Exchange Rate Difference Report for Turkey

This topic includes details about the Process Exchange Rates Difference report.

Overview

This report summarizes the exchange rate differences for invoice, credit memo, and journal. Use this report to:

-

View ledger currency including tax components.

-

Print the eligible gain/loss lines that are processed by the Process Exchange Rates Difference job for each trading partner and site.

Key Insights

You must run the Process Exchange Rate Difference job before running this report. The report output is a predefined PDF format that displays the following information:

-

Eligible gains/losses in terms of the total exchange rate difference amount, recorded for a trading partner enabled to generate the exchange rate difference invoice.

-

Total tax amount segregated from the total exchange rate difference amount.

-

Line level information for the invoice, credit memo, and journal.

Use the report grouping to view the details of eligible gain/loss incurred and how it is processed at various levels. The trading partner and trading partner site at each level are the final grouping level. The following combinations are used:

-

Exchange rate difference type, creation option, status, transaction currency, and receipt currency

-

Exchange rate difference type, and creation option

-

Exchange rate difference type

When you search for processed records, the report displays additional information about reference numbers of the invoices, credit memos, and journals. This reference number can be used to query exchange rate difference invoices, credit memos, and journals.

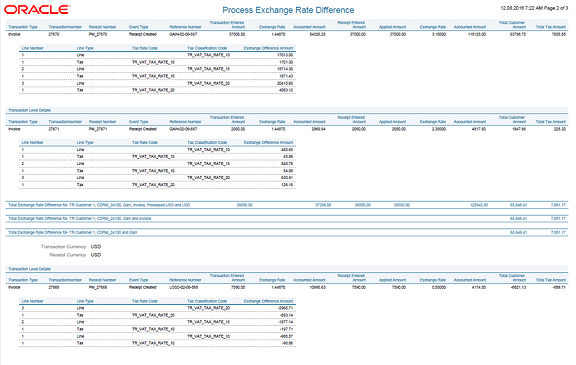

The following figure is an example of the report.

Report Parameters

The following table describes selected process parameters:

|

Parameter |

Description |

|---|---|

|

Source |

Specify the subledger application for which the report must be run. The available options are Accounts Receivables and Accounts Payables. The default value is Accounts Receivables. |

|

Business Unit |

Specify the business unit for which the report must be run. The default value is the business unit to which a user has access. If a user has access to multiple business units, the default is the last used business unit. |

|

Period |

Specify the period for which the report must be run. The list of values includes all the open subledger periods. The default value is the earliest unprocessed open period if the exchange rate difference is enabled. Otherwise, it is the earliest open general ledger period. |

|

Unprocessed Only |

Specify if the report must be printed for unprocessed or processed records. If you select Yes, only the lines that were processed in the preview mode of the exchange rate difference job are printed. If you select No, all the invoices, credit memos, and journals are printed. |

|

Report Mode |

Specify the layout of the report. Valid values are Detail and Summary. If the report is submitted in the detail mode, it displays both header and line level details for each record. If the report is submitted in the summary mode, it displays only the header level details for each record. |

Frequently Asked Questions

The following table lists frequently asked questions about the Process Exchange Rate Differences Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use the Process Exchange Rate Differences report to analyze records. These records are of the following types:

|

|

What type of reports are these? |

Oracle Analytics Publisher |