Budgetary Control Implementation: Vision City

This topic describes a case study on Budgetary Control Implementation.

In this case study we will discuss the Budgetary Control Implementation for an imaginary city called Vision City.

Vision City

Vision City is a small fictional city in northern California. The city purchases Oracle ERP Cloud to address these requirements:

- Better analytics during budget preparation and planning to budget execution cycle

- Improved analysis and monitoring of budget consumption

- Increased visibility of budget issues for transaction users

- Streamlined legal and management reporting

Key Funds and Funding Sources

- General Fund

- Wastewater Fund

- Capital Funds

- Internal Service Fund

- City Debt Fund

The main citywide expenditures that must be budgetary controlled are in the General Fund. These five areas of expenditures are funded by the General Fund:

- General Government

- Public Safety (Police and Fire)

- Parks and Recreation

- Community Development

- Public Works

Vision City Organization

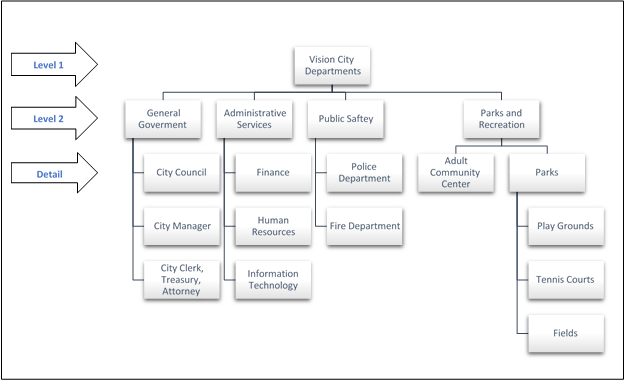

The Vision City government is organized into departments, with lower-level departments rolling up to higher-level or parent departments as depicted in this chart.

The city has department managers that control purchase approvals and budget spending at the detail level in the department hierarchy. Public reporting on the General Fund spending on administration is separated from operations. The finance department on behalf of the city council requires reporting on the type of expenditures at the object or natural account level.

Financial Management Cycle

The financial management cycle of the city mainly revolves around the budget planning for the next year and staying on track in the current year. The budget is a financial plan on how the city will receive and spend money during the fiscal year.

The financial management cycle has these four phases:

- Planning and Budgeting: Prioritize objectives and determine the allocation of funds to meet these objectives.

- Budget Implementation: Map objectives to specific programs and departments in the city's organizational structure for recording, expense monitoring, and control.

- Expenditure Monitoring: Ensure that the budget amounts allocated are correctly reflected in Oracle ERP Cloud and proper controls are set up for expenditures.

- Inquiry and Reporting: Generate periodic reports for public and department heads to reflect prior period budget versus expenditure. Perform budget transfers and approve any budgetary control override requests.

Each department head is responsible for approving expenditures and controlling their budget to ensure they are meeting the associated objectives.

Planning and Budgeting

The planning and budgeting phase starts in August and continues until March. The proposed budget is prepared in April and is available for public review and hearings in May and June. The final adopted budget is released on July 1st.

The planning and budgeting phase has these four steps:

- Create a Plan for the Next Year

- Define Strategic Goals and Objectives

- Prepare Budget

- Review Budget

Create a Plan for the Next Year

This step of the planning and budgeting phase is to determine budget priorities and expected funding for the next year. Departments review funding and feasibility of projects. Department managers or their representatives review prior year objectives and budget expenditures. Department managers also review reports such as Performance Highlights from Prior Year Benchmarks and Results by Department.

Define Strategic Goals and Objectives

Goals are finalized and budget allocations are refined. The finance department proposes multiple funding scenarios and forecasts revenue and funding.

Prepare Budget

The budget manager prepares a preliminary budget for review. The budget amounts are allocated to departments and programs. Department managers allocate budgets to the programs for which they're responsible.

Review Budget

The proposed budget is reviewed by the city manager and council. In addition, it's released to the public for review. A final budget is published and adopted for the new fiscal year.

Budget Implementation

After the budget is adopted, it's available for consumption at the beginning of the fiscal year. The control on spending is now enforced.

The public safety is the highest expenditure in the city and it is outsourced and the funds are managed by a supplier, and monthly reports on expenditures are provided to the city. This case study focuses on the two main functions under the city's direct control, namely General Government and Parks and Recreation.

Expenditure Monitoring

Vision City requires all expenditures to be subject to budgetary control validation. They elect to enable funds control at the time of requisition to ensure requestors are aware of any budget issues before they submit requisitions to approvers. Any variances from the requisition to the purchase orders and invoices will also be subject to budgetary control as well as any manual journal entries that impact the budgeted accounts.

Some organizations may elect to bypass budgetary control at requisition time and only enforce controls during purchase order preparation. This may give buyers greater control to complete purchase requests that otherwise would have been rejected. Vision City, however, prefers the requester to be notified as early as possible when there is insufficient budget for their request.

Inquiry and Reporting

During the budget year, the budget manager performs these tasks:

- Monitors the overall health of the budget

- Alerts department managers of potential budget issues

- Overrides insufficient funds

- Runs budget transfers or adjustments

- Prepares periodic reports for management

- Prepares periodic reports for public

Key Implementation Considerations: Enterprise Structures

The budget managers at Vision City define its chart of accounts using the Rapid Implementation spreadsheet.

The chart of accounts has these segments:

- Fund: Enables reporting by fund, and their balancing segment, ensures all transactions must balance by fund

- Department: Mirrors the organizational structure including the hierarchical relationships

- Program, Object, and Location: Provides detailed tracking and analysis

- Future Use: Allows easy expansion in the future if needed

Budget managers enter the segment names, values, and hierarchies in the Rapid Implementation spreadsheet and set July 1 as the beginning of their fiscal year. After that they generate a .csv file and upload it to Oracle Financials Cloud, creating all required enterprise structures, including a ledger and business unit that are linked to the newly-defined chart of accounts.

Key Implementation Considerations: Budgeting

Budget Entry and Approval

Vision City has historically managed its budgets in spreadsheets. They considered continuing with this approach that involves simply loading their budgets into Oracle Financials Cloud periodically using the open interface for budgets. However, Vision City instead opts to use the Oracle EPM Planning and Budgeting Cloud Service (EPM Planning), which is seamlessly integrated with Oracle Financials Cloud and offers management and control capabilities beyond what Vision City has with spreadsheets.

Vision City budgets by fund, object, department, and program and defines their EPM Planning budgeting application based on these three segments. They include additional segments in their chart of accounts for tracking expenditures at more granular levels, but they don't budget at these levels.

They define mapping rules to write budget information from EPM Planning directly to Oracle Financials Cloud for use in budgetary control and actual-budget analysis. Since they don't budget at the Location and future use level, they automatically enter 000 as the value for these segments in their budgets. They also define mapping rules for transferring actual balances from Oracle Financials Cloud to EPM Planning for use in the budgeting process.

Using Budgets for Budgetary Control

Before loading budgets to Oracle Financials Cloud, Vision City first defines control budgets. The control budget specifies how the budget will be used to control expenditures, including these parameters:

- Transaction types: Requisitions, purchase orders, invoices, manual journal entries, and purchase receipts.

- Level of control:

- Absolute: Reject the transaction if there is insufficient budget.

- Advisory: Allow the transaction to proceed but notify the user of any budget violations.

- Track: Allow the transaction to proceed without notifying users of budget violations, but still report on budget versus consumption report.

- None: Don't track activity.

- Exception conditions: Set one level of control as the default but then use a different level of control in exception conditions, such as a specific fund or group of departments. While it wouldn't make much sense to use None as the control level for an entire control budget, there are definite cases where it makes sense to use None as the default level and then set up exception conditions to enforce stricter control in certain cases.

- Tolerance: Whether users can spend beyond the allowed budget, and if so, by how much.

- Overrides: Whether users can allow a rejected transaction to proceed, and if so, which users and under what conditions.

Vision City defines two control budgets: one for spending control and the other for management reporting.

| Control Budget Attribute | Monthly Reporting | Annual Control |

|---|---|---|

| Calendar (July 1-June 30) | 12 periods (one for each month) | 1 period (year) |

| Segments – hierarchy |

Fund Object Department Program Location Future Use |

Fund Department (level 2) Program |

| Control Level | Track - record transaction impact on funds balances only | Absolute – stop transactions when there are insufficient funds |

| Source Budget Type | Other | Control Budget |

| Source Budget | Monthly Reporting | Monthly Reporting (This budget summarizes balances from the monthly budget and is not maintained separately) |

| Tolerance/Override | None | The budget manager in finance can approve and override insufficient funds |

| Exceptions | Revenue, Asset, and Liability accounts are excluded from budgetary control, therefore the control level is None | Public safety departments are outsourced and expenditures are

controlled by the provider, therefore their transaction control

level is Advisory Waste Water Fund is a custodial fund and is not subject to budgetary Control, therefore the transaction control level is set to None Revenue, Asset, and Liability accounts are excluded from budgetary control, therefore the control level is None |

Vision City enters its budgets in EPM Planning and loads the budget data into the Monthly Reporting control budget. The other control budget (Annual Control) uses Monthly Reporting as its budget source. Therefore, Vision City does not enter two sets of budgets; one control budget derives its amounts from the other. This setup allows Vision City to do reporting and analysis at a more granular level than transaction control.

Budget Adjustments

Though Vision City has standardized on EPM Planning as its budgeting solution, they opted to manage budget adjustments directly in Oracle Financials Cloud. Oracle Financials Cloud offers a spreadsheet interface for budget adjustments. Vision City allows a small group of budget managers to enter budget adjustments. They have also opted to use the Other source budget type that allows them to perform these tasks:

- Enter budget in a third-party software and load it using FBDI

- Enter budget using Enter Budgets in the Spreadsheet task

- Enter budget transfer using Budget Transfer section from the Review Budgetary Control Balances page

In the future, Vision City will adopt the EPM Budget Revision process and plan to reclassify the source budget type to EPM Financials Module. Using the EPM Financials Module Source Type will allow them to perform these tasks:

- Enter Budget in EPM using Planning and load to Oracle Financials Cloud using Data Exchange

- Revise budget in EPM using Budget Revisions and load it using the Funds Reservation action

When the reclassification occurs, EPM Planning will become the single source of truth for budget, and as a result, Vision City will no longer be able to use the FBDI, Spreadsheet, or Budget Transfer to manage budget adjustments. Instead, all adjustments will be initiated in EPM Budget Revisions and sent to Oracle Financials Cloud using the delivered integration.

Vision City has opted to load budgets in General Ledger to support financial reporting across both revenue and expenditure accounts. Vision City only controls expenditure accounts within Budgetary Control, and hence only loads expenditure accounts into Budgetary Control. They have set up a supplemental rule that excludes, None, all Revenues and Balance Sheet accounts in both their control budgets. Since Vision City needs to report on revenues and expenditures in a single financial report, they have elected to use General Ledger for all their financial reports and Budgetary Control for managerial reporting purposes.

Vision City has set up two general ledger budget scenarios to allow for reporting of Initial and Adjusted budget balances separately.

- Initial, to load the original budget

- Monthly Reporting, to sync with the Monthly Reporting Control Budget as

adjustments are madeNote: When Vision City implements Budget Revisions, the delivered integration will automatically sync budget adjustments to General Ledger when a budget scenario exists with the exact name as the control budget. So, Vision City opted to use the control budget name as the scenario name, making sure that there will be no impact when budget revisions are implemented in the future.

As Vision City makes budget adjustments using the Enter Budgets in Spreadsheet tasks from the Budgetary Control Dashboard, they will use these options to keep the Monthly Control Budget in sync with the Monthly Reporting general ledger budget scenario:

| Field | Option |

|---|---|

| Budget Usage | Budgetary Control Validation and General Ledger reporting |

| Budget Entry Classification | Budget Revision |

| Control Budget | Monthly Reporting |

| Budget Scenario | Monthly Reporting |

| Enter Budget Amounts | Addition to or subtraction from current budget |

Vision City will also load the revenue budget to both general ledger budget scenarios. At the beginning of the fiscal year, they will load revenue accounts to the Initial budget scenario and the Monthly Reporting general ledger budget scenario. As budget adjustments are made to revenue accounts throughout the year, the adjustments will be made to only the Monthly Reporting general ledger budget scenario. For the revenue accounts, changes can be loaded using the Create Budgets in Spreadsheet task from the General Accounting Dashboard or by using the FBDI Import Budget Data from a flat file.

Key Implementation Considerations: Transaction Control

Any transaction that consumes funds from the General Government, Administrative Services, or Parks and Recreation department must pass a funds reservation before it can proceed. Funds reservation is performed automatically during requisition or purchase order approval, invoice validation, creation of purchase receipt distributions, or posting for a manual journal entry. Users can optionally check funds before submitting a transaction to ensure it goes through. Vision City opts not to enforce budgetary control during requisitioning, so the first control point is purchase order approval.

Transactions that consume funds from a Public Safety department are only subject to Advisory control, so a funds reservation is not required for these transactions to continue processing. Transactions are also checked against the Monthly Reporting control budget, but as this is track only, budget violations aren't enforced.

Budgetary Control Infolets

The Budget Consumed and Funds Available infolets allow the budget manager to quickly view and track the funds consumption and funds availability of critical control budgets and budget accounts. These infolets provide insight into your budget position based on real-time transactions, and alert the budget manager to potential risks. Each budget manager can configure up to five different instances of each infolet.

The Budget Consumed infolet displays the budget consumption for a group of budget accounts you choose. You can expand the infolet to see the budget accounts with the highest consumption percentages for the control budget. On the expanded view, you can also view the funds available details by clicking the budget account link.

The Funds Available infolet displays the funds available amount and percentage based on the unused portion of the current period budget for a budget account you specify. You can click the funds available amount link to view the additional funds available details for the budget account.

Budget Manager Inquiry and Reporting

The Budgetary Control Dashboard allows budget managers to monitor summary fund and department balances, and drill down to specific accounts and transactions. To Review Budgetary Control Balances for that account combination, click a balance link on Budget Monitor. You can further drill down to Review Budgetary Control Transactions for a specific period and balance type. This page allows the budget manager to drill to any specific transaction.

Budgetary Control Exceptions Report

An exceptions report tracks the health of the budget. Transactions with budgetary control failures are grouped and reported.

Overrides

When there are insufficient funds and a transaction fails because of funds control, a transaction user can request an override. This will automatically notify the budget manager and the notification includes a link to the transaction details. The budget manager dashboard lists the overrides under Requiring My Attention and Requested By Me, and provides the budgetary control results for the override requests.

Department Head Inquiry and Reporting

The city chose Oracle ERP Cloud to improve analysis and monitoring of budget consumption for the department heads who approve and monitor budget consumption. The main use cases for the department heads include:

- Periodic reports to ensure budget is on track

- Ad hoc analysis to "look for funds" when budget is low

- Budget planning for the next year

The budgetary control transaction details can be monitored from the Budgetary Control Analysis report. This interactive Business Intelligence Publisher (BI Publisher) report is shipped with these three layouts and is fully configurable:

- Funds Available Trend

- View Funds Available

- Account Activities

Vision City has also opted to create a custom Budget Inquiry role to allow all Department Heads and staff the ability to use the budget monitor without having the administrative budgetary control tasks. See My Oracle support document 2501873.1 for detailed steps.

Vision City has also used the Add Reporting Tree to Budgetary Control Cubes to the Monthly Reporting Control Budget for the object and department segments to use the hierarchy for summarized reporting.

Funds Available Trend Layout

The Funds Available Trend layout shows the balances by fund, department and object, and the corresponding transaction details of the balance.

View Funds Available Layout

The View Funds Available layout shows the budget, commitment, obligation, expenditure, and funds available balance by budget account. It can be further filtered by budget period or fund.

The commitment column typically represents the open balance from requisitions, though it also includes manual encumbrance journals with this encumbrance type. The obligation column represents the open balance from purchase orders, also including the appropriate manual encumbrance journals. The expenditure column includes invoices and actual journal entries.

Account Activities Layout

The Account Activities layout shows account balances and details of the specific transactions that have consumed the budget for each account. The interactive layout allows further filtering by budget account and budget period.

An Oracle Transactional Business Intelligence (OTBI) subject area called Budgetary Control - Transactions Real Time is also available for advanced ad hoc queries. This subject area contains budgetary control and source transaction attributes.

Periodic Public and Management Reporting

Oracle Financial Reporting Center delivers a unique multidimensional reporting and analysis platform that provides real time access to financial information. Users can quickly report and analyze data from different perspectives from the same application that is used for operational accounting.

The reports allow users to:

- Dynamically drill down from balances to active transactions

- Perform multidimensional analysis and drill down from anywhere

- Ensure that all users are making decisions from the same source of information

The city provides its users with three reports based on the funds balances from the budgetary control balances. These are secured by budget and published periodically by the budget manager for department heads.

- Balances by Department

- Budget versus Actual

- Year on Year Comparison

Year-End Public and Management Reporting

Oracle Financial Reporting Center streamlines reporting for management and public reporting on accounting balances, enabling Vision City to:

- Securely distribute and access active or prepublished financial reports from a central location

The city creates this financial report by using the general ledger balances:

- Trial Balance

These government-wide Financial Statements are created from their secondary full accrual ledger:

- Statement of Net Position

- Statement of Activities

These governmental Fund Financial Statements are created from their primary modified accrual ledger:

- Balance Sheet

- Statement of Revenues, Expenditures, and Changes in Fund Balances

- Statement of Activities

- Budgetary Comparison Schedule Note: Vision City has adopted Modified accrual accounting as their budgetary basis with no exceptions.

Conclusion

Oracle ERP Cloud provides Vision City with a robust application for managing its entire purchasing cycle with strict controls to ensure it stays within budget, and much more. It provides rich visibility and insight into how the budget is used, more than the city has ever before been able to derive. This added insight leads to more efficient allocation of scare funds, and a better use of taxpayer and other resources. The employees of Vision City will spend less time worrying about transaction controls and purchasing processes, and more time focusing on delivering city services to the citizens of Vision City.