Withholding Tax Report for Spain

This topic explains about the withholding tax reports for Spain.

Overview

The Withholding Tax Report for Spain is an annual report that's submitted to the tax authorities at the beginning of the year. Using this report you can list the operations of the previous year.

The Withholding Tax Reports for Spain includes:

-

Withholding Tax Extract Report for Spain: Extracts the withholding tax transactions for Spain, and stores them in an interface table. You can select information based on a specific legal entity, and optionally based on a specific supplier.

-

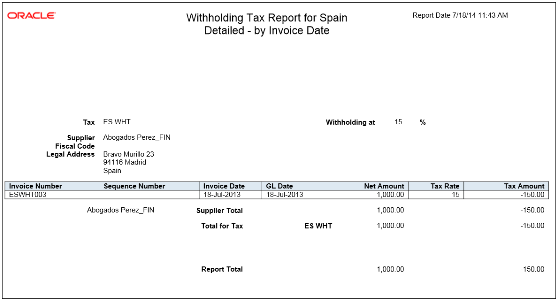

Withholding Tax Report for Spain: Identifies summary or detail of withholding tax information for Spain by invoice and withholding tax type. You can print information for a selected legal entity, and optionally for a specific supplier.

-

Withholding Magnetic Format for Spain: Lists withholding tax transactions for the selected legal entity and tax year in a flat file format in the predefined layout.

Here's an example of the report.

Key Insights

When you submit the Withholding Tax Data Extract Report for Spain, the data extract overwrites the transactions stored from any previous submission.

The Withholding Tax Report for Spain lists only invoices that are posted to the general ledger, and includes prepayments. When you apply prepayment to an invoice on a date other than the invoice accounting date, the report displays prepayment as a negative amount with the prepayment application date.

Report Parameters

The following table lists selected report parameters:

|

Parameter |

Description |

|---|---|

|

Withholding Tax Type |

Select one of the following:

|

|

Selection Criteria |

Select one of the following:

|

Frequently Asked Questions

Here are few frequently asked questions about the Withholding Tax Reports for Spain.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use these reports to declare withholding and payments on account of income from employment, economic activities, prizes, certain capital gains and income allocations. |

|

What type of reports are these? |

Oracle Analytics Publisher |