VAT Reports for Spain

This topic includes details about the VAT reports for Spain.

Overview

Oracle Fusion Applications provide a set of VAT reports to meet the legal and business reporting requirements of tax authorities.

The VAT reports for Spain include:

-

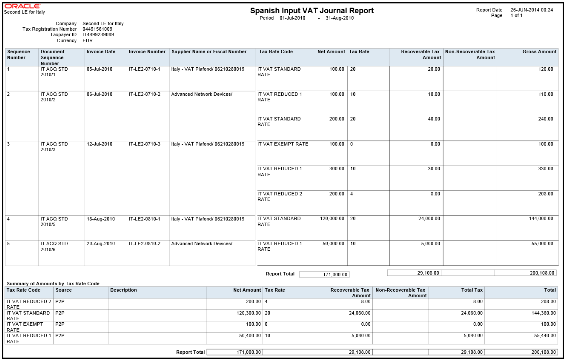

Input VAT Journal for Spain: Provides summary and detail tax information on recoverable and nonrecoverable tax for accounted transactions entered in Oracle Fusion Payables and tax repository. Reports by register type, such as recoverable tax register or nonrecoverable tax register.

The following figure is an example of the report.

-

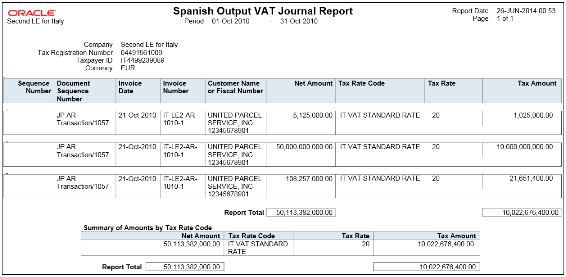

Output VAT Journal for Spain: Provides summary and detail tax information on recoverable and nonrecoverable tax for accounted transactions entered in Oracle Fusion Receivables and tax repository. Reports by register type, such as recoverable tax register or nonrecoverable tax register.

The following figure is an example of the report.

-

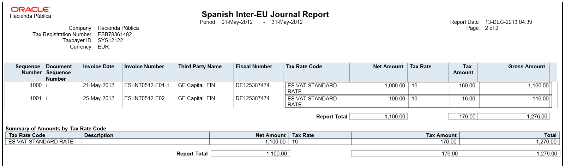

VAT Inter-EU Invoice Journal for Spain: Provides summary and detail information on invoices received in Spain from suppliers located in any European Union member state. Includes invoices that have offset or self-assessed tax distributions.

The following figure is an example of the report.

-

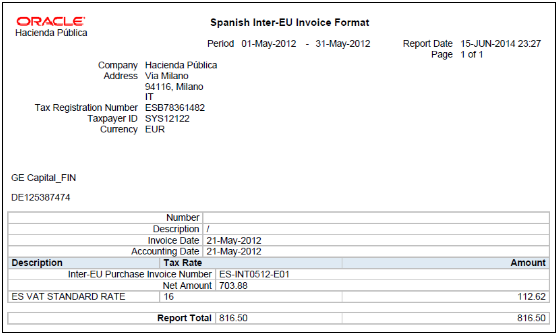

VAT Inter-EU Invoice Format for Spain: Lists details of the same invoices that appear on the VAT Inter-EU Invoices Journal for Spain. Selects transactions based on tax reporting type and tax reporting code.

The following figure is an example of the report.

Key Insights

You can report transactions based on a specific tax reporting type and tax reporting code or report transactions associated with all the tax reporting types and codes. Ensure that you create relevant tax reporting types and tax reporting codes and assign them to tax rates before running the reports. When the tax rate is applied to a transaction, tax reporting type and tax reporting code is also applied.

If you want to use a calendar for tax reporting that is different from the accounting calendar, set up a new calendar and associate it with the tax reporting entity. However, before you create a new calendar, you must set up a new tax reporting entity.

Before you run the VAT reports for Spain, ensure you:

-

Configure the document sequence to be used for reporting and printing transactions on the reports.

-

Run the Select Transactions for Tax Reporting process to select and mark transactions for reporting.

When you finish reviewing the reports and want to close the tax period, run the Finalize Transactions for Tax Reporting process. The process marks all the reported transactions as finally reported.

Report Parameters

The following table lists selected parameters for the VAT reports for Spain:

|

Parameter |

Description |

|---|---|

|

From Tax Calendar Period and To Tax Calendar Period |

Specify the tax calendar period range for reporting data. The transactions are selected for reporting based on the tax point date that is within the specified tax calendar period range. |

|

Tax Reporting Type |

(Optional) Select a tax reporting type created in Oracle Fusion Tax. Select the appropriate tax reporting type for reporting VAT on transactions for Spain. |

|

Tax Reporting Code |

(Optional) Select a tax reporting code created as a part of the tax reporting type that you previously selected. Specify the tax reporting code for reporting VAT on transactions for Spain. |

|

Enable Reporting Sequence |

Indicate whether you want to print reporting sequences for your transactions. |

|

Register Type |

Select the register type. You can select tax register, nonrecoverable tax register, or both. This parameter is applicable only for:

Note: When you want to list transactions with interim tax,

run the Interim Tax Register.

|

|

Start Invoice Sequence |

Indicate the starting invoice sequence number. When you want to continue the reporting sequence numbers from the previous reporting period, specify the number you want to use as the starting number for this period. The default value is 1. |

Usability Improvements

You can define withholding keys and sub keys, and additional extracted data elements.

The Withholding Magnetic Format for Spain report includes the ability to define withholding keys and sub keys and assign them to the withholding tax rates. The keys (sub keys) allowed in the Modelo 190 are A, B (01, 02, 03), C, D, E (01, 02, 03, 04), F (01, 02), G (01, 02, 03), H (01, 02, 03, 04), I (01, 02), J, K (01, 02, 03), L (01 to 30). If withholding keys and sub keys are not defined and assigned to tax rates, expense reports are populated with the default value A00 and all other transactions populated with the default value G01.

The Withholding Magnetic Format for Spain XML Data extract file contains additional data elements:

- Header elements

- ERP Cloud Program Version - EXTERNAL_VERSION

- Legal Entity primary contact name, phone and email - G_LEGAL_ENTITY - FULL_NAME, EMAIL_ADDRESS and PHONE_NUM

- Detail records

- Supplier Type and Tax Organization Type - C_VENDOR_TYPE and C_ORGANIZATION_TYPE

Setup Steps

To implement changes related to the keys and sub keys reported in the Withholding Magnetic Format for Spain output file, follow these setup steps:

- Create new Tax Reporting Type for withholding keys and sub keys:

- Navigate to the Setup and Maintenance, Manage Tax Reporting Types.

- Create new Tax Reporting Type JEES_WHT_KEY_SUBKEY with these values:

- Tax Reporting Type Code: JEES_WHT_KEY_SUBKEY

- Tax Reporting Type Name: WHT Keys and Subkeys for Spain

- Tax Reporting Type Purpose: Withholding tax reporting type

- Country: Spain

- Data Type: Text

- Minimum Length of Reporting Codes: 1

- Maximum Length of Reporting Codes: 3

- Reporting Type Uses: enable Tax Rate

- Add new Tax Reporting Codes:

- Tax Reporting Code: G01

- Description: G: Income from economic activities: Professional activities to which the general withholding rate is applicable: Sub key 01

- Define all required Tax Reporting Codes for Spanish withholding keys and sub keys. Example: A01, G03, H04.

- Save and Close.

-

Associate Tax Reporting Code JEES_WHT_KEY_SUBKEY to the Withholding Tax Rates Codes:

- Navigate to Setup and Maintenance, Manage Tax Rate and Tax Recovery Rates.

- Search for Withholding Tax and define Search Withholding Tax Rates parameters or create new Withholding Tax Rate.

- Associate Withholding Tax Rate with Tax Reporting Codes with these

values:

- Tax Reporting Type Code = JEES_WHT_KEY_SUBKEY

- Data Type = Text

- Tax Reporting Code = G01

- Description = G: Income from economic activities: Professional activities to which the general withholding rate is applicable: Sub key 01

- Save and Close.

-

(Optional) Here are some considerations:

- The keys and sub keys values are defined as Tax Reporting Code for the Tax Reporting Type Code JEES_WHT_KEY_SUBKEY. The Tax Reporting Code for key and sub key is assigned to the Withholding Tax Rate. In the Withholding Magnetic Format for Spain output file the Key is the first position from the Tax Reporting Code and is reported in the position 78. The sub key is the second and third position from the Tax Reporting Code JEES_WHT_KEY_SUBKEY and is reported in the position 79 and 80.

- If withholding keys and sub keys are not defined and assigned to tax rates, expense reports are populated with the default value A00 and all other transactions populated with the default value G01.

- Define primary Legal Entity contact name, primary phone and email, Supplier Type and Tax Organization Type for supplier to extract values in the Withholding Magnetic Format for Spain XML extract data file.

Frequently Asked Questions

This table lists frequently asked questions about the VAT reports for Spain.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use the VAT reports for Spain to review tax information on:

You can also use these reports for tax reconciliation and for preparing tax declarations. |

|

What type of reports are these? |

Oracle Analytics Publisher. |