Upload dual currency corporate card transactions

Corporate card administrators can enable a company account to accept corporate card charges in currencies other than the payment currency configured for the account by enabling the Allow multiple billed currencies option.

When this option is enabled, Expenses converts the billed amounts in other currencies from the card feed file to the payment currency of the company account using the daily currency conversion rates available in Oracle Fusion General Ledger. If the conversion rate isn't defined in the General Ledger Daily Rates table, the transaction is marked invalid with the status Missing currency conversion rate.

Card issuers in certain countries bill their customers in two currencies through dual currency corporate cards. The local transactions made within the country are billed in local currency. The foreign transactions are billed in an agreed upon stable currency. For example, all foreign charges are billed in USD. The transaction file of dual currency corporate cards contain transactions with billed currencies in local currency and a foreign currency. When the company pays the card issuer, all the charges are paid in the local currency. To support this payment in local currency, the card issuer provides an average conversion rate separately.

To enable this feature, perform these steps:

-

Log in as the Corporate Card Administrator.

-

On the Manage Corporate Card Programs page in the Setup and Maintenance work area, select the corporate card program.

-

In the Company Accounts section, click the company account to modify.

-

In the Edit Company Account dialog box, select the Allow multiple billed currencies option.

-

Click Save and Close.

-

On the Edit Corporate Card Program page, click Save and Close.

The following scenario illustrates how the transactions of a dual currency corporate card are processed when the Allow multiple billed currencies option is enabled. AMEX GL1025 file format is considered for this scenario.

Linda is an employee based in Argentina and her employer has a dual currency card program with ARS as the payment currency and USD as the currency for foreign billing. The dual currency card charges her expenses in Argentina in ARS, which is the local currency. When Linda travels to the US, all the transactions are billed in USD. If Linda travels to Spain, all the transactions are billed in EUR and converted to USD in the card feed file. The transactions in ARS and USD are sent in the same card feed file and can be uploaded to Expenses for processing.

In this scenario, Expenses processes the card feed file and pays the card issuer in ARS when:

-

Payment Option is set to Both Pay

-

Payment Currency of the company account is ARS

-

Allow multiple billed currencies option is enabled for the company account

The transactions are processed and all the charges in the file for that company account are converted to ARS using the conversion rates from GL Daily Rates as of the transaction dates.

These transactions were made on her card:

-

Purchased an item for personal use for 1000 ARS. This transaction was made in the local currency ARS and captured in ARS in the file.

-

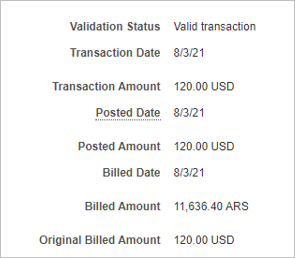

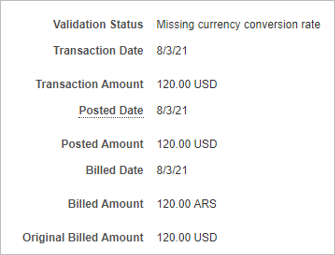

Paid 120 USD for a business meal which was captured in USD in the file. When the file is uploaded and processed, the transaction made in USD is converted to ARS by Expenses and is displayed as follows on the Review Corporate Card Transactions page:

The transaction is rejected if the conversion rates aren't available in GL Daily Rates for a given currency or a transaction date. You must ensure that conversion rates are available for those currencies for the time ranges applicable to the transactions.

-

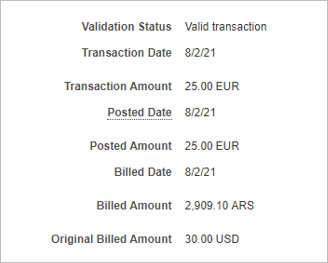

Purchased a computer peripheral for 25 EUR. This transaction was converted to 30 USD in the card feed file. The transaction is converted to ARS by Expenses and is displayed as follows on the Review Corporate Card Transactions page:

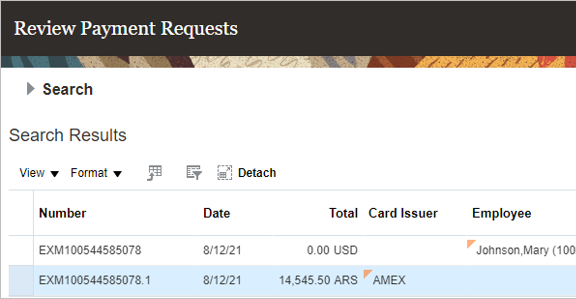

American Express sends the billed amounts in two currencies in the data file, which are ARS and USD, and expects a payment in the local currency as per the market regulation. A total payment of 15,545.50 ARS is to be made.

After successful validation, the transactions are available to employees in their Expenses work area. They can view the billed amounts converted to ARS and the original receipt amounts.

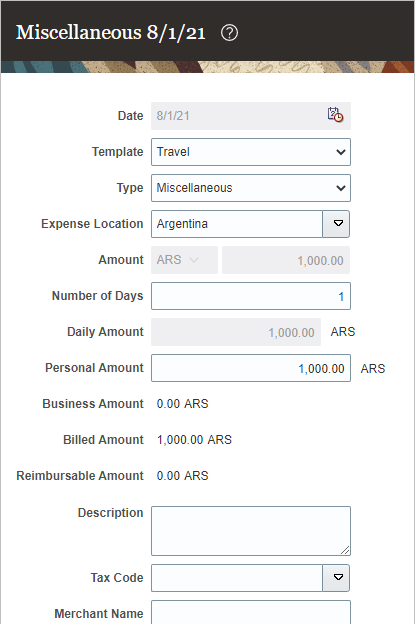

This image shows the Expenses work area displaying the transaction of 1000 ARS.

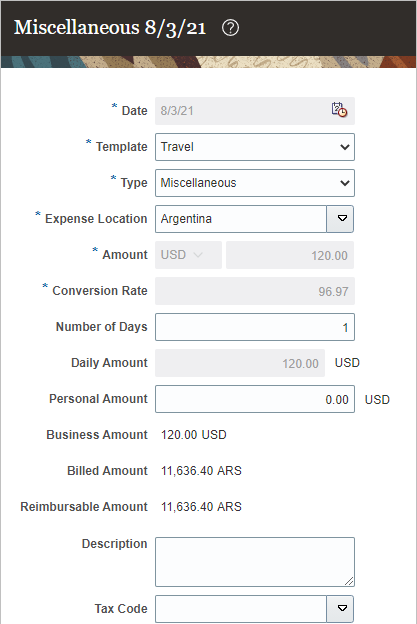

This image shows the Expenses work area displaying the transaction of 120 USD and its equivalent amount in ARS.

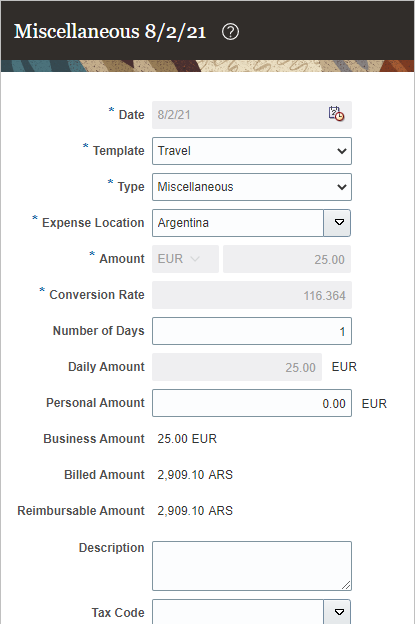

This image shows the Expenses work area displaying the transaction of 25 EUR and its equivalent amount in ARS.

Employees can add these expenses to their expense reports and submit them for reimbursement.

After the expense report is approved and audited, the auditor runs the Process Expense Reimbursement process to create payment requests for the employees and the card issuers. The payment request is generated in ARS for the card issuer.

At statement close, American Express converts the foreign currencies to local currency using the conversion rates as of the cutoff date. These may differ from the conversion rates in the GL Daily Rates tables. The organization must identify the variations arising out of such differences in conversion rates outside Expenses, and pay any remaining amounts to the card issuer or use the debit memo to get refunded for any additional amounts paid.