VAT Reports for Italy

This topic includes details about the VAT reports for Italy.

Overview

Oracle Fusion Applications provide a set of VAT reports to meet the legal and business reporting requirements of tax authorities.

The VAT reports for Italy include:

-

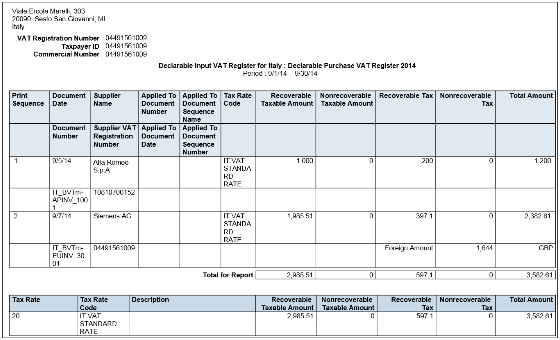

Declarable Input VAT Register for Italy: Lists the declarable input VAT activities with document sequences assigned to the selected tax register, including payments of invoices with deferred tax for a specific period. The report displays the recoverable and nonrecoverable tax amounts and corresponding taxable amounts. Provides a summary section with totals by tax rate code and a grand total.

The following figure is an example of the report.

-

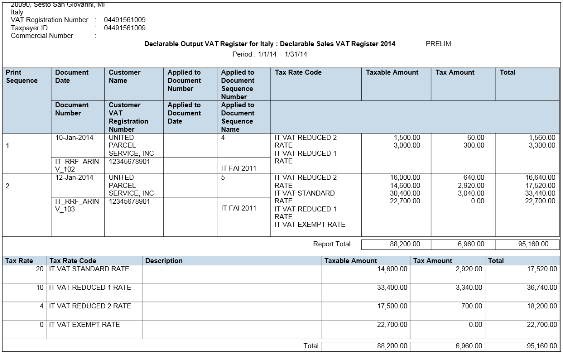

Declarable Output VAT Register for Italy: Lists the declarable output VAT activities with document sequences assigned to the selected tax register, including cash receipt applications of invoices with deferred tax and adjustments. Displays the tax and taxable amounts. Provides a summary section with totals by tax rate code and a grand total for invoices, receipts and adjustments.

The following figure is an example of the report.

-

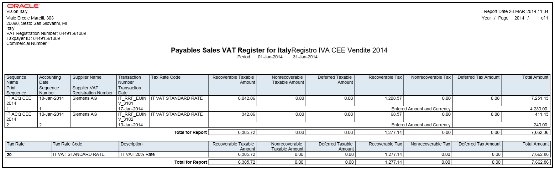

Payable Sales VAT Register for Self Invoices, Inter-EU Invoices, and VAT for Italy: Provides the recoverable, nonrecoverable and deferred tax amounts, and corresponding portions of taxable amounts for all invoices received from suppliers within the European Union, or all self-billing invoices that have accounting dates within the reporting period.

The following figure is an example of the report.

-

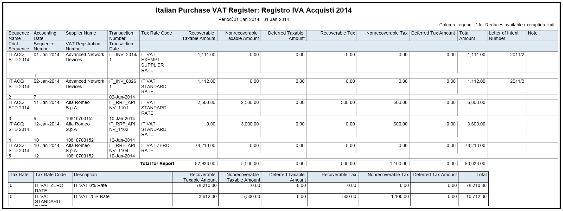

Purchase VAT Register for Italy: Lists all purchase invoices with document sequences that are assigned to the selected tax register and have accounting dates within the selected tax period.

The following figure is an example of the report.

-

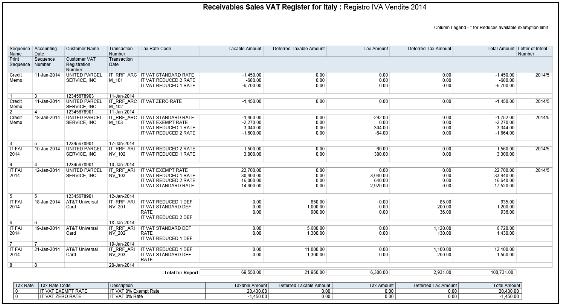

Receivables Sales VAT Register for Italy: Lists all sales invoices with document sequences that are assigned to the selected tax register and have accounting dates within the selected tax period.

The following figure is an example of the report.

-

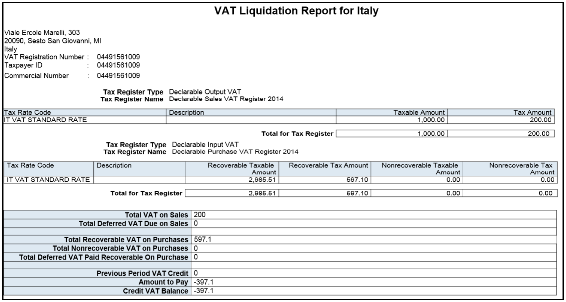

VAT Liquidation Report for Italy: Provides summary information for all tax events that can be reported with tax point dates within the reporting period. Identifies the associated tax register for each transaction. Provides a summary per tax rate code with the totals for each tax register. Includes a grand total section for all sales and purchases VAT that can be reported and credit balances from the previous report, which determines the net VAT amount to be paid to the authorities.

The following figure is an example of the report.

Key Insights

Before you run the VAT reports for Italy, ensure that you:

-

Set up tax reporting entities and tax registers

-

Configure tax reporting type and tax reporting type codes

-

Associate document sequence names with tax registers

The VAT reports for Italy either use accounting date or tax point date for reporting data. Reporting of data by:

-

Accounting date lets you list all invoicing activity regardless of what is declarable from tax perspective.

-

Tax point date lets you report all declarable tax activity within a specific period and helps you to prepare declaration.

The following table lists the reports that use accounting date and tax point date for reporting transactions:

|

Report Name |

Accounting Date |

Tax Point Date |

|---|---|---|

|

Declarable Input VAT Register for Italy |

No |

Yes |

|

Declarable Output VAT Register for Italy |

No |

Yes |

|

Payable Sales VAT Register for Self Invoices, Inter-EU Invoices, and VAT for Italy |

Yes |

No |

|

Purchase VAT Register for Italy |

Yes |

No |

|

Receivables Sales VAT Register for Italy |

Yes |

No |

|

VAT Liquidation Report for Italy |

No |

Yes |

Run the Select Transactions for Tax Reporting process before you run the VAT reports for Italy. The process marks the transactions with a tax reporting identifier, and identifies the tax reporting periods and tax registers defined for Italy.

Run the Finalize Transactions for Tax Reporting process to mark transactions as finally reported for the following reports:

-

Declarable Input VAT Register for Italy

-

Declarable Output VAT Register for Italy

-

VAT Liquidation Report for Italy

Report Parameters

The following table lists the common parameters for the VAT Reports for Italy:

|

Parameters |

Description |

|---|---|

|

Tax Calendar Period |

Indicate the period name of the monthly calendar for reporting data. |

|

Tax Register |

Indicate the tax register such as, recoverable and nonrecoverable for reporting VAT reporting for Italy. |

|

First Page Number |

Indicate the starting page for the report. |

The following table lists additional parameters for the VAT Liquidation Report for Italy:

|

Parameters |

Description |

|---|---|

|

Variation on Sales |

Indicate the debit amount to reduce the sales VAT for net payment purposes. |

|

Variation on Purchase |

Indicate the credit amount to reduce the sales VAT for net payment purposes. |

Frequently Asked Questions

The following table lists frequently asked questions about the VAT reports for Italy.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use VAT reports for Italy to review:

|

|

What type of reports are these? |

Oracle Analytics Publisher |