Review Provided Accounts Rules for Deriving Stakeholder Accounts to Record Cost Amounts

Review the provided account rules that enable lines within internal transfer journals to be entered as a debit in stakeholder accounts.

In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the Manage Account Rules task.

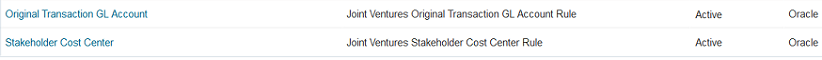

This task includes the following account rules that you can use for your setup:

-

Original Transaction GL Account

-

Stakeholder Cost Center

You can open the Stakeholder Cost Center account rule to review the Rule Type, which is Segment. The account rule uses this setting to retrieve the stakeholder’s cost center from the stakeholder. Remember that when users add a stakeholder with the "Create journals" option to a joint venture definition, they're prompted to enter a cost center for the stakeholder.

Continue the setup by completing the tasks described in Derive Expense Cutback Accounts for Internal Transfer Journals. In one of the tasks, you copy and modify an example journal entry rule set. This journal entry rule set contains two journal line rules, one for adding amounts to cutback accounts and the other for adding amounts to stakeholder accounts. The journal line rule for stakeholder accounts works as provided; you don't need to modify it.