Reverse Charge Sales Listing Report for UK

This topic includes details about the Reverse Charge Sales Listing Report for UK.

Overview

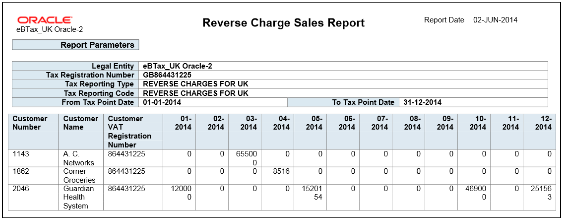

The Reverse Charge Sales Listing Report for UK lists the sales transactions for UK that are created in Oracle Fusion Receivables. It lists transactions for high value electronic goods that are subjected to the Reverse Tax Charge and reported to HRMC (Her Majesties Revenue and Customs). Reported data is grouped by customers.

The following figure is an example of the report.

Key Insights

Before you run the report, configure self-assessed tax in Oracle Fusion Tax and ensure that transactions with self-assessed tax are available for reporting.

The report output is available in two formats:

-

XML: Provides a readable view of the report.

-

CSV: Creates the electronic output to submit the report to HMRC.

HMRC requires a specific format for the CSV version, no specific format for the XML output.

Report Parameters

The following table describes selected report parameters of the report:

|

Parameter |

Description |

|---|---|

|

Legal Entity |

Specify the legal entity submitting the declaration to the tax authority. |

|

Tax Registration Number |

Specify the tax registration number of the legal entity or legal reporting unit submitting the declaration to the tax authority. |

|

Tax Reporting Type |

Indicate the appropriate reporting type that you defined to be used for reporting of reverse charges. Tax reporting type identifies a specific unit of information, such as a date or a text comment, to associate with a specific tax usage. |

|

Tax Reporting Code |

Specify the appropriate tax reporting code. |

|

From Tax Point Date and To Tax Point Date |

Print all the transactions based on the selected tax point date range. |

Frequently Asked Questions

The following table lists frequently asked questions about the Reverse Charge Sales Listing Report for UK.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use this report to provide details of high value sales transactions that are subject to reverse tax charges. |

|

What type of reports are these? |

Oracle Analytics Publisher |