Tax Determining Factor Sets and Condition Sets

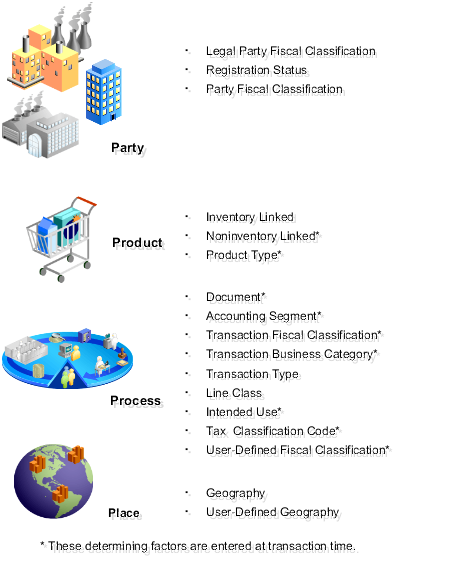

A tax determining factor is an attribute that contributes to the outcome of a tax determination process, such as a geographical location, tax registration status, or a fiscal classification. Determining factors are represented in tax rules as the following concepts:

-

Determining factor class: Tax determining factors are categorized into logical groupings called determining factor classes, such as Accounting or Geography.

-

Tax class qualifier: Use a class qualifier with a determining factor class when it is possible to associate a determining factor class with more than one value on the transaction. For example, you need to specify which location type, such as ship-to party, a specific geography level, such as country, is associated with.

-

Determining factor name: Each determining factor class contains one or more determining factor names that constitute the contents of the class.

The result of a determining factor class, and its class qualifiers and determining factor names, is a list of available factors for use with tax conditions. Each tax condition within a tax condition set must result in a valid value or range of values for tax determination.

The relationship between the determining factor and condition sets and the party, product, process, and place is shown in the following table. The relationship value is a concept to group tax drivers and not an element in the tax rule definition. The determining factor, determining factor class, tax class qualifier, determining factor name, condition set operator, and condition set value are all components of tax rule setup.

|

Relationship |

Determining Factor |

Determining Factor Class |

Tax Class Qualifier |

Determining Factor Name |

Condition Set - Operator |

Condition Set - Value |

|---|---|---|---|---|---|---|

|

Process |

Accounting |

Accounting |

Line Account |

Equal to |

Flexible with range of qualifiers and segment or account values |

|

|

Process |

Document |

Document |

Document fiscal classification level (1-5) or blank |

Document Fiscal Classification |

|

Document fiscal classification codes of the class qualifier level or all document fiscal classification codes if there is not class qualifier |

|

Place |

Geography |

Geography |

Location type which can be one of the following:

|

Geography type from Oracle Fusion Trading Community Model |

|

Trading Community Model geography names of the geography type belonging to the location identified by the class qualifier, for example, country or state. If the operator is Equal to determining factor or Not equal to determining factor then the values are:

The available values do not include the tax class qualifier value. |

|

Party |

Legal Party Classification |

Legal party fiscal classification |

First party |

Legal activity codes for:

|

|

Legal classification codes of the legal classification activity |

|

Party |

Party Fiscal Classification |

Party fiscal classification |

Location type which can be one of the following:

|

Party fiscal classification type |

|

Fiscal classification codes of the party fiscal classification type assigned to the party identified by the class qualifier |

|

Product |

Product Inventory Linked |

Product inventory linked |

Name of a specific level of a product fiscal classification |

|

Fiscal classification codes of the applicable product fiscal classification type |

|

|

Product |

Product Noninventory Linked |

Product noninventory linked |

Product fiscal classification level (1-5) or blank |

Product category product fiscal classification type |

|

Product classification codes of the class qualifier level or all product fiscal classification codes if there is no class qualifier |

|

Party |

Registration Status |

Registration |

Location type which can be one of the following:

|

Registration Status |

|

The registration status defined in the registration status lookup. If the operator is Equal to determining factor or Not equal to determining factor then the values are:

|

|

Process |

Transaction Fiscal Classification |

Transaction fiscal classification |

Transaction fiscal classification type |

|

Specific transaction fiscal classification code |

|

|

Process |

Transaction Business Category |

Transaction generic classification |

Classification level (1-5) or blank |

Transaction Business Category |

|

Transaction business category fiscal classification codes of the class qualifier level or all fiscal classification codes if there is no class qualifier |

|

Process |

Transaction Type |

Transaction generic classification |

Classification level (1-5) or blank |

Transaction Business Category |

|

Transaction business category fiscal classification codes of the class qualifier level or all fiscal classification codes if there is no class qualifier |

|

Process |

Intended Use |

Transaction input factor |

Intended Use |

|

Product intended use fiscal classification codes |

|

|

Product |

Line Class |

Transaction input factor |

Line Class |

|

Transaction event classes and activities Code list of line transaction types such as:

|

|

|

Process |

Product Type |

Transaction input factor |

Product Type |

|

Predefined goods or services |

|

|

Process |

Tax Classification Code |

Transaction input factor |

Tax Classification Code |

|

Tax classification codes |

|

|

Process |

User-Defined Fiscal Classification |

Transaction input factor |

User-Defined Fiscal Classification |

|

User-defined fiscal classification codes |

|

|

Place |

User-Defined Geography |

User-defined geography |

Location type which can be one of the following:

|

Tax zone types |

|

Tax zones of the tax zone type belonging to the location identified by the class qualifier |

You can use multiple party and product fiscal classifications at the same time. However, only the primary product fiscal classification, as defined in the country defaults is displayed on the transaction line. When you override the product fiscal classification at transaction time that value is used in preference to the default product fiscal classification.