Intra-EU Reports for Italy

This topic includes details of the Intra-EU reports for Italy.

Overview

Companies in Italy must report the details of the sale or purchase of services to or from companies in European Union (EU) member states.

The reported transactions, once declared to the tax authority, must be stamped with declaration number issued by the tax authority.

Use the following reports to report intra-EU transactions to the tax authorities:

-

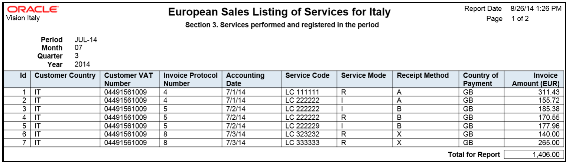

European Sales Listing of Services for Italy: Use this report to declare services rendered by Italian companies to VAT-registered customers in European Union (EU) member states.

The report prints service mode, service code, reporting receipt method, and reporting receipt country details associated with the transactions. The following figure is an example of the report.

-

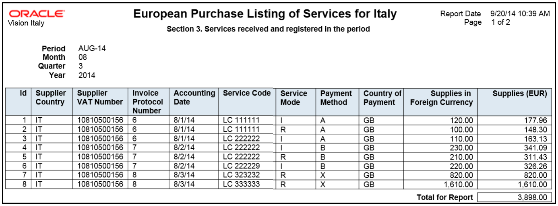

European Purchase Listing of Services for Italy: Use this report to declare services purchased by Italian companies from VAT-registered suppliers in European Union (EU) member states.

The report prints service mode, service code, reporting payment method, and reporting payment country details associated with the transactions. The following figure is an example of the report.

Key Insights

Both the European Sales Listing of Services for Italy and European Purchase Listing of Services for Italy reports:

-

Display report level totals for invoice amount.

Note: Create your own templates to specify page totals, carry forward totals, or brought forward totals. -

Round off all amounts to the nearest Euro.

-

List invoices that are reported and later canceled in the adjustments section of the report.

Before running the European Sales Listing of Services for Italy report, ensure that you:

-

In Oracle Fusion Functional Setup Manager, use the:

-

JG_ESL_EPL_SERVICE_CODElookup type to specify the service code. -

JG_ESL_EPL_SERVICE_MODElookup type to specify the service mode. -

JG_ESL_EPL_RCPT_PYMT_MODElookup type to specify the reporting payment method.

-

-

Configure the tax reporting type and tax reporting code for intra-EU transactions.

Before running the European Purchase Listing of Services for Italy report, ensure that you:

-

Update the service code, service mode, reporting payment method, and reporting payment country for the services you purchase.

-

Update the service codes for the services you purchase. Use the Service Code (

JG_ESL_EPL_SERVICE_CODE) lookup type in Oracle Fusion Functional Setup Manager to specify the service codes. -

Configure the tax reporting type and tax reporting code for intra-EU transactions.

Report Parameters

The following table describes selected parameters of the European Sales and Purchase Listing of Services for Italy reports:

|

Parameter |

Description |

|---|---|

|

Tax Registration Number |

Specify the registration number assigned to a party or party site by the tax authority when it's registered. A party or party site is identified by this registered number. |

|

Tax Reporting Type |

Select a tax reporting type code created in Oracle Fusion Tax. Select the appropriate Intra-EU transaction tax reporting type. |

|

Tax Reporting Code |

Select a tax reporting code created as a part of the tax reporting type you previously selected. Specify the tax reporting code relating to European Sales Listing of Services for Italy. |

Frequently Asked Questions

The following table lists frequently asked questions about the European Sales and Purchase Listing of Services for Italy reports:

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use the European Sales Listing of Services for Italy and European Purchase Listing of Services for Italy reports to:

|

|

What type of reports are these? |

Oracle Analytics Publisher. |