Derive Expense Cutback Accounts for Internal Transfer Journals

To derive the cutback accounts for internal transfer journal amounts, you need to complete the following tasks:

-

Identify expense cutback accounts

-

Create a mapping set

-

Create an account rule

-

Create and activate a journal entry rule set

-

Associate the journal entry rule set to the accounting method in the primary ledger

Identify Expense Cutback Accounts

You need to identify the managing partner’s cutback accounts for crediting expense amounts from internal transfer journals.

Make sure that the cutback accounts are not part of the range of account values that are identified as distributable in the distributable segment values for the joint venture. This prevents lines from internal transfer journals from being identified as joint venture transactions for distribution.

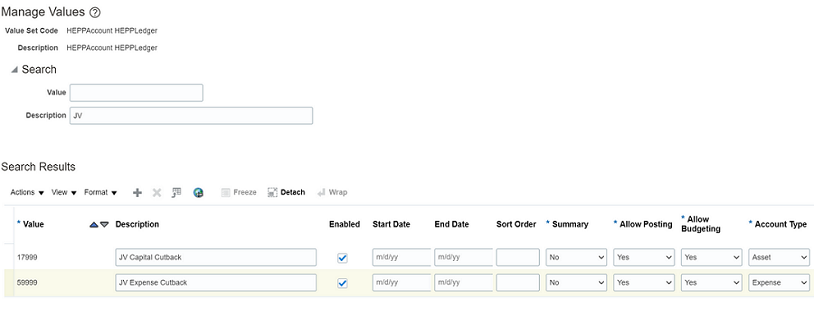

The following image shows an example of two cutback accounts for a joint venture on the Manage Values page. It shows a JV Capital Cutback account with an Asset account type and a JV Expense Cutback account with an Expense account type.

Create a Mapping Set

Create a mapping set to derive the cutback accounts.

-

Navigate to Setup and Maintenance and select the Joint Venture Management functional area under the Financials offering.

-

Click Show – All Tasks and then select the Manage Mapping Sets task.

-

Click Create.

-

Complete the following fields in the header area:

-

Name.

-

Short Name.

-

Output Type. Select Segment.

-

Description.

Note: The Subledger Application field is set to Joint Ventures by default and can’t be changed. This is because the Manage Mapping Sets task, when accessed from the Joint Venture Management functional area, is designed specifically for setting up journal entries in the Joint Venture Subledger. -

- Identify the input source:

- In the Input Sources area, click “Select and Add” and then enter these

values to search for the input source:

- Event Class. Select Cost Transfer.

- Source. Enter Distribution Type.

- Select the Distribution Type row in the results and click OK.

- In the Input Sources area, click “Select and Add” and then enter these

values to search for the input source:

-

In the Chart of Accounts area, enter the chart of accounts of the primary ledger for the joint venture and select the appropriate segment.

-

In the Mappings area, add rows to map the following distribution types from internal transfer journals to the cutback accounts:

- A - Assets

- E - Expenses

-

Click Save and Close.

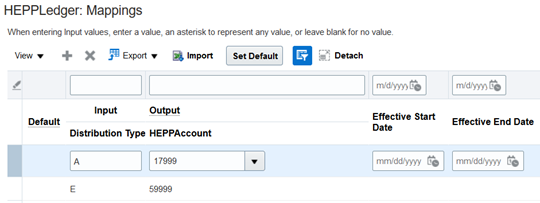

The following image shows an example of the mappings for the distribution types:

Notice in this example, HEPPLedger in the Mappings heading indicates the chart of accounts of the primary ledger of the joint venture. The mapping sets are used to map distributions from a joint venture to cutback accounts, which are in HEPPAccount segment in this example. You create a mapping for each type of distribution or account, for example:

-

Distribution type A (Asset) to cutback account 17999 (JV Capital Cutback)

-

Distribution type E (Expense) to cutback account 59999 (JV Expense Cutback)

For distributions with a value of A, the system will output a value of 17999 for the HEPPAccount segment. Likewise, it will output 59999 for a value of E.

Create an Account Rule

Create an account rule to enable lines within internal transfer journals to be entered as a credit in the cutback accounts for a joint venture. You associate the mapping set created in the preceding task to this account rule.

-

In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the Manage Account Rules task.

-

On Manage Account Rules: Joint Ventures, click Create.

-

On Create Account Rule, complete these fields:

-

Name.

-

Short Name.

-

Description.

-

Chart of Accounts. Select the chart of accounts of the primary ledger of your joint venture.

-

Rule Type. Select Segment from the drop-down list.

Then, for the chart of accounts you selected, select the natural account segment value from the drop-down list.

-

-

In the Rules area, click Add and specify the following values in the first row:

-

Value Type. Select Mapping Set.

-

Value. Select the mapping set that you created in the preceding task.

-

Click Save and Close.

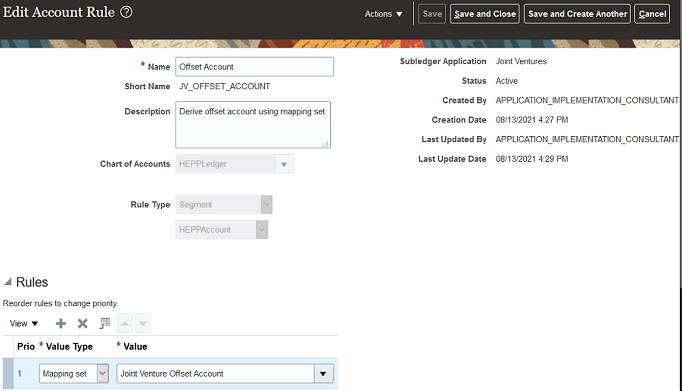

The following image shows an example of a new account rule that’s defined with a mapping set.

In this example, the account rule is created for and associated with a mapping set named Joint Venture Offset Account. The rule type for the account rule is Segment, which enables it to derive the value for the HEPPAccount segment in the HEPPLedger chart of accounts.

Create a Journal Entry Rule Set

The Manage Subledger Journal Entry Rule Sets task in FSM includes an example journal entry rule set that contains journal line rules for deriving:

-

Cutback accounts

-

Stakeholder accounts

-

Joint venture partner contribution accounts

-

Stakeholder partner contribution accounts

The journal line rule for stakeholder accounts works as delivered. You only have to modify the journal line rule for the cutback accounts by assigning it to the account rule created in the preceding task. To do so:

-

In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the “Manage Subledger Journal Entry Rule Sets” task.

-

Select the row with the example Cost Transfer journal entry rule set and click Duplicate to copy it.

Caution: You must copy and rename the example, and then modify it for your setup. -

In the dialog box, complete these fields to create the new journal entry rule set:

-

Name.

-

Short name.

-

Description.

-

Chart of accounts. Select the chart of accounts of the primary ledger of your joint venture.

-

-

Click Save and Close.

-

Select the row with the new journal entry rule set and click Edit.

-

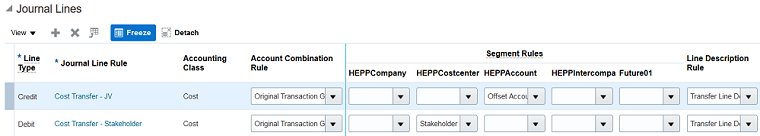

On Edit Subledger Journal Entry Rule Set, access the Journal Lines area and highlight the Credit row for deriving cutback accounts.

The columns in the Segment Rules represent the segments in the primary ledger for identifying the accounts that contain the original joint venture transactions.

In the column representing the natural account segment of the chart of accounts, select the account rule that you set up in the preceding task.

The account rule contains the mapping set that's used to enter internal transfer journal amounts into the appropriate cutback accounts.

The following example shows a Credit journal line rule, in which the HEPPAccount column represents the natural account segment of the chart of accounts. An account rule named Offset Account was selected for the HEPPAccount.

The example shows a Debit journal line rule, which was not modified because by default, it’s set up to use the cost center of the stakeholder to debit internal transfer amounts to the stakeholder accounts.

Caution: Do not change the Debit row.

Caution: Do not change the Debit row.If your costs distributions are covered by partner contributions, you must modify the journal line rules for partner contributions as a part of this setup. See Derive Partner Contribution Accounts for Journal Entries Created to Close Partner Contributions.

-

Click Save and Close.

-

After setting up the rule set, return to the “Manage Subledger Journal Entry Rule Sets: Joint Ventures” page and use the Actions menu to activate the new journal entry rule set.

Associate the Journal Entry Rule Set to the Accounting Method in the Primary Ledger

Identify the accounting method of the primary ledger and associate the new journal entry rule set to this method.

-

In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the Manage Accounting Methods task.

-

Select the accounting method for the primary ledger of your joint venture and click Edit.

-

On the Joint Ventures tab in the Journal Entry Rule Set Assignments area, click Add Row and complete these fields:

-

Event Class. Select Cost Transfer.

-

Event Type. Select All.

-

Rule Set. Select the journal entry rule set that you created in the preceding task.

-

Click Save and Close.

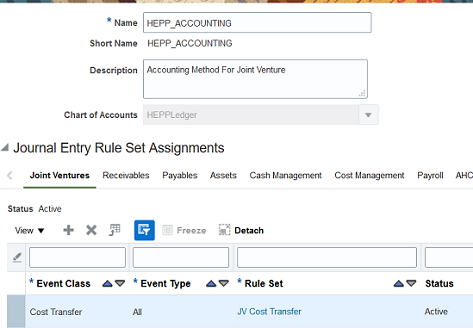

The following image shows an example of a journal entry rule set named JV Cost Transfer that's associated to an accounting method named HEPP_ACCOUNTING and for a primary ledger named HEPPLedger US.

- To complete the setup, run the Update Subledger Application Options program. You must run this program before you can create any events for the primary ledger and Joint Ventures application.