Associate the Supporting Reference to Accounting Methods

Associate the supporting reference you created in the preceding task to an accounting method.

The following steps use the Payables subledger as an example. Use the steps as a guide to associate the supporting reference to other subledgers within the same or different accounting methods.

-

Navigate to Setup and Maintenance and select the Payables functional area under the Financials offering.

- Click Show - All Tasks and select Manage Accounting Methods in the list of tasks.

-

In the Search area, search on the accounting method that contains journal entry rule sets for the subledgers for a specific chart of accounts

-

Click the link to the accounting method to edit it.

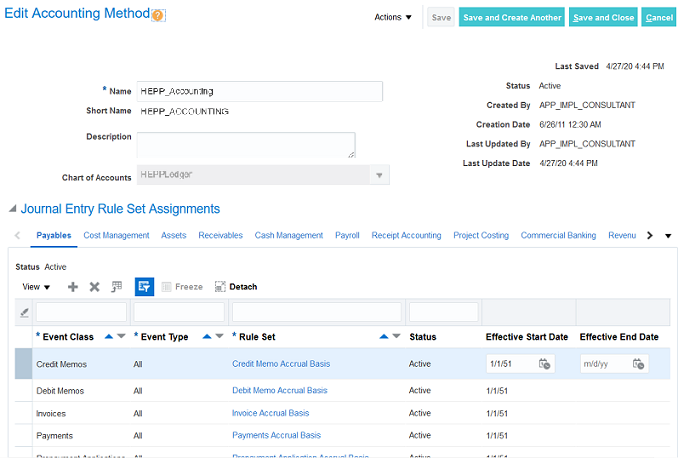

The following example shows an accounting method for a chart of accounts named HEPPLedger. The Payables subledger contains a rule set for each event class: Credit Memos, Debit Memos, Invoices, Payments, and so forth. The rule set establishes the data required for a journal entry line for an event class.

-

In the event class row, click the rule set to edit it.

This is where you associate the supporting reference to a journal line for Payables.

-

In the Journal Lines area, review if the journal lines that you want to associate with the supporting reference already exist. If you need to create a new journal line, click Add Row (+ icon) and select the following values to add a journal line rule for invoicing:

-

Line Type

-

Journal Line Rule

-

Account Combination Rule

Note: If you have two journal line rules for invoicing, there can’t be an overlap or a gap in the effective dates. They must be successive. -

-

To associate the supporting reference to a journal line:

-

Highlight the journal line.

-

Scroll to the Supporting References area below the Journal Lines area and click Add.

-

Select the supporting reference and then save your changes.

Note: The event class in the supporting reference must be the same as the event class in the journal rule set. For example, if one of the sources in the supporting reference is for the Invoicing event class, then the journal rule set must also be for the Invoicing event class. -

-

Continue to associate the supporting reference to all applicable journal lines as appropriate.

-

Click Save and Close.

The system returns you to the Edit Accounting Method page.

-

To associate the supporting reference to the journal lines of another rule set, click the rule set to edit it, and then follow the appropriate steps.

-

Change the status to Active.

-

Click Save and Close.

This returns you to the Accounting Method page.

-

Make sure the status of the accounting method is Active and then save it.

-

Continue to add the supporting reference to journal line rules in other accounting methods as appropriate.