specified in the joint venture definition. For example, if $500 is specified as the invoice minimum amount, the process will create invoices only when the unbilled distribution amount reaches $500.

In the Joint Venture Distributions work area, you can access the invoice from the distribution to view the details of the invoice in Receivables.

Invoicing Currency

By default, the process creates invoices in the primary ledger currency of the business unit associated with the joint venture.

When a joint venture involves partners from different countries, the partners might request invoices in their currencies. In this case, the managing partner can specify the overriding invoice currency for each stakeholder in the joint venture definition. When the Create Joint Venture Invoices and Journal Entries process is run, it will then generate receivables invoices for stakeholders in the overriding invoice currencies.

Invoice Receivable Account

The process creates the receivable accounting entry for each invoice using the receivable account derived from AutoAccounting rules or the account specified in the joint venture definition. If the managing partner has set up a receivable account override through subledger accounting rules, the posting process will use the receivable account override when posting the invoice.

Partner Contribution Invoice Lines

A joint venture might use partner contributions to fund up-front costs of the joint venture. Distributed costs not covered by partner contributions are billed to the partners through receivables invoices using the Create Joint Venture Invoices and Journal Entries process. The invoice captures the partner contribution amount and the actual invoice amount in separate invoice lines.

In Receivables, the process writes the invoice amounts generated from distributions and partner contributions in what is referred to as “partner account” and "joint venture partner contribution account", respectively, in Joint Venture Management. Although these accounts are written in the Revenue accounting class in Oracle Fusion Financials, it’s a reimbursement account in joint venture invoice lines and a liability account in partner contribution invoice lines.

Example: Accounting in Receivables when a distributed cost is completely covered by the partner contribution invoice line, resulting in a zero amount invoice.

Joint venture partner contribution account: 11-1001-49003-11-0001

Partner account for reimbursing distributed costs: 11-1001-49002-11-0001

| Account | Debit | Credit |

|---|---|---|

Joint venture partner contribution account (11-1001-49003-11-0001) |

50000 USD | None |

Partner Account (11-1001-49002-11-0001) |

None | 50000 USD |

| Receivable | 0 | None |

Example: Accounting in Receivables when a distributed cost is partially covered by the partner contribution invoice line and an invoice line is created to reimburse the remaining amount.

Joint venture partner contribution account: 11-1001-49003-11-0001

Partner account for reimbursing distributed costs: 11-1001-49002-11-0001

| Account | Debit | Credit |

|---|---|---|

Joint venture partner contribution account (11-1001-49003-11-0001) |

20,000 USD | None |

Partner Account (11-1001-49002-11-0001) |

None | 30,000 USD |

| Receivable | 10,000 USD | None |

Joint Venture Information in Receivables Invoices

The invoice includes the following joint venture information:

-

The business unit, customer information, distribution amount, currency, distribution type (assets, expense, overhead, and so on) and distribution ID associated with each distribution.

-

If the line description isn't available in the original transaction, the invoice lines associated with the transaction use the description sent by Joint Venture Management, which is in the format "<joint venture name> – AR Invoice." The line description for partner contribution invoice lines is in the format "<joint venture name> – Partner Contribution."

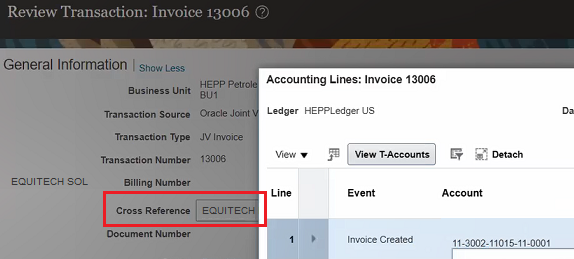

The name of the joint venture associated with the receivables invoice, which is shown in the Cross Reference field of the invoice. To see this field on the Review Transaction page, you need to click “Show more” next to General Information.

The following example shows the Review Transaction page for an invoice with the Cross Reference field populated with the joint venture name EQUITECHSOLUTION.

Distribution Statuses Associated with Invoicing

In the Joint Venture Distributions work area, the status of the distribution indicates the stage and the result of the invoicing process.

| Status | Description |

|---|---|

| Invoicing in progress | Indicates that the invoicing process has started but is not complete. |

| Accounting in progress | Indicates that the distribution has been invoiced but the “Create Accounting” and “Update Accounting for Invoices” processes haven’t completed. |

| Process complete | Indicates that the distribution has been invoiced and fully accounted. |

| Error | Indicates that the distribution wasn't invoiced due to an error. |

Manage Distributions in Error

The process generates logs that the joint venture accountant can use to review the details of any errors and take corrective action. After you correct the error, you can make the distribution available for processing in the next scheduled run of the process.

Or after you review the error, you might need to take one of the following actions:

-

Change the distribution status from “Error” to “On hold” if the error can’t be resolved sooner, for example, it's pending analysis and approval.

-

Mark the distribution as “Distribution Only” if after analysis, you found that the distribution must not have been included in the invoicing process.

-

Delete the distribution so you can redistribute the transaction and invoice again. When you delete a distribution at “Error” status, the system deletes all distributions at status “Error”, “Available to process”, or “On hold” that originate from the same transaction. The transaction status automatically changes to “Available to process” in the Joint Venture Transactions work area.

For information about possible errors that you can encounter when creating invoices, see Correcting Issues with Creating Joint Venture Invoices.