How You Print Commercial Documents Execution Report

This topic contains summary information about the Print Commercial Documents Execution Report.

Overview

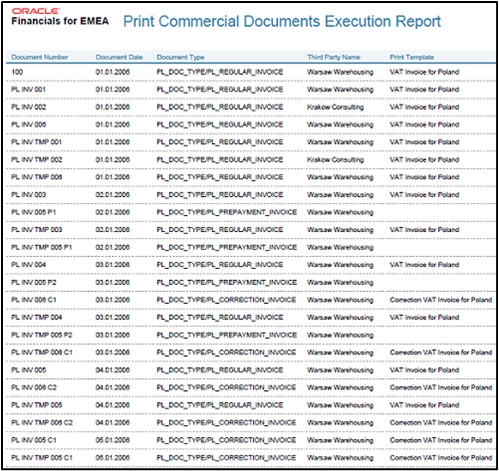

The Print Commercial Documents Execution Report lists all the selected transactions to be printed based on the parameters that you have provided. The printing program checks the following information:

-

The validity of the association between Document Fiscal Classification or Document Subtype and the template, which you use for the invoice print process.

-

Document Fiscal Information such as Third-Party Name, Document Number, and Transaction Date.

Key Insights

Before running the reports, ensure that you:

-

Set up the following entities:

-

Data Security

-

Geographies

-

Address Style Format

-

Enterprise Structures

-

Tax Regimes to Rate Flow

-

Tax Profiles for Parties

-

Tax Rules

-

Customers and Suppliers

-

First Party Bank, Branch, and Account

-

-

Complete the implementation project for your organization before you start the following feature-specific setup.

This is what a typical Commercial Documents Execution Report looks like:

Report Parameters

This table describes the process parameters:

|

Parameter |

Description |

|---|---|

|

Legal Entity |

Indicates the legal entity that issues the documents to be printed. The default value is the legal entity that's associated to the reference data set of the user. This parameter is mandatory. |

|

Tax Registration Number |

Indicates the tax registration number that issued the documents to be printed. This parameter is optional. |

|

Business Unit |

Indicates the business unit that issued the documents to be printed. The default value is the business unit that's linked to the reference data set of the user. This parameter is mandatory. |

|

Start Date |

Indicates the start date of the period that the documents are registered in. This parameter is optional. |

|

End Date |

Indicates the end date of the period that the documents are registered in This parameter is optional. |

|

Third Party Type |

Indicates the type of third party the documents are sent to. For Poland, value of the third-party type is Customer. This parameter is mandatory. |

|

Third Party |

Indicates the third party to whom the documents are issued. This parameter is optional. |

|

Third Party Site |

Indicates the third-party site to which the documents are issued. This parameter is optional. |

|

Print Mode |

Indicates the print mode. Select Draft or Final. The default value is Draft. Use the Draft mode to verify data after your print. Select Final when you're ready to present the printed copy to a third party. Selecting Final also links the copy of the report to the transaction that you can view from the View Transactions page. This parameter is mandatory. |

|

Document Type |

Indicates the document type to be printed. The specific Document Fiscal Classification that you defined determines the documents. This parameter is optional. |

|

Start Document Number |

Indicates the first number in the range of document numbers to be printed. This parameter is optional. |

|

End Document Number |

Indicates the last number in the range of document numbers to be printed. This parameter is optional. |

|

Print Currency |

Indicates the print currency in which the documents are to be printed. Select Entered or Ledger. This parameter is mandatory. |

|

Print Template |

Indicates the template to be used to print the documents. This parameter is optional. |

|

Order By |

Indicates the order in which the documents are printed. This parameter is mandatory. |

Frequently Asked Questions

This table lists frequently asked questions about the Print Commercial Documents Execution Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

This report is used by:

|

|

When do I use this report? |

Use the Print Commercial Documents Execution report to check:

|

|

What type of report is this? |

Oracle Analytics Publisher. |